Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 6, Problem 9CE

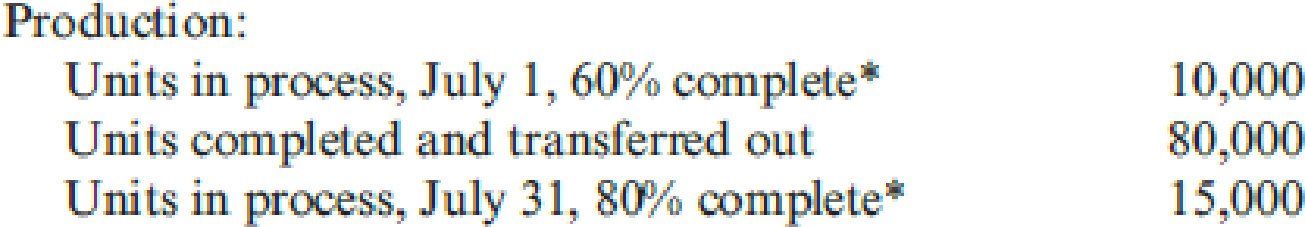

Jackson Products produces a barbeque sauce using three departments: Cooking, Mixing, and Bottling. In the Cooking Department, all materials are added at the beginning of the process. Output is measured in ounces. The production data for July are as follows:

*With respect to conversion costs.

Required:

- 1. Prepare a physical flow schedule for July.

- 2. Prepare an equivalent units schedule for July using the weighted average method.

- 3. What if you were asked to calculate the FIFO units beginning with the weighted average equivalent units? Calculate the weighted average equivalent units by subtracting out the prior-period output found in BWIP.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

You Can Paint Too prepares and packages paint products. You Can Paint Too has two departments: Blending and Packaging. Direct materials are added at the beginning of the blending process (dyes) and at the end of the packaging

process (cans). Conversion costs are added evenly throughout each process. The company uses the weighted-average method. Data from the month of May for the Blending Department are as follows:

(Click the icon to view the data from May.)

Read the requirements.

Requirement 1. Compute the Blending Department's equivalent units of production for direct materials and for conversion costs. (Complete all input fields. Enter a "0" for any zero balances.)

You Can Paint Too

Production Cost Report - Blending Department (Partial)

Month Ended May 31

UNITS

Units to account for:

Total units to account for

Units accounted for:

Total units accounted for

Requirements

1.

2.

Physical

Units

Equivalent Units

Direct

Materials

Conversion

Costs

Compute the Blending Department's equivalent…

Information for the Hi-Test company’s production process for September in the attached picture. Assume that all materials are added at the beginning of this production process, and that conversion costs are added uniformly throughout the process.

Compute each of the following.

The number of equivalent units for materials for the month.

The number of equivalent units for conversion for the month.

The variable cost per equivalent unit of materials for the month.

Powers Inc. produces a protein drink. The product is sold by the gallon. The company has two departments: Mixing and Bottling. For August, the bottling department had

60,900 gallons in beginning inventory (with transferred-in costs of $283,000) and completed 211,000 gallons during the month. Further, the mixing department

completed and transferred out 295,000 gallons at a cost of $649,000 in August.

Required:

1. Prepare a physical flow schedule for the bottling department.

Powers Inc.

Physical Flow Schedule - Bottling Department

For the Month of August

Physical flow schedule:

Units in beginning work in process

Units started during the period

Total units to account for

Units completed and transferred out:

Units started and completed

Units completed from beginning work in process

Units in ending work in process

Total units accounted for

2. Calculate equivalent units for the transferred-in category.

equivalent units

3. Calculate the unit cost for the transferred-in category. If required,…

Chapter 6 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 6 - What is a process? Provide an example that...Ch. 6 - Describe the differences between process costing...Ch. 6 - Prob. 3DQCh. 6 - What are transferred-in costs?Ch. 6 - Explain why transferred-in costs are a special...Ch. 6 - What is a production report? What purpose does...Ch. 6 - Can process costing be used for a service...Ch. 6 - What are equivalent units? Why are they needed in...Ch. 6 - How is the equivalent unit calculation affected...Ch. 6 - Describe the five steps in accounting for the...

Ch. 6 - Under the weighted average method, how are...Ch. 6 - Under what conditions will the weighted average...Ch. 6 - In assigning costs to goods transferred out, how...Ch. 6 - Prob. 14DQCh. 6 - What is operation costing? When is it used?Ch. 6 - Lamont Company produced 80,000 machine parts for...Ch. 6 - Lising Therapy has a physical therapist who...Ch. 6 - Fleming, Fleming, and Johnson, a local CPA firm,...Ch. 6 - During October, McCourt Associates incurred total...Ch. 6 - Tomar Company produces vitamin energy drinks. The...Ch. 6 - Apeto Company produces premium chocolate candy...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Gunnison Company had the following equivalent...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Morrison Company had the equivalent units schedule...Ch. 6 - Shorts Company has three process departments:...Ch. 6 - A local barbershop cuts the hair of 1,200...Ch. 6 - Friedman Company uses JIT manufacturing. There are...Ch. 6 - Lacy, Inc., produces a subassembly used in the...Ch. 6 - Softkin Company manufactures sun protection...Ch. 6 - Heap Company manufactures a product that passes...Ch. 6 - K-Briggs Company uses the FIFO method to account...Ch. 6 - The following data are for four independent...Ch. 6 - Using the data from Exercise 6.18, compute the...Ch. 6 - Holmes Products, Inc., produces plastic cases used...Ch. 6 - Dama Company produces womens blouses and uses the...Ch. 6 - Fordman Company has a product that passes through...Ch. 6 - Using the same data found in Exercise 6.22, assume...Ch. 6 - Baxter Company has two processing departments:...Ch. 6 - Tasty Bread makes and supplies bread throughout...Ch. 6 - Under either weighted average or FIFO, when...Ch. 6 - During the month of June, the mixing department...Ch. 6 - As goods are transferred from a prior process to a...Ch. 6 - During March, Hanks Manufacturing started and...Ch. 6 - Proteger Company manufactures insect repellant...Ch. 6 - Swasey Fabrication, Inc., manufactures frames for...Ch. 6 - Refer to the data in Problem 6.31. Assume that the...Ch. 6 - Hatch Company produces a product that passes...Ch. 6 - FIFO Method, Single Department Analysis, One Cost...Ch. 6 - Hepworth Credit Corporation is a wholly owned...Ch. 6 - Muskoge Company uses a process-costing system. The...Ch. 6 - Prob. 37PCh. 6 - Healthway uses a process-costing system to compute...Ch. 6 - FIFO Method, Two-Department Analysis Refer to the...Ch. 6 - Jacson Company produces two brands of a popular...Ch. 6 - Golding Manufacturing, a division of Farnsworth...Ch. 6 - Larkin Company produces leather strips for western...Ch. 6 - Novel Toys, Inc., manufactures plastic water guns....Ch. 6 - Prob. 44P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jackson Products produces a barbeque sauce using three departments: Cooking, Mixing, and Bottling. In the Cooking Department, all materials are added at the beginning of the process. Output is measured in ounces. The production data for July are as follows: With respect to conversion costs. Required: 1. Prepare a physical flow schedule for July. 2. Prepare an equivalent units schedule for July using the FIFO method. 3. What if 60 percent of the materials were added at the beginning of the process and 40 percent were added at the end of the process (all ingredients used are treated as the same type or category of materials)? How many equivalent units of materials would there be?arrow_forwardStone Company produces carrying cases for CDs. It has compiled the following information for the month of June: Physical Units Percent Complete for Conversion Beginning work in process 55,000 61% Ending work in process 36,000 71 Stone adds all materials at the beginning of its manufacturing process. During the month, it started 96,000 units.Required:1. Using the weighted-average method, reconcile the number of physical units.2. Using the weighted-average method, calculate the number of equivalent units.arrow_forwardStone Company produces carrying cases for CDs. It has compiled the following information for the month of June: Physical Units Percent Complete for Conversion Beginning work in process 68,000 55% Ending work in process 91,000 70% Stone adds all materials at the beginning of its manufacturing process. During the month, it started 178,000 units. Required: Using the FIFO method, reconcile the number of physical units. Using the FIFO method, calculate the number of equivalent units.arrow_forward

- lemon Enterprises produces premier raspberry jam. Output is measured in pints. Lemon uses the weighted-average method. During January, Lemon had the following production data: Required: a) Using the average weightage method, calculate the equivalent units for January. b) Calculate the unit cost for January. c) Assign costs to units transferred out and EWIP.arrow_forwardUnits in process at the beginning of August 1,100 Units started in August 2,700 Units completed and transferred 3,400 Units in process at end of August 400arrow_forwardElliott Company produces large quantities of a standardized product. The following information is available for its first production department for March. Prepare a production cost report for this department using the weighted average method. (Round "Cost per EUP" to 2 decimal places.) Beginning work in process inventory Units started this period Completed and transferred out Ending work in process inventory Beginning work in process inventory Direct materials Conversion Costs added this period Direct materials Conversion Total costs to account for Unit Reconciliation: Units to account for: Total units to account for Units accounted for: Total units accounted for Equivalent Units of Production (EUP) Equivalent Units of Production Cost per Equivalent Unit of Production Ending work in process Direct materials Conversion Units Total costs accounted for 2,000 20,000 17,000 5,000 $ 2,500 6,360 168,000 479,640 Total costs + Equivalent units of production Cost per equivalent unit of…arrow_forward

- Elliott Company produces large quantities of a standardized product. The following information is available for its first production department for March. Prepare a production cost report for this department using the weighted average method. (Round "Cost per EUP" to 2 decimal places.) Beginning work in process inventory Units started this period Completed and transferred out Ending work in process inventory Beginning work in process inventory Direct materials Conversion Costs added this period Direct materials Conversion Total costs to account for Unit Reconciliation: Units to account for: Total units to account for Units accounted for: Total units accounted for Equivalent Units of Production (EUP) Equivalent Units of Production Cost per Equivalent Unit of Production Units 2,000 20,000 17,000 5,000 Direct Materials Percent Complete $ 2,500 6,360 168,000 479,640 Units 100% Conversion Percent Complete $8,860 647,640 $ 656,500 ELLIOTT COMPANY-First Department Production Cost…arrow_forwardStep-by-Step Painting prepares and packages paint products. Step-by-Step Painting has two departments: Blending and Packaging. Direct materials are added at the beginning of the blending process (dyes) and at the end of the packaging process (cans). Conversion costs are added evenly throughout each process. The company uses the weighted-average method. Data from the month of May for the Blending Department are as follows: (Click the icon to view the data from May.) Read the requirements. Requirement 1. Compute the Blending Department's equivalent units of production for direct materials and for conversion costs. (Complete all input fields. Enter a "0" for any zero balances.) Step-by-Step Painting Production Cost Report - Blending Department (Partial) Month Ended May 31 UNITS Units to account for: Total units to account for Units accounted for: Total units accounted for Physical Units Equivalent Units Direct Materials C Conversion Costs Data table Gallons Beginning Work-in-Process…arrow_forwardThe Mixing Department of It Was Fresh Bakery had 50,500 units to account for in October. Of the 50,500 units, 40,400 units were completed and and transferred to the next department, and 10,100 units were 35% complete. All of the materials are added at the beginning of the process. Conversion costs are added evenly throughout the mixing process.(Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the total equivalent units of production for direct materials and conversion costs for October. Direct Materials # of units X % completed = EUP Started and Completed X = Work-in-Process X = Total EUP = Conversion Costs # of units X % completed = EUP Started and Completed X = Work-in-Process X = Total EUP = The Mixing Department for It Was Fresh Bakery has direct materials costs totaling $49,100 and conversions cost of $29,300 for October.2. Compute the cost per…arrow_forward

- The Mixing Department of It Was Fresh Bakery had 50,500 units to account for in October. Of the 50,500 units, 40,400 units were completed and and transferred to the next department, and 10,100 units were 35% complete. All of the materials are added at the beginning of the process. Conversion costs are added evenly throughout the mixing process.(Round your answers to two decimal places when needed and use rounded answers for all future calculations). 1. Compute the total equivalent units of production for direct materials and conversion costs for October. The Mixing Department for It Was Fresh Bakery has direct materials costs totaling $49,100 and conversions cost of $29,300 for October.2. Compute the cost per equivalent unit of production for direct materials and for conversion costs.arrow_forwardFluffy manufactures chocolate syrup in three departments: Cooking, Mixing,and Bottling. Fluffy uses the weighted average method. The following are cost andproduction data for the cooking department for August (Note: Assume that units aremeasured in gallons):Production:Units in process, August 1, 60% complete 20,000Units completed and transferred out 50,000Units in process, August 30, 20% complete 10,000Costs:WIP, August 1 RM 93,600Costs added during August RM 314,600Required:Prepare a production report for the cooking department.arrow_forwardThe Mixing Department of It Was Fresh Bakery had 50,500 units to account for in October. Of the 50,500 units, 41,200 units were completed and and transferred to the next department, and 9,300 units were 40% complete. All of the materials are added at the beginning of the process. Conversion costs are added evenly throughout the mixing process. (Round your answers to two decimal places when needed and use rounded answers for all future calculations). 1. Compute the total equivalent units of production for direct materials and conversion costs for October. Direct Materials # of units X Started and Completed Work-in-Process Conversion Costs # of units X Started and Completed X Work-in-Process X Total Direct Materials Total conversion costs X X 1 / % completed = EUP / Total EUP % completed Total EUP The Mixing Department for It Was Fresh Bakery has direct materials costs totaling $49,900 and conversions cost of $27,600 for October. 2. Compute the cost per equivalent unit of production for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY