Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 10CE

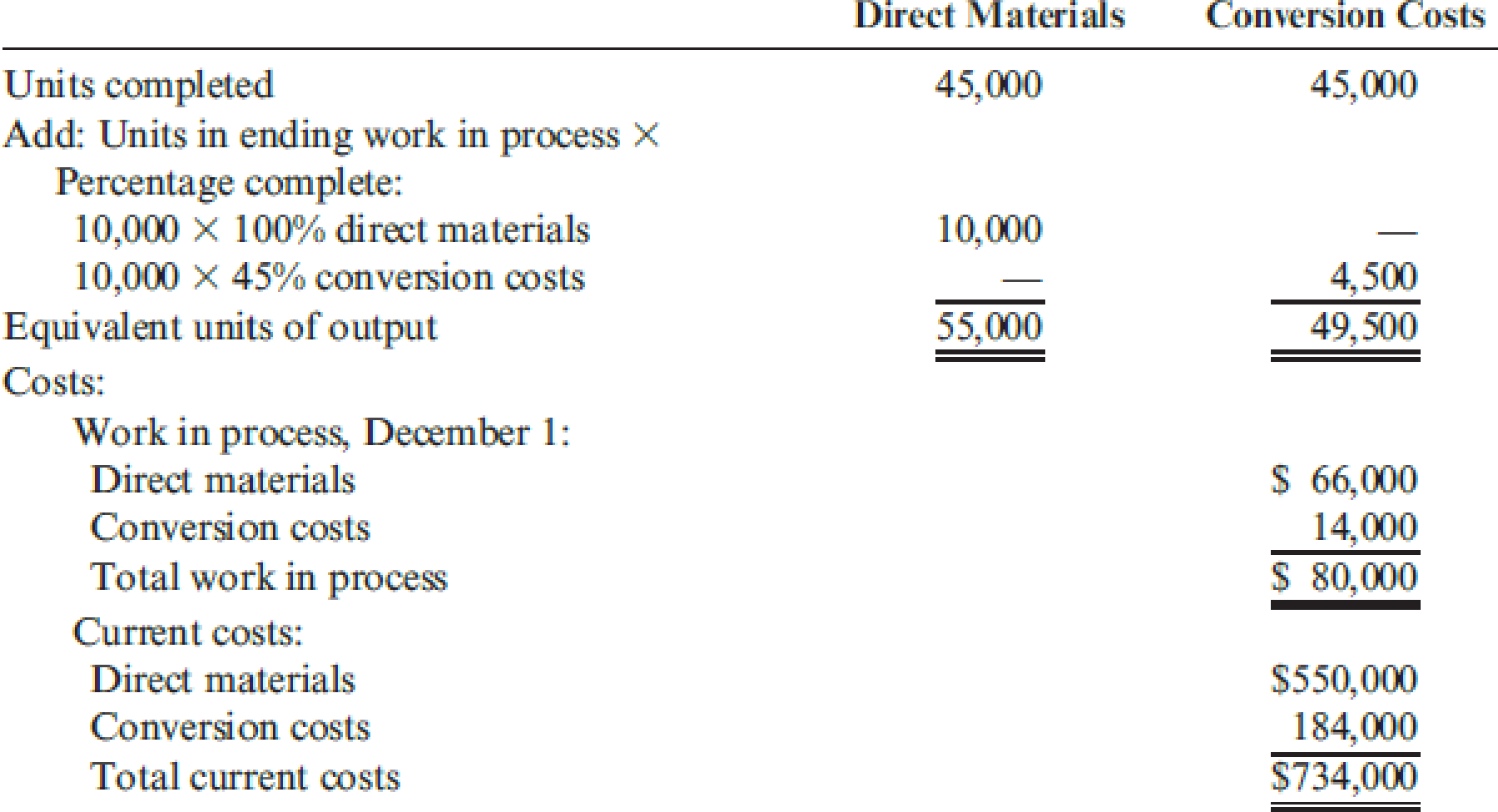

Morrison Company had the equivalent units schedule and cost information for its Sewing Department for the month of December, as shown on the next page.

Required:

- 1. Calculate the unit cost for December, using the weighted average method.

- 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for.

- 3. What if you were asked to show that the weighted average unit cost for materials is the blend of the November unit materials cost and the December unit materials cost? The November unit materials cost is $6.60 ($66,000/10,000), and the December unit materials cost is $12.22 ($550,000/45,000). The equivalent units in BWIP are 10,000, and the FIFO equivalent units are 45,000. Calculate the weighted average unit materials cost using weights defined as the proportion of total units completed from each source (BWIP output and current output).

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Equivalent Units, Unit Cost, Weighted AverageRefer to the information for Alfombra Inc. on the previous page.Required:1. Prepare a physical flow analysis for the throw rug department for August.2. Calculate equivalent units of production for the throw rug department for August.3. Calculate the unit cost for the throw rug department for August.4. Show that the cost per unit calculated in Requirement 3 is a weighted average ofthe FIFO cost per equivalent unit in BWIP and the FIFO cost per equivalent unitfor August. (Hint: The weights are in proportion to the number of units from eachsource.)

The controller at Bethune Chemicals asks for your help in sorting out some cost information. You receive the following sheet for the

most recent year:

Cost of goods manufactured

Cost of goods sold

Direct labor costs

Direct materials inventory, December 31

Direct materials purchased

Finished goods inventory, December 31

Prime costs for the year

Total manufacturing costs

Work-in-process inventory, January 11

Required:

Compute:

a. Direct materials used.

b. Direct materials inventory, January 1.

c. Conversion costs.

d. Work-in-process inventory, December 31.

e. Manufacturing overhead.

1. Finished goods inventory, January 1.

a. Direct materials used

b. Direct materials inventory

c. Conversion costs

d. Work-in-process inventory

e. Manufacturing overhead

f. Finished goods inventory

$ 906,000

727,400

184,000

52,000

263,200

236,400

466,600

914,400

26,200

Multitute Inc., manufactures products that pass through two processes. The company uses the weighted average method to compute unit costs. During November, equivalent units were computed as follows:

Required:

a. Calculate the cost of the goods transferred out.

b. Calculate the cost of ending work in process.

c. Explain the manufacturing environment in which process costing is suitable.

Chapter 6 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 6 - What is a process? Provide an example that...Ch. 6 - Describe the differences between process costing...Ch. 6 - Prob. 3DQCh. 6 - What are transferred-in costs?Ch. 6 - Explain why transferred-in costs are a special...Ch. 6 - What is a production report? What purpose does...Ch. 6 - Can process costing be used for a service...Ch. 6 - What are equivalent units? Why are they needed in...Ch. 6 - How is the equivalent unit calculation affected...Ch. 6 - Describe the five steps in accounting for the...

Ch. 6 - Under the weighted average method, how are...Ch. 6 - Under what conditions will the weighted average...Ch. 6 - In assigning costs to goods transferred out, how...Ch. 6 - Prob. 14DQCh. 6 - What is operation costing? When is it used?Ch. 6 - Lamont Company produced 80,000 machine parts for...Ch. 6 - Lising Therapy has a physical therapist who...Ch. 6 - Fleming, Fleming, and Johnson, a local CPA firm,...Ch. 6 - During October, McCourt Associates incurred total...Ch. 6 - Tomar Company produces vitamin energy drinks. The...Ch. 6 - Apeto Company produces premium chocolate candy...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Gunnison Company had the following equivalent...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Morrison Company had the equivalent units schedule...Ch. 6 - Shorts Company has three process departments:...Ch. 6 - A local barbershop cuts the hair of 1,200...Ch. 6 - Friedman Company uses JIT manufacturing. There are...Ch. 6 - Lacy, Inc., produces a subassembly used in the...Ch. 6 - Softkin Company manufactures sun protection...Ch. 6 - Heap Company manufactures a product that passes...Ch. 6 - K-Briggs Company uses the FIFO method to account...Ch. 6 - The following data are for four independent...Ch. 6 - Using the data from Exercise 6.18, compute the...Ch. 6 - Holmes Products, Inc., produces plastic cases used...Ch. 6 - Dama Company produces womens blouses and uses the...Ch. 6 - Fordman Company has a product that passes through...Ch. 6 - Using the same data found in Exercise 6.22, assume...Ch. 6 - Baxter Company has two processing departments:...Ch. 6 - Tasty Bread makes and supplies bread throughout...Ch. 6 - Under either weighted average or FIFO, when...Ch. 6 - During the month of June, the mixing department...Ch. 6 - As goods are transferred from a prior process to a...Ch. 6 - During March, Hanks Manufacturing started and...Ch. 6 - Proteger Company manufactures insect repellant...Ch. 6 - Swasey Fabrication, Inc., manufactures frames for...Ch. 6 - Refer to the data in Problem 6.31. Assume that the...Ch. 6 - Hatch Company produces a product that passes...Ch. 6 - FIFO Method, Single Department Analysis, One Cost...Ch. 6 - Hepworth Credit Corporation is a wholly owned...Ch. 6 - Muskoge Company uses a process-costing system. The...Ch. 6 - Prob. 37PCh. 6 - Healthway uses a process-costing system to compute...Ch. 6 - FIFO Method, Two-Department Analysis Refer to the...Ch. 6 - Jacson Company produces two brands of a popular...Ch. 6 - Golding Manufacturing, a division of Farnsworth...Ch. 6 - Larkin Company produces leather strips for western...Ch. 6 - Novel Toys, Inc., manufactures plastic water guns....Ch. 6 - Prob. 44P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gunnison Company had the following equivalent units schedule and cost information for its Sewing Department for the month of December: Required: 1. Calculate the unit cost for December, using the FIFO method. 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for. 3. What if you were asked for the unit cost from the month of November? Calculate Novembers unit cost and explain why this might be of interest to management.arrow_forwardEquivalent Units, Unit Cost, Weighted Average Refer to the information for Alfombra Inc. on the previous page. Required: 1. Prepare a physical flow analysis for the throw rug department for August. 2. Calculate equivalent units of production for the throw rug department for August. 3. Calculate the unit cost for the throw rug department for August. 4. Show that the cost per unit calculated in Requirement 3 is a weighted average of the FIFO cost per equivalent unit in BWIP and the FIFO cost per equivalent unit for August. (Hint: The weights are in proportion to the number of units from each source.) Use the following information for Problems 6-59 and 6-60: Alfombra Inc. manufactures throw rugs. The throw rug department weaves cloth and yarn into throw rugs of various sizes. Alfombra uses the weighted average method. Materials are added uniformly throughout the weaving process. In August, Alfombra switched from FIFO to the weighted average method. The following data are for the throw rug department for August:arrow_forwardMethod of Least Squares, Predicting Cost for Different Time Periods from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. However, assume that Tracy has used the method of least squares on the receiving data and has gotten the following results: Required: 1. Using the results from the method of least squares, prepare a cost formula for the receiving activity. 2. Using the formula from Requirement 1, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? (Note: Round your answer to the nearest dollar.) 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated?arrow_forward

- I need to finish with these three questions and need help please. Journalize the entries for costs transferred from Milling to Sifting and the costs transferred from Sifting to Packaging. 2. Determine the increase or decrease in the cost per equivalent unit from June to July for direct materials and conversion costs. 3.Discuss the uses of the cost of production report and the results of part (c).arrow_forwardquestion is in image. Required: Prepare a schedule of cost of goods manufactured. Prepare a schedule of cost of goods sold. Prepare an income statement. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how both cost schedules and the income statement will change if the following data change: direct labor is $390,000 and utilities cost $35,000.arrow_forwardComputing the cost per EUP, second department The Finishing Department reports the following data for the month: Calculate the cost per equivalent units of production for each input. The company uses the weighted-average method.arrow_forward

- We discuss how to calculate the number of equivalent units and theequivalent cost per unit, and to reconcile the total cost of Work inProcess Inventory using the first-in, first-out (FIFO) method. You alsounderstood how to prepare the process costing production reportusing the first-in, first-out (FIFO) method. Knowledge Check 02Parker Corporation makes candy bars. One of its processing departmentsreported the following information for August. Beginning work in process costsincluded $50,000 in direct materials and $110,000 in conversion cost. A total of$144,000 of direct materials costs and $210,000 in conversion cost wasincurred during the month. Equivalent units totaled 12,000 for direct materialsand 8,000 for conversion cost. Using the first-in, first-out (FIFO) method,Parker's cost per equivalent unit for conversion during August would be:arrow_forwardi) Using the high-low method derive the cost function that can be used to predict the Sales&Marketing department overhead cost using the Number of Baby Powder OrdersReceived during the month (X1) as the activity level. ii) Using the high-low method derive the cost function that can be used to predict the Sales&Marketing department overhead cost using the Total weight of Baby Powder sold duringthe month in Kgs (X2)as the activity level iii) Using the cost function derived in (i) above using the Number of Baby Powder OrdersReceived during the month (X1) as the activity level estimate the Sales &Marketingdepartment overhead cost for the month of September 2021 where the Number of BabyPowder Orders Received is expected to be 1,800 orders iv) Using the cost function derived in (ii) above using the Total weight of Baby Powder soldduring the month in Kgs (X2) as the activity level estimate the Sales &Marketingdepartmentoverhead cost for the month of September 2021 where Total…arrow_forwardRequired: 1. Tabulate the conversion costs of each operation, the total units produced, and the conversion costs per unit for November. 2. Calculate the total costs and the cost per unit of each style of box produced in November. Be sure to account for all the total costs. 3. Prepare summary journal entries for each operation. For simplicity, assume that all direct materials are introduced at the beginning of the cutting operation. Also, assume that all units were transferred to finished goods when completed and that there was no beginning or ending work in process. Prepare one summary entry for all conversion costs incurred. but prepare a separate entry for allocating conversion costs in each operation.arrow_forward

- Recording manufacturing costs in a JIT costing system Gateway produces electronic calculators. Suppose Gateway’s Standard cost per calculator is $25 for direct materials and $68 for conversion costs. The following data apply to August activities: Requirements Prepare summary journal entries for August using JIT costing, including the entry to adjust the Conversion Costs account. The beginning balance of Finished Goods Inventory was $1,300. Use a T-account to find the ending balance of Finished Goods Inventory.arrow_forward⦁ Determine total manufacturing overhead.Frame Place manufactures picture frames. Suppose the company’s May records include the items described below. What is Frame Place’s total manufacturing overhead cost in May?arrow_forwardWeighted Average Method, Single-Department AnalysisRefer to the information for Millie Company above.Required:Prepare a production report for the assembly department for June using the weighted averagemethod of costing. The report should disclose the physical flow of units, equivalent units, andunit costs and should track the disposition of manufacturing costs.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY