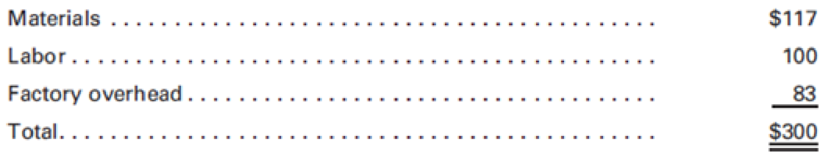

Lloyd Industries manufactures electrical equipment from specifications received from customers. Job X10 was for 1,000 motors to be used in a specially designed electrical complex. The following costs were determined for each motor:

At final inspection, Lloyd discovered that 33 motors did not meet the exacting specifications established by the customer. An examination indicated that 18 motors were beyond repair and should be sold as spoiled goods for $75 each. The remaining 15 motors, though defective, could be reconditioned as first-quality units by the addition of $1,650 for materials, $1,500 for labor, and $1,200 for factory

Required:

Prepare the

- 1. The scrapping of the 18 motors, with the income from spoiled goods treated as a reduction in the

manufacturing cost of the specific job. - 2. The correction of the 15 defective motors, with the additional cost charged to the specific job.

- 3. The additional cost of replacing the 18 spoiled motors with new motors.

- 4. The sale of the spoiled motors for $75 each.

- 5. If the reconditioned motors sell for $400 each, is Lloyd better off reconditioning the defective motors or selling them as is for $75 as spoiled goods?

Trending nowThis is a popular solution!

Chapter 2 Solutions

Principles of Cost Accounting

- One of the tennis rackets that Ace Sporting Goods manufactures is a titanium model (Slam) that sells for 149. The cost of each Slam consists of: Job 100 produced 100 Slams, of which six were spoiled and classified as seconds. Seconds are sold to discount stores for 50 each. Required: 1. Under the assumption that the loss from spoilage will be distributed to all jobs produced during the current period, use general journal entries to (a) record the costs of production, (b) put spoiled goods into inventory, and (c) record the cash sale of spoiled units. 2. Under the assumption that the loss due to spoilage will be charged to Job 100, use general journal entries to (a) record the costs of production, (b) put spoiled goods into inventory, and (c) record the cash sale of spoiled units.arrow_forwardParadise Bay Shop is a manufacturer of golf carts. Peter Cranston, the plant manager of Paradise Bay, obtains the following information for Job # 22 in August 2020. A total of 23 units were started, and 3 spoiled units were detected and rejected at final inspection, yielding 20 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,300 per unit. Assume that Job #22 of Paradise Bay Shop generates scrap with a total sales value of $400 (it is assumed that scrap returned to the storeroom is sold quickly). Read the requirements. Prepare the journal entries for the recognition of scrap, assuming the following: (Record debits first, then credits. Exclude explanations from any journal entries.) a. The value of scrap is immaterial and scrap is recognized at the time of sale. Journal Entry Accounts Debit (...) Credit Requirements Prepare journal entries for the recognition of scrap, assuming the following: The value of scrap is…arrow_forwardSitChairwn Company manufactures chairs to the exacting specifications of various customers. During January 2020, Job 023 for the production of 1,100 was completed at the following costs per unit: Direct Materials 10 Direct Labor 8 Applied Factory Overhead 12 Final Inspection of the order dislosed 50 defective units and 100 spoiled units. The defective chairs were reworked at a total cost of $50 and the spoiled chairs were sold toa jobber for $150. What would be the unit cost of the good units produced?arrow_forward

- Big Company manufactures electric drills to the exact specifications of various customers. During April 2020, Job 403 for the production of 1,100 units was completed at the following costs per unit: DIRECT MATERIALS P10 DIRECT LABOR 8 APPLIED FACTORY OVERHEAD 12 TOTAL P30 Final inspection of Job 403 disclosed 50 defective units and 100 spoiled units. The defective units were reworked at a total cost of P500, and the spoiled units were sold to an employee for P1,500. What would be the unit cost of the good units produced on Job 403? SOLUTION MUST BE IN GOOD ACCOUNTING FORM. EXCEL FORM WILL ALSO BE GOOD!arrow_forwardBig Company manufactures electric drills to the exact specifications of various customers. During April 2020, Job 403 for the production of 1,100 units was completed at the following costs per unit: Direct materials P10 Direct labor 8 Applied factory overhead 12 P30 Total Final inspection of Job 403 disclosed 59 defective units and 100 spoiled units. The defective units were reworded at a total cost of P500, and the spoiled units were sold to an employee for P1,500. What would be the unit cost of the good units produced on Job 403?arrow_forwardParadise Bay Shop is a manufacturer of golf carts. Peter Cranston, the plant manager of Paradise Bay, obtains the following information for Job #22 in August 2020. A total of 23 units were started, and 3 spoiled units were detected and rejected at final inspection, yielding 20 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,300 per unit. Assume that the 3 spoiled units of Paradise Bay Shop's Job #22 can be reworked for a total cost of $2,200. A total cost of $3,900 associated with these units has already been assigned to Job #22 before the rework. Requirements: Prepare the journal entries for the rework, assuming the following: a. The rework is related to a specific job. b. The rework is common to all jobs. c. The rework is considered to be abnormal.arrow_forward

- Paradise Bay Cart Shop is a manufacturer of golf carts. Peter Cranston, the plant manager of Paradise Bay Cart, obtains the following information for Job # 22 in August 2020. A total of 40 units were started, and 8 spoiled units were detected and rejected at final inspection, yielding 32 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,100 per unit. The current disposal price of the spoiled units is $200 per unit. When the spoilage is detected, the spoiled goods are inventoried at $200 per unit. Read the requirements. Requirement 1. What is the normal spoilage rate? Select the formula, then calculate the normal spoilage rate. (Round the percentage to the nearest tenth percent, X.X%.) = Normal spoilage rate % b. The spoilage Requirement 2. Prepare the journal entries to record the normal spoilage, assuming the following: a. The spoilage is related to a specific job. b. The spoilage is common to all jobs. c. The…arrow_forwardParadise Bay Shop is a manufacturer of golf carts. Peter Cranston, the plant manager of Paradise Bay, obtains the following information for Job # 22 in August 2020. A total of 23 units were started, and 3 spoiled units were detected and rejected at final inspection, yielding 20 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,300 per unit. The current disposal price of the spoiled units is $215 per unit. When the spoilage is detected, the spoiled goods are inventoried at $215 per unit. Read the requirements. Requirement 1. What is the normal spoilage rate? Select the formula, then calculate the normal spoilage rate. (Round the percentage to the nearest tenth percent, X.X%.) + = Normal spoilage rate % Requirements 1. What is the normal spoilage rate? 2. Prepare the journal entries to record the normal spoilage, assuming the following: The spoilage is related to a specific job. a. b. The spoilage is common to all…arrow_forwardJellyfish Machine Shop is a manufacturer of motorized carts for vacation resorts. Patrick Cullin, the plant manager of Jellyfish, obtains the following information for Job #10 in August 2017. A total of 46 units were started, and 6 spoiled units were detected and rejected at final inspection, yielding 40 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,100 per unit. The current disposal price of the spoiled units is $235 per unit. When the spoilage is detected, the spoiled goods are inventoried at $235 per unit. Q. Prepare the journal entries to record the normal spoilage, assuming the following: a. The spoilage is related to a specific job. b. The spoilage is common to all jobs. c. The spoilage is considered to be abnormal spoilagearrow_forward

- Jellyfish Machine Shop is a manufacturer of motorized carts for vacation resorts. Patrick Cullin, the plant manager of Jellyfish, obtains the following information for Job #10 in August 2017. A total of 46 units were started, and 6 spoiled units were detected and rejected at final inspection, yielding 40 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,100 per unit. The current disposal price of the spoiled units is $235 per unit. When the spoilage is detected, the spoiled goods are inventoried at $235 per unit. Q. What is the normal spoilage rate?arrow_forwardJellyfish Machine Shop is a manufacturer of motorized carts for vacation resorts. Patrick Cullin, the plant manager of Jellyfish, obtains the following information for Job #10 in August 2017. A total of 46 units were started, and 6 spoiled units were detected and rejected at final inspection, yielding 40 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,100 per unit. The current disposal price of the spoiled units is $235 per unit. When the spoilage is detected, the spoiled goods are inventoried at $235 per unit. . Assume that Job #10 of Jellyfish Machine Shop generates normal scrap with a total sales value of $700 (it is assumed that the scrap returned to the storeroom is sold quickly). Prepare the journal entries for the recognition of scrap, assuming The value of scrap is material, is related to a specific job, and is recognized at the time of sale.arrow_forwardJellyfish Machine Shop is a manufacturer of motorized carts for vacation resorts. Patrick Cullin, the plant manager of Jellyfish, obtains the following information for Job #10 in August 2017. A total of 46 units were started, and 6 spoiled units were detected and rejected at final inspection, yielding 40 good units. The spoiled units were considered to be normal spoilage. Costs assigned prior to the inspection point are $1,100 per unit. The current disposal price of the spoiled units is $235 per unit. When the spoilage is detected, the spoiled goods are inventoried at $235 per unit. . Assume that Job #10 of Jellyfish Machine Shop generates normal scrap with a total sales value of $700 (it is assumed that the scrap returned to the storeroom is sold quickly). Prepare the journal entries for the recognition of scrap, assuming The value of scrap is immaterial and scrap is recognized at the time of salearrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning