Concept explainers

Methods of Cost Analysis: Account Analysis, Simple and Multiple Regression Using a Spreadsheet (Appendix A)

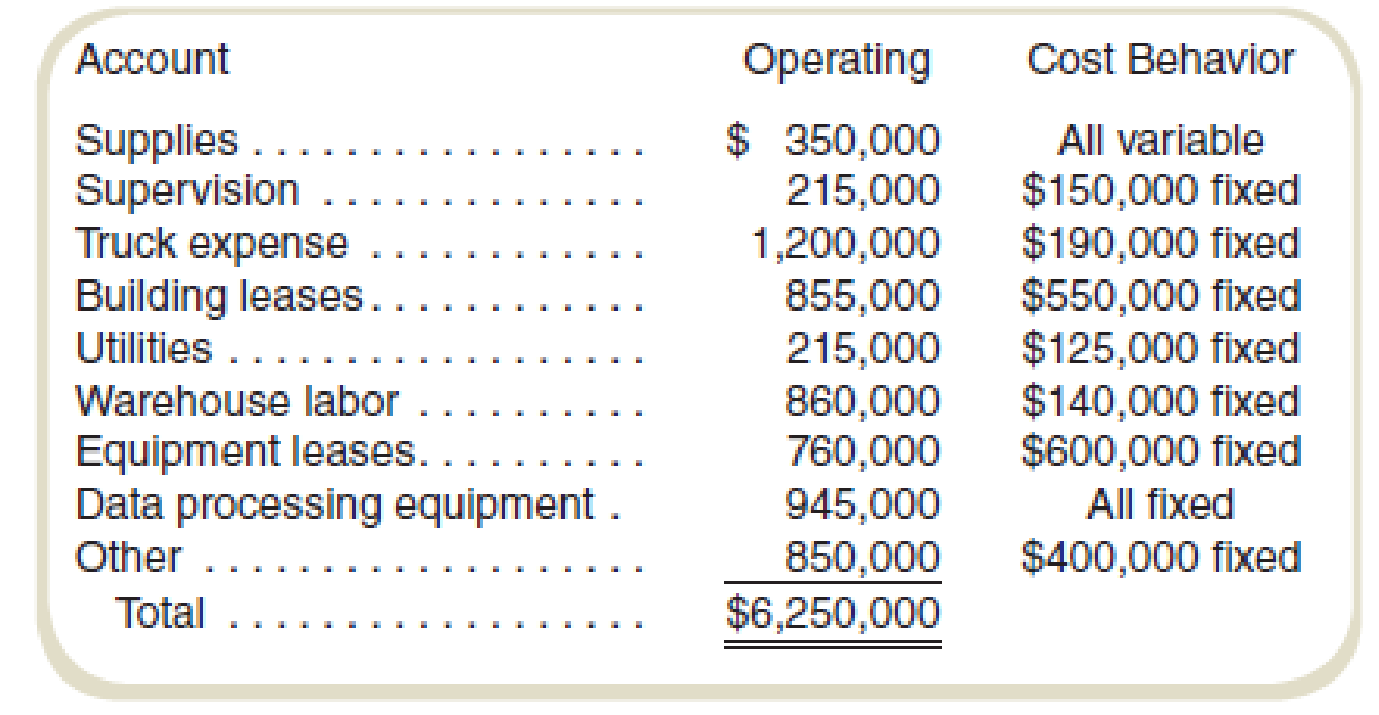

Caiman Distribution Partners is the Brazilian distribution company of a U.S. consumer products firm. Inflation in Brazil has made bidding and budgeting difficult for marketing managers trying to penetrate some of the country’s rural regions. The company expects to distribute 450,000 cases of products in Brazil next month. The controller has classified operating costs (excluding costs of the distributed product) as follows:

Although overhead costs were related to revenues throughout the company, the experience in Brazil suggested to the managers that they should incorporate information from a published index of Brazilian prices in the distribution sector to

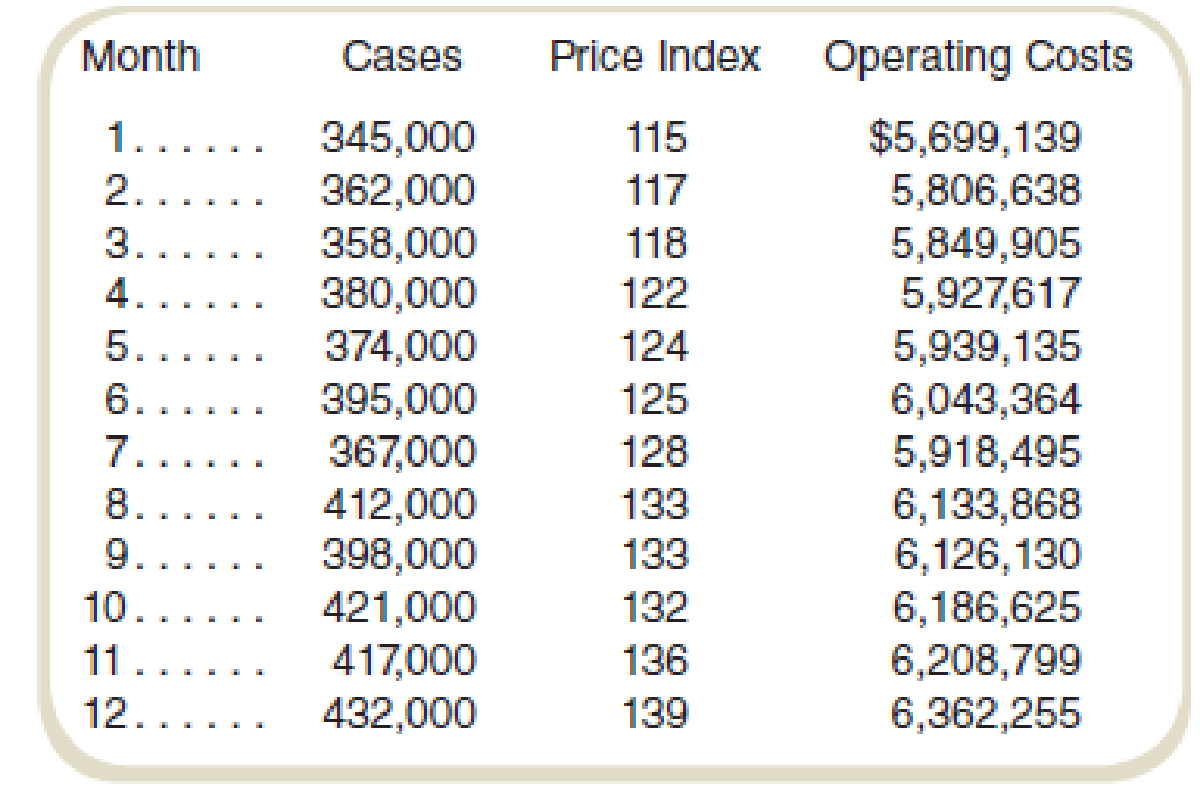

Following instructions from the corporate offices, the controller’s office in Brazil collected the following information for monthly operations from last year:

These data are considered representative for both past and future operations in Brazil.

Required

- a. Prepare an estimate of operating costs assuming that 450,000 cases will be shipped next month based on the controller’s analysis of accounts.

- b. Use the high-low method to prepare an estimate of operating costs assuming that 450,000 cases will be shipped next month.

- c. Prepare an estimate of operating costs assuming that 450,000 cases will be shipped next month by using the results of a simple regression of operating costs on cases shipped.

- d. Prepare an estimate of operating costs assuming that 450,000 cases will be shipped next month by using the results of a multiple regression of operating costs on cases shipped and the price level. Assume a price level of 145 for next month.

- e. Make a recommendation to the managers about the most appropriate estimate given the circumstances.

a.

Prepare an estimate of operating costs assuming that 450,000 cases will be shipped next month based on the controller’s analysis of accounts.

Explanation of Solution

Operating cost:

Operating cost is the total cost of the production. It includes direct and indirect cost of the production. Operating profit is calculated by deducting the operating cost from the revenue of the business.

Calculate the estimated overhead cost:

Thus, the estimated overhead cost is $6,250,000.

Working note 1:

Calculate the variable cost per unit:

Working note 2:

Prepare a schedule to show the allocation of fixed and variable cost:

| Particulars |

Operating cost (a) |

Fixed cost (b) |

Variable cost |

| Supplies | $350,000 | $0 | $350,000 |

| Supervision | $215,000 | $150,000 | $65,000 |

| Truck expenses | $1,200,000 | $190,000 | $1,010,000 |

| Building lease | $855,000 | $550,000 | $305,000 |

| Utilities | $215,000 | $125,000 | $90,000 |

| Warehouse labor | $860,000 | $140,000 | $720,000 |

| Equipment lease | $760,000 | $600,000 | $160,000 |

| Data processing equipment | $945,000 | $945,000 | $0 |

| Other | $850,000 | $400,000 | $450,000 |

| Total cost | $6,250,000 | $3,100,000 | $3,150,000 |

Table: (1)

b.

Use the high-low method to prepare an estimate of operating costs assuming that 450,000 cases will be shipped next month.

Explanation of Solution

High-low cost method:

High-low cost method helps in separating the fixed and variable cost from the total cost. It is calculated by comparing the highest and lowest level of activities and the cost of these activities.

Show the cost equation of fixed and variable cost with the overhead cost:

Thus, the cost equation is

Working note 1:

Calculate the fixed cost:

Calculate the highest and lowest activity:

| Particular | Cases | Cost |

| Highest activity | 432,000 | $6,362,255 |

| Lowest activity | 345,000 | $5,699,139 |

Table: (2)

Working note 2:

Calculate the variable cost (unit) with the help of high-low cost method:

Working note 3:

Calculate the variable cost ($) with the help of high-low cost method:

c.

Prepare an estimate of operating costs assuming that 450,000 cases will be shipped next month by using the results of a simple regression of operating costs on cases shipped.

Explanation of Solution

Regression analysis:

Regression analysis is used to show the relationship between the cost and the activity. It is used to estimate the cost at various level of activity.

The most important step in the calculation of regression analysis is to establish a logical relationship between the cost and the activity. The activity (independent variable) is placed on the right-hand side and the cost (dependent variable) is placed on the left-hand side of the graph.

Calculate the regression analysis to compute the cost equation:

| Regression Statistics | ||||||||

| Multiple R | 0.980345 | |||||||

| R Square | 0.961076 | |||||||

| Adjusted R Square | 0.957184 | |||||||

| Standard Error | 39850.14 | |||||||

| Observations | 12 | |||||||

| ANOVA | ||||||||

| Df | SS | MS | F | Significance F | ||||

| Regression | 1 | 3.92E+11 | 3.92E+11 | 246.9132 | 2.24E-08 | |||

| Residual | 10 | 1.59E+10 | 1.59E+09 | |||||

| Total | 11 | 4.08E+11 | ||||||

| Coefficients | Standard Error | t Stat | P-value | Lower 95% | Upper 95% | Lower 95.0% | Upper 95.0% | |

| Intercept | 3411468 | 166203 | 20.52591 | 1.66E-09 | 3041145 | 3781791 | 3041145 | 3781791 |

| X Variable 1 | 6.707649 | 0.426873 | 15.71347 | 2.24E-08 | 5.756518 | 7.658781 | 5.756518 | 7.658781 |

Table: (3)

The regression analysis of the company provides the following details:

Calculate the cost equation:

Put the values in the cost equation:

Thus, the operating cost equation is:

d.

Prepare an estimate of operating costs assuming that 450,000 cases will be shipped next month by using the results of multiple regression of operating costs on cases shipped and the price level.

Explanation of Solution

Regression analysis:

Regression analysis is used to show the relationship between the cost and the activity. It is used to estimate the cost at various level of activity.

The most important step in the calculation of regression analysis is to establish a logical relationship between the cost and the activity. The activity (independent variable) is placed on the right-hand side, and the cost (dependent variable) is placed on the left-hand side of the graph.

| SUMMARY OUTPUT | ||||||||

| Regression Statistics | ||||||||

| Multiple R | 0.990475 | |||||||

| R Square | 0.981042 | |||||||

| Adjusted R Square | 0.976829 | |||||||

| Standard Error | 29315.83 | |||||||

| Observations | 12 | |||||||

| ANOVA | ||||||||

| df | SS | MS | F | Significance F | ||||

| Regression | 2 | 4E+11 | 2E+11 | 232.8623 | 1.78E-08 | |||

| Residual | 9 | 7.73E+09 | 8.59E+08 | |||||

| Total | 11 | 4.08E+11 | ||||||

| Coefficients | Standard Error | t Stat | P-value | Lower 95% | Upper 95% | Lower 95.0% | Upper 95.0% | |

| Intercept | 3176995 | 144048.2 | 22.05509 | 3.83E-09 | 2851136 | 3502855 | 2851136 | 3502855 |

| X Variable 1 | 8857.728 | 2877.157 | 3.078639 | 0.013169 | 2349.147 | 15366.31 | 2349.147 | 15366.31 |

| X Variable 2 | 4.418915 | 0.807028 | 5.475543 | 0.000392 | 2.593292 | 6.244539 | 2.593292 | 6.244539 |

Table: (4)

The regression analysis of the company provides the following details:

Calculate the cost equation:

Put the values in the cost equation:

Thus, the operating cost equation is

e.

Make a recommendation to the managers about the most appropriate estimate given the circumstances.

Explanation of Solution

Recommendation to the manager:

The multiple regressions seem to be more useful as per the adjusted R2. But the inclusion of price index may not be dependent on the cost of the product instead on the growth of the business. So correlating the price with the cost will not be very useful.

Simple regression is easy to compute, and it shows the clear relationship between the cost and the revenue so it should be considered for the cost estimation.

Thus, management should consider the simple regression for the cost estimation.

Want to see more full solutions like this?

Chapter 5 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Caiman Distribution Partners is the Brazilian distribution company of a U.S. consumer products firm. Inflation in Brazil has made bidding and budgeting difficult for marketing managers trying to penetrate some of the country's rural regions. The company expects to distribute 450,000 cases of products in Brazil next month. The controller has classified operating costs (excluding costs of the distributed product) as follows. Account Operating Cost Behavior Supplies $ 350,000 All variable Supervision 215,000 $ 150,000 Fixed Truck expense 1,200,000 $ 190,000 Fixed Building leases 855,000 $ 550,000 Fixed Utilities 215,000 $ 125,000 Fixed Warehouse labor 860,000 $ 140,000 Fixed Equipment leases 760,000 $ 600,000 Fixed Data processing equipment 945,000 All fixed Other 850,000 $ 400,000 Fixed Total $ 6,250,000 Although overhead costs were related to revenues throughout the company, the experience in Brazil suggested to…arrow_forwardYardwork Tools Corp manufactures garden tools in a factory in Taneytown, Maryland. Recently, the company designed a collection of tools for professional use rather than consumer use. Management needs to make a good decision about whether to produce this line in their existing space in Maryland, where space is available or to accept an offer from a manufacturer in Taiwan. Data concerning the decision are as follows: Expected annual sales of tools (in units) 660,000 Average selling price of tools $11 Price quoted by Taiwanese company, in New Taiwanese Dollars (NTD) 27,300 Current exchange rate 9,100 NTD = $1 Variable manufacturing costs $2.85 per unit Incremental annual fixed manufacturing costs associated with the new product line $310,000 Variable selling and distribution costsª $0.50 per unit Annual fixed selling and distribution costsª $250,000 ªSelling and distribution costs are the same regardless of whether the tools…arrow_forwardYardwork Tools Corp manufactures garden tools in a factory in Taneytown, Maryland. Recently, the company designed a collection of tools for professional use rather than consumer use. Management needs to make a good decision about whether to produce this line in their existing space in Maryland, where space is available or to accept an offer from a manufacturer in Taiwan. Data concerning the decision are as follows: Expected annual sales of tools (in units) 660,000 Average selling price of tools $11 Price quoted by Taiwanese company, in New Taiwanese Dollars (NTD) 27,300 Current exchange rate 9,100 NTD = $1 Variable manufacturing costs $2.85 per unit Incremental annual fixed manufacturing costs associated with the new product line $310,000 Variable selling and distribution costsª $0.50 per unit Annual fixed selling and distribution costsª $250,000 ªSelling and distribution costs are the same regardless of whether the tools…arrow_forward

- Product costing and decision analysis for a service company Blue Star Airline provides passenger airline service, using small jets. The airline connects four major cities: Charlotte, Pittsburgh, Detroit, and San Francisco. The company expects to fly 170,000 miles during a month. The following costs are budgeted for a month: Blue Star management wishes to assign these costs to individual flights in order to gauge the profitability of its service offerings. The following activity bases were identified with the budgeted costs: The size of the companys ground operation in each city is determined by the size of the workforce. The following monthly data are available from corporate records for each terminal operation: Three recent representative flights have been selected for the profitability study. Their characteristics are as follows: Instructions Determine the fuel, crew, and depreciation cost per mile flown. Determine the cost per arrival or departure by terminal city. Use the information in (1) and (2) to construct a profitability report for the three flights. Each flight has a single arrival and departure to its origin and destination city pairs.arrow_forwardAldovar Company produces a variety of chemicals. One division makes reagents for laboratories. The divisions projected income statement for the coming year is: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. (Note: Round answer to the nearest unit.) Calculate the contribution margin ratio and use it to calculate the break-even sales revenue. (Note: Round contribution margin ratio to four decimal places, and round the break-even sales revenue to the nearest dollar.) 2. The divisional manager has decided to increase the advertising budget by 250,000. This will increase sales revenues by 1 million. By how much will operating income increase or decrease as a result of this action? 3. Suppose sales revenues exceed the estimated amount on the income statement by 1,500,000. Without preparing a new income statement, by how much are profits underestimated? 4. Compute the margin of safety based on the original income statement. 5. Compute the degree of operating leverage based on the original income statement. If sales revenues are 8% greater than expected, what is the percentage increase in operating income? (Note: Round operating leverage to two decimal places.)arrow_forwardDecision on accepting additional business A manager of Varden Sporting Goods Company is considering accepting an order from an overseas customer. This customer has requested an order for 20,000 dozen golf balls at a price of 22 per dozen. The variable cost to manufacture a dozen golf balls is 18 per dozen. The full cost is 25 per dozen. Varden has a normal selling price of 35 per dozen. Vardens plant has just enough excess capacity on the second shift to make the overseas order. What are some considerations in accepting or rejecting this order?arrow_forward

- A new product is being designed by an engineering team at Golem Security. Several managers and employees from the cost accounting department and the marketing department are also on the team to evaluate the product and determine the cost using a target costing methodology. An analysis of similar products on the market suggests a price of $132.00 per unit. The company requires a profit of 0.20 of selling price. How much is the target cost per unit? Round to two decimal places.arrow_forwardAm Berhad is a company producing tables. After discussing with the marketing manager, the production manager planning to focus on producing a product named AFI. The marketing manager is observing on two states, Selangor and Pahang, the sales at both states is expected to be RM500,000 an RM810,000 respectively. Information related to the cost per unit of the production for both states are as follows: SELANGOR (RM) PAHANG (RM) Selling price Direct material 100 135 40 45 Direct labour 10 15 Overhead 20 30 50% of the overhead in SELANGOR and PAHANG are fixed. 2.Calculate the followings and show all your workings. i. The break-even point (in unit and sales value) for both states. i. The margin of safety (in unit) for both states. ii. Advice to the management in which state should the company sell AFI.arrow_forwardAm Berhad is a company producing tables. After discussing with the marketing manager, the production manager planning to focus on producing a product named AFI. The marketing manager is observing on two states, Selangor and Pahang, the sales at both states is expected to be RM500,000 an RM810,000 respectively. Information related to the cost per unit of the production for both states are as follows: SELANGOR (RM) PAHANG (RM) Selling price Direct material 100 135 40 45 Direct labour 10 15 Overhead 20 30 50% of the overhead in SELANGOR and PAHANG are fixed. 1.Classify the cost incurred into variable cost per unit and total fixed cost for both states.arrow_forward

- Am Berhad is a company producing tables. After discussing with the marketing manager, the production manager planning to focus on producing a product named AFI. The marketing manager is observing on two states, Selangor and Pahang, the sales at both states is expected to be RM500,000 an RM810,000 respectively. Information related to the cost per unit of the production for both states are as follows: SELANGOR (RM) PAHANG (RM) 135 Selling price Direct material 100 40 45 Direct labour 10 15 Overhead 20 30 50% of the overhead in SELANGOR and PAHANG are fixed. 3.Marketing manager suggested the company should sell AFl in both states as he is convinced the market would be good. However, the direct material cost will increase by 10%. Advice the management on how many additional units to be sold for both states, assuming other information remains unchanged and Am Berhad would like to maintain its annual profit. (Calculate to the nearest unit).arrow_forwardThe West Company’s cost structure for a certain items at a level of 20,000 units per month are as follows: Manufacturing Costs: Direct Material 1.00 Direct Labor 1.20 Variable indirect cost .80 Fixed indirect cost .50 Selling and other: Variable 1.50 Fixed .90 Required: Determine the minimum basis for break even price considering the following: The company desires to enter the foreign market, in which price competition is keen. An order of 10,000 units of this product is being sought on a minimum unit price basis. It is expected that shipping costs for this order will amount to only P0.75 per unit but the fixed costs of obtaining the contract will be P4,000. Domestic business will be unaffected.arrow_forwardMohave Corporation is considering outsourcing production of the umbrella tote bag included with some of its products. The company has received a bid from a supplier in Vietnam to produce 8,900 units per year for $7.50 each. Mohave the following information about the cost of producing tote bags: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost per unit Mohave determined all variable costs could be eliminated by outsourcing the tote bags, while 70 percent of the fixed overhead cost is unavoidable. At this time, Mohave has no specific use in mind for the space currently dedicated to producing the tote bags. Required: 1. Compute the difference in cost between making and buying the umbrella tote bag. 2. Based strictly on the incremental analysis, should Mohave buy the tote bags or continue to make them? 3-a. Suppose the space Mohave currently uses to make the bags could be utilized by a new product line that would generate $12,000 in…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning