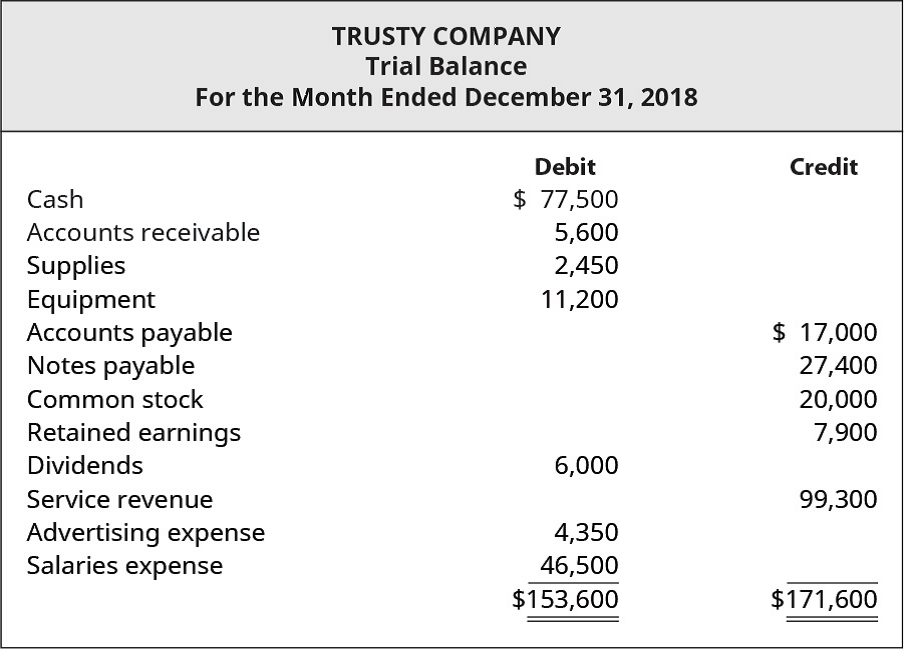

Analyze Trusty Company’s

A. what is causing the trial balance to be out of balance

B. any other errors that require corrections that are identified during your analysis

C. the effect (if any) that correcting the errors will have on the

A review of transactions revealed the following facts:

• A service fee of $18,000 was earned (but not yet collected) by the end of the period but was accidentally not recorded as revenue at that time.

• A transposition error occurred when transferring the account balances from the ledger to the trial balance. Salaries expense should have been listed on the trial balance as $64,500 but was inadvertently recorded as $46,500.

• Two machines that cost $9,000 each were purchased on account but were not recorded in company accounting records.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Principles of Accounting Volume 1

Additional Business Textbook Solutions

Principles of Management

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Financial Accounting (12th Edition) (What's New in Accounting)

Managerial Accounting (5th Edition)

Principles of Accounting Volume 2

Managerial Accounting (4th Edition)

- You are assigned to audit Bonifacio Inc. for the year ending June 30, 2014. Prior to any adjustments you were able to extract the following balances from the client’s records:Accounts receivable, control account P221,250Allowance for doubtful accounts (7,500)Amortized cost P213,750arrow_forwardChoose A, B, C or D and give an explanation The debit side of a company’s trial balance totals $800 more than the credit side.Which one of the following errors would fully account for the difference?A $400 paid for plant maintenance has been correctly entered in the cash book and credited to the plant asset account.B Discount allowed $400 has been debited to discount received accountC A receipt of $800 for commission receivable has been omitted from the recordsD The petty cash balance of $800 has been recorded to the trial balance twice.arrow_forwardThe trial balance of The White Ribbon failed to agree, and the difference was posted to a suspense account. The Income Statement then showed a net loss $15,800. A subsequent audit revealed the following accounting errorsa) The loan interest of $25,000 was paid by cheque and correctly posted in the cashbook, but was debited to the loan accountb) An invoice for credit sales of $70,000 was posted in the sales ledger but was not posted in the sales accountc) Office expense of $30,000 paid by cheque and correctly posted in the cashbook, was debited to the Insurance accountd) The Closing Stock valued at $60,500 was taken as $44,500e) Cash donations of $22,500 was posted to the books as $55,200f) The Opening Stock valued at $35,000 was taken as $55,000g) Building repairs paid for $40,000 by cheque was correctly recorded in the cashbook but was debited to the building accountRequired1. Write up the General Journal to note the corrections required for the above…arrow_forward

- (Corrected Trial Balance) The following trial balance of Wanda Landowska Company does not balance. Your review of the ledger reveals the following. (a) Each account had a normal balance. (b) The debit footings in Prepaid Insurance,Accounts Payable, and Property Tax Expense were each understated $100. c) A transposition error was made in AccountsReceivable and Service Revenue; the correct balances for Accounts Receivable and Service Revenue are $2,750 and $6,690,respectively. (d) A debit posting to Advertising Expense of $300 was omitted. (e) A $1,500 cash drawing by the owner was debited to Owner’s Capital and credited to Cash. InstructionsPrepare a correct trial balance.arrow_forwardThe trial balance of The White Ribbon failed to agree, and the difference was posted to a suspense account. The Income Statement then showed a net loss $15,800. A subsequent audit revealed the following accounting errors a) The loan interest of $25,000 was paid by cheque and correctly posted in the cashbook, but was debited to the loan account b) An invoice for credit sales of $70,000 was posted in the sales ledger but was not posted in the sales account c) Office expense of $30,000 paid by cheque and correctly posted in the cashbook, was debited to the Insurance account d) The Closing Stock valued at $60,500 was taken as $44,500 e) Cash donations of $22,500 was posted to the books as $55,200 f) The Opening Stock valued at $35,000 was taken as $55,000 g) Building repairs paid for $40,000 by cheque was correctly recorded in the cashbook but was debited to the building account Required REQUIRED 2. Prepare the Statement of Adjusted Net Income and identify and briefly explain the errors…arrow_forwardResolving Errors and Correcting a Trial Balance Assume we examine the accounts of Century Inc. and identify the following errors. 1. Equipment purchased for $37,500 at year-end was debited to Expenses. 2. Sales on credit of $4,145 were debited to Accounts Receivable for $4,460 and credited to Revenues for $4,145. 3. A $30,000 cash collection on accounts receivable was debited to Cash and credited to Revenues. 4. The inventory amount is understated by $10,000 because the entry to record the purchase of $10,000 of inventory was incorrectly recorded in cost of goods sold (cost of goods sold is included in Expenses). The unadjusted trial balance of Century Inc. is provided below. Prepare a correct unadjusted trial balance, correcting for all errors, including improper recording of debits and credits. Note: Do not use negative sign in your answers. Accounts Cash Accounts receivable Allowance for doubtful accounts Inventory Equipment Accumulated depreciation Accounts payable Notes payable…arrow_forward

- Creative Solutions Company, a computer consulting firm, has decided to write off the $15,220 balance of an account owed by a customer, Wil Treadwell. a. Journalize the entry to record the write-off, assuming that the direct write-off method is used. If an amount box does not require an entry, leave it blank. Account Debit Credit Bad Debt Expense Accounts Receivable-Wil Treadwell Feedback Check My Work Remember that under the direct write-off method, Bad Debt Expense is not recorded until the customer's account is determined to be worthless. b. Journalize the entry to record the write-off, assuming that the allowance method is used. If an amount box does not require an entry, leave it blank. Account Debit Credit Allowance for Doubtful Accounts Accounts Receivable-Wil Treadwellarrow_forward1. While reviewing a trial balance, you notice the following account balances. Which one is likely to be an error? a. Inventory with a debit balance of $43,000 b. Discount on Bonds Payable with a debit balance of $4,000 c. Accumulated Depreciation with a debit balance of $8,000 d. Allowance for Doubtful Accounts with a credit balance of $23,000 2. Debiting an insurance payment to Rent Expense instead of Insurance Expense is an example of... a. an accrual error b. a deferral error c. a classification error d. use of an incorrect accounting principle 3. InCo. recorded a customer's $20,000 check as a $20,000 debit to Cash and as a $2,000 credit to Accounts Receivable. This is an example of: a. an oversight b. an incorrect account classification c. a transposition error d. a slide error 4. During a bank reconciliation, a deposit recorded by the bank but not in the company's ledger Cash account is... a. added to both the bank balance and the ledger Cash account balance b. added to the…arrow_forwardThe firm of Adam and Son extracted a Trial Balance from the books on 30th June 2020 and found that the credit side exceeded the debit by sh.92,000. This difference was entered into a suspense account and the final account prepared. The following mistakes were subsequently discovered: 1. machinery repairs of sh.40,000 had been entered on the debit side of the machinery account. 2. Cash discount of sh.2000 allowed by Milele Ltd., a payable had not been entered in Milele Ltd Account. 3. The purchase of a computer for sh.320,000 had been entered in the office equipment account as sh.230,000. 4. The Sales Book had been under cast by sh.10,000. 5. Loan interest charged by the bank, sh.60,000, had been entered in the Bank account but not posted to the interest on loan account. 6. Sh.25,000 received for the sale of an old office desk had been debited in the cash book and also debited to the office equipment account. Required: a) Draw the journal entries…arrow_forward

- At the end of year there was an imbalance in the trial balance of Messy and Co which meant that a suspense account with a credit balance of €700 had to be created. The following items were discovered after investigation: I. A sales credit note for €750 was correctly recorded on the trade receivables account but inconectly included with purchases returns. A stock of Heating Oil valued at €300 had not been accounted for at all. All costs associated with light and heat have been recorded in the appropriate expense account. III. П. An early settlement discount of €100 had been taken even though the early payment period had expired, and the supplier statement records the amount as still due Cost of sales included €750 for components for a new non-current asset. These components will extend the useful life of the asset and should have been capitalised. Sale of goods for €1,200 on credit had been entered correctly in the trade receivables account but omitted in the sales account. IV. V. VI.…arrow_forward3. What kind of an account (asset, liability, etc.) is Allowance for Doubtful Accounts, and is its normal balance a debit or a credit? 4. After the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $673,400 and Allowance for Doubtful Accounts has a balance of $11,900. Describe how the accounts receivable and the allowance for doubt-ful accounts are reported on the balance sheet.arrow_forwardthe draft financial statements. Question nineteen: At the end of a financial year, the trial balance of a small company failed to agree and the difference was entered in a suspense account. Subsequently, the following errors were discovered: (i) The sales day book had been undercast by shs. 10. (ii) A customer's personal account has been correctly credited with shs.2 discount, but no corresponding entry was made in the discount column of the cash book. (iii) Discounts allowed for July, amounting to shs.70 were credited instead of being debited to the discount account. (iv) A debit balance on the account of D Bird, a customer, was carried forward shs. 10 short. (v) An old credit balance of shs.3 on a customer's account (J Flyn) had been entirely overlooked when extracting the balances. Required: (a) Prepare, where necessary, the journal entries to correct the errors. (b) Draw up a statement showing the impact of these errors upon the trial balance. Question twenty:arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College