Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 1P

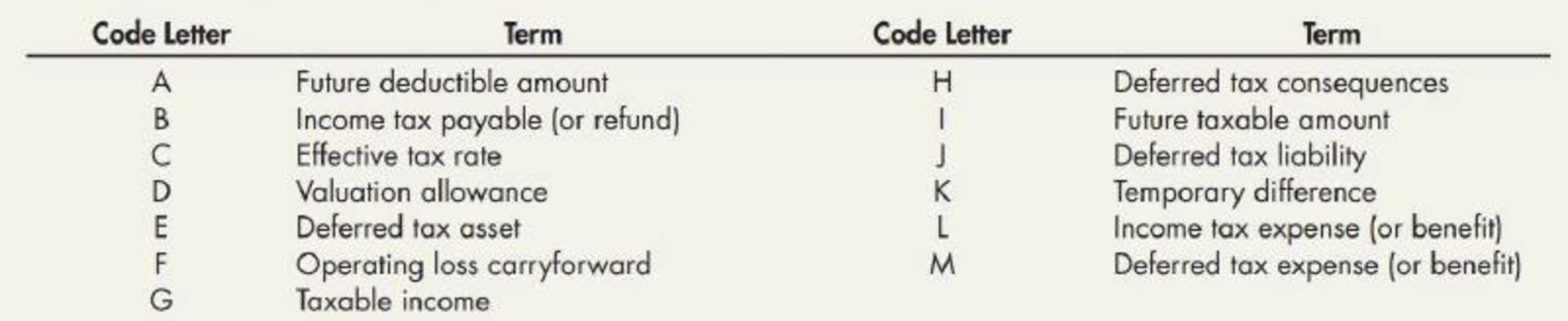

Definitions The FASB has defined several terms in regard to accounting for income taxes. Below are various code letters (for terms) followed by definitions.

- 1. The

deferred tax consequences of future deductible amounts and operating loss carryforwards - 2. A difference between the tax basis of an asset or liability and its reported amount in the financial statements that will result in taxable or deductible amounts in future years when the reported amount of the asset or liability is recovered or settled, respectively

- 3. Temporary difference that results in taxable amounts in future years when the related asset or liability is recovered or settled, respectively

- 4. The future effects on income taxes, as measured by the applicable enacted tax rate and provisions of the enacted tax low, resulting from temporary differences and operating loss carryforwards at the end of the current year

- 5. The change during the year in a corporation’s

deferred tax liabilities and assets - 6. The deferred tax consequences of future taxable amounts

- 7. The portion of o

deferred tax asset for which it is more likely than not that a tax benefit will not be realized - 8. Temporary difference that results in deductible amounts in future years when the related asset or liability is recovered or settled, respectively

- 9. The sum of income tax payable and deferred tax expense (or benefit)

- 10. The amount of income taxes paid or payable (or refundable) for the current year

- 11. An excess of tax deductible expenses over taxable revenues in a year that may be carried forward to reduce taxable income in a future year

- 12. The excess of taxable revenues over tax deductible expenses and exemptions for the year

- 13. Income tax expense divided by income before income taxes

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Definitions

The FASB has defined several terms in regard to accounting for income taxes. Below are various code letters (for terms) followed by definitions.

Code Letter

Term

Code Letter

Term

A.

Future deductible amount

H

Deferred tax consequences

B

Income tax payable (or refund)

I

Future taxable amount

Operating loss carryback

Deferred tax liability

D

Valuation allowance

K

Temporary difference

E

Deferred tax asset

Income tax expense (or benefit)

F

Operating loss carryforward

M

Deferred tax expense (or benefit)

Taxable income

Required:

Indicate which term belongs with each definition by choosing the correct term.

1. The deferred tax consequences of future deductible amounts and operating loss carryforwards

2. A difference between the tax basis of an asset or liability and its reported amount in the financial statements that will result in taxable or deductible amounts in future years when the reported amount of the asset or liability is recovered or

settled, respectively

X

3. Temporary…

1. The amount of income taxes that relate to financial income subject to tax is reported on the income

statement as

A. long-term deferred income taxes (credit) C. income tax expense

B. current deferred income taxes (debit)

D. income tax payable

2. An item that would create a permanent difference in pretax financial and taxable income would be

A. using accelerated depreciation for tax purposes & straight line depreciation for book purposes.

B. using the percentage of completion method on long-term construction contracts.

C. purchasing equipment previously leased with an operating lease in prior years.

D. paying fines for violation of laws.

3. Which of the following is the most likely item to result in a deferred tax asset?

A. using completed contract method of recognizing construction revenue tax purposes, but using

percentage of completion method for financial reporting purposes.

B. using accelerated depreciation for tax purposes but straight-line depreciation for accounting

purposes.…

The recognition of current tax under AASB 112/IAS 12 Income Taxes is based on the following.

a. the total income tax expense for the current period.

b. the prima facie tax on accounting profit before tax for the current period.

c. the tax on taxable profit of the current period that is due to the taxation authorities including amounts paid during the period and amounts payable or receivable at the end of the period.

d. the amount of income tax payable to, or receivable from, the taxation authorities at the end of the current period

Chapter 18 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 18 - What source is used to determine income tax...Ch. 18 - Prob. 2GICh. 18 - Prob. 3GICh. 18 - Prob. 4GICh. 18 - Prob. 5GICh. 18 - Prob. 6GICh. 18 - What are the three characteristics of a liability,...Ch. 18 - Prob. 8GICh. 18 - When does a corporation establish a valuation...Ch. 18 - List the steps necessary to measure and record a...

Ch. 18 - Prob. 11GICh. 18 - Prob. 12GICh. 18 - Prob. 13GICh. 18 - Prob. 14GICh. 18 - Prob. 15GICh. 18 - Describe an operating loss carryforward. List the...Ch. 18 - Prob. 17GICh. 18 - Prob. 18GICh. 18 - Prob. 19GICh. 18 - Prob. 20GICh. 18 - Prob. 21GICh. 18 - Prob. 22GICh. 18 - Prob. 23GICh. 18 - Which of the following is not a cause of a...Ch. 18 - Which of the following is an argument in favor of...Ch. 18 - Prob. 3MCCh. 18 - Prior to and during 2019, Shadrach Company...Ch. 18 - At the beginning of 2019, Conley Company purchased...Ch. 18 - Oliver Company earned taxable income of 7,500...Ch. 18 - Prob. 7MCCh. 18 - Prob. 8MCCh. 18 - Brooks Company reported a prior period adjustment...Ch. 18 - Which component of current income is not disclosed...Ch. 18 - Parker Company identifies depreciation as the only...Ch. 18 - Refer to RE18-1. Assume that Parkers taxable...Ch. 18 - In the current year, Madison Corporation had...Ch. 18 - Refer to RE18-3. Prepare the additional journal...Ch. 18 - Turnip Company purchased an asset at a cost of...Ch. 18 - Prob. 6RECh. 18 - Compute Radish Companys taxable income given the...Ch. 18 - Sky Company reports a pretax operating loss of...Ch. 18 - Prob. 9RECh. 18 - Kline Company has the following items of pretax...Ch. 18 - Barth James Inc. has the following deferred tax...Ch. 18 - Cole Company had a deferred tax liability of 1,000...Ch. 18 - Future Taxable Amount Arrow Company began...Ch. 18 - Change in Tax Rates At the end of 2019, Sentry...Ch. 18 - Temporary Difference At the end of 2019, its first...Ch. 18 - Single Temporary Difference: Multiple Rates At the...Ch. 18 - Prob. 5ECh. 18 - Valuation Account At the end of 2019, its first...Ch. 18 - Deferred Tax Asset and Valuation Account Zeta...Ch. 18 - Incomc Taxes Then Company has been in operation...Ch. 18 - Prob. 9ECh. 18 - Multiple Temporary Differences Vickers Company...Ch. 18 - Multiple Tax Rates For the year ended December 31,...Ch. 18 - Temporary and Permanent Differences Lin has just...Ch. 18 - Temporary and Permanent Differences Assume the...Ch. 18 - Operating Loss At the end of 2019, Keil Company...Ch. 18 - Operating Loss At the end of 2019, its first year...Ch. 18 - Operating Loss Baxter Company began operations in...Ch. 18 - Intraperiod Tax Allocation Wright Company reports...Ch. 18 - Prob. 18ECh. 18 - Prob. 19ECh. 18 - Balance Sheet Presentation Thiel Company reports...Ch. 18 - Uncertain Tax Position At the end of the current...Ch. 18 - Definitions The FASB has defined several terms in...Ch. 18 - Temporary and Permanent Differences In the current...Ch. 18 - Multiple Temporary Differences Wilcox Company has...Ch. 18 - Interperiod Tax Allocation Klerk Company had four...Ch. 18 - Prob. 5PCh. 18 - Interperiod Tax Allocation Quick Company reports...Ch. 18 - Deferred Tax Liability: Depreciation At the...Ch. 18 - Deferred Tax Liability: Depreciation Gire Company...Ch. 18 - Interperiod Tax Allocation Peterson Company has...Ch. 18 - Operating Loss Ross Company has been in business...Ch. 18 - Prob. 11PCh. 18 - Comprehensive Colt Company reports pretax...Ch. 18 - Prob. 13PCh. 18 - Comprehensive Jayryan Company sells products in a...Ch. 18 - Prob. 1CCh. 18 - Prob. 2CCh. 18 - Prob. 3CCh. 18 - Interperiod and Intraperiod Tax Allocation Income...Ch. 18 - Prob. 5CCh. 18 - Intel-period Tax Allocation Chris Green, CPA, is...Ch. 18 - Prob. 7CCh. 18 - Analyzing Coca-Colas Income Tax Disclosures Obtain...Ch. 18 - Prob. 9C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is not a cause of a difference between pretax financial income and taxable income in a given period? a. operating loss carryforwards b. permanent differences c. applicable tax rates d. temporary differencesarrow_forwardThe definition of gross income in the tax law is: All items specifically listed as income in the tax law All cash payments received for goods provided and services performed All income from whatever source derived All income from whatever source derived unless the income is earned illegallyarrow_forwardList the steps necessary to measure and record a corporations current and deferred income taxes.arrow_forward

- Requirements: Compute for the following: a Income tax expense, Current tax expense and Deferred tax a. expense/benefit b. Current tax liability c Deferred tax liability and Deferred tax asset d. Provide the journal entry. C.arrow_forwardIn relation to accounting for income taxes, which one of the following statements is correct? a. Tax expense is the sum of current tax expense plus deferred tax expense. b. All movements in deferred tax assets and liabilities are recognised in the statement of profit or loss and other comprehensive income. c. Current tax expense is the sum of tax expense plus deferred tax expense. d. Deferred tax liabilities are determined from deductible temporary differences.arrow_forwardAccess the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific citation for accounting for each of the following items: 1. The specific items to which income tax expense is allocated for intraperiod tax allocation. 2. The tax rate used to calculate deferred tax assets and liabilities. 3. The required disclosures in the notes to financial statements for the components of income tax expense.arrow_forward

- PROBLEM 3: EXERCISES 1. Park Co. has the following information for the current year: Pretax income 900,000 Penalty on late filing of income tax return Interest on borrowings incurred to acquire tax- 30,000 exempt securities Interest income on government securities Excess of tax depreciation over book depreciation Excess of revenue recognized over taxable income Excess of provision over actual expenditures Advanced rent received (taxable upon receipt) Unrealized loss on change in fair value of investment Temporary differences as at the beginning of the year 3,000 9,000 60,000 45,000 54,000 12,000 18,000 Income tax rate 30%arrow_forwardAccounting profit is O A. The The profit or loss is for a period determined before deducting in accordance tax expense O B. The profit or loss is for a period determined in accordance with tax law C. The profit or loss after for a period after deducting tax expense O D. The profit or loss after current tax expense determined accordance with tax lawarrow_forwardStatement 1: Life insurance premiums shall be reported as a deductible expense for financial reporting purposes if the company paying it is the beneficiary. Statement 2: Life insurance premiums shall be reported as a deductible expense for taxation purposes if the company paying it is the beneficiary. Statement 3: The total income tax expense can be computed as financial income multiplied by the tax rate. Statement 4: Future taxable amounts should be deducted in determining the taxable income which will yield the deferred tax asset. Statement 5: Future deductible amounts should be deducted in determining the taxable income. Which statement/s are true?arrow_forward

- Which option is the correct definition of tax base? Select one: a. Tax base is the amount the asset or liability is recorded at in the accounting records. b. Tax base is a comparing the balance sheet derived using accounting rules with balance sheet that would be derived from taxation rules c. Tax base is the recognition of assets and liabilities in the balance sheet based on the differences between accounting and tax values of assets and liabilities. d. Tax base is defined as the amount that is attributed to an asset or liability for tax purposes.arrow_forward1. Which statement is true about intraperiod tax allocation? a. It arises because certain revenue and expense items appear in the income statement either before or after they are included in the tax return b. It is required for the cumulative effect of accounting changes but not for prick period adjustments c. The purpose is to allocate income tax expense evenly over a number of accounting periods d. The purpose is to relate the income tax expense to the items which affect the amount of tax 2. Which temporary difference would result in a deferred tax asset? a. Tax penalty or surcharge b. Dividend received on share investment c. Excess tax depreciation over accounting depreciation d. Rent received in advance included in taxable income but deferred for financial accounting 3. Which temporary difference would result in a deferred tax liability? a. Interest revenue on municipal bonds b. Accrual of warranty expense c. Excess tax depreciation over…arrow_forward1. cont... Listed below are items that are commonly accounted for differently for financial reporting purposes than they are for tax purposes.For each item below, indicate whether it involves: 1. A temporary difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred income tax asset. 2. A temporary difference that will result in future taxable amounts and, therefore, will usually give rise to a deferred income tax liability. 3. A permanent difference. (e) Installment sales of investments are accounted for by the accrual method for financial reporting purposes and the installment method for tax purposes. (f) For some assets, straight-line depreciation is used for both financial reporting purposes and tax purposes, but the assets’ lives are shorter for tax purposes. (g)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Chapter 19 Accounting for Income Taxes Part 1; Author: Vicki Stewart;https://www.youtube.com/watch?v=FMjwcdZhLoE;License: Standard Youtube License