Construction Accounting And Financial Management (4th Edition)

4th Edition

ISBN: 9780135232873

Author: Steven J. Peterson MBA PE

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 7P

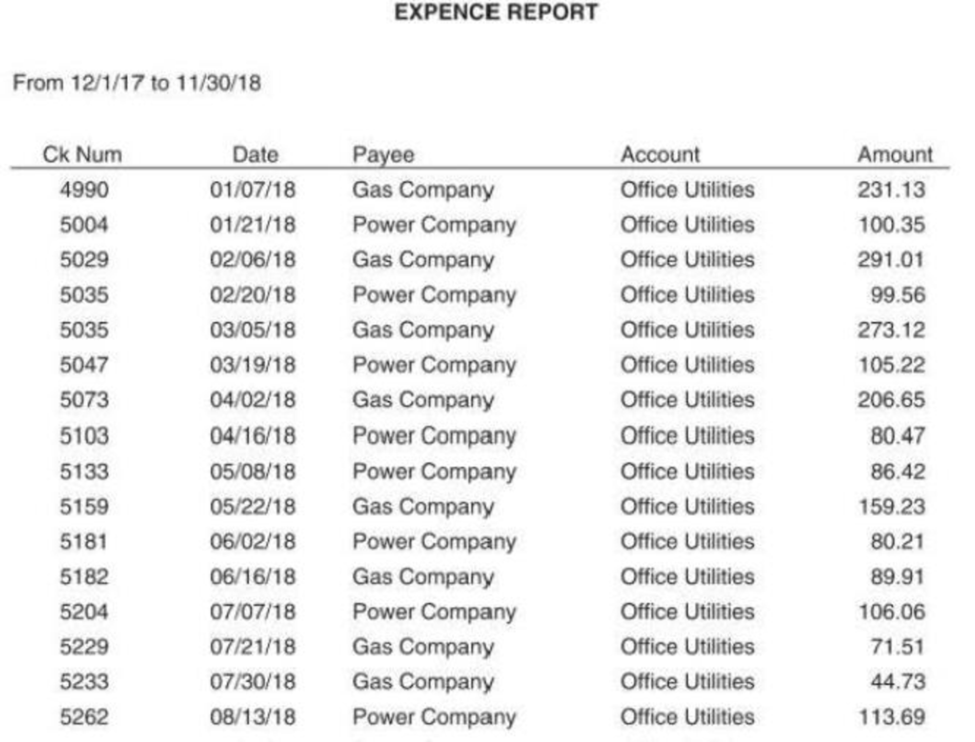

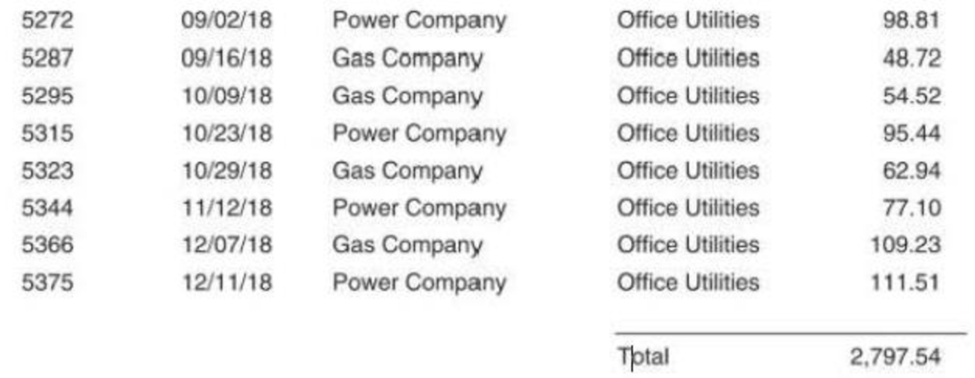

Determine the annual budget for office utilities using the data from the past 12 months shown in Figure 9-7. Utility costs are expected to increase by 7% per year due to inflation. The company is planning on doubling its office space in July by expanding into some unoccupied space adjacent to its existing office space.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Easy Clean operates a chain of dry cleaners. It is experimenting with the use of a continuous-improvement

(i.e., kaizen) budget for operating expenses. Currently, a typical location has operating expenses of

$28,000 per month. Plans are in place to achieve labor and utility savings. The associated operational

changes are estimated to reduce monthly operating expenses by a factor of 0.99 beginning in January.

Required:

What are the estimated operating expenses for January? For June? For December? (Do not round

intermediate calculations. Round your final answers to the nearest whole dollar amount.)

January

June

December

Estimated operating costs

Major Landscaping Company is preparing its budget for the first quarter of 2017. The next step in the budgeting process is to prepare a cash receipts schedule and a cash payments schedule. To that end the following information has been collected.

Clients usually pay 60% of their fee in the month that service is provided, 30% the month after, and 10% the second month after receiving service.

Actual service revenue for 2016 and expected service revenues for 2017 are: November 2016, $120,000; December 2016, $110,000; January 2017, $140,000; February 2017, $160,000; March 2017, $170,000.

Purchases on landscaping supplies (direct materials) are paid 40% in the month of purchase and 60% the following month. Actual purchases for 2016 and expected purchases for 2017 are:

December 2016, $21,000; January 2017, $20,000; February 2017, $22,000; March 2017, $27,000.

Instructions

Prepare the following schedules for each month in the first quarter of 2017 and for the quarter in total:

Expected…

Cash DisbursementTimber Company is in the process of preparing its budget for next year. Cost of goods sold has been estimated at 70 percent of sales. Lumber purchases and payments are to be made during the month preceding the month of sale. Wages are estimated at 15 percent of sales and are paid during the month of sale. Other operating costs amounting to 10 percent of sales are to be paid in the month following the month of sale. Additionally, a monthly lease payment of $64,000 is paid for computer services. Sales revenue is forecast as follows

Month

Sales Revenue

February

$220,000

March

260,000

April

270,000

May

310,000

June

290,000

July

330,000

RequiredPrepare a schedule of cash disbursements for April, May, and June.Do not use a negative sign with your answers.

Timber Company

Schedule of Cash Disbursements

April, May, and June

April

May

June

Lumbers purchases

Answer

Answer

Answer

Wages

Answer

Answer

Answer

Operating expenses

Answer

Answer…

Chapter 9 Solutions

Construction Accounting And Financial Management (4th Edition)

Ch. 9 - What is general overhead?Ch. 9 - What are the two types of general overhead budgets...Ch. 9 - You are preparing a general overhead budget to be...Ch. 9 - Why must meals and entertainment be kept separate...Ch. 9 - Why are fixed costs fixed only over a specified...Ch. 9 - Determine the annual budget for office utilities...Ch. 9 - Determine the annual budget for office utilities...Ch. 9 - Prob. 8PCh. 9 - Prob. 9P

Additional Business Textbook Solutions

Find more solutions based on key concepts

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting

The amount that should be recorded by Company R for building under historical cost principle.

Financial Accounting (11th Edition)

Preparing Financial Statements from a Trial Balance The following accounts are taken from Equilibrium Riding, I...

Fundamentals of Financial Accounting

Calculating certain information using the direct method (Learning Objective 4) 20-25 min. Trudeaus Marine, Inc....

Financial Accounting, Student Value Edition (5th Edition)

Bank loan; accrued interest LO132 On October 1, Eder Fabrication borrowed 60 million and issued a nine-month, ...

INTERMEDIATE ACCOUNTING

Based on your answers to the above questions, should Lockwood invest in the machinery?

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data were obtained from the financial records of Sonicbrush, Inc., for March: Sales are expected to increase each month by 15%. Prepare a budgeted income statement.arrow_forwardEliot Sprinkler Systems produces equipment for lawn irrigation. One of the parts used in selected Eliot equipment is a specialty nozzle. The budgeting team is now determining the purchase requirements and monthly cash disbursements for this part. Eliot wishes to have in stock enough nozzles to use for the coming month. On August 1, the company has 18,700 nozzles in stock, although the latest estimate for August production indicates a requirement for only 18,800 nozzles. Total uses of the nozzle are expected to be 18,500 in September and 19,340 in October. Nozzles are purchased at a wholesale price of $27. Eliot pays 25 percent of the purchase price in cash in the month when the parts are delivered. The remaining 75 percent is paid in the following month. Eliot purchased 40,000 parts in July. Required: Estimate purchases of the nozzle (in units) for August and September. Estimate the cash disbursements for nozzles in August and September.arrow_forwardEliot Sprinkler Systems produces equipment for lawn irrigation. One of the parts used in selected Eliot equipment is a specialty nozzle. The budgeting team is now determining the purchase requirements and monthly cash disbursements for this part. Eliot wishes to have in stock enough nozzles to use for the coming month. On August 1, the company has 17,100 nozzles in stock, although the latest estimate for August production indicates a requirement for only 15,600 nozzles. Total uses of the nozzle are expected to be 15,300 in September and 16,140 in October. Nozzles are purchased at a wholesale price of $11. Eliot pays 25 percent of the purchase price in cash in the month when the parts are delivered. The remaining 75 percent is paid in the following month. Eliot purchased 24,000 parts in July. Required: a. Estimate purchases of the nozzle (in units) for August and September. b. Estimate the cash disbursements for nozzles in August and September. Complete this question by entering your…arrow_forward

- Striker Corporation is preparing its cash payments budget for next month. The following information pertains to the cash payments: How much cash will be paid out next month? a. Striker Corporation pays for 55% of its direct materials purchases in the month of purchase and the remainder the following month. Last month's direct material purchases were $73,000, while the company anticipates $85,000 of direct material purchases next month. b. Direct labor for the upcoming month is budgeted to be $37,000 and will be paid at the end of the upcoming month. c. Manufacturing overhead is estimated to be 150% of direct labor cost each month and is paid in the month in which it is incurred. This monthly estimate includes $18,000 of depreciation on the plant and equipment. d. Monthly operating expenses for next month are expected to be $45,000, which includes $2,800 of depreciation on office equipment and $1,200 of bad debt expense. These monthly operating…arrow_forwardSurity Corporation is preparing its cash payments budget for next month. The following information pertains to the cash payments: 1 Click the icon to view the data.) How much cash will be paid out next month? Surity Corporation Cash Payments Budget Cash payments for direct materials: 45% of last month's purchases 55% of next month's purchases Cash payments for direct labor Cash payments for manufacturing overhead Cash payments for operating expenses Cash payment for taxes Total cash paymentsarrow_forwardEliot Sprinkler Systems produces equipment for lawn irrigation. One of the parts used in selected Eliot equipment is a specialty nozzle. The budgeting team is now determining the purchase requirements and monthly cash disbursements for this part. Eliot wishes to have in stock enough nozzles to use for the coming month. On August 1, the company has 16,800 nozzles in stock, although the latest estimate for August production indicates a requirement for only 15,000 nozzles. Total uses of the nozzle are expected to be 14,700 in September and 15,540 in October. Nozzles are purchased at a wholesale price of $8. Eliot pays 25 percent of the purchase price in cash in the month when the parts are delivered. The remaining 75 percent is paid in the following month. Eliot purchased 21,000 parts in July. Required: a. Estimate purchases of the nozzle (in units) for August and September. b. Estimate the cash disbursements for nozzles in August and September.arrow_forward

- Eliot Sprinkler Systems produces equipment for lawn irrigation. One of the parts used in selected Eliot equipment is a specialty nozzle. The budgeting team is now determining the purchase requirements and monthly cash disbursements for this part. Eliot wishes to have in stock enough nozzles to use for the coming month. On August 1, the company has 17,300 nozzles in stock, although the latest estimate for August production indicates a requirement for only 16,000 nozzles. Total uses of the nozzle are expected to be 15,700 in September and 16,540 in October. Nozzles are purchased at a wholesale price of $13. Eliot pays 25 percent of the purchase price in cash in the month when the parts are delivered. The remaining 75 percent is paid in the following month. Eliot purchased 26,000 parts in July. Required: a. Estimate purchases of the nozzle (in units) for August and September. b. Estimate the cash disbursements for nozzles in August and September. Complete this question by entering your…arrow_forwardB. Mahmoud Repair Company is preparing its budget for the first quarter of 2021. The next step in the budgeting process is to prepare a cash receipts schedule and a cash payments schedule. To that end the following information has been collected. Clients usually pay 60% of their fee in the month that service is provided, 30% the month after, and 10% the second month after receiving service. Actual service revenue for 2016 and expected service revenues for 2021 are: November 2020, $120,000; December 2020, $110,000; January 2021, $140,000; February 2021, $160,000; March 2021, $170,000. Purchases on landscaping supplies (direct materials) are paid 40% in the month of purchase and 60% the following month. Actual purchases for 2020 and expected purchases for 2021 are: December 2020, $21,000; January 2021, $20,000; February 2021, $22,000; March 2021, $27,000. Instructions (a) Prepare the following schedules for each month in the first quarter of 2021 and for the quarter in total: (1)…arrow_forwardParliament Company, which expects to start operations on January 1, year 2, will sell digital cameras in shopping malls. Parliament has budgeted sales as indicated in the following table. The company expects a 10 percent increase in sales per month for February and March. The ratio of cash sales to sales on account will remain stable from January through March. Required a. Complete the sales budget by filling in the missing amounts. b. Determine the amount of sales revenue Parliament will report on its first quarter pro forma income statement. Complete this question by entering your answers in the tabs below. Required A Required B Complete the sales budget by filling in the missing amounts. February Sales Cash sales Sales on account Total budgeted sales January $ 50,000 120,000 $ 170,000arrow_forward

- Munoz Company is a retail company that specializes in selling outdoor camping equipment. The company is considering opening a new store on October 1, year 1. The company president formed a planning committee to prepare a master budget for the first three months of operation. As budget coordinator, you have been assigned the following tasks. Required a. October sales are estimated to be $340,000, of which 40 percent will be cash and 60 percent will be credit. The company expects sales to increase at the rate of 20 percent per month. Prepare a sales budget. b. The company expects to collect 100 percent of the accounts receivable generated by credit sales in the month following the sale. Prepare a schedule of cash receipts. c. The cost of goods sold is 70 percent of sales. The company desires to maintain a minimum ending inventory equal to 20 percent of the next month's cost of goods sold. However, ending inventory of December is expected to be $12,900. Assume that all purchases are made…arrow_forwardJordan Company, which expects to start operations on January 1, year 2, will sell digital cameras in shopping malls. Jordan has budgeted sales as indicated in the following table. The company expects a 12 percent increase in sales per month for February and March. The ratio of cash sales to sales on account will remain stable from January through March. Required Complete the sales budget by filling in the missing amounts. Determine the amount of sales revenue Jordan will report on its first quarter pro forma income statement. Required A Required B Complete the sales budget by filling in the missing amounts. (Do not round intermediate calculations. Round final answers to two decimal places.) a. Sales January February March Cash sales $43,000 Sales on account 107,000 Total budgeted sales $150,000 $0.00 $0.00 b. Determine the amount of sales revenue Jordan will report on its first quarter pro forma income…arrow_forwardWhispering Winds Landscaping Company is preparing its budget for the first quarter of 2022. The next step in the budgeting process is to prepare cash receipts and cash payments schedules. To that end the following information has been collected.Clients usually pay 60% of their fee in the month that service is provided, 30% the month after, and 10% the second month after receiving service.Actual service revenue for 2021 and expected service revenues for 2022 are: November 2021, $130,000; December 2021, $100,000; January 2022, $144,000; February 2022, $161,000; March 2022, $170,000.Purchases of landscaping supplies are paid 30% in the month of purchase and 70% the following month. Actual purchases for 2021 and expected purchases for 2022 are: December 2021, $21,000; January 2022, $19,600; February 2022, $22,400; March 2022, $27,500. Determine the account receivable balances at March 31, 2022.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY