1.

Journalize the transactions for the month of July.

1.

Explanation of Solution

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and

stockholders’ equities . - Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Journalize the transactions for the month of July:

| Date | Account title and explanation | Post Ref. | Amount | ||

| Debit | Credit | ||||

| 20-- | |||||

| July | 1 | Cash | 111 | $25,000.00 | |

| Person AV's Capital | 311 | $25,000.00 | |||

| 1 | Spa Supplies | 115 | $490.00 | ||

| Accounts Payable - Company GSS | 211/✓ | $490.00 | |||

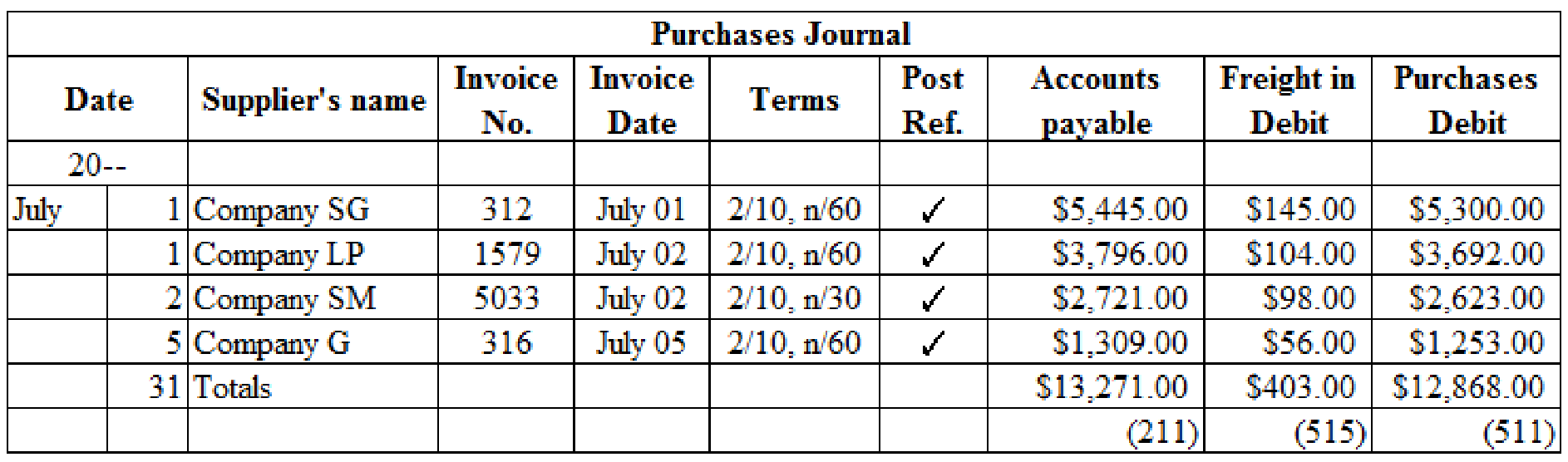

| 1 | Purchases | 511 | $5,300.00 | ||

| Freight In | 515 | $145.00 | |||

| Accounts Payable - Company SG | 211/✓ | $5,445.00 | |||

| 1 | Purchases | 511 | $3,692.00 | ||

| Freight In | 515 | $104.00 | |||

| Accounts Payable – Company LP | 211/✓ | $3,796.00 | |||

| 2 | Purchases | 511 | $2,623.00 | ||

| Freight In | 515 | $98.00 | |||

| Accounts Payable - Company SM | 211/✓ | $2,721.00 | |||

| 2 | Accounts receivable - Company LOL | 113/✓ | $351.00 | ||

| Merchandise Sales | 412 | $325.00 | |||

| Sales Tax Payable | 215 | $26.00 | |||

| 3 | Spa Equipment | 128 | $8,235.00 | ||

| Accounts Payable -Incorporation SE | 211/✓ | $6,235.00 | |||

| Cash | 111 | $2,000.00 | |||

| 3 | Rent Expense | 612 | $1,650.00 | ||

| Cash | 111 | $1,650.00 | |||

| 4 | Accounts Receivable- Company C | 113/✓ | $520.02 | ||

| Merchandise Sales | 412 | $481.50 | |||

| Sales Tax Payable | 215 | $38.52 | |||

| 5 | Accounts Payable - Company GSS | 211/✓ | $492.00 | ||

| Cash | 111 | $492.00 | |||

| 5 | Accounts Payable - Company OS | 211/✓ | $120.00 | ||

| Cash | 111 | $120.00 | |||

| 5 | Miscellaneous Expense | 630 | $98.00 | ||

| Cash | 111 | $98.00 | |||

| 5 | Accounts Payable - Incorporation A | 211/✓ | $397.00 | ||

| Cash | 111 | $397.00 | |||

| 5 | Wages Payable | 212 | $369.50 | ||

| Wages Expense | 611 | $1,476.00 | |||

| Cash | 111 | $1,845.50 | |||

| 5 | Office Equipment | 124 | $420.00 | ||

| Accounts Payable - Company SE | 211/✓ | $420.00 | |||

| 5 | Promotion Expense | 630 | $186.00 | ||

| Accounts Payable - Company OS | 211/✓ | $186.00 | |||

| 5 | Office Supplies | 114 | $118.00 | ||

| Accounts Payable -Company OS | 211/✓ | $118.00 | |||

| 5 | Purchases | 511 | $1,253.00 | ||

| Freight In | 515 | $56.00 | |||

| Accounts Payable - Company G | 211/✓ | $1,309.00 | |||

| 5 | Accounts receivable - Company PS | 113/✓ | $1,961.23 | ||

| Merchandise Sales | 412 | $1,815.95 | |||

| Sales Tax Payable | 215 | $145.28 | |||

| 7 | Cash | 111 | $4,881.60 | ||

| Merchandise Sales | 412 | $1,410.00 | |||

| Income from Services | 411 | $3,110.00 | |||

| Sales Tax Payable | 215 | $361.60 | |||

| 7 | Cash | 111 | $150.00 | ||

| Accounts Receivable - Company JA | 113/✓ | $150.00 | |||

| 10 | Accounts Receivable - Company HC | 113/✓ | $367.47 | ||

| Merchandise Sales | 412 | $340.25 | |||

| Sales Tax Payable | 215 | $27.22 | |||

| 10 | Accounts Receivable - Company MS | 113/✓ | $222.48 | ||

| Merchandise Sales | 412 | $206.00 | |||

| Sales Tax Payable | 215 | $16.48 | |||

| 12 | Wages Expense | 611 | $1,845.50 | ||

| Cash | 111 | $1,845.50 | |||

| 12 | Accounts Receivable - Company AFS | 113/✓ | $521.59 | ||

| Merchandise Sales | 412 | $482.95 | |||

| Sales Tax Payable | 215 | $38.64 | |||

| 14 | Cash | 111 | $200.00 | ||

| Accounts Receivable - Company JM | 113/✓ | $200.00 | |||

| 14 | Cash | 111 | $4,158.00 | ||

| Merchandise Sales | 412 | $1,220.00 | |||

| Income from Services | 411 | $2,630.00 | |||

| Sales Tax Payable | 215 | $308.00 | |||

| 18 | Accounts Payable - Company SE | 211/✓ | $1,150.00 | ||

| Cash | 111 | $1,150.00 | |||

| 19 | Wages Expense | 611 | $1,840.50 | ||

| Cash | 111 | $1,840.50 | |||

| 21 | Cash | 111 | $180.00 | ||

| Accounts Receivable - Company TL | 113/✓ | $180.00 | |||

| 21 | Cash | 111 | $5,248.80 | ||

| Merchandise Sales | 412 | $1,940.00 | |||

| Income from Services | 411 | $2,920.00 | |||

| Sales Tax Payable | 215 | $388.80 | |||

| 25 | Spa Equipment | 128 | $173.00 | ||

| Cash | 111 | $173.00 | |||

| 26 | Wages Expense | 611 | $1,842.00 | ||

| Cash | 111 | $1,842.00 | |||

| 28 | Laundry Expense | 615 | $84.00 | ||

| Cash | 111 | $84.00 | |||

| 28 | Cash | 111 | $109.00 | ||

| Accounts Receivable - Company JW | 113/✓ | $109.00 | |||

| 31 | Cash | 111 | $6,471.36 | ||

| Merchandise Sales | 412 | $1,930.00 | |||

| Income from Services | 411 | $4,062.00 | |||

| Sales Tax Payable | 215 | $479.36 | |||

| 31 | Person AV's Drawing | 312 | $2,500.00 | ||

| Cash | 111 | $2,500.00 | |||

| 31 | Utilities Expense | 617 | $225.00 | ||

| Cash | 111 | $225.00 | |||

| 31 | Utilities Expense | 617 | $248.00 | ||

| Cash | 111 | $248.00 | |||

| 31 | Spa Equipment | 128 | $1,800.00 | ||

| Person AV's Capital | 311 | $1,800.00 | |||

Table (1)

2.

2.

Explanation of Solution

Post the entries to the accounts receivable, accounts payable and general ledger:

General Ledger:

| Sales journal | |||||||

| Date | Invoice No. | Customer's name | Post Ref. | Accounts Receivable debit ($) | Sales tax payable credit ($) | Merchandise sales credit ($) | |

| 20-- | |||||||

| July | 2 | 14 | Company LOL | 351.00 | 26.00 | 325.00 | |

| 4 | 15 | Company C | 520.02 | 38.52 | 481.50 | ||

| 5 | 16 | Company PS | 1,961.23 | 145.28 | 1,815.95 | ||

| 10 | 17 | Company HC | 367.47 | 27.22 | 340.25 | ||

| 10 | 18 | Company MS | 222.48 | 16.48 | 206.00 | ||

| 12 | 19 | Company AFS | 521.59 | 38.64 | 482.95 | ||

| 31 | Totals | 3,943.79 | 292.14 | 3,651.65 | |||

| (113) | (215) | (412) | |||||

Table (2)

Table (3)

| Account: Cash | Account No. 111 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $15,170.00 | |||

| 1 | J6 | $25,000.00 | $40,170.00 | ||||

| 3 | J6 | $2,000.00 | $38,170.00 | ||||

| 3 | J6 | $1,650.00 | $36,520.00 | ||||

| 3 | J7 | $89.00 | $36,431.00 | ||||

| 5 | J7 | $492.00 | $35,939.00 | ||||

| 5 | J7 | $120.00 | $35,819.00 | ||||

| 5 | J7 | $98.00 | $35,721.00 | ||||

| 5 | J7 | $397.00 | $35,324.00 | ||||

| 5 | J7 | $1,845.50 | $33,478.50 | ||||

| 7 | J8 | $4,881.60 | $38,360.10 | ||||

| 7 | J8 | $150.00 | $38,510.10 | ||||

| 12 | J8 | $1,845.50 | $36,664.60 | ||||

| 14 | J8 | $200.00 | $36,864.60 | ||||

| 14 | J9 | $4,158.00 | $41,022.60 | ||||

| 18 | J9 | $1,150.00 | $39,872.60 | ||||

| 19 | J9 | $1,840.50 | $38,032.10 | ||||

| 21 | J9 | $180.00 | $38,212.10 | ||||

| 21 | J9 | $5,248.80 | $43,460.90 | ||||

| 25 | J9 | $173.00 | $43,287.90 | ||||

| 26 | J9 | $1,842.00 | $41,445.90 | ||||

| 28 | J9 | $84.00 | $41,361.90 | ||||

| 28 | J9 | $109.00 | $41,470.90 | ||||

| 31 | J9 | $6,471.36 | $47,942.26 | ||||

| 31 | J10 | $2,500.00 | $45,442.26 | ||||

| 31 | J10 | $225.00 | $45,217.26 | ||||

| 31 | J10 | $248.00 | $44,969.26 | ||||

Table (4)

| Account: Accounts receivable | Account No. 113 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $1,273.00 | |||

| 2 | J6 | $367.20 | $1,640.20 | ||||

| 4 | J7 | $513.54 | $2,153.74 | ||||

| 5 | J8 | $1,639.39 | $3,793.82 | ||||

| 7 | J8 | $150.00 | $3,643.82 | ||||

| 10 | J8 | $351.54 | $3,995.36 | ||||

| 10 | J8 | $244.08 | $4,239.44 | ||||

| 12 | J8 | $503.23 | $4,742.67 | ||||

| 14 | J8 | $200.00 | $4,542.67 | ||||

| 21 | J9 | $185.00 | $4,357.67 | ||||

| 28 | J9 | $110.00 | $4,247.67 | ||||

Table (5)

| Account: Office supplies | Account No. 114 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $130.00 | |||

| 2 | J7 | $118.00 | $248.00 | ||||

Table (6)

| Account: Spa supplies | Account No. 115 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $205.00 | |||

| 5 | J7 | $490.00 | $695.00 | ||||

Table (7)

| Account: Prepaid insurance | Account No. 117 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $800.00 | |||

Table (8)

| Account: Office equipment | Account No. 124 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $1,150.00 | |||

| 5 | J7 | $420.00 | $1,570.00 | ||||

Table (9)

| Account: Accumulated Depreciation, Office equipment | Account No. 125 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $10.00 | |||

Table (10)

| Account: Spa equipment | Account No. 128 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $7,393.00 | |||

| 3 | J6 | $8,235.00 | $15,628.00 | ||||

| 25 | J9 | $173.00 | $15,801.00 | ||||

| 31 | J10 | $1,800.00 | $17,601.00 | ||||

Table (11)

| Account: Accumulated Depreciation, Spa equipment | Account No. 129 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $64.88 | |||

Table (12)

| Account: Accounts payable | Account No. 211 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $2,248.00 | |||

| 1 | J6 | $490.00 | $2,738.00 | ||||

| 1 | J6 | $5,445.00 | $8,183.00 | ||||

| 1 | J6 | $3,796.00 | $11,979.00 | ||||

| 2 | J6 | $2,721.00 | $14,700.00 | ||||

| 3 | J6 | $6,235.00 | $20,935.00 | ||||

| 3 | J7 | $89.00 | $20,846.00 | ||||

| 5 | J7 | $492.00 | $20,354.00 | ||||

| 5 | J7 | $120.00 | $20,234.00 | ||||

| 5 | J7 | $397.00 | $19,837.00 | ||||

| 5 | J7 | $420.00 | $20,257.00 | ||||

| 5 | J7 | $186.00 | $20,443.00 | ||||

| 5 | J7 | $118.00 | $20,561.00 | ||||

| 5 | J8 | $1,309.00 | $21,870.00 | ||||

| 18 | J9 | $1,150.00 | $20,720.00 | ||||

Table (13)

| Account: Wages payable | Account No. 212 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $369.50 | |||

| 5 | J7 | $369.50 | |||||

Table (14)

| Account: Sales tax payable | Account No. 215 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 2 | J6 | $26.00 | $26.00 | |||

| 4 | J7 | $38.52 | $64.52 | ||||

| 5 | J8 | $145.28 | $209.80 | ||||

| 7 | J8 | $361.60 | $571.40 | ||||

| 10 | J8 | $27.22 | $598.62 | ||||

| 10 | J8 | $16.48 | $615.10 | ||||

| 12 | J8 | $38.64 | $653.74 | ||||

| 14 | J9 | $308.00 | $961.74 | ||||

| 21 | J9 | $388.80 | $1,350.54 | ||||

| 31 | J9 | $479.36 | $1,829.90 | ||||

Table (15)

| Account: Person AV, Capital | Account No. 311 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $23,419.62 | |||

| 1 | J6 | $25,000.00 | 48,419.62 | ||||

| 31 | J10 | $1,800.00 | 50,219.62 | ||||

Table (16)

| Account: Person AV, Drawing | Account No. 312 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 31 | J10 | $2,500.00 | $2,500.00 | |||

Table (17)

| Account: Income summary | Account No. 313 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (18)

| Account: Income from services | Account No. 411 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 7 | J8 | $3,110.00 | $3,110.00 | |||

| 14 | J9 | $2,630.00 | $5,740.00 | ||||

| 21 | J9 | $2,920.00 | $8,660.00 | ||||

| 31 | J9 | $4,062.00 | $12,722.00 | ||||

Table (19)

| Account: Merchandise sales | Account No. 412 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 2 | J6 | $325.00 | $325.00 | |||

| 4 | J7 | $481.50 | $806.50 | ||||

| 5 | J8 | $1,815.95 | $2,622.45 | ||||

| 7 | J8 | $1,410.00 | $4,032.45 | ||||

| 10 | J8 | $340.25 | $4,372.70 | ||||

| 10 | J8 | $206.00 | $4,578.70 | ||||

| 12 | J8 | $482.95 | $5,061.65 | ||||

| 14 | J9 | $1,220.00 | $6,281.65 | ||||

| 21 | J9 | $1,940.00 | $8,221.65 | ||||

| 31 | J9 | $1,930.00 | $10,151.65 | ||||

Table (20)

| Account: Purchases | Account No. 511 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | J6 | $5,300.00 | $5,300.00 | |||

| 1 | J6 | $3,692.00 | $8,992.00 | ||||

| 2 | J6 | $2,623.00 | $11,615.00 | ||||

| 5 | J8 | $1,253.00 | $12,868.00 | ||||

Table (21)

| Account: Freight In | Account No. 515 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | J6 | $145.00 | $145.00 | |||

| 1 | J6 | $104.00 | $249.00 | ||||

| 2 | J6 | $98.00 | $347.00 | ||||

| 5 | J8 | $56.00 | $403.00 | ||||

Table (22)

| Account: Wages expense | Account No. 611 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 5 | J7 | $1,476.00 | $1,476.00 | |||

| 12 | J8 | $1,845.50 | $3,321.50 | ||||

| 19 | J9 | $1,840.50 | $5,162.00 | ||||

| 26 | J9 | $1,842.00 | $7,004.00 | ||||

Table (23)

| Account: Rent expense | Account No. 612 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 3 | J6 | $1,650.00 | $1,650.00 | |||

Table (24)

| Account: Office supplies expense | Account No. 613 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (25)

| Account: Spa supplies expense | Account No. 614 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (26)

| Account: Laundry expense | Account No. 615 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 28 | J9 | $84.00 | $84.00 | |||

Table (27)

| Account: Advertising expense | Account No. 616 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (28)

| Account: Utilities expense | Account No. 617 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 31 | J10 | $225.00 | $225.00 | |||

| 31 | J10 | $248.00 | $473.00 | ||||

Table (29)

| Account: Insurance expense | Account No. 618 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (30)

| Account: Depreciation expense, Office equipment | Account No. 619 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (31)

| Account: Depreciation expense, Spa equipment | Account No. 620 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (32)

| Account: Miscellaneous expense | Account No. 630 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 5 | J7 | $98.00 | $98.00 | |||

| 5 | J7 | $186.00 | $284.00 | ||||

Table (33)

Accounts receivable ledger:

| Accounts receivable ledger | ||||||

| Name : Company AFS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 12 | J8 | $521.59 | $521.59 | ||

Table (34)

| Accounts receivable ledger | ||||||

| Name : Company JA | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | ✓ | $325.00 | |||

| 7 | J8 | $150.00 | $175.00 | |||

Table (35)

| Accounts receivable ledger | ||||||

| Name : Company C | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 4 | J7 | $520.02 | $520.02 | ||

Table (36)

| Accounts receivable ledger | ||||||

| Name : Company HC | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 10 | J8 | $367.47 | $367.47 | ||

Table (37)

| Accounts receivable ledger | ||||||

| Name : Company TL | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $344.00 | ||

| 21 | J9 | $180.00 | $164.00 | |||

Table (38)

| Accounts receivable ledger | ||||||

| Name : Company LOL | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 2 | J6 | $351.00 | $351.00 | ||

Table (39)

| Accounts receivable ledger | ||||||

| Name : Company MS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 10 | J8 | $222.48 | $222.48 | ||

Table (40)

| Accounts receivable ledger | ||||||

| Name : Company JM | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | ✓ | $486.00 | |||

| 14 | J8 | $200.00 | $286.00 | |||

Table (41)

| Accounts receivable ledger | ||||||

| Name : Company PS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 5 | J8 | $1,961.23 | $1,961.23 | ||

Table (42)

| Accounts receivable ledger | ||||||

| Name : Company JW | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $109.00 | ||

| 28 | J8 | $109.00 | ||||

Table (43)

Accounts payable ledger:

| Accounts payable ledger | ||||||

| Name : Incorporation A | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $397.00 | ||

| August | 5 | $397.00 | ||||

Table (44)

| Accounts payable ledger | ||||||

| Name : Company G | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 5 | J8 | $1,309.00 | $1,309.00 | ||

Table (45)

| Accounts payable ledger | ||||||

| Name : Company GSS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $492.00 | ||

| 1 | J6 | $490.00 | $982.00 | |||

| 5 | J7 | $492.00 | $490.00 | |||

Table (46)

| Accounts payable ledger | ||||||

| Name : Company LP | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | J6 | $3,796.00 | $3,796.00 | |

Table (47)

| Accounts payable ledger | ||||||

| Name : Company OS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $120.00 | ||

| 5 | J7 | $120.00 | $0.00 | |||

| 5 | J7 | $186.00 | $186.00 | |||

| 5 | J7 | $118.00 | $304.00 | |||

Table (48)

| Accounts payable ledger | ||||||

| Name : Incorporation SE | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $89.00 | ||

| 3 | J6 | $6,235.00 | $6,324.00 | |||

| 3 | J7 | $89.00 | $6,235.00 | |||

Table (49)

| Accounts payable ledger | ||||||

| Name : Company SG | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | J6 | $5,445.00 | $5,445.00 | ||

Table (50)

| Accounts payable ledger | ||||||

| Name : Company SM | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 2 | J6 | $2,721.00 | $2,721.00 | ||

Table (51)

| Accounts payable ledger | ||||||

| Name : Company SE | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $1,150.00 | ||

| 5 | J7 | $420.00 | $1,570.00 | |||

| 18 | J9 | $1,150.00 | $420.00 | |||

Table (52)

3.

Prepare

3.

Explanation of Solution

Trial balance: Trial balance is a summary of all the asset, liability, and equity accounts and their balances.

Prepare the trial balance.

| Company AAY | ||

| Trial balance | ||

| As on July 31, 20-- | ||

| Account name | Debit | Credit |

| Cash | $44,969.26 | |

| Accounts Receivable | $4,568.79 | |

| Office Supplies | $248.00 | |

| Spa Supplies | $695.00 | |

| Prepaid Insurance | $800.00 | |

| Office Equipment | $1,570.00 | |

| Accumulated Depreciation, Office Equipment | $10.00 | |

| Spa Equipment | $17,601.00 | |

| Accumulated Depreciation, Spa Equipment | $64.88 | |

| Accounts Payable | $20,720.00 | |

| Sales Tax Payable | $1,829.90 | |

| Person AV, Capital | $50,219.62 | |

| Person AV, Drawing | $2,500.00 | |

| Income from Services | $12,722.00 | |

| Merchandise Sales | $10,151.65 | |

| Purchases | $12,868.00 | |

| Freight In | $403.00 | |

| Wages Expense | $7,004.00 | |

| Rent Expense | $1,650.00 | |

| Laundry Expense | $84.00 | |

| Utilities Expense | $473.00 | |

| Miscellaneous Expense | $284.00 | |

| Total | $95,718.05 | $95,718.05 |

Table (53)

Thus, the total of trial balance of Company AAY is $95,718.05.

4.

Prepare a schedule of accounts receivable.

4.

Explanation of Solution

Schedule of accounts receivable: A schedule of accounts receivable is a subsidiary ledger that list out the accounts of credit customers individually in alphabetical or numeric order with their respective balances.

Prepare a schedule of accounts receivable:

| Company AAY | |

| Schedule of Accounts receivable | |

| July 31, 20-- | |

| Particulars | Amount |

| Company AFS | $521.59 |

| Company JA | $175.00 |

| Company C | $520.02 |

| Company HC | $367.47 |

| Incorporation TL | $164.00 |

| Company LOL | $351.00 |

| Company MS | $222.48 |

| Company JM | $286.00 |

| Company PS | $1,961.23 |

| Total Accounts receivable | $4,568.79 |

Table (54)

5.

Prepare a schedule of Accounts payable.

5.

Explanation of Solution

Schedule of accounts payable: A schedule of accounts payable lists is a subsidiary ledger that list out the accounts of creditors (vendors/suppliers) individually in alphabetical or numeric order with their respective balances.

Prepare a schedule of Accounts payable:

| Company AAY | |

| Schedule of Accounts payable | |

| July 31, 20-- | |

| Particulars | Amount |

| Company G | $1,309.00 |

| Company GSS | $490.00 |

| Company LP | $3,796.00 |

| Company OS | $304.00 |

| Incorporation SE | $6,235.00 |

| Company SG | $5,445.00 |

| Company SM | $2,721.00 |

| Company SE | $420.00 |

| Total Accounts payable | $20,720.00 |

Table (55)

Want to see more full solutions like this?

Chapter 9 Solutions

College Accounting (Book Only): A Career Approach

- You are the accountant for the Best Outdoor Living company which manufactures various outdoor furniture. The furniture is sold by specialty stores and through internet outlets. You are responsible for reviewing costs and creating standards costs based on the information you have reviewed. One of your former colleagues has recently started a company to collect and sell data on industry benchmarks. You are offered the chance to receive benchmarks from other outdoor furniture companies for free if you will provide the standard and actual costs for the last three years of your company. As creation of the standards is a tedious process, you feel this data would be helpful in your job. Review the IMA’s ethical guidelines, under Reading Preparation and identify the conflict with the guidelines. What are the relevant factors in this situation and how you should handle this, and what you would recommend to the Controllerarrow_forwardABC Company is a small business that sells handmade crafts online. The company has been in operation for three years and has been profitable since its inception. The owner, Sarah, has decided to expand her business by renting a physical storefront in addition to her online sales. She plans to purchase inventory and hire an employee to help manage the physical storefront. Sarah wants to know how this expansion will affect her financial statements and overall profitability. 1. How will the purchase of inventory affect the financial statements 2. How will the hiring of an employee affect the financial statements 3. How will the rental expense for the storefront affect the financial statements ???ts?arrow_forwardAlice Trading runs 10 branches and pays for a variety of expenses. Zabrina, the Accounts Payable Clerk of Alice Trading writes the checks for each supplier and the Accounting Manager signs the checks. Zabrina decided she needs a raise and the Manager told her to wait for six months. Zabrina devised a plan to get a raise on her own. She created a new supplier account for her friend’s business, Prime Auto Parts. Zabrina also created two purchase orders for Prime Auto Parts for ₱20,000 and ₱15,000 and wrote checks to pay these invoices. She knows the Manager will sign all checks only looking at the checks over ₱30,000. She delivers the checks to her friend who will encash the checks and give the money to Zabrina. Is this a good way for Zabrina to obtain a raise? Eventually, what will be the effect of her actions? How can Jiffy prevent this type of incident?arrow_forward

- (essay) Jiffy Trading runs 10 branches and pays for a variety of expenses. Anna, the Accounts Payable Clerk of Jiffy Trading writes the checks for each supplier and the Accounting Manager signs the checks. Anna decided she needs a raise and the Manager told her to wait for six months. Anna devised a plan to get a raise on her own. She created a new supplier account for her friend's business, Prime Auto Parts. Anna also created two purchase orders for Prime Auto Parts for P20,000 and P15,000 and wrote checks to pay theses invoices. She knows the Manager will sign all checks only looking at the checks over P30.000. She delivers the checks to her friend who will encash the checks and give the money to Anna. Is this a good way for Anna to obtain a raise? Eventually, what will be the effect of her actions? How can Jiffy prevent this type of incident?arrow_forwardKowkeela has recently opened The Cooker Shop, a store that specializes in one type of cooker. Kowkeela has just received a degree in business and she is anxious to apply the principles she has learned to her business. In time, she hopes to open a chain of cooker shops. As a first step, she has prepared the following analysis for her new store:Sales price per cooker . . . . . . . . . . . $50Variable expenses per cooker. . . . . . $16Fixed expenses per year:- - - Building rental . . . . . . . . . . . . . . $12000- - - Equipment depreciation . . . . . . $5300- - - Selling . . . . . . . . . . . . . . . . . . . . . $15500- - - Administrative . . . . . . . . . . . . . . $17000 d. Refer to the original data, the number of cookers to be sold each year to break even is (f)Refer to the original data, Kowkeela now has two salespersons working in the store—one full time and one part time. It will cost her an additional $7700 per year to convert the part-time position to a full-time position.…arrow_forwardSales and Purchases Ms. Valli of All About You Spa has decided to expand her business by adding two lines of merchandisea selection of products used in the salon for the body, the feet, and the face, as well as logo mugs, T-shirts, and baseball caps that can provide advertising benefits. She believes she will be able to increase her profits significantly. July Journal Entries So that you can complete the journal entries for the month of July, Ms. Valli has also left the information you will need and directions on how to proceed. Note that with the expansion of the business into merchandising, new accounts have been added to the chart of accounts. For example, an additional revenue account, Merchandise Sales, is needed. Because All About You Spa now needs a Purchases account, the chart of accounts needs to be modified as follows: The 500599 range is used for the purchase-related accounts (for example, Purchases 511 and Freight In 515). Your new chart of accounts is as follows: CHART OF ACCOUNTS FOR ALL ABOUT YOU SPA Also note that because you will be making purchases on account and sales on account, subsidiary ledgers will be needed to track what is due from individual customers and owed to individual vendors. A listing of customers and vendors with current balances are as follows: Checkbook Register Purchases Invoices for Merchandise Bought on Account During July All About You Spa will pay all freight costs associated with purchases of merchandise to the supplier. Use the new accounts Purchases 511 and Freight In 515. Sales Invoices for Gift Certificates Sold on Account During July All About You Spa is responsible for collecting and paying the sales tax on merchandise that it sells. The sales tax rate where All About You Spa does business is 8 percent of each sale (for example, 340.00 0.08 = 27.20). Note: All gift certificates were redeemed for merchandise by the end of the month. Other July Transactions There were five other transactions in July. None involved cash. Required 1. Journalize the transactions for July (in date order). Ask your instructor whether you should use the special journals or the general journal for this problem. If you are preparing the journal entries using Working Papers, enter your transactions beginning on page 6. 2. Post the entries to the accounts receivable, accounts payable, and general ledgers. Ignore this step if you are using CLGL. 3. Prepare a trial balance as of July 31, 20--. 4. Prepare a schedule of accounts receivable as of July 31, 20--. 5. Prepare a schedule of accounts payable as of July 31, 20--.arrow_forward

- A sales representative lives in Bloomington and must be in Indianapolis next Thursday. On each of the days Monday, Tuesday, and Wednesday, he can sell his wares in Indianapolis, Bloomington, or Chicago. From past experience, he believes that he can earn $12 from spending a day in Indianapolis, $16 from spending a day in Bloomington, and $17 from spending a day in Chicago. Where should he spend the first three days and nights of the week to maximize his sales income less travel costs? Travel costs are shown in Table 2. TABLE 2 From To Indianapolis Bloomington Chicago Indianapolis 5 2 | Bloomington 5 7 Chicago 7 -arrow_forwardTeasha Pratt will graduate from high school next month and cannot decide what she wants to do. She had originally planned to go to college and major in marketing and accounting, but now she is thinking about opening her own business. Teasha has worked in a gift store for the last two years and gained a lot of experience and knowledge by working with inventory, pricing, customers, and accounting. However, her real interest is in crafts. After conducting some marketing research, Teasha determines that there is a very small market for a craft store (there are currently two craft stores in town), but there is a larger market for a gift store. Teasha decides to open a small gift store in the mall with a loan from the local bank. After much hard work, she locates two suppliers, Gifts Plus Wholesalers and Hearts Manufacturing Corporation, hires employees, buys display equipment, accounting equipment, a cash register, supplies, etc. Three months later, she is ready to open her store.…arrow_forwardBefore you begin this assignment review the Tying It All Together feature in the chapter. Best Buy Co., Inc. is a leading provider of technology products. Customers can shop at more than 1,700 stores or online. The company is also known for its Geek Squad for technology services. Suppose Best Buy is considering a particular HDTV for a major sales item for Black Friday, the day after Thanksgiving, known as one of the busiest shopping days of the year. Assume the HDTV has a regular sales price of $900, a cost of $500, and a Black Friday proposed discounted sales price of $650. Best Buy’s 2015 Annual Report states that failure to manage costs could have a material adverse effect on its profitability and that certain elements in its cost structure are largely fixed in nature. Best Buy, like most companies, wishes to maintain price competitiveness while achieving acceptable levels of profitability. (Item 1A. Risk Factors.) Requirements Calculate the gross profit of the HDTV at the regular…arrow_forward

- Sally works as a manager in the gardening section of her local Bunnings Store. Recently, Sally was approached by a customer asking questions about the store's range of built-in kitchens. Although she knew nothing about the products, Sally recommended the deluxe kitchen package which came with free installation. After completing the sale, Sally handed the customer her Bunnings business card (which identified her as a manager), explained that the customer should get his new kitchen professionally installed and to forward her the 3 party's invoice- which Bunnings would pay. A few weeks later, the customer is shocked to learn that Bunnings is refusing to pay his carpenter's $10,000 invoice and that Sally failed to mention that the offer was capped at $500. Required: a) With reference to Pacific Cariers v Paribas, what is the test for deciding if an agent had apparent authority? b) Analyse whether Sally had apparent authority to bind Bunnings Pty Ltd to this $10,000 contract. C) How would…arrow_forwardRyan Egan and Jack Moody are both cash register clerks for Organic Markets. Lee Sorrell is the store manager for Organic Markets. The following is an excerpt of a conversation between Ryan and Jack: Ryan: Jack, how long have you been working for Organic Markets? Jack: Almost five years this November. You just started two weeks ago … right? Ryan: Yes. Do you mind if I ask you a question? Jack: No, go ahead. Ryan: What I want to know is, have they always had this rule that if your cash register is short at the end of the day, you have to make up the shortage out of your own pocket? Jack: Yes, as long as I’ve been working here. Ryan: Well, it’s the pits. Last week I had to pay in almost $40. Jack: It’s not that big a deal. I just make sure that I’m not short at the end of the day. Ryan: How do you do that? Jack: I just shortchange a few customers early in the day. There are a few jerks that deserve it anyway. Most of the time, their attention is elsewhere and they don’t think to check…arrow_forwardYou have just begun your summer internship at Omni Instruments. The company supplies sterilized surgical instruments for physicians. To expand sales, Omni is considering paying a commission to its sales force. The controller, Matthew Barnhill, asks you to compute: (1) the new breakeven sales figure, and (2) the operating profit if sales increase 15% under the new sales commission plan. He thinks you can handle this task because you learned CVP analysis in your accounting class. You spend the next day collecting information from the accounting records, performing the analysis, and writing a memo to explain the results. The company president is pleased with your memo. You report that the new sales commission plan will lead to a significant increase in operating income and only a small increase in breakeven sales. The following week, you realize that you made an error in the CVP analysis. You overlooked the sales personnel’s $2,800 monthly salaries, and you did not include this fixed…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning