To discuss:

Annual average return and standard deviation.

Introduction:

Return: In financial context, return is seen as percentage that represents the profit in an investment.

Explanation of Solution

The annual average

Using equation (1) the annual average return of Miller’s Fund (MF) is calculated as follows:

The annual average return of Miller’s Fund (MF) is 24.325%..

Using equation (1) the annual average return of S&P is calculated as follows:

The annual average return of S&P is 14.925%.

By the annual average returns, Miller’s Fund performed better than the S&P over the given period of time.

If money investment of $1,000 is made in Miller’s Fund in 2009, the money reaped at the end of 2012 would be $1,243.25

If money investment of $1,000 is made in S&P in 2009, the money reaped at the end of 2012 would be $1,149.25

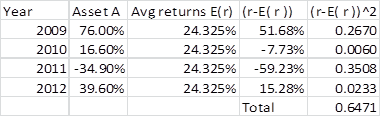

The standard deviation of Miller’s Fund can be calculated as follows using excel functions as in table1.

Table 1

The standard deviation of Miller’s Fund is calculated as follows:

The standard deviation of Miller’s Fund is 46.44%.

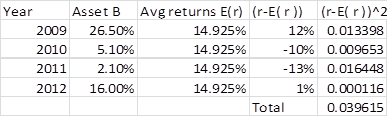

The standard deviation of S&P can be calculated as follows using excel functions as in table 2.

Table 2

The standard deviation of S&P is calculated as follows:

The standard deviation of S&P is 11.5%.

By the value of standard deviation, Millers Fund is more volatile than S&P.

Want to see more full solutions like this?

Chapter 8 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- In a recent 5-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. 1 2 3 4 5 Fund −1.2 +24.5 +40.5 +11.5 +0.3 Market index −1.0 +17.0 +31.5 +10.8 −0.8 a. Calculate (a) the average return on both the Fund and the index, and (b) the standard deviation of the returns on each. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b. Did Ms. Sauros do better or worse than the market index on these measures?arrow_forwardIn a recent 5-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. 1 2 3 4. Fund -1.3 +24.2 +40.2 +11.2 +0.4 Market index -0.7 +14.0 +31.2 +10.5 -0.5 a. Calculate (a) the average return on both the Fund and the index, and (b) the standard deviation of the returns on each. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b. Did Ms. Sauros do better or worse than the market index on these measures? Mesozoic Fund Market Portfolio Return Return Average return a. Standard deviation Did Ms. Sauros do better or worse than the b. market index on these measures?arrow_forwardYou have been given the following return information for two mutual funds (Papa and Mama), the market index, and the risk-free rate. Year Papa Fund Mama Fund Market Risk-Free 2011 –12.6 % –22.6 % –24.5 % 1 % 2012 25.4 18.5 19.5 3 2013 8.5 9.2 9.4 2 2014 15.5 8.5 7.6 4 2015 2.6 –1.2 –2.2 2 Calculate the Sharpe ratio, Treynor ratio, Jensen’s alpha, information ratio, and R-squared for both funds. (Input all amounts as positive values. Do not round intermediate calculations. Enter all answers as a decimal value rounded to 4 decimal places.) PAPA MAMA SHARPE RATIO: TREYNOR RATIO JENSEN'S ALPHA INFORMATION RATIO R-SQUAREDarrow_forward

- Mr. Abir, after joining in Classic Mutual Fund has been asked to compute the returns. Apart from this, he must have to highlight the other areas of the fund. Consider the following information about the returns on Classic Fund, the market returns, and the T-Bill returns. Year Returns on Classic Fund % Market Index (Nifty Returns) % T-Bills Returns % 2003 15.3 10.5 5.4 2004 14.2 16.5 6.1 2005 -5.0 -7.9 5.9 2006 21.2 18.0 6.2 2007 18.3 15.5 5.5 2008 12.5 10.7 5.4 2009 -9.5 -3.0 5.8 2010 -7.3 4.9 6.1 2011 8.5 -7.5 6.2 2012 -11.4 3.0 5.8 2013 25.2 20.5 5.7 2014 22.0 18.0 5.4 2015 -16.3 4.3 6.0 2016 14.7 12.0 6.2 2017 18.5 15.3 5.8 2018 20.2 18.0 6.0 From the above information calculate all the inputs required for determining the Sharpe’s Ratio Treynor Ratio Jensen Ratioarrow_forwarda. A mutual fund is a professionally managed type of collective investment scheme that pools money from many investors and invests in stocks, bonds, short-term money market instruments and other securities. The performance of these mutual funds and the portfolio they build needs to be evaluated as frequently as possible. Evaluating the performance of these mutual funds is important for both existing and potential investors. The Table below provides the average return, standard deviation and betas of selected equity mutual funds over a period of three years. The average risk free rate for the period is estimated at 15%. Portfolio Average return Standard Deviation Beta Portfolio A 27.62 16 1.2 Portfolio B 20.12 15 0.9 Portfolio C 26.25 12 1.05 GSE return(benchmark) 16.18 10 1.0 Required:Estimate and compare the performance of the funds with the market using:i. Treynor’s measureii. Sharpe’s measureiii. Jensen’s Measure b. The issuing of security goes through a number of…arrow_forwardIn a recent 5-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. Fund Market index -1.2 -0.9 2 +24.8 +16.0 a. Average retur a. Standard deviation b. Did Ms. Sauros do better or worse than the market index on these measures? 3 +40.7 +31.7 a. Calculate (a) the average return on both the Fund and the index, and (b) the standard deviation of the returns on each. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. b. Did Ms. Sauros do better or worse than the market index on these measures? Answer is complete but not entirely correct. Mesozoic Fund Return Better +11.1 +10.9 19.23 15.14 x Market Portfolio Return 19.53 +0.3 -0.7 8.85 xarrow_forward

- You have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is .97. Year Fund Market Risk-Free 2015 −18.80 % −36.50 % 1 % 2016 25.10 20.70 6 2017 13.60 13.00 2 2018 7.00 8.40 6 2019 −1.92 −4.20 2 Calculate Jensen’s alpha for the fund, as well as its information ratio. (Do not round intermediate calculations. Enter the alpha as a percent rounded to 2 decimal places. Round the ratio to 4 decimal places.)arrow_forwardAnalyze the following three years of data relating to the MoMoney Mutual Fund, . It should report the amount of dividend income and capital gains distributed to the shareholders, along with any other changes in the fund's net asset value (b = 0.5). (Click the icon here ☐ in order to copy the contents of the data table below into a spreadsheet.) 2019 2018 NAV (beginning of period) ? ? 2017 $35.56 Net investment income 0.64 0.74 0.56 Net gains on securities 5.48 4.52 - 3.41 Dividends from net investment income 0.64 0.56 Distributions from realized gains 1.61 1.96 0.51 1.44 a. What is the total income from the investment operations? b. What are the total distributions from the investment operations? a. The total income from investment operations in 2019 is $ The total income from investment operations in 2018 is $ (Round to the nearest cent.) (Round to the nearest cent.) (Round to the nearest cent.) The total income from investment operations in 2017 is $ b. The total distributions from…arrow_forwardIn a recent 5-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. Fund Market index a. 1 -1.2 -0.9 b. 2 +24.8 +16.0 a. Calculate (a) the average return on both the Fund and the index, and (b) the standard deviation of the returns on each. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b. Did Ms. Sauros do better or worse than the market index on these measures? Average return Standard deviation Did Ms. Sauros do better or worse than the market index on these measures? 3 +40.7 +31.7 Mesozoic Fund Return Better 4 +11.1 +10.9 15.06 16.04 Market Portfolio Return 5 +0.3 -0.7 10.70 11.76arrow_forward

- You have been given the following return information for a mutual fund, the morket index, and the risk-free rate. You also know that the return correlation between the fund and the market is 97. Year Fund Market Risk-Free 2015 -20.6% 25.1 13.9 7.6 -2.1 -39.5% 1% 2016 21.0 13.9 2017 2018 8.B 2019 -5.2 What ore the Sharpe and Treynor ratios for the fund? (Do not round intermediate calculations. Round your answers to 4 decimal places.) Sharpe ratio Treynor ratioarrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is .96. Year Fund 2015 -14.92% Market -28.50% Risk-Free 2% 2016 25.10 19.90 2017 12.80 10.60 2018 7.00 2019 -1.44 7.60 -2.20 4252 Calculate Jensen's alpha for the fund, as well as its information ratio. (Do not round intermediate calculations. Enter the alpha as a percent rounded to 2 decimal places. Round the ratio to 4 decimal places.) Jensen's alpha Information ratio %arrow_forwardIn a recent 5-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. Fund Market index 1 -1.2 -0.9 2 +24.8 +16.0 a. Average return a. Standard deviation b. Did Ms. Sauros do better or worse than the market index on these measures? +40.7 +31.7 4 +11.1 +10.9 a. Calculate (a) the average return on both the Fund and the index, and (b) the standard deviation of the returns on each. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. b. Did Ms. Sauros do better or worse than the market index on these measures? Mesozoic Fund Return Market Portfolio. Return +0.3 -0.7 11.40arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education