Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 7MC

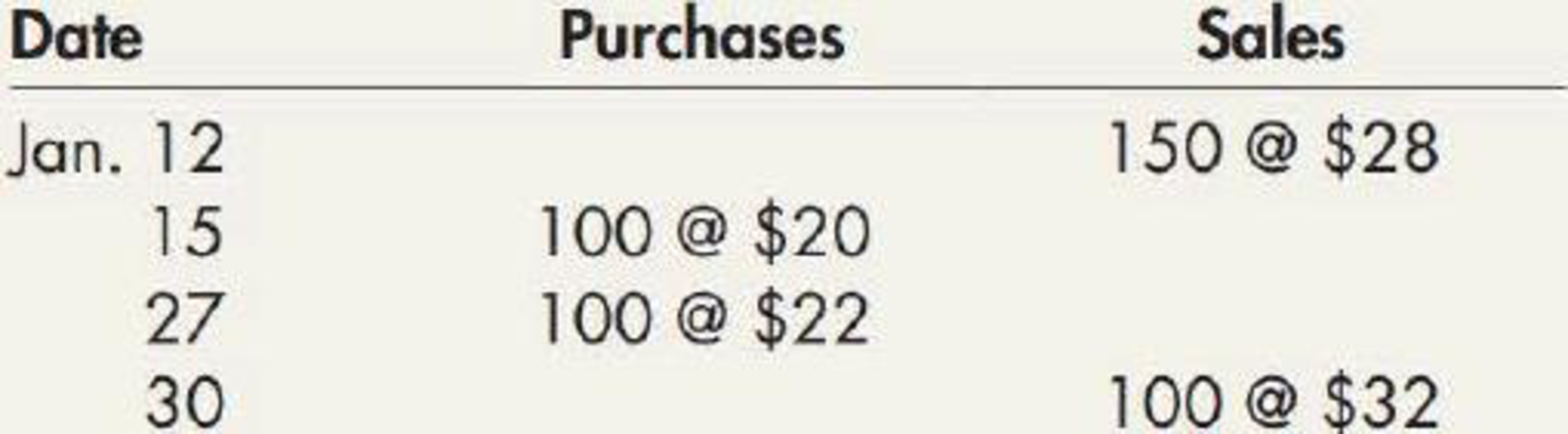

Questions M7-6 and M7-7 are based on the following data: City Stationers Inc. had 200 calculators on hand on January 1, 2019, costing $18 each. Purchases and sales of calculators during the month of January were as follows:

City uses a periodic inventory system. According to a physical count, 150 calculators were on hand at January 31, 2019.

M7-6 The cost of the inventory on January 31, 2019, under the FIFO method is:

- a. $400

- b. $2,700

- c. $3,100

- d. $3,200

M7-7 The cost of the inventory on January 31, 2019, under the LIFO method is:

- a. $400

- b. $2,700

- c. $3,100

- d. $3,200

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Windsor Furniture Sales uses the periodic inventory system. On April 30, 2021, the company's year end, a physical count was taken of

the inventory on hand in both the warehouse and the retail store area for the purpose of determining cost of goods sold and ending

inventory value. The preliminary inventory list prepared by the warehouse manager shows a total inventory on hand of $760,000. The

following are items that the warehouse manager noted ona separate sheet. None of these items are currently part of the final

inventory listing because the manager was not sure how they should be treated for inventory purposes.

On April 30, Windsor shipped an order to a customer, FOB shipping point. The cost of the goods shipped is $9,870. Freight,

which is to be paid by the appropriate party, will cost $595.

1.

On April 30, a customer visited Windsor's shop and selected a desk that she wanted to purchase and paid for it in full. The

sales price of the desk was $5,700, and the cost was $4,400. The…

The Kwok Company’s inventory balance on December 31, 2018, was $165,000 (based on a 12/31/2018 physicalcount) before considering the following transactions:1. Goods shipped to Kwok f.o.b. destination on December 20, 2018, were received on January 4, 2019. Theinvoice cost was $30,000.2. Goods shipped to Kwok f.o.b. shipping point on December 28, 2018, were received on January 5, 2019. Theinvoice cost was $17,000.3. Goods shipped from Kwok to a customer f.o.b. destination on December 27, 2018, were received by the customer on January 3, 2019. The sales price was $40,000 and the merchandise cost $22,000.4. Goods shipped from Kwok to a customer f.o.b. destination on December 26, 2018, were received by the customer on December 30, 2018. The sales price was $20,000 and the merchandise cost $13,000.5. Goods shipped from Kwok to a customer f.o.b. shipping point on December 28, 2018, were received by thecustomer on January 4, 2019. The sales price was $25,000 and the merchandise cost…

Jungkook Corp. has reported an inventory balance of P2,500,000 (based on physical count on January 5, 2021) by end of year 2020. As the company’s auditor, you have noted of the following transactions: • Goods shipped to Jungkook F.O.B. destination on December 28, 2019 were received on January 5, 2021. Based on the provided invoice, this costs P300,000 and is physically counted as part of the initial inventory balance. • There are also goods amounting to P250,000 which you have learned later on, has been held on consignment from a major consignor of Jungkook Corp. This is as well physically counted as part of the initial inventory balance. • Merchandise with cost of P100,000 was already in-transit to a customer, F.O.B shipping point on December 30, 2020. It arrived on January 4, 2021. Since it has already been shipped before the physical count on January 5, the merchandise is not included in the initial inventory balance. • You also have noted that P150,000 worth of merchandise has not…

Chapter 7 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 7 - Distinguish among the types of inventory accounts...Ch. 7 - Prob. 2GICh. 7 - Describe the flow of costs for o merchandising...Ch. 7 - Describe the relationship between cost of goods...Ch. 7 - Prob. 5GICh. 7 - Does the use of a perpetual system eliminate the...Ch. 7 - What is the general rule used to determine if a...Ch. 7 - For goods in transit at the end of a period,...Ch. 7 - Prob. 9GICh. 7 - Prob. 10GI

Ch. 7 - Prob. 11GICh. 7 - Consider each of the following independent...Ch. 7 - Prob. 13GICh. 7 - Prob. 14GICh. 7 - Prob. 15GICh. 7 - Prob. 16GICh. 7 - Prob. 17GICh. 7 - Prob. 18GICh. 7 - Prob. 19GICh. 7 - Prob. 20GICh. 7 - Discuss the LIFO and FIFO cost flow assumptions...Ch. 7 - Prob. 22GICh. 7 - Prob. 23GICh. 7 - List the acceptable cost flow assumptions under...Ch. 7 - Prob. 25GICh. 7 - Explain the dollar-value LIFO method of inventory...Ch. 7 - Describe the double-extension and link-chain...Ch. 7 - Prob. 28GICh. 7 - Prob. 29GICh. 7 - What is the impact of LIFO inventory liquidation...Ch. 7 - Goods on consignment should be included in the...Ch. 7 - The following items were included in Venicio...Ch. 7 - During 2019, R Corp., a manufacturer of chocolate...Ch. 7 - Dixon Menswear Shop purchased shirts from Colt...Ch. 7 - The moving average inventory cost flow assumption...Ch. 7 - The cost of the inventory on January 31, 2019,...Ch. 7 - Questions M7-6 and M7-7 are based on the following...Ch. 7 - Assuming no beginning inventory, what can be said...Ch. 7 - On December 31, 2018, Kern Company adopted the...Ch. 7 - When the double-extension approach to the...Ch. 7 - On December 31, Pitts Manufacturing Company...Ch. 7 - On January 1, Pope Enterprises inventory was...Ch. 7 - Reid Company uses the periodic inventory system....Ch. 7 - Billings Company uses a periodic inventory system....Ch. 7 - Dani Corporation signed a binding commitment on...Ch. 7 - Stevens Company uses a perpetual inventory system....Ch. 7 - RE7-6 Stevens Company uses a perpetual inventory...Ch. 7 - Johnson Company uses a perpetual inventory system....Ch. 7 - RE7-8 Johnson Company uses a perpetual inventory...Ch. 7 - Jessie Stores uses the periodic system of...Ch. 7 - Jessie Stores uses the periodic system of...Ch. 7 - Carla Company uses the perpetual inventory system....Ch. 7 - Carla Company uses the perpetual inventory system....Ch. 7 - On January 1 of Year 1, Dorso Company adopted the...Ch. 7 - An evaluation of Bryces Bookstores inventory was...Ch. 7 - Inventory Accounts for a Manufacturing Company...Ch. 7 - Prob. 2ECh. 7 - Perpetual versus Periodic Inventory Systems Graham...Ch. 7 - Determining Net Purchases The following amounts...Ch. 7 - Perpetual versus Periodic Inventory Systems...Ch. 7 - Goods in Transit Gravais Company made two...Ch. 7 - Items Included in Inventory The following are...Ch. 7 - Prob. 8ECh. 7 - Prob. 9ECh. 7 - Discounts Nelson Company bought inventory for...Ch. 7 - Alternative Inventory Methods Nevens Company uses...Ch. 7 - Alternative Inventory Methods Park Companys...Ch. 7 - Alternative Inventory Methods Frate Company was...Ch. 7 - LIFO, Perpetual and Periodic Riedel Companys...Ch. 7 - Habicht Company was formed in 2018 to produce a...Ch. 7 - Dollar-Value LIFO A company adopted the LIFO...Ch. 7 - On January 1, 2018, Sato Company adopted the...Ch. 7 - Dollar-Value LIFO Beistock Company manufactures...Ch. 7 - Acute Company manufactures a single product. On...Ch. 7 - Inventory Pools Stone Shoe Company adopted...Ch. 7 - Grimstad Company uses FIFO for internal reporting...Ch. 7 - LIFO and Interim Financial Reports Assume prices...Ch. 7 - Applying the Cost of Goods Sold Model The...Ch. 7 - Items to Be Included in Inventory As the auditor...Ch. 7 - Valuation of Inventory The inventory on hand at...Ch. 7 - Prob. 4PCh. 7 - Cost of Goods Sold As an accountant for Lee...Ch. 7 - Alternative Inventory Methods Garrett Company has...Ch. 7 - Totman Company has the following transactions...Ch. 7 - Comprehensive The following information for 2019...Ch. 7 - LIFO Liquidation Profit Hammond Company adopted...Ch. 7 - LIFO and Inventory Pools On January 1, 2016,...Ch. 7 - Olson Company adopted the dollar-value LIFO method...Ch. 7 - Dollar-Value LIFO Kwestel Company adopted the...Ch. 7 - Webster Company adopted do liar-value LIFO on...Ch. 7 - Dollar-Value LIFOComprehensive Kelly Company...Ch. 7 - On January 1, 2019, Lucas Distributors Inc....Ch. 7 - Inventory Valuation You are engaged in an audit of...Ch. 7 - Allen Company is a wholesale distributor of...Ch. 7 - FIFO and LIFO A company may compute inventory...Ch. 7 - Prob. 2CCh. 7 - In January, Broome Inc. requested and secured...Ch. 7 - Prob. 4CCh. 7 - Prob. 5CCh. 7 - Interpretation of GAAP and Ethical Issues Robin...Ch. 7 - Selection of an Inventory Method and Ethical...Ch. 7 - Analyzing Starbuckss Inventory Disclosures Obtain...Ch. 7 - Fenimore Manufacturing Company uses the average...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Take me to the text Suppose that on June 20, 2021, both Company A and Company B sold inventory with a cost of $32,600. The updated balance of inventory as at June 1 for both companies was $110,600. Company A uses the perpetual inventory system. Company B uses the periodic inventory system and performs an inventory count at the end of each month. What is the value of inventory as at June 20 for each company? Do not enter dollar signs or commas in the input boxes. Company Inventory System Value of Inventory on June 20 $ 65000 A B Check Perpetual Periodic $40900 Iarrow_forwardThe Kwok Company’s inventory balance on December 31, 2021, was $165,000 (based on a 12/31/2021 physical count) before considering the following transactions: Goods shipped to Kwok f.o.b. destination on December 20, 2021, were received on January 4, 2022. The invoice cost was $30,000. Goods shipped to Kwok f.o.b. shipping point on December 28, 2021, were received on January 5, 2022. The invoice cost was $17,000. Goods shipped from Kwok to a customer f.o.b. destination on December 27, 2021, were received by the customer on January 3, 2022. The sales price was $40,000 and the merchandise cost $22,000. Goods shipped from Kwok to a customer f.o.b. destination on December 26, 2021, were received by the customer on December 30, 2021. The sales price was $20,000 and the merchandise cost $13,000. Goods shipped from Kwok to a customer f.o.b. shipping point on December 28, 2021, were received by the customer on January 4, 2022. The sales price was $25,000 and the merchandise cost $12,000.…arrow_forwardTake me to the text Suppose that on November 20, 2021, both Company A and Company B sold inventory with a cost of $38,800. The updated balance of inventory as at November 1 for both companies was $104, 700. Company A uses the perpetual inventory system. Company B uses the periodic inventory system and performs an inventory count at the end of each month. What is the value of inventory as at November 20 for each company? Do not enter dollar signs or commas in the input boxes. Company Inventory System Value of Inventory on November 20 A Perpetual SAnswer B Periodic $Answerarrow_forward

- The DJ company uses a periodic inventory system. The beginning balance of inventory and purchases made by the company during December 2020 are given below. December 01: Beginning inventory, 50 units @ Rs40 per unit. December 18: Inventory purchased, 60 units @ Rs48 per unit. December 20: Inventory purchased, 20 units @ Rs 52 per unit. December 25: Inventory purchased, 70 units @ Rs56 per unit. The DJ company sold 160 units during December 2020. Required: Compute inventory on December 31, 2020, and cost of goods sold for December using the following inventory costing method: Last in, first-out (LIFO) method. Average cost method.arrow_forwardCrosby Company owns a chain of hardware stores throughout the state. The company uses a periodic inventory system and the retail Inventory method to estimate ending inventory and cost of goods sold. The following data are available for the three months ending March 31, 2021: Beginning inventory. Net purchases Net markups Net markdowns Net sales Beginning inventory Net purchases Net markups Required: Complete the table below to estimate the LIFO cost of ending inventory and cost of goods sold for the three months ending March 31, 2021, using the information provided. Assume stable retail prices during the period (Round ratio calculation to 2 decimal places (i.e.. 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign.) Cost $180,000 630,000 Net markdowns Goods available for sale (excluding beg. inventory) Goods available for sale (including beg inventory) Cost-to-retail percentage (beginning) Cost-to-retail percentage (current) sales Estimated ending…arrow_forwardThe Kwok Company's inventory balance on December 31, 2021, was $200,000 (based on a 12/31/2021 physical count) before considering the following transactions: 1. Goods shipped to Kwok f.o.b. destination on December 20, 2021, were received on January 4, 2022. The invoice cost was $37,000. 2. Goods shipped to Kwok f.o.b. shipping point on December 28, 2021, were received on January 5, 2022. The invoice cost was $24,000. 3. Goods shipped from Kwok to a customer f.o.b. destination on December 27, 2021, were received by the customer on January 3, 2022. The sales price was $47,000 and the merchandise cost $29,000. 4. Goods shipped from Kwok to a customer f.o.b. destination on December 26, 2021, were received by the customer on December 30, 2021. The sales price was $27,000 and the merchandise cost $20,00o. 5. Goods shipped from Kwok to a customer f.o.b. shipping point on December 28, 2021, were received by the customer on January 4, 2022. The sales price was $32,000 and the merchandise cost…arrow_forward

- Fischer, Inc. had the following inventory in fiscal 2019. The company uses the average cost method of accounting for inventory. Beginning Inventory, January 1, 2019: 100 units @ $10.00 Purchase of inventory, June 1, 2019: 200 units @ $12.00 Sale of inventory, November 1, 2019: 150 units What amount is reported as cost of goods sold?arrow_forwardGivenchy Inc. sells electric stoves. It uses the perpetual inventory system and allocates cost to inventory on a first-in, first-out basis. The company's reporting date is December 31. At December 1, 2020, inventory on hand consisted of 350 stoves at P820 each and 43 stoves at P850 each. During the month ended December 31, 2020, the following inventory transactions occurred (all purchase and sales transactions are on credit): 2020 Dec. Sold 300 stoves for P1,200 each. All stoves were from 820 cost each. Five stoves were returned by customers. They had originally cost P820 3 each and were sold for P1,200 each. Purchased 55 stoves at P910 each. 10 Purchased 76 stoves at P960 each. 15 Sold 86 Stoves for P1,350 each. 17 Returned one damaged stove to supplier purchased on Dec. 9. 22 Sold 60 stoves for P1,250 each. 26 Purchased 72 stoves at P980 each Requirement: a. Journalize the above transaction. b. What is the FIFO cost of Givenchy's inventory on Dec. 31, 2020? c. What is the cost of…arrow_forwardOn January 1, 2019, the general ledger of Global Corporation included supplies of $1,600. During 2019, supplies purchased amounted to $6,200. A physical count of inventory on hand at December 31, 2019 determined that the amount of supplies on hand was $1,800. How much is the supplies expense for year 2019? Multiple Choice $6,400. O $6,000. $7,800. O $1,600.arrow_forward

- Crosby Company owns a chain of hardware stores throughout the state. The company uses a periodic inventory system and the retsil inventory method to estimate ending inventory and cost of goods sold. The following dats are available for the three months ending March 31, 2021: Cost Retail Beginning inventory Net purchases Net narkups Net narkdowns Net sales $310, e00 $381, 000 750, 000 986, e00 21,000 7,e0e 946, B00 Required: Complete the table below to estimate the LIFO cost of ending inventory and cost of goods sold for the three months ending March 31, 2021, using the information provided. Assume stable retsil prices during the period. (Round ratio calculation to 2 declmal places (1.e., 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign.) Cost-to-Retall Cost Retall Ratio Beginning inventory 310,000 S 381,000 Net purchases Net markups Net markdowns Goods available far sale (excluding beg. inventory) Goods available for sale (including beg. inventory)…arrow_forwardEsquire Inc. uses the LIFO method to report its inventory. Inventory at January 1, 2021, was $500,000 (20,000 units at $25 each). During 2021, 80,000 units were purchased, all at the same price of $30 per unit. 85,000 units were sold during 2021. Calculate the December 31, 2021, ending inventory and cost of goods sold for 2021 based on a periodic inventory system.arrow_forwardCrosby Company owns a chain of hardware stores throughout the state. The company uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the three months ending March 31, 2021: Cost Retail Beginning inventory Net purchases Net markups Net markdowns $320,000 $382,000 707,000 995,000 23,000 8,000 961,000 Net sales Required: Complete the table below to estimate the LIFO cost of ending inventory and cost of goods sold for the three months ending March 31, 2021, using the information provided. Assume stable retail prices during the period. (Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign.) Cost-to-Retail Cost Retail Ratio Beginning inventory $ 320,000 $ 382,000 Net purchases 707,000 995,000 Net markups 23,000 Net markdowns (8,000) Goods available for sale (excluding beg. inventory) 707,000 1,010,000 Goods…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License