Concept explainers

a.

To determine: The value of the common stock if the growth rate is 0.00% to infinity.

a.

Answer to Problem 7.1STP

Explanation of Solution

Given information:

Required rate: 12.00%

Annual dividend: $1.80

Formula used to calculate the stock price if the growth rate is 0.00% to infinity.

Calculation of the stock price:

Therefore, the stock price is $15.00.

b.

To determine: The value of the common stock if the growth rate is 5.00% to infinity.

b.

Answer to Problem 7.1STP

Explanation of Solution

Given information:

Required rate: 12.00%

Annual dividend: $1.80

Growth rate: 5.00%

Formula used to calculate the stock price

Calculation of the stock price if the growth rate is 5.00% to infinity:

Therefore, stock price is $27.00.

b.

To determine: The stock price if expected to grow at an annual rate of 5% for each of the next 3 years, followed by a constant annual growth rate of 4% in year 4 to infinity.

b.

Answer to Problem 7.1STP

Explanation of Solution

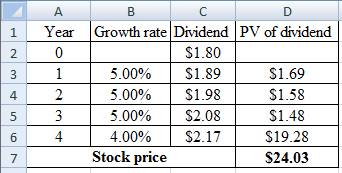

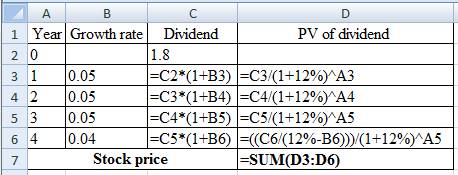

Calculation of the stock price:

Excel working:

Therefore, stock price is $24.03.

Want to see more full solutions like this?

Chapter 7 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- Return on Common Stock You buy a share of The Ludwig Corporation stock for $21.40. You expect it to pay dividends of $1.07, $1.1449, and $1.2250 in Years 1, 2, and 3, respectively, and you expect to sell it at a price of $26.22 at the end of 3 years. Calculate the growth rate in dividends. Calculate the expected dividend yield. Assuming that the calculated growth rate is expected to continue, you can add the dividend yield to the expected growth rate to obtain the expected total rate of return. What is this stock’s expected total rate of return (assume the market is in equilibrium with the required return equal to the expected return)?arrow_forwardThe Castle Company recently reported net profits after taxes of $15.8 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company’s stock currently trades at $60 per share. Compute the stock’s earnings per share (EPS). What is the stock’s P/E ratio? Determine what the stock’s dividend yield would be if it paid $1.75 per share to common stockholders.arrow_forward$3 DIVIDEND IN ONE YEAR, YOU EXPECTA DIVIDEND OF $2.10 IN TWO YEARS, YOU EXPECT TO RECEIVE A DIVIDEND OF $2.205 AT THE END OF YEAR 3 AND A STOCK PRICE OF $15.435. iF REQUIRED RETURN ON STOCK IS 10% AND INTEREST RATE IS 5%. HOW MUCH WILL YOU PAY FOR THE STOCK? Select one: а. 17.72 b. 20.00 С. 15.80 O d. 17.27arrow_forward

- Return on Common Stock You buy a share of The Ludwig Corporation stock for $18.40. You expect it to pay dividends of $1.08, $1.1491, and $1.2226 in Years 1, 2, and 3, respectively, and you expect to sell it at a price of $22.16 at the end of 3 years. a. Calculate the growth rate in dividends. Round your answer to two decimal places. % b. Calculate the expected dividend yield. Round your answer to two decimal places. % c. Assuming that the calculated growth rate is expected to continue, you can add the dividend yield to the expected growth rate to obtain the expected total rate of return. What is this stock's expected total rate of return? (Assume the market is in equilibrium with the required return equal to the expected return.) Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardProblem 1. Ferry Motors' common stock just paid its annual dividend of $1.80 per share. The required return on the common stock is 12%. Estimate the value of the common stock under each of the following assumptions about the dividend: a. Dividends are expected to grow at annual rate of 0% to infinity. b. Dividends are expected to grow at a constant annual rate of 5% to infinity. C. Dividends are expected to grow at an annual rate of 5% for each of the next 3 years, followed by a constant annual growth rate of 4% in years 4 to infinity.arrow_forwardListen You purchased stock in Magneto Vision for $13 per share on January 1, 2022. Over the next year you received $2.22 per share in dividends. On December 31,2022 Magneto Vision is selling for $12.50 per share. What has been your total gross return (in percent) over the one-year period? 13.23% 113.23% 1.13% 13.00%arrow_forward

- ADC 1) Based on End-of-Chapter Problem 6 in Chapter 5 The stock of Business Adventures sells for $40 a share. Its likely dividend payout and end- of-year price depend on the state of the economy by the end of the year as follows: Stock Price Dividend. $2.00 $50 1.00 43 0.50 34 a. Calculate the expected holding-period return and standard deviation of the holding- period return. All three scenarios are equally likely. Boom Normal economy Recession b. Calculate the expected return and standard deviation of a portfolio invested half in Business Adventures and half in Treasury bills. The return on bills is 4%.arrow_forwardQ36 A stock that just gave a dividend of OMR 1.545 and long-term annual growth rate of the company is 3%. If the Investors required rate of return (Ke) of 8% from such stock, then how much is the market price of the stock? a. OMR18.75 b. OMR 31.827 c. OMR 30.9 d. OMR 30arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning