To determine: Whether the policy is worth purchasing.

Introduction:

The

Answer to Problem 60QP

The policy is not worth purchasing.

Explanation of Solution

Given information:

An insurance company offers a new policy to their customers. The children’s parents or grandparents will buy the policy at the time of the child’s birth. The parents can make 6 payments to the insurance company. The six payments are as follows:

- On the 1st birthday, the payment amount is $800.

- On the 2nd birthday, the payment amount is $800.

- On the 3rd birthday, the payment amount is $900.

- On the 4th birthday, the payment amount is $900.

- On the 5th birthday, the payment amount is $1000.

- On the 6th birthday, the payment amount is $1000.

After the 6th birthday of the child, the payment will not be made. At the time when the child is 65 years, he or she gets $150,000. The interest rate for the first 6 years is 9% and for the rest of the years is 5.5%.

Note: From the given information, it is essential to compute the future value of the premiums for the comparisons of the promised cash payments at 65 years. Thus, it is necessary to determine the premiums’ value at 6 years first, as the rate of interest varies at that time.

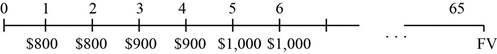

Time line of the payments:

Formula to calculate the future value is as follows:

Note: PV denotes the present value, r denotes the rate of discount and t denotes the number of years.

Compute the future value for the five years is as follows:

Hence, the future value of 1st year is $1,230.90.

Hence, the future value of 2nd year is $1,129.27.

Hence, the future value of 3rd year is $1,165.53.

Hence, the future value of 4th year is $1,069.29.

Hence, the future value of 5th year is $1,090.

Compute the value of 6th year is as follows:

Note: The value of 6th year is calculated by adding all the computed future values and the 6th year’s value, that is, $1,000.

Hence, the value of 6th year is $6,684.98.

Compute the future value of the lump sum at the 65th birthday of the child is as follows:

Note: The number of years is 59, because after the 6th birthday of the child the payments will not be paid.

Hence, the future value of the lump sum at the 65th birthday of the child is $157,396.57.

From the above calculation of the future value, it can be stated that the policy is not worth purchasing as the deposit’s value in the future is $157,396.57, but the contract will pay off at $150,000. The premium’s amount to $7,396.57 is more than the payoff of the policy.

Note: The present value of the two cash flows can be compared.

Formula to calculate the present value of the premiums is as follows:

Compute the present value of the premiums as follows:

Hence, the present value of the premiums is $3,986.04.

The today’s value of the $150,000 at the age of 65 is as follows:

The cash flow of the premiums is still higher. At the time of zero, the difference is $187.32

Want to see more full solutions like this?

Chapter 5 Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday: Second birthday: Third birthday: Fourth birthday: Fifth birthday: Sixth birthday: $ 890 $ 890 Future value $ 990 $ 850 $ 1,090 $ 950 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $390,000. The relevant interest rate is 11 percent for the first six years and 7 percent for all subsequent years. Find the future value of the payments at the child's 65th birthday. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward6. An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday: Second birthday: Third birthday: Fourth birthday: Fifth birthday: Sixth birthday: $800 $800 $800 $1,000 $1,000 $1,000 After the child's 6th birthday, no more payments are made. When the child reaches age 65, he or she receives $1,000,000. If the relevant interest rate is 15% for the first six years and 12% for all subsequent years, is the policy worth buying? Why?arrow_forwardAn Insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The purchaser (say, the parent) makes the following six payments to the insurance company First birthday: Second birthday Third birthday: Fourth birthday Fifth birthday: Sixth birthday. $ 800 $800 $ 900 $ 900 Future value $1,000 $ 1,000 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $350,000. The relevant interest rate is 10 percent for the first six years and 7 percent for all subsequent years. Calculate the future value of the payments at the child's 65th birthday. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child’s birth. The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday: $ 820 Second birthday: $ 820 Third birthday: $ 920 Fourth birthday: $ 850 Fifth birthday: $ 1,020 Sixth birthday: $ 950 After the child’s sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $320,000. The relevant interest rate is 10 percent for the first six years and 7 percent for all subsequent years. Find the future value of the payments at the child's 65th birthday.arrow_forwardAn insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday: $950 Second birthday. $950 Third birthday: $1,050 Fourth birthday: $850 Fifth birthday: $1,150 Sixth birthday: $950 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $450,000. The relevant interest rate is 15 percent for the first six years and 7 percent for all subsequent years. Find the future value of the payments at the child's 65th birthday. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardGive typing answer with explanation and conclusion With this type of cash value life insurance policy, the mortality charges for each year, the administrative charges, and the interest rate that you will receive are all set at the time that the policy is written: A. Whole life B. Universal life C. Variable life D. Variable universal lifearrow_forward

- Insurance underwriting relies heavily on statistics to determine the amount of insurance premium to charge. The probability that a 25-year-old female will live another year is 0.99786 based on data from the national registry agency. Calculate the insurance premium an insurance company would charge to break even on a 1 year $0.5million term-life insurance policy?arrow_forwardAs a new parent, you decided to make annual deposits into a saving account with the first deposit being made on your child's first birthday and last deposit being made on the 15th birthday. The following withdraws are being made on the child's 18th birthday. • Complete the cash flow diagram Find the value of annual deposit that you need to make so withdraws can be made. The interest rate for the account is 8%. $3.200 $2.800 $2,400 $2.000 18 19 20 21arrow_forwardSuppose a life insurance company sells a $250,000 one-year term life insurance policy to a 24-year-old female for $360. The probability that the female survives the year is 0.999477. Compute and interpret the expected value of this policy to the insurance company. The expected value is $ (Round to two decimal places as needed.) Which of the following interpretation of the expected value is correct? O A. The insurance company expects to make an average profit of $32.71 on every 24-year-old female it insures for 1 month. O B. The insurance company expects to make an average profit of $359.81 on every 24-year-old female it insures for 1 year. O C. The insurance company expects to make an average profit of $20.84 on every 24-year-old female it insures for 1 month. O D. The insurance company expects to make an average profit of $229.25 on every 24-year-old female it insures for 1 year.arrow_forward

- Give typing answer with explanation and conclusion 18. Of the following expenses, which one can be considered an annuity? Question 18 options: A) Monthly bill for electricity or gas B) Yearly homeowner association fees C) Recurring car maintenance D) A payment for a car loanarrow_forwardAuto insurance options offered by AA Auto Insurance are outlined in the table below. What monthly payment would you expect for an insurance polier through A Auto Insurance with the following options? Bodily Injury: S50/100,000 Property Damage: $100,000 Collison: S100 deductible Comprehensive: $100 deductible a.$845 b. $350 c. $7O d. $67arrow_forwardMrs. Shimizu borrowed money from a bank. She received from the bank P1,342 and promised torepay P1,500 at the end of 10 months. Determine (a) simple interest rate (b) discount offered asBanker’s discount. Show your complete solution.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education