College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 2PA

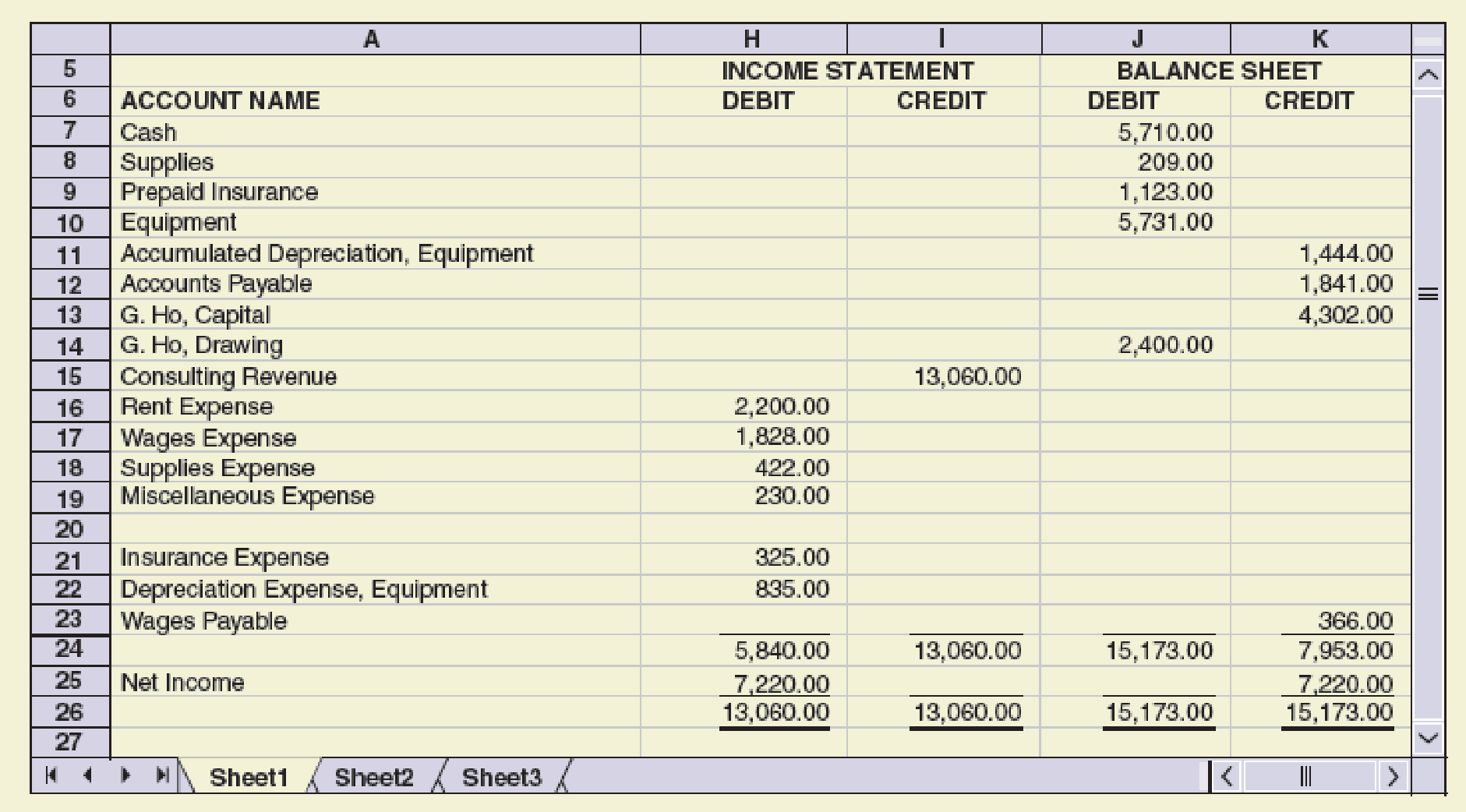

The partial work sheet for Ho Consulting for May follows:

Required

- 1. Write the owner’s name on the Capital and Drawing T accounts.

- 2. Record the account balances in the T accounts for owner’s equity, revenue, and expenses.

- 3. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4.

- 4.

Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number the closing entries 1 through 4.Check Figure

Debit to Income Summary,

second entry, $5,840

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You must complete the following tasks below for the month of April in the Excel workbook provided.

Required:

Part 1. Prepare a journal entry to record each transaction. You must provide a short explanation for each transaction.

Part 2. Setup appropriate T-accounts. All accounts begin with 0 balances.

Part 3. Record in the T-accounts the effects of each transaction for Sydney Stables in April, referencing each transaction in the accounts with the transaction letter. Show the ending balances in the T-accounts.

Part 4. Prepare a trial balance.

Part 5. Prepare a statement of earnings, a statement of shareholders’ equity and a statement of financial position for the month ended April 30, 2020.

Required:

Part 1. Prepare a journal entry to record each transaction. You must provide a short explanation for each transaction.

Part 2. Setup appropriate T-accounts. All accounts begin with 0 balances.

Part 3. Record in the T-accounts the effects of each transaction for Sydney Stables in April, referencing each transaction in the accounts with the transaction letter. Show the ending balances in the T-accounts.

Part 4. Prepare a trial balance.

Part 5. Prepare a statement of earnings, a statement of shareholders’ equity and a statement of financial position for the month ended April 30, 2020.

For additional help, see the demonstration problem at the beginning of each chapter in your Working Papers.

The completed worksheet for Valerie Insurance Agency as of December 31 is presented in your Working Papers or in CengageNow, along with the general ledger as of December 31 before adjustments.

Check Figure

Post-closing trial balance total, $10, 170

Required

1. Write the name of the owner, M. Valerie, in the Capital and Drawing accounts.

2. Write the balances from the unadjusted trial balance in the general ledger.

3. Journalize and post the adjusting entries.

4. Journalize and post the closing entries in the correct order.

5. Prepare a post-closing trial balance.

Chapter 5 Solutions

College Accounting (Book Only): A Career Approach

Ch. 5 - What is the third step in the accounting cycle?...Ch. 5 - Which of the following accounts would be closed...Ch. 5 - If Income from Services had a 20,400 credit...Ch. 5 - Which of the following accounts would appear on a...Ch. 5 - Under the cash basis of accounting, which of the...Ch. 5 - Prob. 6QYCh. 5 - Number in order the following steps in the...Ch. 5 - List the steps in the closing procedure in the...Ch. 5 - What is the purpose of closing entries? What is a...Ch. 5 - What are real accounts? What are nominal accounts?...

Ch. 5 - What is the purpose of the Income Summary account?...Ch. 5 - What is the purpose of the post-closing trial...Ch. 5 - Write the third closing entry to transfer the net...Ch. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Classify the following accounts as real...Ch. 5 - The ledger accounts after adjusting entries for...Ch. 5 - As of December 31, the end of the current year,...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - The Income Statement columns of the work sheet of...Ch. 5 - After all revenue and expenses have been closed at...Ch. 5 - Identify whether the following accounts would be...Ch. 5 - Prob. 8ECh. 5 - Indicate with an X whether each of the following...Ch. 5 - Prepare a statement of owners equity for The...Ch. 5 - Prob. 1PACh. 5 - The partial work sheet for Ho Consulting for May...Ch. 5 - The account balances of Bryan Company as of June...Ch. 5 - Williams Mechanic Services prepared the following...Ch. 5 - Prob. 1PBCh. 5 - Prob. 2PBCh. 5 - Prob. 4PBCh. 5 - Toms Catering Services prepared the following work...Ch. 5 - Rather than going directly to college, some...Ch. 5 - Prob. 2ACh. 5 - The post-closing trial balance submitted to you by...Ch. 5 - You are preparing a post-closing trial balance for...Ch. 5 - The bookkeeper has completed a work sheet and has...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - This problem is designed to enable you to apply...Ch. 5 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The partial work sheet for Emil Consulting for June is as follows: Required If you are using Working Papers, complete the following: 1. a.Write the owners name on the Capital and Drawing T accounts. b.Record the account balances in the T accounts for owners equity, revenue, and expenses. 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 3. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 4,930arrow_forwardThe ledger accounts after adjusting entries for Cruz Services are presented below. a. Journalize the following closing entries and number as steps 1 through 4. b. What is the new balance of A. Cruz, Capital after closing? Show your calculations.arrow_forwardAfter the adjusting entries are recorded and posted and the financial statements have been prepared, you are ready to record the closing entries. Closing entries zero out the temporary owners equity accounts (revenue(s), expenses(s), and Drawing). This process transfers the net income or net loss and the withdrawals to the Capital account. In addition, the closing process prepares the records for the new fiscal period. Required 1. Journalize the dosing entries in the general journal. (If you are using Working Papers to prepare the closing entries, enter your transactions beginning on page 5.) 2. Post the closing entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a post-dosing trial balance as of October 31, 20--. Check Figures 1. Debit to Income Summary second entry, 12,023.25 2. Post-closing trial balance total, 37,420.00arrow_forward

- The ledger accounts after adjusting entries for Cortez Services are presented below. a. Journalize the following closing entries and number as steps 1 through 4. b. What is the new balance of J. Cortez, Capital after closing? Show your calculations.arrow_forwardLeanders Landscaping Service maintains the following chart of accounts: The following transactions were completed by Leander: Required 1. Journalize the transactions in the general journal. Prepare a brief explanation for each entry. 2. If you are using working papers, write the name of the owner on the Capital and Drawing accounts. 3. Post the journal entries to the general ledger accounts. (Skip this step if you are using CLGL.) 4. Prepare a trial balance dated April 30, 20. If you are using CLGL, use the year 2020 when recording transactions and preparing reports.arrow_forwardLaras Landscaping Service has the following chart of accounts: The following transactions were completed by Laras Landscaping Service: Required 1. Journalize the transactions in the general journal. Provide a brief explanation for each entry. 2. If you are using working papers, write the name of the owner on the Capital and Drawing accounts. (Skip this step if you are using CLGL.) 3. Post the journal entries to the general ledger accounts. (Skip this step if you are using CLGL.) 4. Prepare a trial balance dated March 31, 20. If you are using CLGL, use the year 2020 when recording transaction! and preparing reports.arrow_forward

- Use the following partial listing of T accounts to complete this exercise. 1. Prepare closing entries dated January 31, 20--. Do not enter the posting references until you have completed part 2. If an amount box does not require an entry, leave it blank. 2. Post the closing entries to the T accounts following the top-down journal entry order. If there is more than one closing entry for an account, enter in the order given in the journal above. Then, complete the posting for part 1. Closing Entries (Net Loss) Accum. Depr.—Delivery Equip 185.1 Bal. 100 Wages Payable 219 Bal. 200 Kylea Vasquez, Capital 311 Bal. 4,000 Kylea Vasquez, Drawing 312 Bal. 800 Income Summary 313 Delivery Fees 401 Bal. 2,200 Wages Expense 511 Bal. 1,710 Advertising Expense 512 Bal. 80 Rent Expense 521 Bal. 400 Supplies Expense 523 Bal. 120 Phone Expense 525 Bal. 58…arrow_forwardSelect the best answer for the question. 17. Which one of the following accounts would not appear on a post-closing trial balance? H O A. Owner's Drawing account B. Interest Receivable account C. Cash account O D. Mortgage Payable account Mark for review (Will be highlighted on the review page) > घ O Ïarrow_forwardClosing Entries From the work sheet shown below, prepare the following: 1. Prepare closing entries for Gimbel's Gifts and Gadgets in a general journal. If an amount box does not require an entry, leave it blank. 2. Prepare a post-closing trial balance.arrow_forward

- Using the trial balance Journalize the closing entries and balance off the ledger accounts including the income summary account. Prepare the post-closing trial balance.arrow_forwardNumber in their proper order the following steps in the accounting cycle. a. Prepare a trial balance. b. Post to the general ledger accounts. c. Journalize and post the closing entries. d. Complete an end-of-period work sheet. e. Prepare a post-closing trial balance. f. Journalize and post the adjusting entries. g. Analyze source documents. h. Record the adjusting entries on a work sheet. i. Journalize the transactions. j. Prepare the financial statements.arrow_forwardThe account that is brought up to date after the closing entries have been journalized and posted is the ____. Select one: a. Capital Account b. Sales account c. Capital Stock account d. Purchases accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY