Concept explainers

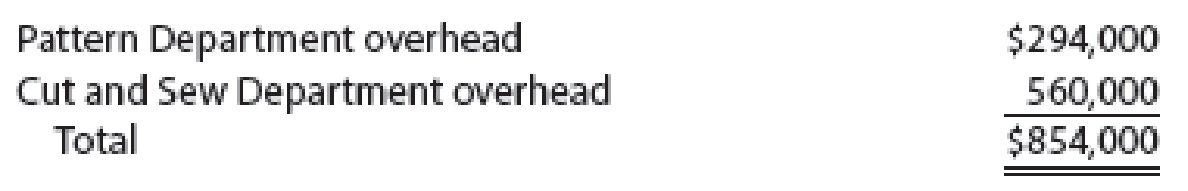

Handy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stencilled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Handy Leather uses the multiple production department factory overhead rate method of allocating

The direct labor estimated for each production department was as follows:

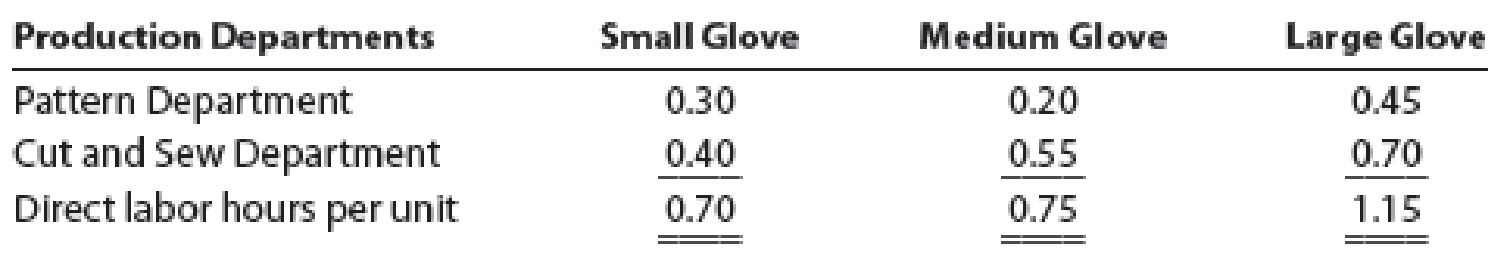

Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows:

- a. Determine the two production department factory overhead rates.

- b. Use the two production department factory overhead rates to determine the factory overhead per unit for each product.

Trending nowThis is a popular solution!

Chapter 4 Solutions

Managerial Accounting

- Eclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Direct machine hours were estimated as follows: In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: a. Determine the per-unit factory overhead allocated to the commercial and residential motors under the single plantwide factory overhead rate method, using direct machine hours as the allocation base. b. Determine the per-unit factory overhead allocated to the commercial and residential motors under the multiple production department factory overhead rate method, using direct machine hours as the allocation base for each department. c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Support your recommendation.arrow_forwardPelder Products Company manufactures two types of engineering diagnostic equipment used in construction. The two products are based upon different technologies, X-ray and ultrasound, but are manufactured in the same factory. Pelder has computed the manufacturing cost of the X-ray and ultrasound products by adding together direct materials, direct labor, and overhead cost applied based on the number of direct labor hours. The factory has three overhead departments that support the single production line that makes both products. Budgeted overhead spending for the departments is as follows: Pelders budgeted manufacturing activities and costs for the period are as follows: The budgeted cost to manufacture one ultrasound machine using the activity-based costing method is: a. 225. b. 264. c. 293. d. 305.arrow_forwardHandy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stenciled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Handy Leather uses the multiple production department factory overhead rate method of allocating factory overhead costs. Its factory overhead costs were budgeted as follows: Pattern Department overhead $162,500 Cut and Sew Department overhead 266,600 Total $429,100 The direct labor estimated for each production department was as follows: Pattern Department 2,500 direct labor hours Cut and Sew Department 3,100 Total 5,600 direct labor hours Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows: Production Departments…arrow_forward

- Handy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stenciled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Handy Leather uses the multiple production department factory overhead rate method of allocating factory overhead costs. Its factory overhead costs were budgeted as follows: Pattern Department overhead $122,400 Cut and Sew Department overhead 204,000 Total $326,400 The direct labor estimated for each production department was as follows: Pattern Department 2,400 direct labor hours Cut and Sew Department 3,000 Total 5,400 direct labor hours Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows: Production Departments…arrow_forwardPerformance Gloves, Inc. produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stenciled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Performance Gloves uses the multiple production department factory overhead rate method of allocating factory overhead costs. Its factory overhead costs were budgeted as follows: Pattern Department overhead $113,900 Cut and Sew Department overhead 186,900 Total $300,800 The direct labor estimated for each production department was as follows: Pattern Department 1,700 direct labor hours Cut and Sew Department 2,100 Total 3,800 direct labor hours Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows: Production…arrow_forwardHandy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stenciled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Handy Leather uses the multiple production department factory overhead rate method of allocating factory overhead costs. Its factory overhead costs were budgeted as follows: Pattern Department overhead $138,000 Cut and Sew Department overhead 232,000 Total $370,000 The direct labor estimated for each production department was as follows: Pattern Department 2,300 direct labor hours Cut and Sew Department 2,900 Total 5,200 direct labor hours Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows: Production Departments…arrow_forward

- Performance Gloves, Inc. produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stenciled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Performance Gloves uses the multiple production department factory overhead rate method of allocating factory overhead costs. Its factory overhead costs were budgeted as follows:Department Dollar AmountPattern Department $216,000Cut and Sew Department 960,000Total Overhead 1,176,000The direct labor estimated for each production department was as follows:Department Direct Labor HoursPattern Department 36,000Cut and Sew Department 60,000Total Direct Labor Hours 96,000Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows:Production Departments Small…arrow_forwardCullumber Inc. makes two types of handbags: standard and custom. The controller has decided to use a plant-wide overhead rate based on direct labour costs. The president has heard of activity-based costing and wants to see how the results would differ if this system were used. Two activity cost pools were developed: machining (machine hours) and machine set-up (number of set-ups). The total estimated machine hours is 1,500, and the total estimated number of setups is 500. Presented below is information related to the company's operations. Direct labour costs Machine hours Set-up hours Standard (a) $50,000 500 100 Custom $100,000 Predetermined overhead rate 1,000 Total estimated overhead costs are $360,000. The overhead cost allocated to the machining activity cost pool is $187,500, and $172,500 is allocated to the machine set-up activity cost pool. 400 Calculate the overhead rate using the traditional (plant-wide) approach. % of direct labour cost 41 SUFarrow_forwardSportway Inc. produces high-quality tennis racquets and golf clubs using a patented forming process and high-quality hand-finishing. Products move through two production departments: Forming and Finishing. The company uses departmental overhead rates to allocate overhead costs. Overhead is allocated based on machine-hours in Forming and direct labour cost in Finishing. Information related to costs for last year is provided below: Annual production and sales (units) Direct materials cost per unit Direct labour cost per unit: Forming Department Finishing Department Machine-hours per unit: Forming Department Finishing Department Tennis Golf Racquets Clubs 6,800 10,700 $ 5.10 $ 4.20 $7.00 $ 6.50 $6.00 $ 7.00 0.25 0.00 0.25 0.50 In addition, the firm budgets manufacturing overhead at $62,750 in the Forming Department and $64,500 in the Finishing Department. Determine the total cost per unit of tennis racquets and golf clubs.arrow_forward

- Sportway Inc. produces high-quality tennis racquets and golf clubs using a patented forming process and high-quality hand-finishing. Products move through two production departments: Forming and Finishing. The company uses departmental overhead rates to allocate overhead costs. Overhead is allocated based on machine-hours in Forming and direct labour cost in Finishing. Information related to costs for last year is provided below: Annual production and sales (units) Direct materials cost per unit Direct labour cost per unit: Forming Department Finishing Department Machine-hours per unit: Forming Department Finishing Department Forming Finishing per MH per DL$ Total cost per unit Tennis Golf Racquets Clubs 6,500 10, 250 $ 4.80 $ 3.90 In addition, the firm budgets manufacturing overhead at $58,250 in the Forming Department and $61,500 in the Finishing Department. Required: 1. Determine the overhead application rate for each department. (Round your answers to 2 decimal places.) $4.00 $…arrow_forwardLens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 2.40 per part Manufacturing supervision Hours of machine time $ 14.80 per hour Assembly Number of parts $ 3.30 per part Machine setup Each setup $ 56.50 per setup Inspection and testing Logged hours $ 45.50 per hour Packaging Logged hours $ 19.50 per hour LCI currently sells the B-13 model for $1,775 and the F-32 model for $1,220. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.50 $ 75.60 Number of parts 160 120 Machine hours 7.90 4.20…arrow_forwardLens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 2.40 per part Manufacturing supervision Hours of machine time $ 14.80 per hour Assembly Number of parts $ 3.30 per part Machine setup Each setup $ 56.50 per setup Inspection and testing Logged hours $ 45.50 per hour Packaging Logged hours $ 19.50 per hour LCI currently sells the B-13 model for $1,775 and the F-32 model for $1,220. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.50 $ 75.60 Number of parts 160 120 Machine hours 7.90 4.20…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub