Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

15th Edition

ISBN: 9780134476315

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 4.21P

Learning Goal 5

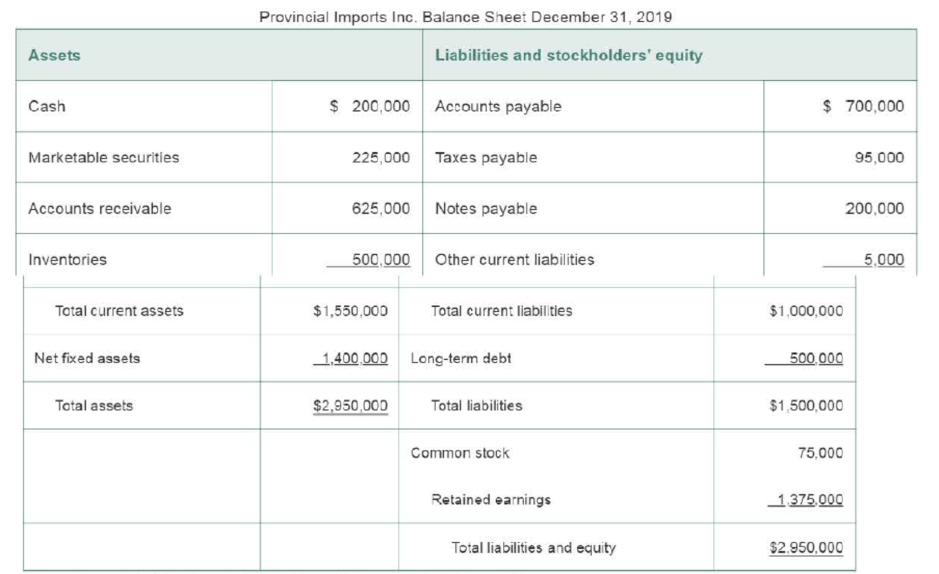

P4-21 Integrative: Pro forma statements Provincial Imports Inc. has assembled past (2019) financial statements (income statement and balance sheet below) and financial projections for use in preparing financial plans for the coming year (2020).

Provincial Imports Inc. Income Statement for the Year Ended December 31, 2019

| Sales revenue | $5,000,000 |

| Less: Cost of goods sold | 2,750,000 |

| Gross profits | $2,250,000 |

| Less: Operating expenses | 850,000 |

| Operating profits | $1,400,000 |

| Less: Interest expense | 200,000 |

| Net profits before taxes | $1,200,000 |

| Less: Taxes (rate = 40%) | 480,000 |

| Net profits after taxes | $ 720,000 |

| Less: Cash dividends | 288,000 |

| To |

$ 432,000 |

Information related to financial projections for the year 2020 is as follows:

- 1. Projected sales are $6,000,000.

- 2. Cost of goods sold in 2019 includes $1,000,000 in fixed costs.

- 3. Operating expense in 2019 includes $250,000 in fixed costs.

- 4. Interest expense will remain unchanged

- 5. The firm will pay cash dividends amounting to 40% of net profits after taxes.

- 6. Cash and inventories will double.

- 7. Marketable securities, notes payable, long-term debt, and common stock will remain unchanged.

- 8. Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales

- 9. A new computer system costing $356,000 will be purchased during the year. Total

depreciation expense for the year will be $110,000. - 10. The tax rate will remain at 40%.

- a. Prepare a pro forma income statement for the year ended December 31, 2020, using the fixed cost data given to improve the accuracy of the percent-of-sales method.

- b. Prepare a pro forma balance sheet as of December 31, 2020, using the information given and the judgmental approach. Include a reconciliation of the retained earnings account.

- c. Analyze these statements, and discuss the resulting external financing required.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

BUS 203: INTRODUCTION TO COST AND MANAGEMENT ACCOUNTING PROJECT: CASH BUDGETING ASSOCIATE DEGREE YEAR 2: SEMESTER 1 (2020/21)Ronstadt Limited’s budget for the four months from January to April includes the following data:1. MonthSalesMaterialsWagesOverheads

$000$000$000$000January615115.030360February636120.033390March690135.036420April684130.040425

2. One-third of sales revenue is received one month after sale and the remainder is received two months after sale. The sales in the previous two months were: November $600 000; December $540 000.3. One-quarter of purchases of materials are paid for in the month of purchase. The remainder are paid for two months later. Purchases in the previous two months were: November $108 000; December $106 000.4. Two-thirds of the wages are paid in the month in which they are earned, and the balance is paid in the following month. The wages for the previous December amounted to $30 000.5. One-half of the overhead expenditure is paid in the month in…

HIC GROUP OF Companies

COMPARATIVE INCOME STATEMENT

For years ended 3rd December 2019 2020

Revenue and gains

Sales revenue 495,500 496,738.75

Interest revenue 278,500 279,196.25

Investment Income 71,700 71,879.25

Other revenue 101,500 101,753.75

Total revenue and gains 947,200 949,968

Expenses and losses

Cost of good sold 450,000 447,750

Selling&administrative 185,000 184,075

Computer (operating) 42,500 42,288…

HIC GROUP OF Companies

COMPARATIVE INCOME STATEMENT

For years ended 3rd December 2019 2020

Revenue and gains

Sales revenue 495,500 496,738.75

Interest revenue 278,500 279,196.25

Investment Income 71,700 71,879.25

Other revenue 101,500 101,753.75

Total revenue and gains 947,200 949,968

Expenses and losses

Cost of good sold 450,000 447,750

Selling&administrative 185,000 184,075

Computer (operating) 42,500 42,288

Depreciation 50,000…

Chapter 4 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Ch. 4.1 - Prob. 4.1RQCh. 4.1 - Prob. 4.2RQCh. 4.2 - Briefly describe the first four modified...Ch. 4.2 - Describe the overall cash flow through the firm in...Ch. 4.2 - Prob. 4.5RQCh. 4.2 - 4-B Why is depreciation (as well as amortization...Ch. 4.2 - Prob. 4.7RQCh. 4.2 - Prob. 4.8RQCh. 4.2 - Prob. 4.9RQCh. 4.3 - Prob. 4.10RQ

Ch. 4.3 - Prob. 4.11RQCh. 4.3 - Prob. 4.12RQCh. 4.3 - What is the cause of uncertainty in the cash...Ch. 4.4 - Prob. 4.14RQCh. 4.5 - Prob. 4.15RQCh. 4.5 - Prob. 4.16RQCh. 4.6 - Prob. 4.17RQCh. 4.6 - What is the significance of the plug figure,...Ch. 4.7 - Prob. 4.19RQCh. 4.7 - Prob. 4.20RQCh. 4 - Opener-in-Review The chapter opener described a...Ch. 4 - Learning Goals 2, 3 ST4-1 Depreciation and cash...Ch. 4 - Prob. 4.2STPCh. 4 - Prob. 4.3STPCh. 4 - Prob. 4.1WUECh. 4 - Prob. 4.2WUECh. 4 - Learning Goal 3 E4-3 Determine the operating cash...Ch. 4 - Prob. 4.4WUECh. 4 - Learning Goal 5 E4-5 Rimier Corp. forecasts sales...Ch. 4 - Prob. 4.1PCh. 4 - Learning Goal 2 P4-2 Depreciation In early 2019,...Ch. 4 - Prob. 4.3PCh. 4 - Learning Goals 2, 3 P4-4 Depreciation and...Ch. 4 - Learning Goal 3 P4-5 Classifying inflows and...Ch. 4 - Prob. 4.6PCh. 4 - Learning Goal 4 P4-8 Cash receipts A firm has...Ch. 4 - Learning Goal 4 P4-9 Cash disbursements schedule...Ch. 4 - Learning Goal 4 P4-10 Cash budget: Basic Grenoble...Ch. 4 - Prob. 4.11PCh. 4 - Learning Goal 4 P4-12 Cash budget: Advanced The...Ch. 4 - Prob. 4.13PCh. 4 - Prob. 4.14PCh. 4 - Learning Goal 4 P4-15 Multiple cash budgets:...Ch. 4 - Learning Goal 5 P4-16 Pro forma income statement...Ch. 4 - Learning Goal 5 P4-17 Pro forma income statement:...Ch. 4 - Learning Goal 5 P4-18 Pro forma balance sheet:...Ch. 4 - Learning Goal 5 P4-19 Pro forma balance sheet...Ch. 4 - Learning Goal 5 P4-20 Integrative: Pro forma...Ch. 4 - Learning Goal 5 P4-21 Integrative: Pro forma...Ch. 4 - Prob. 4.22PCh. 4 - Prob. 1SE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Problem 13-02A (Video) The comparative statements of Cullumber Company are presented here: Cullumber CompanyIncome StatementsFor the Years Ended December 31 2020 2019 Net sales $1,891,640 $1,751,600 Cost of goods sold 1,059,640 1,007,100 Gross profit 832,000 744,500 Selling and administrative expenses 501,100 480,100 Income from operations 330,900 264,400 Other expenses and losses Interest expense 23,700 21,700 Income before income taxes 307,200 242,700 Income tax expense 93,700 74,700 Net income $213,500 $168,000 Cullumber CompanyBalance SheetsDecember 31 Assets 2020 2019 Current assets Cash $60,100 $64,200 Debt investments (short-term) 74,000 50,000 Accounts receivable 118,900 103,900 Inventory 127,700 117,200 Total current assets 380,700 335,300 Plant assets (net)…arrow_forwardFINA310 IP TEMPLATE FOR STUDENTS Student name: Date: ACTUAL FORECAST Current Year Next Year Total Revenue 71,879 |Cost of Revenue (51,125) Gross Profit 20,754 Operating Expenses: Selling, General, and Administrative (14,248) Research and Development Special Income/Other Charges (2,194) Total Operating Expenses (16,442) Operating Income 4,312 Net Interest Income (666) edite Pre-Tax Income 3,646 Provision for Income Tax (19.5%) (711) Net Income 2,935 Additionally, Tag-It's CEO has predicted a 12% increase in total revenue next year. Utilizing the percentage of sales method, prepare a forecast for next year in the correct section on the Excel spreadsheet. 1. The total revenue numbers over the past 4 years for Tag-lt Corporation were as follows (values in millions): o 73,785 O 69,495 o 75,356 o 71,879 2. Determine whether you think Tag-It can hit the target of a 12% increase in sales next year.arrow_forwardLearning Objective 2 Product Costs and Product Profitability Reports, using a Single Plantwide Factory Overhead Rate Isaac Engines Inc. produces three products-pistons, valves, and cams-for the heavy equipment industry. Isaac Engines has a very simple production process and product line and uses a single plantwide factory overhead rate to allocate overhead to the three products. The factory overhead rate is based on direct labor hours. Information about the three products for 20Y2 is as follows: Pistons Valves Cams Budgeted Volume (Units) 6,000 13,000 1,000 Pistons Direct Labor Hours Per Unit Valves Cams If required, round all per unit answers to the nearest cent. a. Determine the plantwide factory overhead rate. $ 28 ✔per dlh 0.30 0.50 0.10 0.3 ✔ dlh The estimated direct labor rate is $20 per direct labor hour. Beginning and ending inventories are negligible and are, thus, assumed to be zero. The budgeted factory overhead for Isaac Engines is $235,200. 0.5 dlh 0.1 ✓dlh Price Per Unit…arrow_forward

- Income Statement for the years ending 31 August: 2020 2019 £ £Revenue 950,000 975,000Cost of sales 455,000 460,000Gross profit 495,000 515,000Total expenses 320,000 310,000Net profit 175,000 205,000 Statement of financial position as at 31 August:- 2020 2019£ £Non-current assets 70,000 65,000Current assetsCash at bank…arrow_forwardExcerpts from the annual report of XYZ Corporation follow: 2019 $675,138 $241,154 $64,150 $93,650 $25,100 2020 Cost of goods sold Inventory Net income $754,661 $219,686 $31,185 $68,685 $26,900 Retained earnings LIFO reserve Tax rate 20% 20% If XYZ used FIFO, its net income for fiscal 2020 would be O a. $34,165 O b. $30,375 O c. $32,625 d. $36,545arrow_forwardOperating data for Joshua Corporation are presented below. 2020 2019 Sales revenue $745,000 $595,000 Cost of goods sold 459,665 384,965 Selling expenses 114,730 67,235 Administrative expenses 55,130 48,790arrow_forward

- LOGIC COMPANYComparative Income StatementFor Years Ended December 31, 2019 and 2020 2020 2019 Gross sales $ 19,000 $ 15,000 Sales returns and allowances 1,000 100 Net sales $ 18,000 $ 14,900 Cost of merchandise (goods) sold 12,000 9,000 Gross profit $ 6,000 $ 5,900 Operating expenses: Depreciation $ 700 $ 600 Selling and administrative 2,200 2,000 Research 550 500 Miscellaneous 360 300 Total operating expenses $ 3,810 $ 3,400 Income before interest and taxes $ 2,190 $ 2,500 Interest expense 560 500 Income before taxes $ 1,630 $ 2,000 Provision for taxes 640 800 Net income $ 990 $ 1,200 LOGIC COMPANYComparative Balance SheetDecember 31, 2019 and 2020 2020 2019 Assets Current assets: Cash $ 12,000 $ 9,000 Accounts receivable 16,500 12,500 Merchandise inventory 8,500 14,000 Prepaid expenses 24,000 10,000 Total current assets $ 61,000 $ 45,500 Plant and…arrow_forwardStatement of comprehensive income for the year ended 31 December 2021Sales 10 000 000Cost of sales (5 750 000)Gross profit 4 250 000Variable selling and administrative expenses (1 500 000)Fixed selling and administrative expenses (500 000)Net profit 2 250 000 Additional information:1. The sales budget for 2022 is as follows:First quarter R2 625 000Second quarter R2 750 000Third quarter R2 875 000Fourth quarter R2 750 0002. 90% of the sales is collected in the quarter of the sale and 10% in the quarter following the sale.3. The gross margin ratio for 2022 is expected to be the same as for 2021.4. Inventory is purchased in the quarter of the expected sale. Eighty (80%) of inventory purchases is paid for in thequarter of purchase and twenty percent (20%) is paid for in the quarter following the purchase.5. The inventories balance at the end of each quarter is expected to be the same as the end of the last quarter of2021 viz. R1 600 000.6. Variable selling and administrative expenses will…arrow_forwardLOGIC COMPANYComparative Income StatementFor Years Ended December 31, 2019 and 2020 2020 2019 Gross sales $ 19,000 $ 15,000 Sales returns and allowances 1,000 100 Net sales $ 18,000 $ 14,900 Cost of merchandise (goods) sold 12,000 9,000 Gross profit $ 6,000 $ 5,900 Operating expenses: Depreciation $ 700 $ 600 Selling and administrative 2,200 2,000 Research 550 500 Miscellaneous 360 300 Total operating expenses $ 3,810 $ 3,400 Income before interest and taxes $ 2,190 $ 2,500 Interest expense 560 500 Income before taxes $ 1,630 $ 2,000 Provision for taxes 640 800 Net income $ 990 $ 1,200 LOGIC COMPANYComparative Balance SheetDecember 31, 2019 and 2020 2020 2019 Assets Current assets: Cash $ 12,000 $ 9,000 Accounts receivable 16,500 12,500 Merchandise inventory 8,500 14,000 Prepaid expenses 24,000 10,000 Total current assets $ 61,000 $ 45,500 Plant and…arrow_forward

- Management Accounting Course Project – Part 1, B Group The Terranova Company is preparing information to complete its master budget for the quarter ending December 31, 2020. The company intends to make unit sales in the related months as follows: September 5,000 October 9,750 November 11,700 December 14,625 Units are to be sold for $10 each. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following the sale. *Required: 1) Prepare a sales budget for Terranova for the quarter ending December 31, 2020. Show activity by month and in total. (Hint: a quarter = 3 months.) 2) Complete a schedule of expected cash collections for the quarter ending December 31, 2020. Show activity by month and in total.arrow_forwardPrepare the Pro-Forma Statement of Financial Position for the year ending 31 December 2023 INFORMATIONSibiya ProjectsStatement of Comprehensive Income for the year ended 31 December 2022 RSales 10 000 000Cost of sales (5 750 000)Gross profit 4 250 000Variable, selling and administrative costs (1 500 000)Fixed selling and administrative costs (500 000)Net profit 2 250 000 Statement of Financial Position for the year ended 31 December 2022ASSETS RNon-current assets 800 000Property, plant and equipment 800 000 Current assets 3 400 000Inventories 1 600 000Accounts receivable 600 000Cash 1 200 000TOTAL ASSETS 4 200 000 EQUITY AND LIABILITIESEquity 3 760 000 Current liabilities 440 000Accounts payable 440 000TOTAL ASSETS AND LIABILITIES 4 200 000 Additional informationA. The sales budget for 2023 is as follows:First Quarter Second Quarter Third Quarter Fourth QuarterR2 625 000 R2 750 000 R2 875 000 R2 750 000 B. 90% of sales is collected in the quarter of the sale and 10% in the quarter…arrow_forwardNational Chemicals Company Income Statements for the years Ended June 30 2020 2019 $ $ Revenue 6,336.3 5790.4 Cost of sales 1,617.4 1476.3 Gross profit 4,718.9 4,314.1 Selling and Administrative Expenses 4,007.6 3679 PBIT 711.3 635.1 Interest Expense 13.9 27.1 PBT 697.4 608.0 Income Tax 291.3 232.6 Net Profit 406.1 375.4 Calculate the following ratios: Interest Cover ratio for 2020 is: Net Profit Margin for 2020 isarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License