Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

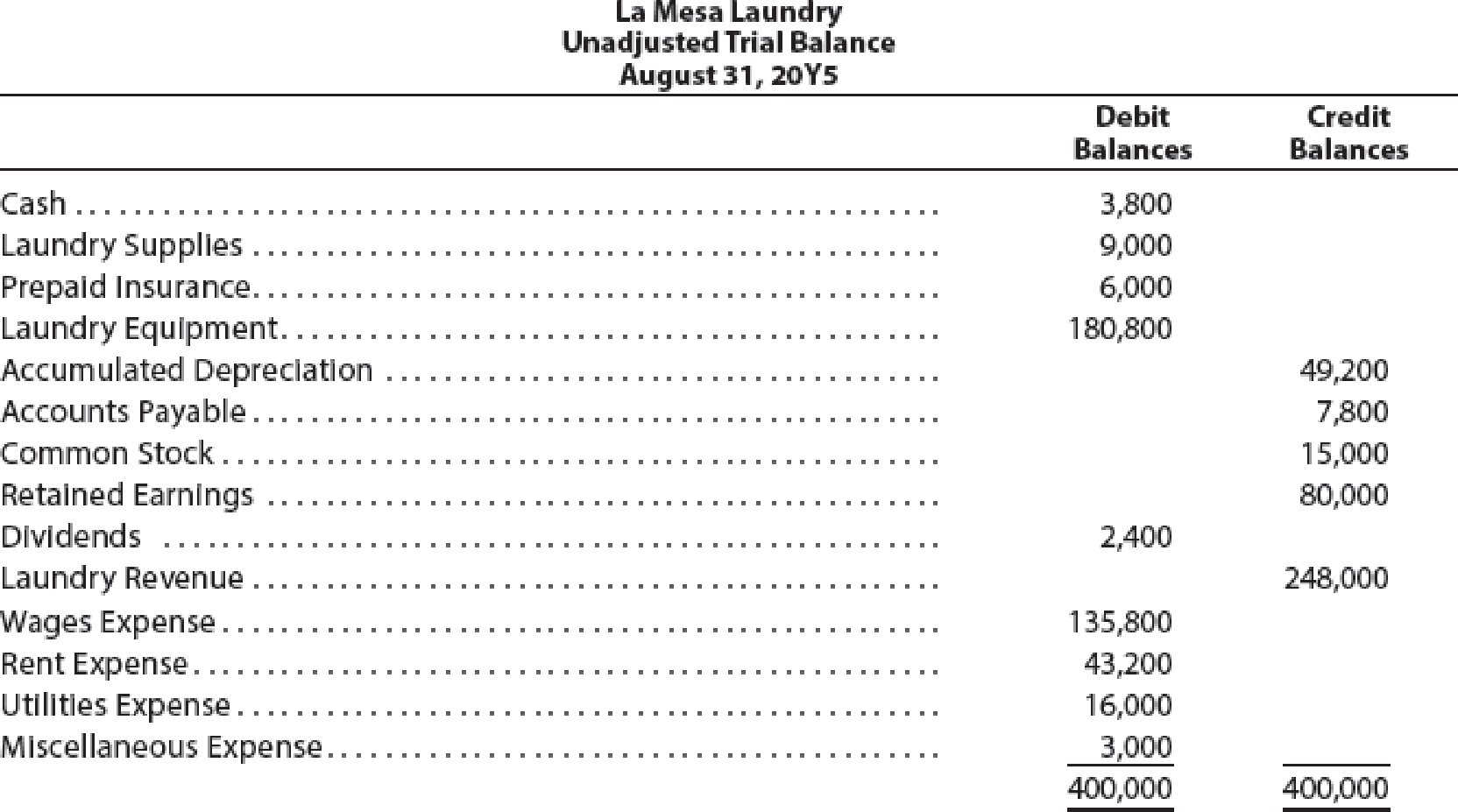

Chapter 4, Problem 3PB

T accounts,

The unadjusted

The data needed to determine year-end adjustments are as follows:

- (a) Wages accrued but not paid at August 31 are $2,200.

- (b)

Depreciation of equipment during the year is $8,150. - (c) Laundry supplies on hand at August 31 are $2,000.

- (d) Insurance premiums expired during the year are $5,300.

Instructions

- 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as “Aug. 31 Bal.” In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, and Insurance Expense.

- 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

- 3. Journalize and post the adjusting entries. Identify the adjustments by “Adj.” and the new balances as “Adj. Bal.”

- 4. Prepare an adjusted trial balance.

- 5. Prepare an income statement, a statement of stockholders’ equity, and a balance sheet. During the year ended August 31, 20Y5, common stock of $3,000 was issued.

- 6. Journalize and

post the closing entries. Identify the closing entries by “Clos.” - 7. Prepare a post-closing trial balance.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Hankik Enterprises

Worksheet

For the Year Ended July 31, 2015

Adjusted Trial

Trial Balance

Adjustments

Description

Balance

Debit

Debit

Credit

Credit

Debit

Credit

Cash

36

Prepaid Insurance

12

Fees Receivable

56

Supplies

12

Equipment

60

Accum. Depreciation

12

Uncarned Revenue

20

Accounts Payable

32

Wages Payable

Ramon Hikik, Capital

84

Ramon Hikik,

4

Drawing

Service Revenue

80

Advertising Expense

28

Wage Expense

20

Insurance Expense

Supplies Expense

Depreciation Expense

228

Totals

228

Required 1. Prepare and complete a 10-column work sheet for fiscal year 2019, starting with the unadjusted trial balance and including adjustments based on these additional facts. a. The supplies available at the end of fiscal year 2019 had a cost of $7,900. b. The cost of expired insurance for the fiscal year is $10,600. c. Annual depreciation on equipment is $7,000. d. The April utilities expense of $800 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $800 amount owed needs to be recorded. e. The company’s employees have earned $2,000 of accrued and unpaid wages at fiscal year-end. f. The rent expense incurred and not yet paid or recorded at fiscal year-end is $3,000. g. Additional property taxes of $550 have been assessed for this fiscal year but have not been paid or recorded in the accounts. h. The $300 accrued interest for April on the long-term notes payable has not yet been paid or recorded. 2. Using information…

Instructions: Prepare an Adjusted Trial balance. Your guide is the new ending balance after adjustments for each account.

Additional Information

a. Physical count of unused supplies on December 31 were conducted and amounted to P900.

b. Equipment is being depreciated over a 10 year period without salvage value. The equipment was purchased two years ago.

c. Prepaid rent reflected in the unadjusted trial balance was paid on September 1 to cover six-month period.

d. Last two-week salary at P2,750 per week for the month of December will be paid on January 3 of the following year.

e. The balance of unearned fees at December 31 should be P5,500.

f. Lopez additional fee of P12,250 from his last client was still unrecorded and remained uncollected at year-end.

Chapter 4 Solutions

Financial And Managerial Accounting

Ch. 4 - Why do some accountants prepare an end-of-period...Ch. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - Which step of the accounting cycle is optional?Ch. 4 - Prob. 10DQ

Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Prob. 2BECh. 4 - Classified balance sheet The following accounts...Ch. 4 - Closing entries After the accounts have been...Ch. 4 - Accounting cycle From the following list of steps...Ch. 4 - Working capital and current ratio Current assets...Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Classifying accounts Balances for each of the...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Income statement The following account balances...Ch. 4 - Income statement; net loss The following revenue...Ch. 4 - Income statement FedEx Corporation (FDX) had the...Ch. 4 - Statement of stockholders equity Climate Control...Ch. 4 - Statement of stockholders equity; net loss...Ch. 4 - Classifying assets Identify each of the following...Ch. 4 - Balance sheet classification At the balance sheet...Ch. 4 - Balance sheet Dynamic Weight Loss Co. offers...Ch. 4 - Balance sheet The following balance sheet was...Ch. 4 - Identifying accounts to be closed From the list...Ch. 4 - Closing entries with net income Automation...Ch. 4 - Closing entries with net loss Summit Services Co....Ch. 4 - Identifying permanent accounts Which of the...Ch. 4 - Post-closing trial balance An accountant prepared...Ch. 4 - Steps in the accounting cycle Rearrange the...Ch. 4 - Completing an end-of-period spreadsheet List (a)...Ch. 4 - Appendix 1 Adjustment data on an end-of-period...Ch. 4 - Prob. 22ECh. 4 - Appendix 1 Financial statements from an...Ch. 4 - Appendix 1 Adjusting entries from an end-of-period...Ch. 4 - Prob. 25ECh. 4 - Reversing entry The following adjusting entry for...Ch. 4 - Adjusting and reversing entries On the basis of...Ch. 4 - Adjusting and reversing entries On the basis of...Ch. 4 - Entries posted to wages expense account Portions...Ch. 4 - Entries posted to wages expense account Portions...Ch. 4 - Financial statements and closing entries Beacons...Ch. 4 - Financial statements and closing entries Foxy...Ch. 4 - T accounts, adjusting entries, financial...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Complete accounting cycle For the past several...Ch. 4 - Financial statements and closing entries Last...Ch. 4 - Financial statements and closing entries The...Ch. 4 - T accounts, adjusting entries, financial...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Complete accounting cycle For the past several...Ch. 4 - The unadjusted trial balance of PS Music as of...Ch. 4 - Kelly Pitney began her consulting business, Kelly...Ch. 4 - Analyze and compare Amazon.com to Best Buy...Ch. 4 - Analyze and compare Zynga, Electronic Arts, and...Ch. 4 - Analyze and compare Foot Locker and The Finish...Ch. 4 - Analyze Under Armour The following year-end data...Ch. 4 - Prob. 5MADCh. 4 - Analyze and compare Alphabet (Google) and...Ch. 4 - Prob. 1TIFCh. 4 - Your friend, Daniel Nat, recently began work as...Ch. 4 - Prob. 4TIFCh. 4 - Prob. 5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Instructions: Prepare an Income Statement. Your guide is the new ending balance after adjustments for each account. Additional Information a. Physical count of unused supplies on December 31 were conducted and amounted to P900. b. Equipment is being depreciated over a 10 year period without salvage value. The equipment was purchased two years ago. c. Prepaid rent reflected in the unadjusted trial balance was paid on September 1 to cover six-month period. d. Last two-week salary at P2,750 per week for the month of December will be paid on January 3 of the following year. e. The balance of unearned fees at December 31 should be P5,500. f. Lopez additional fee of P12,250 from his last client was still unrecorded and remained uncollected at year-end.arrow_forwardThe following additional accounts from Recessive Interiors' chart of accounts should be used: Wages Payable, 22; Income Summary, 33; Depreciation Expense-Equipment, 54; Supplies Expense, 55; Depreciation Expense-Trucks, 56; Insurance Expense, 57. The data needed to determine year-end adjustments are as follows: Supplies on hand at January 31 are $2,850. Insurance premiums expired during the year are $3,150. Depreciation of equipment during the year is $5,250. Depreciation of trucks during the year is $4,000. Wages accrued but not paid at January 31 are $900. Required: 1. Journalize the adjusting entries on of the journal. 2. Prepare an adjusted trial balance. 3. Prepare a post-closing trial balance.arrow_forwardThe following additional accounts from Recessive Interiors' chart of accounts should be used: Wages Payable, 22; Income Summary, 33; Depreciation Expense-Equipment, 54; Supplies Expense, 55; Depreciation Expense-Trucks, 56; Insurance Expense, 57. The data needed to determine year-end adjustments are as follows: Supplies on hand at January 31 are $2,850. Insurance premiums expired during the year are $3,150. Depreciation of equipment during the year is $5,250. Depreciation of trucks during the year is $4,000. Wages accrued but not paid at January 31 are $900. Required: 1. Journalize the closing entries on of the journal. Then post to the general ledger in the attached spreadsheet. For a compound transaction, if an amount box does not require an entry, leave it blank.arrow_forward

- The following additional accounts from Recessive Interiors' chart of accounts should be used: Wages Payable, 22; Income Summary, 33; Depreciation Expense-Equipment, 54; Supplies Expense, 55; Depreciation Expense-Trucks, 56; Insurance Expense, 57. The data needed to determine year-end adjustments are as follows: Supplies on hand at January 31 are $2,850. Insurance premiums expired during the year are $3,150. Depreciation of equipment during the year is $5,250. Depreciation of trucks during the year is $4,000. Wages accrued but not paid at January 31 are $900. Required: 1. Prepare an income statement. 2. Prepare a Statement of Owner's Equity (no additional investments were made during the year.) 3. Prepare a balance sheet.arrow_forwardThe following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. amount due for employee salaries, $4,800 B. actual count of supplies inventory, $ 2,300 C. depreciation on equipment, $3,000arrow_forward

- Complete the work sheet for Ramey Company, dated December 31, 20, through the adjusted trial balance using the following adjustment information: a. Expired or used-up insurance, 460. b. Depreciation expense on equipment, 870. (Remember to credit the Accumulated Depreciation account for equipment, not Equipment.) c. Wages accrued or earned since the last payday, 120 (owed and to be paid on the next payday). d. Supplies remaining, 80.arrow_forwardThe following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. depreciation on buildings and equipment, $17,500 B. advertising still prepaid at year end, $2,200 C. interest due on notes payable, $4,300 D. unearned rental revenue, $6,900 E. interest receivable on notes receivable, $1,200arrow_forward

- Adjusting Entries The following information is available for Drake Company, which adjusts and closes its accounts every December 31: 1. Salaries accrued but unpaid total 2,840 on December 31. 2. The 247 December utility bill arrived on December 31 and has not been paid or recorded. 3. Buildings with a cost of 78,000, 25-year life, and 9,000 residual value are to be depreciated; equipment with a cost of 44,000, 8-year life, and 2,000 residual value is also to be depreciated. The straight linemethod is to be used. 4. A count of supplies indicates that the Store Supplies account should be reduced by 128 and the Office Supplies account reduced by 397 for supplies used during the year. 5. The company holds a 6,000, 12% (annual rate), 6 month note receivable dated September 30, from a customer. The interest is to be collected on the maturity date. 6. Bad debts expense is estimated to be 1% of annual sales. Sales total 65,000. 7. An analysis of the company insurance policies indicates that the Prepaid Insurance account is to be reduced for 528 of expired insurance. 8. A review of travel expense reports indicates that 310 has been paid for airfare for a salesperson (and recorded as Travel Expenses), but has not yet been used. 9. The income tax rate is 30% on current income and will be paid in the first quarter of next year. The pretax income of the company before adjustments is 18,270. Required: Journalize the necessary year-end adjusting entries for Drake. Show supporting calculations in your journal entry explanations.arrow_forwardCALCULATING AND JOURNALIZING DEPRECIATION Equipment records for Byerly Construction Co. for the year follow. Byerly Construction uses the straight-line method of depreciation. In the case of assets acquired by the fifteenth day of the month, depreciation should be computed for the entire month. In the case of assets acquired after the fifteenth day of the month, no depreciation should be considered for the month in which the asset was acquired. REQUIRED 1. Calculate the depreciation expense for Byerly Construction as of December 31, 20--. 2. Prepare the entry for depreciation expense using a general journal.arrow_forwardAssume the following data for Oshkosh Company before its year-end adjustments: Journalize the adjusting entries for the following: a. Estimated customer refunds and allowances b. Estimated customer returnsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY