Basics Of Engineering Economy

2nd Edition

ISBN: 9780073376356

Author: Leland Blank, Anthony Tarquin

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 38P

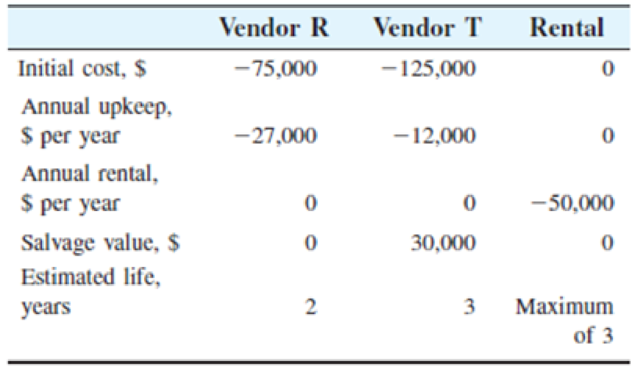

The manager of engineering at the 900-megawatt Hamilton Nuclear Power Plant has three options to supply personal safety equipment to employees. Two are vendors who sell the items, and the third alternative is to rent the equipment for $50,000 per year, but for no more than 3 years per contract. These items have relatively short lives due to constant use. The MARR is 10% per year.

- a. Select from the two vendors using the LCM and PW analysis.

- b. Determine which of the three options is cheaper over a study period of 3 years.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A large textile company is trying to decide among three alternatives of sludge dewatering g, processes. The costs

associated with these alternatives are shown below. Alternative Y will need an upgrade of $9700 at the end of year 2. At

the end of year 2, alternative Z would be replaced with another alternative Z having the same installed and operating

costs. If the MARR is 14% per year, which alternative should be chosen? \table[[Alternative,x,Y,Z

6) A large textile company is trying to decide among three alternatives of sludge dewatering

processes. The costs associated with these alternatives are shown below. Alternative Y

will need an upgrade of $9700 at the end of year 2. At the end of year 2, alternative Z

would be replaced with another alternative Z having the same installed and operating

costs. If the MARR is 14% per year, which alternative should be chosen?

Alternative

X

Y

Z

Installed costs

$68,500

$48,500 $33,500

Annual operating costs.

$6000

$4000

$5000

Overhaul cost in year 2…

Your friend is considering a new exhaust system for his Lamborghini Diablo. The estimates from the two shops are shown in the

following table. Besides installation, shop Y includes a full replacement warranty for 4 years in the quote. Since money does not

appear to be a problem for your friend, and he asked you about the economics of the two quotes, which should he choose based on

annual worth values and an interest rate of 12% per year?

Shop

installed cost, $

Total AOC, $/year

Salvage value, $

Life, years

X

-2,250

-1,200

125

Y

-3,400

-900

900

4

The annual worth value of shop X is $-

, and the annual worth value of shop Y is $-

The shop that your friend has to select on the basis of the annual worth analysis is (Clic to select)

Wall’s Pharmacy will have to sell a new product that has an estimated revenue of $5,100 per month and costs of $1,000 per month with an initial purchase of $28,000.

How long will Wall's Pharmacy have to sell a new product if the MARR is 3% per month?

Wall's Pharmacy will have to sell a new product for __ months.

Chapter 4 Solutions

Basics Of Engineering Economy

Ch. 4 - State two conditions under which the do-nothing...Ch. 4 - Prob. 2PCh. 4 - Prob. 3PCh. 4 - Prob. 4PCh. 4 - Prob. 5PCh. 4 - Prob. 6PCh. 4 - Prob. 7PCh. 4 - Prob. 8PCh. 4 - Prob. 9PCh. 4 - The costs associated with manufacturing a...

Ch. 4 - Prob. 11PCh. 4 - Prob. 12PCh. 4 - Prob. 13PCh. 4 - Prob. 14PCh. 4 - Prob. 15PCh. 4 - Prob. 16PCh. 4 - Prob. 17PCh. 4 - Prob. 18PCh. 4 - Prob. 19PCh. 4 - Prob. 20PCh. 4 - Prob. 21PCh. 4 - Prob. 22PCh. 4 - Prob. 23PCh. 4 - Prob. 24PCh. 4 - Prob. 25PCh. 4 - Prob. 26PCh. 4 - Prob. 27PCh. 4 - Prob. 28PCh. 4 - Prob. 29PCh. 4 - Prob. 30PCh. 4 - Prob. 31PCh. 4 - Two mutually exclusive projects have the estimated...Ch. 4 - Prob. 33PCh. 4 - Prob. 34PCh. 4 - Prob. 35PCh. 4 - Prob. 36PCh. 4 - Prob. 37PCh. 4 - The manager of engineering at the 900-megawatt...Ch. 4 - Prob. 39PCh. 4 - Prob. 40PCh. 4 - Prob. 41PCh. 4 - Three different plans were presented to the GAO by...Ch. 4 - The U.S. Army received two proposals for a turnkey...Ch. 4 - Prob. 44PCh. 4 - Prob. 45PCh. 4 - Prob. 46PCh. 4 - Prob. 47PCh. 4 - Prob. 48PCh. 4 - Prob. 49PCh. 4 - Prob. 50PCh. 4 - Prob. 51PCh. 4 - Prob. 52PCh. 4 - Prob. 53PCh. 4 - Prob. 54PCh. 4 - Prob. 55PCh. 4 - Prob. 56PCh. 4 - Prob. 57PCh. 4 - Prob. 58PCh. 4 - Prob. 59PCh. 4 - Prob. 60PCh. 4 - Prob. 61PCh. 4 - Prob. 62PCh. 4 - Prob. 63APQCh. 4 - Prob. 64APQCh. 4 - Prob. 65APQCh. 4 - Prob. 66APQCh. 4 - Prob. 67APQCh. 4 - Prob. 68APQCh. 4 - Prob. 69APQCh. 4 - Prob. 70APQCh. 4 - Prob. 71APQ

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics

Using the midpoint formula, calculate elasticity for each of the following changes in demand.

Principles of Economics (12th Edition)

A case study in this chapter discusses the federal minimum-wage law. a. Suppose the minimum wage is above the e...

Principles of Economics (MindTap Course List)

• Illustrate and interpret shifts in the short-run and long-run aggregate supply curves.

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- An oil refinery finds that it is necessary to treat the waste liquids from a new process before discharging them into a stream. The treatment will cost $40,000 the first year, but process improvements will allow the costs to decline by $4,000 each year. As an alternative, an outside company will process the wastes for the fixed price of $20,000/year throughout the 7 year period, payable at the beginning of each year. Either way, there is no need to treat the wastes after 7 years. Use the annual worth method to determine how the wastes should be processed. The company's MARR is 12%. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. The AW of the in-house treatment is $ (Round to the nearest dollar) GOTRarrow_forward← An oil refinery finds that it is necessary to treat the waste liquids from a new process before discharging them into a stream. The treatment will cost $40,000 the first year, but process improvements will allow the costs to decline by $4,000 each year. As an alternative, an outside company will process the wastes for the fixed price of $20,000/year throughout the 8 year period, payable at the beginning of each year. Either way, there is no need to treat the wastes after 8 years. Use the annual worth method to determine how the wastes should be processed. The company's MARR is 13%. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 13% per year. wwwarrow_forwardAn oil refinery finds that it is necessary to treat the waste liquids from a new process before discharging them into a stream. The treatment will cost $20,000 the first year, but process improvements will allow the costs to decline by $2,000 each year. As an alternative, an outside company will process the wastes for the fixed price of $10,000/year throughout the 7 year period, payable at the beginning of each year. Either way, there is no need to treat the wastes after 7 years. Use the annual worth method to determine how the wastes should be processed. The company's MARR is 14%. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 14% per year. The AW of the in-house treatment is $ (Round to the nearest dollar.)arrow_forward

- A chemical processing corporation is considering three methods to dispose of a non- hazardous chemical sludge: land application. Fluidized-bed incineration, and private disposal contract. The estimates for each method are shown. a) Determine which has the least cost on the basis of a present worth comparison at 10% per year for the following scenarios (You may assume a planning horizon of 6 years. The estimates are as shown the table b) If land application and incineration costs are as shown in the table, but the annual cost of the contract award cost increase br 20% everv time the contract is renewed (every 2 years) Use factors or formulasarrow_forwardYou have been asked to evaluate two alternatives, X and Y, that may increase plant capacity for manufacturing high-pressure hydraulic hoses. The parameters associated with each alternative have been estimated. Which one should be selected on the basis of a present worth comparison at an interest rate of 12% per year? Why is yours the correct choice? Alternative X Y First cost, $ −45,000 −58,000 Maintenance cost, $/year −8,000 −4,000 Salvage value, $ 2,000 12,000 Life, years 5 5arrow_forwardA company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows estimated. First cost, $ −840,000 Equipment replacement cost in year 2, $ −300,000 Annual operating cost, $/year −890,000 Salvage value, $ 250,000 Life, years 4 At an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using tabulated factors. The equivalent annual cost of the project is $− .arrow_forward

- Question 1:+ What is the equivalent annual cost in years 1 through 7 of a contract that has a first cost of $70,000 in year O and annual costs of $15,000 in years 3 through 7? Use (a) an interest rate of 10% per year, and (b) first estimate the final worth and then calculate the equivalent annual cost.arrow_forwardA construction company is planning to invest for the purchase of a heavy construction equipment which will be used at a construction site. There are three feasible alternatives and the detailed cash flow of all the alternatives are presented in the table. Each alternative has the useful life of 8 years. If the company's MARR is 12% per year, use an appropriate rate of return method to determine which alternative, if any, the company should choose. Alternatives 1 2 3 Initial investment ($) 2 700 000 3 200 000 2 400 000 Annual saving Salvage value Useful life (Years) ($) 525 000 640 000 415 000 ($) 710 000 860 000 590 000 8 8 8arrow_forwardthe cost of painting the golden gate bridge is $400000. if the bridge is painted now and every 2 years hereafter, what is the capitalized cost of painting at an interest rate of 6% per year ?arrow_forward

- A company that manufactures brushless blowers invested $700,000 in an automated quality control system for blower housings. The resultant savings was $180,000 per year for 5 years. If the equipment had a salvage value of $100,000, what rate of return per year did the company make and should the company invest in the blower if MARR is 10%? 7.31% per year (invest in the blower) None of the above 7.31% per year (do not invest in the blower) 12.30% per year (invest in the blower) 12.30% per year (do not invest in the blower)arrow_forwardA company that manufactures clear PVC pipes is investigating the production options of batch and continuous processing. Estimated cash flows are: Batch Process First cost ($) Annual cost ($ per year) Salvage value, any year, Continuous -69,000 -48,000 -140,000 -31,000 20,000 25,000 Life (years) 3-10 The chief operating officer (COO) has asked you to determine if the batch option, using an interest rate of 15% per year, would ever have an annual worth lower than that of the continuous flow system. The continuous flow process was previously determined to have Its lowest cost over a 5-year life cycle, but the batch process can be used from 3 to 10 years. If selecting the batch process is sensitive to its useful life, what is the minimum life that makes It more attractive? The batch system will be less expensive than the continuous flow if it lasts over years.arrow_forwardQUESTION: To improve package tracking at a UPS transfer facility, conveyor equipment was upgraded with RFID sensors at a cost of $300 and has a useful life of 3 years. The operating cost is expected to be $150 per year. The salvage value of the equipment is expected to be $140 for the first 2 years, but due to obsolescence, it won't have a significant value after that. At an interest rate of 10% per year, (a) The economic service life of the equipment and associated annual worth (b) The percentage increase in the AW of cost if the equipment is retained 1 years longer than the ESL determinearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License