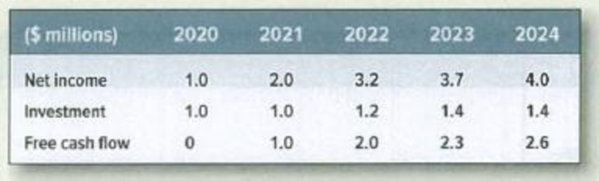

Valuing a business* Phoenix Corp. faltered in the recent recession but is recovering.

Phoenix’s recovery will be complete by 2024, and there will be no further growth in net income or free cash flow.

- a. Calculate the PV of free cash flow, assuming a

cost of equity of 9%. - b. Assume that Phoenix has 12 million shares outstanding. What is the price per share?

- c. Confirm that the expected

rate of return on Phoenix stock is exactly 9% in each of the years from 2020 to 2024.

a)

To determine: Present value of free cash flow

Explanation of Solution

Compute the present value of free cash flow:

Hence, the present value is $24.8 million.

b)

To determine: Price per share

Explanation of Solution

Note:

Assume no debt, the share price are as follows,

Hence, the price per share is $2.04.

c)

To confirm: The expected rate of return is 9%.

Explanation of Solution

Compute PV of the cash flows at various points in time:

Compute rate of return using the formula

Thus, the above calculation shows that the rate of return on Company P is exactly 9%.

Want to see more full solutions like this?

Chapter 4 Solutions

PRIN.OF CORPORATE FINANCE

Additional Business Textbook Solutions

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Fundamentals of Corporate Finance

Corporate Finance

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

- The table below shows the forecast cash flow information of Good Time Inc. for the next year. The required debt payment in the next year is $88 million, with the current market value of $75 million. The company pays no tax. If you invest in the corporate debt of Good Time Inc. today, what is your expected return on this investment? Cash flow in the next year Economy Probability Amount Boom 0.6 $148 million Recession 0.4 I$61 million O 18.77% O 10.29% O 2.93% O 28.67%arrow_forwardSuppose instead that the company is about to pay a dividend of $2.00 per share. You also learn that the company is expected to have net income of $100 million, dividends of $50 million, and total equity of $1.5 billion (and that these relationships are expected to be stable). If the relevant required rate of return is 10%, what is the intrinsic value per share of the company’s stock?arrow_forwardAssume IBM is expected to pay a total cash dividend of $3.90 next year and dividends are expected to grow indefinitely by 3.0 percent a year. Assume the required rate of return (i.e. equity holder's opportunity cost of capital) is 9.3 percent. Assuming this is the best information available regarding the future of this firm, what would be the most economically rational value of the stock today (i.e. today's "price")? Answer to 2 decimal places.arrow_forward

- Please include calculations. XYZ company has the following expected cash flows for three scenarios that could occur: Recession Expected Expansion (prob. = .2) (prob. = .5) (prob. =.3) EBIT $10,000 $20,000 $30,000 MV Assets ______ (a) Complete the table above if the company is 100% equity financed, it pays taxes at 30%, the non-levered return on equity is expected to be 12%, the constant growth rate (g) is 5%, and overall firm value is calculated based on the expected after-tax cash flows (b) If the company wants to recapitalize (debt for equity swap) to save on taxes, what is the most debt the company can add (at a 6% rate) so that it will never go bankrupt under the above scenarios? (Assume the company goes bankrupt if EBIT < Interest owed) (c) Calculate the WACC for the unlevered case and for the result in part (b). (d) What is the…arrow_forwardQuantitative Problem: Barton Industries expects next year's annual dividend, D1, to be $1.70 and it expects dividends to grow at a constant rate gL = 5%. The firm's current common stock price, P0, is $23.60. If it needs to issue new common stock, the firm will encounter a 5.7% flotation cost, F. Assume that the cost of equity calculated without the flotation adjustment is 12% and the cost of old common equity is 11.5%. What is the flotation cost adjustment that must be added to its cost of retained earnings? Round your answer to 2 decimal places. Do not round intermediate calculations. % What is the cost of new common equity? Round your answer to 2 decimal places. Do not round intermediate calculations. %arrow_forwardMuscat company is expected to pay a $1.35 dividend next year and they expect dividends to grow at 3 % and requires. the current value of the stock is $28.16 What is the required rate of return? Select one: 20.86 % 19.67 % 20.14 % 7.79 % None of the answers are correctarrow_forward

- If the last dividend paid by Chemical Brothers Inc. was $1.25 and analysts expect these payments to increase 4% per year, what will the stock price be next year if the required return is 15%? Select one: O a. $12.29 O b. $11.82 O c. $31.25 O d. $12.78 O e. $23.11arrow_forwardA company has current, trailing earnings of 3.2 per share. The company plans to plowback 0.41, a share of the earnings, at an ROE of 0.084. If the required rate of return is 0.095, what is the present value of the firm's growth opportunities? O -2.47 -2.60 -2.74 -2.37 -2.85arrow_forwardEnterex Corporation expects sales of $437,500 next year. Enterex’s profit margin is 4.8% and its dividend payout ratio is 40%. What is Enterex’s projected increase in retained earnings for next year? Multiple Choice $8,400 $12,600 $14,700 $21,000 $262,500 None of the options are correct. Time sensitive!arrow_forward

- Hutch Enterprises recently paid a dividend, D0, of $3.00. It expects to have nonconstant growth of 24% for 2 years followed by a constant rate of 9% thereafter. The firm's required return is 14%. What is the firm's horizon, or continuing, value? Do not round intermediate calculations. Round your answer to the nearest cent. $ What is the firm's intrinsic value today, ? Do not round intermediate calculations. Round your answer to the nearest cent. $ How far away is the horizon date? The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the end of Year 2. The terminal, or horizon, date is infinity since common stocks do not have a maturity date. The terminal, or horizon, date is Year 0 since the value of a common stock is the present value of all future expected dividends at time zero. The terminal, or horizon, date is the date when the growth rate becomes nonconstant. This occurs at time zero. The terminal, or horizon, date is the date…arrow_forwardWalter Enterprises recently paid a dividend, D0, of $2.50. It expects to have nonconstant growth of 25% for 2 years followed by a constant rate of 3% thereafter. The firm's required return is 20%. 1. What is the firm's horizon, or continuing, value? Round your answer to the nearest cent. 2. What is the firm's intrinsic value today? Round your answer to the nearest cent.arrow_forwardRead the scenario below and answer the questions that follow. A company is under pressure from influential shareholders to change its dividend policy. The company has always followed the residual dividend policy, but the influential shareholders feel that the company needs to change to a stable pay-out ratio policy. The company just reported earnings of R232m for the year ended 31 March 2024. The company is considering the following investment opportunities for the upcoming financial year: Investment opportunity A BUD C E Cost R72m R62m R110m R96m R48m Internal rate of return 14.28% 13.03% 15.67% 16.01% 13.79% The company's cost of capital is 13.5% and its target capital structure is represented by a debt-to-assets ratio of 40%. The company has 28m ordinary shares outstanding.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education