Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 19PC

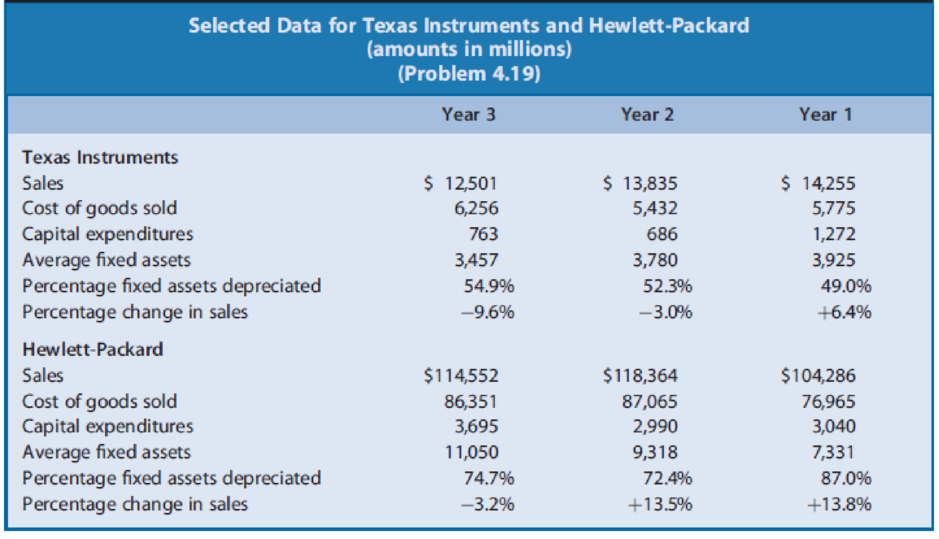

Texas Instruments (TI) designs and manufactures semiconductor products for use in computers, telecommunications equipment, automobiles, and other electronics-based products. The manufacturing of semiconductors is highly capital-intensive. Hewlett-Packard Corporation (HP) manufactures computer hardware and various imaging products, such as printers and fax machines. Exhibit 4.26 presents selected data for TI and HP for three recent years.

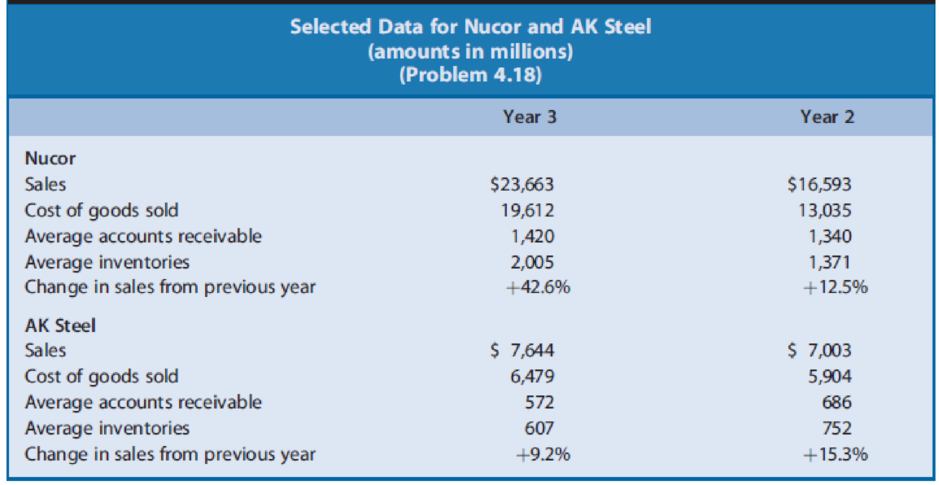

Exhibit 4.25

Exhibit 4.26

REQUIRED

- a. Compute the fixed assets turnover for each firm for Years 1, 2, and 3.

- b. Suggest reasons for the differences in the fixed assets turnovers of TI and HP.

- c. Suggest reasons for the changes in the fixed assets turnovers of TI and HP during the three-year period.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Texas Instruments (TI) designs and manufactures semiconductor products for use

in computers, telecommunications equipment, automobiles, and other electronics-

based products. The manufacturing of semiconductors is highly capital-intensive.

Hewlett-Packard Corporation (HP) manufactures computer hardware and various

imaging products, such as printers and fax machines. Exhibit 4.25 presents selected

data for TI and HP for three recent years.

Exhibit 4.25 Selected Data for Texas Instruments and Hewlett-Packard

(Amounts in Millions) (Problem 4.19)

Texas Instruments

Sales

Cost of goods sold

Capital expenditures

Average fixed assets

Percentage fixed assets depreciated

Percentage change in sales

Hewlett-Packard

Sales

Cost of goods sold

Capital expenditures

Average fixed assets

Percentage fixed assets depreciated

Percentage change in sales

Required

Year 3

$ 12,501

6,256

763

3,457

54.9%

(9.6)%

$114,552

86,351

3,695

11,050

74.7%

(3.2)%

Year 2

$ 13,835

5,432

686

3,780

52.3%

(3.0)%

$118,364

87,065…

Required information

[The following information applies to the questions displayed below.]

Megamart provides the following information on its two investment centers.

Investment Center

Electronics

Income

$ 3,114,000

2,261,000

Average Assets

$ 17,300,000

13,300,000

Sporting goods

Sales

$ 41,520,000

18,088,000

1. Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to generate

income?

2. Assume a target income of 11% of average assets. Compute residual income for each center. Which center generated the most

residual income?

3. Assume the Electronics center is presented with a new investment opportunity that will yield a 14% return on investment. Should the

new investment opportunity be accepted? The target return is 11%.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Compute return on investment for each center. Using return on investment, which center is most efficient…

Required Information

[The following Information applies to the questions displayed below.]

Megamart provides the following Information on its two Investment centers.

Investment Center

Electronics

Sporting goods

Sales

$ 63,460,000

19,050,000

1. Compute return on Investment for each center. Using return on investment, which center is most efficient at using assets to

generate Income?

2. Assume a target Income of 12% of average assets. Compute residual income for each center. Which center generated the most

residual Income?

3. Assume the Electronics center is presented with a new Investment opportunity that will yield a 14% return on Investment. Should

the new Investment opportunity be accepted? The target return is 12%.

Complete this question by entering your answers in the tabs below.

Numerator:

Required 1 Required 2 Required 3

Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to

generate income?

Income

$ 3,173,000…

Chapter 4 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 4 - Common-Size Analysis. Common-size analysis is a...Ch. 4 - Earnings per Share. Firm A reports an increase in...Ch. 4 - Prob. 3QECh. 4 - Profit Margin for ROA versus ROCE. Describe the...Ch. 4 - Concept and Measurement of Financial Leverage....Ch. 4 - Advantages of Financial Leverage. A company...Ch. 4 - Prob. 7QECh. 4 - Nucor, a steel manufacturer, reported net income...Ch. 4 - Phillips-Van Heusen, an apparel manufacturer,...Ch. 4 - TJX, Inc., an apparel retailer, reported net...

Ch. 4 - Boston Scientific, a medical device manufacturer,...Ch. 4 - Valero Energy, a petroleum company, reported net...Ch. 4 - Exhibit 4.22 presents selected operating data for...Ch. 4 - Microsoft Corporation (Microsoft) and Oracle...Ch. 4 - Prob. 17PCCh. 4 - Prob. 18PCCh. 4 - Texas Instruments (TI) designs and manufactures...Ch. 4 - JCPenney operates a chain of retail department...Ch. 4 - Prob. 21PCCh. 4 - Selected data for General Mills for 2007, 2008,...Ch. 4 - Prob. 23PCCh. 4 - Hasbro is a leading firm in the toy, game, and...Ch. 4 - Fitch sells casual apparel and personal care...Ch. 4 - Prob. 26PCCh. 4 - Starwood Hotels (Starwood) owns and operates many...Ch. 4 - Select data for Avis and Hertz for 2012 follow....Ch. 4 - Integrative Case 1.1 introduced the industry...Ch. 4 - Prob. 1ABICCh. 4 - Prob. 1ACICCh. 4 - Prob. 1BAICCh. 4 - Prob. 1BBICCh. 4 - Walmart and Carrefour follow similar strategies....Ch. 4 - Walmart and Carrefour follow similar strategies....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- FedEx Corporation and United Parcel Service, Inc. compete in the package delivery business. The major fixed assets for each business include aircraft, sorting and handling facilities, delivery vehicles, and information technology. The sales and average book value of fixed assets reported on recent financial statements for each company were as follows: a. Compute the fixed asset turnover ratio for each company. Round to one decimal place. b. Which company appears more efficient in using fixed assets? c. Interpret the meaning of the ratio for the more efficient company.arrow_forwardAlyeska Services Company, a division of a major oil company, provides various services to the operators of the North Slope oil field in Alaska. Data concerning the most recent year appear below: Sales $ 17,900,000 Net operating income $ 5,200,000 Average operating assets $ 35,400,000 Required: Compute the margin. Note: Round your answer to 2 decimal places. Compute the turnover. Note: Round your answer to 2 decimal places. Compute the return on investment (ROI). Note: Round your intermediate calculations and final answer to 2 decimal places.arrow_forwardQuestion: FineTech Ltd. is a manufacturing company that produces electronic gadgets. During the last financial year, the company invested heavily in research and development (R&D) to enhance product innovation and competitive advantage. As a result, FineTech incurred significant R&D expenses in the process. The company is now preparing its financial statements and needs to decide whether to treat these R&D expenses as operating expenses or capitalize them as intangible assets. Explain the concept of research and development costs in accounting, the criteria for capitalization, and the implications of each accounting treatment on FineTech's financial statements and financial performance. Additionally, discuss how these accounting decisions may impact investors, creditors, and other stakeholders in their assessment of FineTech's financial position and profitability.arrow_forward

- Navarre Energy Research specializes in developing and commercializing new products. It is organized into two divisions, which are based on the products they produce. Canal Division is smaller, and the lives of the products it produces tend to be shorter than those produced by the larger Lake Division. Selected financial data for the past year are shown in the following table. Divisional investment is as of the beginning of the year. Navarre uses a(n) 8 percent cost of capital and beginning-of- the-year investment when computing ROI and residual income. Ignore income taxes. Allocated corporate overhead Cost of goods sold Divisional investment R&D Sales Selling, general and administrative. (excluding R&D) Division Canal ($000) $4,900 28,000 60,900 12,800 66,008 5,300 Lake (5000) $ 10,000 38,800 400,000 72,000 180,000 7,600 R&D is assumed to have a three-year life in Canal Division and an eight-year life in Lake Division. All R&D expenditures are spent at the beginning of the year. Assume…arrow_forwardAmazon.com, Inc. is the worlds leading Internet retailer of merchandise and media. Amazon also designs and sells electronic products, such as e-readers. Netflix, Inc. is the worlds leading Internet television network. Both companies compete in the digital media and streaming space. However, Netflix is more narrowly focused in the digital streaming business than is Amazon. Sales and average book value of fixed assets information (in millions) are provided for Amazon and Netflix for a recent year as follows: a. Compute the fixed asset turnover ratio for each company. Round to one decimal place. b. Which company is more efficient in generating sales from fixed assets? c. Interpret your results.arrow_forwardCompare Fed Ex and UPS FedEx Corporation (FDX) and United Parcel Service, Inc. (UPS) compete in the package delivery business. The major fixed assets for each business include aircraft, sorting and handling facilities, delivery vehicles, and information technology. The sales and average book value of fixed assets reported on recent financial statements for each company were as follows: a. Compute the fixed asset turnover ratio for each company. Round to one decimal place. b. Which company appears more efficient in using fixed assets? c. Interpret the meaning of the ratio for the more efficient company.arrow_forward

- Complete this question by entering your answers in the tabs below. Profit Margin Investment Turnover Compute investment turnover for each center. Which center has the better investment turnover? Investment Turnover Numerator: / Denominator: Investment Center Electronics Sporting Goods Which center has the better investment turnover?arrow_forwardHeather Smith Cosmetics (HSC) manufactures a variety of products and is organized into three divisions (investment centers): soap products, skin lotions, and hair products. Information about the most recent year's operations follows. The information includes the value of intangible assets, including research and development, patents, and other innovations that are not included on HSC's balance sheet. Were these intangibles to be included in the financial statements (as they are for EVAⓇ), the increase in the balance sheet and the increase in after-tax operating income would be as given below: Soap products Skin lotions Division Hair products Minimum desired rate of return Cost of capital Required: Operating Income $ 3,250,000 2,750,000 5,000,000 5.00% 4.00% Average Total Assets $ 60,000,000 33,000,000 55,000,000 Value of Intangibles $ 1,500,000 8,000,000 1,000,000 Intangibles' Effect on Income $ 1,000,000 6,000,000 700,000 1. Calculate the return on investment (ROI) for each division.…arrow_forwardAssume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below. Assets Current assets $38,000,000 Net plant, property, and equipment $101,000,000 Total assets $139,000,000 Liabilities and Equity Accounts payable $10,000,000 Accruals $9,000,000 Current liabilities $19,000,000 Long-term debt (40,000 bonds, $1,000 par value) $40,000,000 Total liabilities $59,000,000 Common stock (10,000,000 shares) $30,000,000 Retained earnings $50,000,000 Total shareholders' equity $80,000,000 Total liabilities and shareholders' equity $139,000,000 The stock is currently selling for $15.25 per share, and its noncallable $1,000.00 par value, 20-year, 9.00% bonds with semiannual payments are selling for $930.41. The beta is 1.22, the yield on a 6-month…arrow_forward

- Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below. Assets Current assets $38,000,000 Net plant, property, and equipment $101,000,000 Total assets $139,000,000 Liabilities and Equity Accounts payable $10,000,000 Accruals $9,000,000 Current liabilities $19,000,000 Long-term debt (40,000 bonds, $1,000 par value) $40,000,000 Total liabilities $59,000,000 Common stock (10,000,000 shares) $30,000,000 Retained earnings $50,000,000 Total shareholders' equity $80,000,000 Total liabilities and shareholders' equity $139,000,000 The stock is currently selling for $15.25 per share, and its noncallable $1,000.00 par value, 20-year, 9.00% bonds with semiannual payments are selling for $930.41. The beta is 1.22, the yield on a 6-month Treasury bill is 3.50%, and the…arrow_forwardSelected data from an investment center of IROL Inc. follow:Sales $8,000,000Net book value of assets, beginning 2,500,000Net book value of assets, ending 2,600,000Net operating income 640,000Minimum rate of return 12%Required1. Calculate return on sales (ROS), asset turnover (AT), and return on investment (ROI).2. Calculate residual income (RI).arrow_forwardAlyeska Services Company, a division of a major oil company, provides various services to the operators of the North Slope oil field in Alaska. Data concerning the most recent year appear below: Sales Net operating income Average operating assets Required: 1. Compute the margin. Note: Round your answer to 2 decimal places. 2. Compute the turnover. Note: Round your answer to 2 decimal places. 3. Compute the return on investment (ROI). Note: Round your intermediate calculations and final answer to 2 decimal places. 1. Margin 2. Turnover 3. ROI $ 18,100,000 $ 5,500,000 $36,500,000 % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Profitability index; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Md5ocNqKHq8;License: Standard Youtube License