Concept explainers

Contrast Activity-Based Costing and Conventional Product Costing L04−

2, L04−3. L04−4

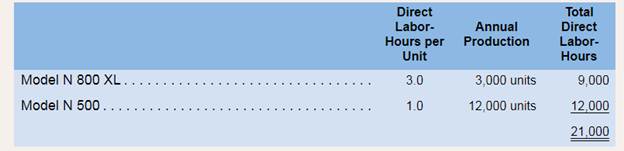

Puet World, Inc., Manufactures two models of television sets, the N 800 XL model and the N 500 model.

Data regarding the two products follow:

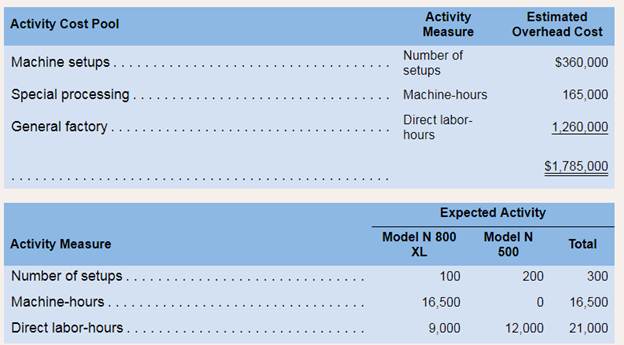

Additional information about the company follows:

a. Model N 800 XL requires $75 in direct materials per unit, and Model N 500 requires $25.

b. The direct labor wage rate is $18 per hour.

c. The company has always used direct labor-hours as the base for applying

d. Model N 800 XL is more complex to manufacture than Model N 500 and requires the use of special equipment. Consequently, the company is considering the use of activity-basedcosting to assign manufacturing overhead cost to products. Three activity cost pools havebeen identified as follows:

Required:

1. Assume that the company continues to use direct labor-hours as the base for applying overhead cost to products.

a. Compute the predetermined overhead rate.

b. Compute the unit product cost of each model.

2. Assume that the company decides to use activity-based costing to assign manufacturing overhead costto products.

a. Compute the activity rate for each activity cost pool and determine the amount of overhead costthat would be assigned to each model using the activity-based costing system.

b. Compute the unit product cost of each model.

3. Explain why manufacturing overhead cost shifts from Model N 500 to Model N 800 XL underactivity-based costing.

1

Predetermined overhead rate

It is a rate that a company determines to allocate its total manufacturing overhead cost to products manufactured. This rate uses estimated amount of cost and hours for its calculation.

Unit product cost

Unit product cost represents the total costincurred by a company to produce one unit. It can be calculated by the division of total cost and total number of units manufactured or by adding per unit direct material cost, per unit direct labor cost and per unit overhead cost.

To calculate: Predetermined overhead rate and unit product cost by using the predetermined overhead rate.

Answer to Problem 17P

Predetermined overhead rate is $85 per DLH.

Unit product cost for model N 800 XL is $384 and for model N 500 is $128.

Explanation of Solution

Part a

Predetermined overhead rate is calculated as:

Here, total manufacturing cost is given as $1,785,000 and total direct labor hours are 21,000. So, the predetermined rate will be calculated as:

Therefore, predetermined overhead rate is $85 per direct labor hour.

Part b

Unit product cost will be calculated by adding per unit cost of direct material, labor and overheads.

So, unit product cost will be calculated as follows:

| Particulars | Model N 800 XL (in $) | Model N 500 (in $) |

| Direct material (per unit) | 75 | 25 |

| Direct labor (per unit) | 54 (18*3) | 18 (18*1) |

| Manufacturing overheads (per unit) | 255 (85*3) | 85 (85*1) |

| Unit product cost | 384 | 128 |

Therefore, unit product cost for Model N 800 XL is $384 and unit product cost for Model N 500 is $128.

2

Activity rates

Activity rates are used in the ABC system, these rates help in allocating manufacturing cost to products and are calculated by dividing estimated manufacturing cost of each cost poolby total estimated activity.

Manufacturing overhead

It includes all the costs that are indirectly related to a product and does not include costs related to direct materials and direct labors.

To compute: Activity cost rates for the pools, manufacturing cost that will be assigned to each model and unit product cost for each model.

Answer to Problem 17P

Activity rates are:

| Machine setups | $1200 per setup |

| Special processing | $10 per MH |

| General factory | $60 per DLH |

Overhead cost that will be allocated to model N 800 XL is $825,000 and cost that will be assigned to model N 500 is $960,000.

Unit product of model N 800 XL is $404 and of model N 500 is 123.

Explanation of Solution

Part a

Activity rates will be calculated as follows:

| Cost pools | Activity measure | Estimated overhead cost (in $) (A) | Estimated activity (B) | Activity rates (A/B) (in $) |

| Machine setups | Number of setups | 360,000 | 300 | 1200 per setup |

| Special processing | Machine hours | 165,000 | 16,500 | 10 per MH |

| General factory | Direct labor hours | 1,260,000 | 21,000 | 60 per DLH |

So, activity rate for machine setups is $1200 per setup, for special processing is $10 per machine hour and for general factory is $60 per DLH.

In the ABC system, allocation of manufacturing overhead costs to all the products is done according to the ratio in which products use different activities. That ratio will be calculated as:

| Particulars | Model N 800 XL | Model N 500 | RatioN 800 XL: N 500 |

| Machine setups (setups) | 100 | 200 | 1:2 |

| Special processing (MHs) | 16:500 | 0 | 16,500:0 |

| General factory (DLHs) | 9,000 | 12,000 | 9:12 or 3:4 |

Now, allocation of overhead cost will be done as follows:

| Activity cost pool | Overhead expense(in $) | Ratio | Model N 800 XL (in $) | Model N 500 (in $) |

| Machine setups | 360,000 | 1:2 | 120,000 | 240,000 |

| Special processing | 165,000 | 16,500:0 | 165,000 | 0 |

| General factory | 1,260,000 | 3:4 | 540,000 | 720,000 |

| Total overhead cost | 825,000 | 960,000 | ||

So, total overhead cost that will be allocated to model N 800 XL is $825,000 and overhead cost that will be allocated to model N 500 is $960,000.

Part b

Unit product cost will be calculated by adding per unit cost of direct material, labor and overheads. Here, per unit cost of direct material and labor is given. Per unit cost of manufacturing overheads will be calculated as follows:

| Particulars | Model N 800 XL | Model N 500 |

| Total manufacturing overhead cost | 825,000 | 960,000 |

| Total units | 3,000 | 12,000 |

| Manufacturing cost per unit | $275 | $80 |

Now, Unit product cost will be calculated as follows:

| Particulars | Model N 800 XL (in $) | Model N 500 (in $) |

| Direct material (per unit) | 75 | 25 |

| Direct labor (per unit) | 54 (18*3) | 18 (18*1) |

| Manufacturing overheads | 275 | 80 |

| Unit product cost | 404 | 123 |

Unit product cost for model N 800 XL is $404 and model N 500 is $123.

4

Activity based costing

ABC system is used in cost accounting, this system identifies certain activities, build a relationship among product, activities and cost and assign manufacturing cost to all the products accordingly. Manufacturing cost are first assigned to activities and then to products.

To explain: Under ABC system, why manufacturing costs shift from model N 500 to model N 800 Xl.

Explanation of Solution

ABC system identifies certain activities, assign costs first to activities and then to products. In this system, manufacturing costs are assigned to products in the ratio in which each product consumes the activity. Machine setups are used by models N 800 Xl and Model N 500 in the ratio 1:2, therefore, total overhead cost is allocated in this ratio only. General factory activity is used in the ratio 3:4, therefore, total overhead cost is allocated in 3:4 ratio only and it is given that special processing activity is not used by model N 500 (used by model N 800 XL only), therefore, this cost is only allocated to model N 800 Xl and no amount is transferred to model N 500.

Manufacturing overhead cost is allocated based on consumption ratio and then per unit manufacturing overhead cost is calculated by dividing the total cost by the total number of units.

Want to see more full solutions like this?

Chapter 4 Solutions

Introduction To Managerial Accounting

- Medical Tape makes two products: Generic and Label. It estimates it will produce 423,694 units of Generic and 652,200 of Label, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: How much is the overhead allocated to each unit of Generic and Label?arrow_forwardBaxter Company has a relevant range of production between 15,000 and 30,000 units. The following cost data represents average variable costs per unit for 25,000 units of production. Using the costs data from Rose Company, answer the following questions: A. If 15,000 units are produced, what is the variable cost per unit? B. If 28,000 units are produced, what is the variable cost per unit? C. If 21,000 units are produced, what are the total variable costs? D. If 29,000 units are produced, what are the total variable costs? E. If 17,000 units are produced, what are the total manufacturing overhead costs incurred? F. If 23,000 units are produced, what are the total manufacturing overhead costs incurred? G. If 30,000 units are produced, what are the per unit manufacturing overhead costs incurred? H. If 15,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forwardCicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price): Required: 1. Prepare a cost report for the year ending 20x1 that shows value-added costs, non-value-added costs, and total costs for each activity. 2. Explain why expediting products and storing goods are non-value-added activities. 3. What if receiving cost is a step-fixed cost with each step being 1,500 orders whereas assembly cost is a variable cost? What is the implication for reducing the cost of waste for each activity?arrow_forward

- The following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardThe following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardRose Company has a relevant range of production between 10,000 and 25.000 units. The following cost data represents average cost per unit for 15,000 units of production. Using the cost data from Rose Company, answer the following questions: If 10,000 units are produced, what is the variable cost per unit? If 18,000 units are produced, what is the variable cost per unit? If 21,000 units are produced, what are the total variable costs? If 11,000 units are produced, what are the total variable costs? If 19,000 units are produced, what are the total manufacturing overhead costs incurred? If 23,000 units are produced, what are the total manufacturing overhead costs incurred? If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred? If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forward

- Using ABC to compute product costs per unit Spectrum Corp. makes two products: C and D. The following data have been summarized: The company plans to manufacture 250 units of each product. Calculate the product cost per unit for Products C and D using activity-based costing.arrow_forwardPat Company uses activity-based costing. The company has two products: A and B. The annual production and sales of Product A is 8,000 units and of Product B is 2,000 units. There are three activity cost pools, with estimated total cost and expected activity as follows: Expected Activity Activity Cost Pool Estimated Cost Product A Product B Total Activity 1…………… $12,000 750 250 1,000 Activity 2…………… $16,000 400 100 500 Activity 3…………… $36,000 2,000 1,000 3,000 The cost per unit of Product B under activity-based costing is closest to: A. $10.67. B. $6.40. C. $6.00. D. $9.10.arrow_forwardChrzan, Incorporated, manufactures and sells two products: Product EO and Product NO. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product E0 Product Ne Total direct labor-hours Activity Cost Pools Labor-related Production orders Order size The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Overhead Cost Multiple Choice $33.94 per MH $54.20 per MH Direct Expected Labor-Hours Production Per Unit 10.1 410 1,550 9.1 $51.98 per MH $21.40 per MH Activity Measures DLHS orders MHs Total Direct Labor- Hours $ 301,890 61,087 585,366 $948,343 The activity rate for the Order Size activity cost pool under activity-based costing is closest to: 4,141 14, 105 18,246 Product E 4,141 850 5,550 Expected Activity Product NO 14, 105 950 5,250 Total 18,246 1,800 10,800arrow_forward

- Which of the following would be included in the cost of a product manufactured according to variable costing? a.sales commissions b.direct materials c.interest expense d.office supply costs Another name for variable costing is: a.indirect costing b.process costing c.direct costing d.differential costing If variable manufacturing costs are $15 per unit and total fixed manufacturing costs are $200,000, what is the manufacturing cost per unit if a. 20,000 units are manufactured and the company uses the variable costing concept?arrow_forwardBrown Dog Company uses activity-based costing (ABC). The company produces two products: CYT56 & RWK29. The annual production and sales volume of CYT56 is 8,000 units and of RWK29 is 6,000 units. There are three activity cost pools with the following expected activities and estimated total costs: Activity Estimated Expected Activity Expected Activity Cost Pool Cost CYT56 RWK29 Total Activity 1 Activity 2 Activity 3 $20,000| $37,000| $91,200 100 400 500 1,000 3,800 800 200 800 3,000 Using ABC, the cost per unit of RWK29 is approximately: O $ 2.40 O $12.00 $15.90 $ 3.90arrow_forwardCoronado Inc. has conducted the following analysis related to its product lines, using a traditional costing system (volume-based) and an activity-based costing system. The traditional and the activity-based costing systems assign the same amount of direct materials and direct labor costs. Products Product 540X Product 137Y Product 249S (a) Sales Revenue $210,000 Product 137Y * Your answer is incorrect. Product 540X $ LA LA 166,000 LA 94,000 Product 249S $ Total Costs Traditional $59,000 For each product line, compute operating income using the traditional costing system. 49,000 17,000 160060 131040 ABC 53900 $49,940 34,960 40,100arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning