Concept explainers

a.

To Determine: The

a.

Answer to Problem 10P

The future value compounded for 10 years is $895.42.

Explanation of Solution

Determine the future value compounded for 10 years using formula

Therefore, the future value compounded for 10 years using formula is $895.42.

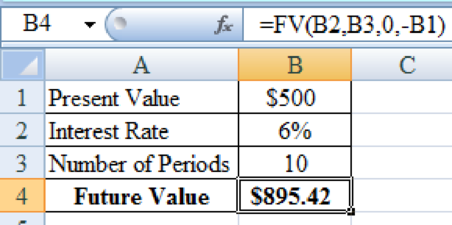

Determine the future value compounded for 10 years using excel

Excel Spreadsheet:

Therefore, the future value compounded for 10 years using excel is $895.42.

b.

To Determine: The future value compounded for 2 years.

b.

Answer to Problem 10P

The future value compounded for 2 years is $1,552.92.

Explanation of Solution

Determine the future value compounded for 2 years using formula

Therefore, the future value compounded for 2 years using formula is $1,552.92.

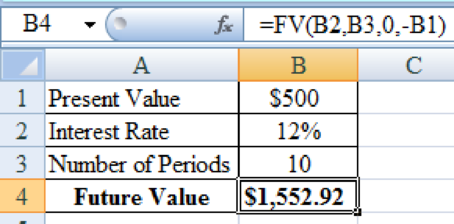

Determine the future value compounded for 2 years using excel

Excel Spreadsheet:

Therefore, the future value compounded for 2 year using excel is $1,552.92.

c.

To Determine: The present value of due in 1 year.

c.

Answer to Problem 10P

The present value of due in 1 year is $279.20.

Explanation of Solution

Determine the present value of due in 1 year using formula

Therefore, the present value of due in 1 year is $279.20.

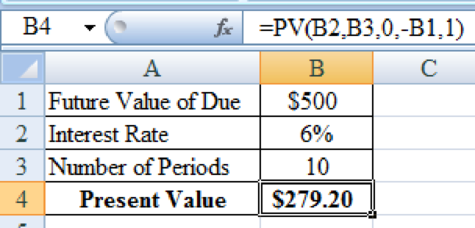

Determine the present value of due in 1 year using excel

Excel Spreadsheet:

Therefore, the present value of due in 1 year using excel is $279.20.

d.

To Determine: The present value of due in 2 years.

d.

Answer to Problem 10P

The present value of due in 2 years is $160.99.

Explanation of Solution

Determine the present value of due in 2 years using formula

Therefore, the present value of due in 2 years is $160.99.

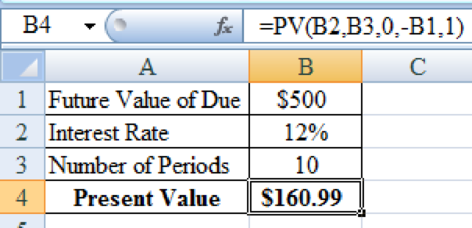

Determine the present value of due in 2 years using excel

Excel Spreadsheet:

Therefore, the present value of due in 2 years using excel is $160.99.

Want to see more full solutions like this?

Chapter 4 Solutions

Corporate Finance: A Focused Approach (mindtap Course List)

- Find the present worth sum of money that would be equivalent to the future amounts of $5000 in year 6 and $7000 in year 8 if the real interest rate is 10% per year and the inflation rate is 5% per year. Solve using the factors and their equations with (a) an inflation-adjusted rate, and (b) the real interest rate. Solve manually pleasearrow_forwardOne can solve for payments (PMT), periods (N), and interest rates (1) for annuities. The easiest way to solve for these variables is with a financial calculator or a spreadsheet. Quantitative Problem 1: You plan to deposit $2,100 per year for 4 years into a money market account with an annual return of 3%. You plan to make your first deposit one year from today. a. What amount will be in your account at the end of 4 years? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. Assume that your deposits will begin today. What amount will be in your account after 4 years? Do not round intermediate calculations. Round your answer to the nearest cent. $ Quantitative Problem 2: You and your wife are making plans for retirement. You plan on living 25 years after you retire and would like to have $95,000 annually on which to live. Your first withdrawal will be made one year after you retire and you anticipate that your retirement account will earn 12% annually. a.…arrow_forward1. If you receive $29 each quarter for 19 years and the discount rate is 0.05, what is the present value? (show the process and can use financial calculator)arrow_forward

- Use the present value and future value tables to answer the following questions. A. If you would like to accumulate $2,600 over the next 5 years when the interest rate is 15%, how much do you need to deposit in the account? $fill in the blank 1 B. If you place $6,300 in a savings account, how much will you have at the end of 7 years with a 12% interest rate? $fill in the blank 2 C. You invest $7,000 per year for 11 years at 12% interest, how much will you have at the end of 11 years? $fill in the blank 3 D. You win the lottery and can either receive $740,000 as a lump sum or $50,000 per year for 20 years. Assuming you can earn 8% interest, which do you recommend and why? Take the lump sum $740,000 because it is more money.arrow_forwardUse the present value and future value tables to answer the following questions. A. If you would like to accumulate $2,500 over the next 4 years when the interest rate is 15%, how much do you need to deposit in the account? $fill in the blank 1 B. If you place $6,100 in a savings account, how much will you have at the end of 7 years with a 12% interest rate? $fill in the blank 2 C. You invest $7,000 per year for 9 years at 12% interest, how much will you have at the end of 9 years? $fill in the blank 3 D. You win the lottery and can either receive $760,000 as a lump sum or $40,000 per year for 19 years. Assuming you can earn 8% interest, which do you recommend and why?arrow_forwardIn this project, you will use a graphing calculator to compare savings plans. For instance, suppose you are depositing $1000 in a savings account and are given the following options: 4 • 6.2% annual interest rate, compounded annually 6.1% annual interest rate, compounded quarterly 6.0% annual interest rate, compounded continuously •arrow_forward

- Find the accumulated value of an investment of $20,000 for 5 years at an interest rate of 4.5% if the money is a. compounded semiannually; b. compounded quarterly; c. compounded monthly d. compounded continuously. Round answers to the nearest cent. Click the icon to view some finance formulas. *** a. What is the accumulated value if the money is compounded semiannually? (Round your answer to the nearest cent.) Inarrow_forward不 a. Use the appropriate formula to determine the periodic deposit. b. How much of the financial goal comes from deposits and how much comes from interest? Periodic Deposit Rate Time Financial Goal $? at the end of each year 3% compounded annually 15 years $130,000 Click the icon to view some finance formulas. a. The periodic deposit is $ (Do not round until the final answer. Then round up to the nearest dollar as needed.) this View an example Get more help 4 Clear all Checarrow_forwardFind the accumulated value of an investment of $25,000 for 5 years at an interest rate of 5% if the money is a. compounded semiannually; b. compounded quarterly; c. compounded monthly d. compounded continuously. Round answers to the nearest cent. Click the icon to view some finance formulas. ..... a. What is the accumulated value if the money is compounded semiannually? (Round your answer to the nearest cent.) Formulas In the provided formulas, A is the balance in the account after t years, P is the principal investment, r is the annual interest rate in decimal form, n is the number of compounding periods per year, and Y is the investment's effective annual yield in decimal form. nt A A: P = A =Pert Y = -1 nt 1+ Print Donearrow_forward

- Complete the following using the future value formula or financial calculator. (Do not round intermediate calculations. Round your final answers to the nearest cent.) Time = 4 years Principal = $3,300 Rate = 8% Compounded = Quarterly What is the amount and interest?arrow_forwardFind the following values using the equations and then a financial calculator. Compounding/discounting occurs annually. Do not round intermediate calculations. Round your answers to the nearest cent. a. An initial $800 compounded for 1 year at 9%. $ b. An initial $800 compounded for 2 years at 9%. $ c. The present value of $800 due in 1 year at a discount rate of 9%. $ d. The present value of $800 due in 2 years at a discount rate of 9%. $arrow_forwardind the following values using the equations and then a financial calculator. Compounding/discounting occurs annually. Do not round intermediate calculations. Round your answers to the nearest cent. An initial $500 compounded for 1 year at 5%. An initial $500 compounded for 2 years at 5%. The present value of $500 due in 1 year at a discount rate of 5%. The present value of $500 due in 2 years at a discount rate of 5%.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education