Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 4E

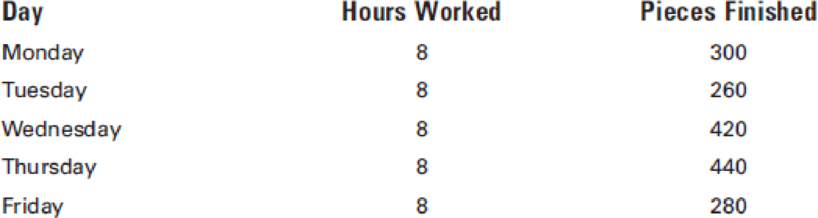

Peggy Nolan earns $20 per hour for up to 300 units of production per day. If she produces more than 300 units per day, she will receive an additional piece rate of $.5333 per unit. Assume that her hours worked and pieces finished for the week just ended were as follows:

- a. Determine Nolan’s earnings for each day and for the week. (Round piece-rate computations to the nearest whole dollar.)

- b. Prepare the

journal entry to distribute the payroll, assuming that any make-up guarantees are charged to Factory Overhead.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Solomon Corporation paid one of its sales representatives $4,000 during the month of March. The rep is paid a base salary plus $10 per unit of product sold. During March, the rep sold 300 units.

Required

Calculate the total monthly cost of the sales representative’s salary for each of the following months:

A saleslady in Fortuna mall receives a monthly salary of Ρhр 12,000.00 рlus 10 % on all sales for the month over Ρhр 25,000.00. At the end of the current month she sold Ρhр 42,856.00. What is the amount of her commission? What is her total gross рay for the month?

Calculate gross pay for each of the following employees. All are paid an overtime wage rate that is 1.5 times their respective regular wage rates.

1.Samuel Worthy earns both $8.10/hour and a 14% commission on all sales. During the most recent week, he worked 41 hours and made total sales of $12,000.NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

Chapter 3 Solutions

Principles of Cost Accounting

Ch. 3 - What is the difference between direct and indirect...Ch. 3 - Prob. 2QCh. 3 - Prob. 3QCh. 3 - In production work teams, output is dependent upon...Ch. 3 - Define productivity.Ch. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - What are the sources for posting direct labor cost...

Ch. 3 - What are the sources for posting indirect labor...Ch. 3 - In accounting for labor costs, what is the...Ch. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Besides FICA, FUTA and state unemployment taxes,...Ch. 3 - Prob. 16QCh. 3 - Prob. 17QCh. 3 - Prob. 18QCh. 3 - What is a shift premium, and how is it usually...Ch. 3 - Prob. 20QCh. 3 - Prob. 21QCh. 3 - Prob. 22QCh. 3 - Prob. 23QCh. 3 - Prob. 24QCh. 3 - Prob. 25QCh. 3 - R. Herbert of Crestview Manufacturing Co. is paid...Ch. 3 - Recording payroll Using the earnings data...Ch. 3 - Prob. 3ECh. 3 - Peggy Nolan earns 20 per hour for up to 300 units...Ch. 3 - Overtime Allocation Arlin Fabrication Company...Ch. 3 - Prob. 6ECh. 3 - Davis, Inc. paid wages to its employees during the...Ch. 3 - Recording the payroll and payroll taxes Using the...Ch. 3 - Prob. 9ECh. 3 - The total wages and salaries earned by all...Ch. 3 - The total wages and salaries earned by all...Ch. 3 - A weekly payroll summary made from labor time...Ch. 3 - Prob. 13ECh. 3 - Accounting for bonus and vacation pay Cathy Muench...Ch. 3 - Prob. 15ECh. 3 - Prob. 16ECh. 3 - Payroll computation with incentive bonus Fifteen...Ch. 3 - Prob. 2PCh. 3 - Prob. 3PCh. 3 - Payroll for piece-rate wage system Collier...Ch. 3 - A rush order was accepted by Bartley's Conversions...Ch. 3 - The following form is used by Matsuto...Ch. 3 - Payment and distribution of payroll The general...Ch. 3 - Prob. 8PCh. 3 - An analysis of the payroll for the month of...Ch. 3 - Prob. 10PCh. 3 - Prob. 11PCh. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - Using the information in P3-13, prepare the...Ch. 3 - Pan-Am Manufacturing Co. prepares cost estimates...Ch. 3 - Incentive wage plan David Kelley is considering...Ch. 3 - Huron Manufacturing Co. uses a job order cost...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the first week in November, Erin Mills worked 48.50 hours and produced 1,248 units under a piece-rate system. The regular piece rate is $0.36 a unit. Mills is paid over time according to the FLSA ruling for overtime work under a piece-rate system. Compute the following amounts. Round all divisions to two decimal places and use the rounded amounts in subsequent computations. Round your final answers to the nearest cent. a. The piecework earnings $fill in the blank 1 b. The regular hourly rate $fill in the blank 2 The overtime hourly rate $fill in the blank 3 c. The overtime earnings $fill in the blank 4 d. The total earnings $fill in the blank 5arrow_forwardDetermine the gross pay for each employee listed below. When necessary, round intermediate calculations and the final answer to the nearest cent. Clay Jones is paid time-and-a-half for all hours over 40. He worked 45 hours during the week. His regular pay rate is $25 per hour. $ Mary James worked 48 hours during the week. She is entitled to time-and-a-half for all hours in excess of 40 per week. Her regular pay rate is $20 per hour. $ Lori Terry is paid a commission of 10 percent of her sales, which amounted to $23,650. $ Nicole Smith's yearly salary is $95,500. During the week, she worked 46 hours, and she is entitled to time-and-a-half for all hours over 40. $arrow_forwardCalculate gross pay for each of the following employees. All are paid an overtime wage rate that is 1.5 times their respective regular wage rates.NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. Anita Workman receives tips from customers as a standard component of her weekly pay. She is paid $2.60/hour by her employer and receives $291 in tips during the most recent 44-hour workweek.Gross Pay = $arrow_forward

- Cabrera Accounting pays Shanaya Kapoor $63,480 per year.(Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. What is the hourly cost to Cabrera Accounting of employing Shanaya Kapoor? Assume it is a 31 hour work week and the work 50 weeks a year. Weeks per year ? Hours per week = Work hours per year = Yearly Rate ? Hours per year = Cost per hour = 2. What is the direct labor cost assigned to Client 123 when Shanaya Kapoor works 18 hours to prepare Clients 123 financial statements? Hours worked ? Rate per hour = Direct Labor Cost =arrow_forwardJessica Porter works in both the Jewelry department and the Cosmetics department of a retail store. Sheassists customers in both departments and arranges and stocks merchandise in both departments. The storeallocates her $30,000 annual wages between the two departments based on the time worked in the twodepartments in each two-week pay period. On average, Jessica reports the following hours and activitiesspent in the two departments. Allocate Jessica’s annual wages between the two departments.Activities HoursSelling in Jewelry department 51Arranging and stocking merchandise in Jewelry department . . . . . . . . . . . . . . 6Selling in Cosmetics department 12Arranging and stocking merchandise in Cosmetics department 7$7,500 to Idle time spent waiting for a customer to enter one of the departments . 4arrow_forwardJon Stone is paid $20 an hour for an 8-hour day, with time-and-a-half for overtime and double-time for Sundays and holidays. Regular employment is on the basis of 40 hours a week, 5 days a week. Overtime premium is charged to Factory Overhead. Required: Using the labor-time record below: a. Compute Jerrod's total earnings for the week. b. Present the journal entry to distribute Jerrod's total earnings. Sunday Monday Tuesday Wednesday Thursday Friday Saturday ТОTAL Job F2 3 5 4 31 Job M1 1 3 6 14 Admin 1 3 6 TOTAL 8. 8. 8 10 51arrow_forward

- Calculate gross pay for each of the following employees. All are paid an overtime wage rate that is 1.5 times their respective regular wage rates.NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation Amy Blackwood receives tips from customers as a standard component of her weekly pay. She is paid $2.38/hour by her employer and receives $155 in tips during the most recent 45-hour workweek. Calculate Gross Pay = $__________ Employees who receive tips are covered by the FLSA and therefore must be paid the applicable hourly minimum wage. A tipped employee is someone who typi-cally receives more than $30/month in tips. Employers can take advantage of a maximum tip credit of $5.12, which results in employees receiving an hourly wage of $2.13 ($7.25 minimum wage minus $5.12 tip credit). Employers who elect to take advantage of this tip credit must inform employees of their intention to do so…arrow_forwardBruce Eaton is paid 10 cents per unit under the piece-rate system. During one week, Eaton worked 46 hours and produced 5,520 units. Compute the following: 1. The piecework earnings ________ 2. The regular hourly rate ________ 3. The overtime hourly rate ________ 4. The overtime earnings ________ 5. The total earnings ________arrow_forwardDirections: Answer the following problems. Use appropriate formula to arrive at the right answer. 1. Algem earns the regular daily rate of P340.00 giving her an hourly rate of P42.50. she was requested by her boss to work on May 1, Labor Day. She worked for 8 hours. Her total pay for the day would be: a.arrow_forward

- Kyle Forman worked 45 hours during the week for Erickson Company at two different jobs. His pay rate was $13.75 for the first 40 hours, and his pay rate was $10.60 for the other 5 hours. Round your overtime rate and other interim computations to two decimal places and use the rounded amount in subsequent computations. Round the final answers to the nearest cent. Determine his gross pay for that week if the company uses the one-half average rate method. a. Gross pay b. If prior agreement existed that overtime would be paid at the rate for the job performed after the 40th hour, the gross pay would bearrow_forwardKyle Forman worked 45 hours during the week for Erickson Company at two different jobs. His pay rate was $14.75 for the first 40 hours, and his pay rate was $11.30 for the other 5 hours. Round your overtime rate and other interim computations to two decimal places and use the rounded amount in subsequent computations. Round the final answers to the nearest cent. Determine his gross pay for that week if the company uses the one-half average rate method. a. Gross pay $ fill in the blank 1 b. If prior agreement existed that overtime would be paid at the rate for the job performed after the 40th hour, the gross pay would be $ fill in the blank 2arrow_forwardCabrera Accounting pays Shanaya Kapoor $62,050 per year. (Round your answers to two decimal places when needed and use rounded answers for all future calculations). 1. What is the hourly cost to Cabrera Accounting of employing Shanaya Kapoor? Assume it is a 38 hour work week and the work 50 weeks a year. Weeks per year ? Hours per week = Work hours per year Yearly Rate ? Hours per year = Cost per hour = = 2. What is the direct labor cost assigned to Client 123 when Shanaya Kapoor works 17 hours to prepare Clients 123 financial statements? Submit All Parts Hours worked ? Rate per hour = Direct Labor Cost =arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Step 5: Base Pay Structure; Author: GreggU;https://www.youtube.com/watch?v=CnBsWsY6O7k;License: Standard Youtube License