a.

To determine: The net operating working capital for 2018 and 2019.

Statement of Cash Flow: It is a part of financial statements that are included in the annual report of a company. It reports the cash generated or used by the business in a specified period.

Cash Flow from Operating Activities: The cash generated over and above required business operations is called and reported as cash flow from operating activities. Statement of cash flow reports the net cash flow generated or consumed by the business.

a.

Answer to Problem 14P

The net operating working capital for 2018 is $42,000 and 2019 is $50,220.

Explanation of Solution

Determine the net operating working capital for 2018:

Therefore the net operating working capital for 2018 is $42,000.

Determine the net operating working capital for 2019:

Therefore the net operating working capital for 2019 is $50,220.

b.

To determine: The

b.

Answer to Problem 14P

The free cash flow in 2019 for Company A is $22,780.

Explanation of Solution

Determine the free cash flow in 2019 for Company A:

Therefore, the free cash flow in 2019 for Company A is $22,780.

c.

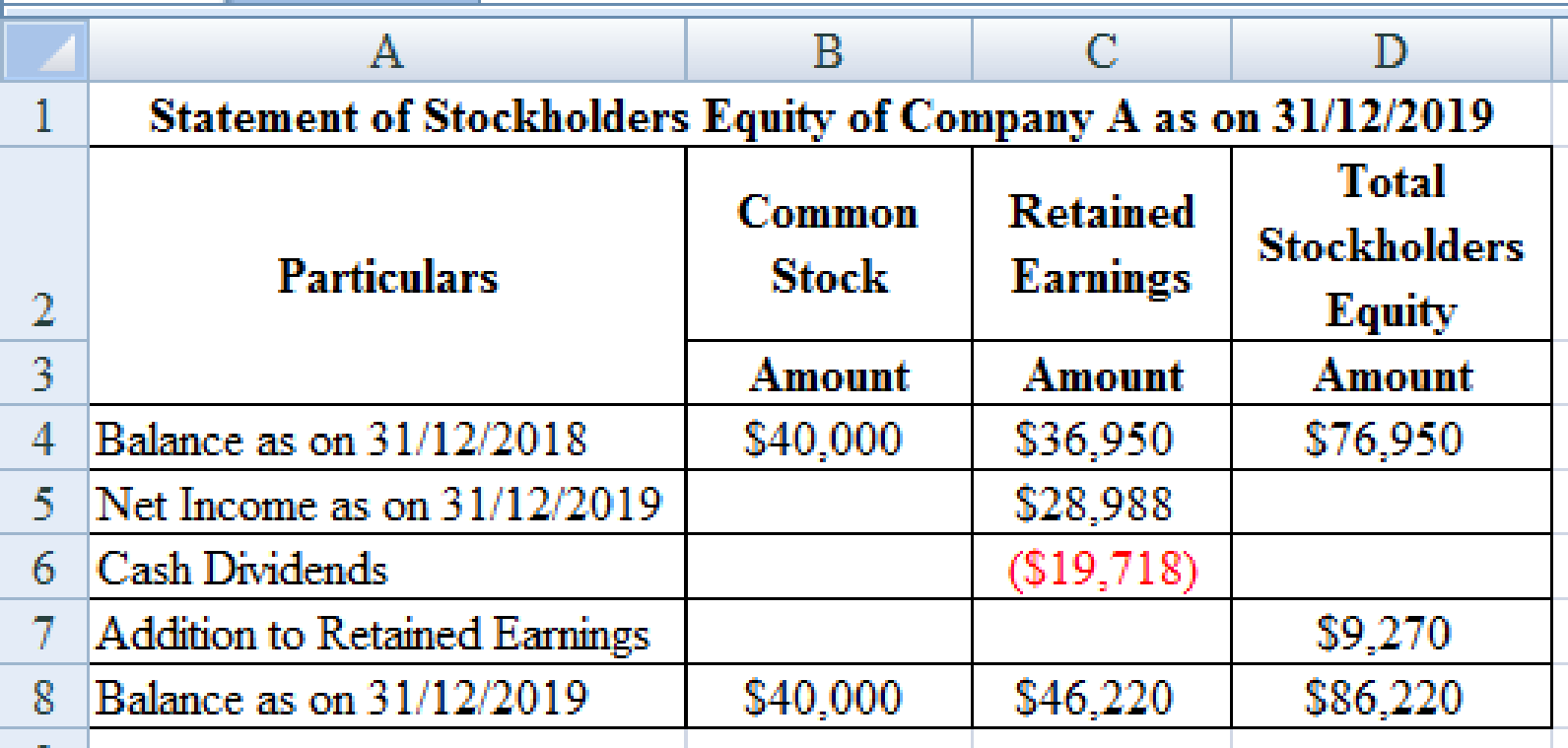

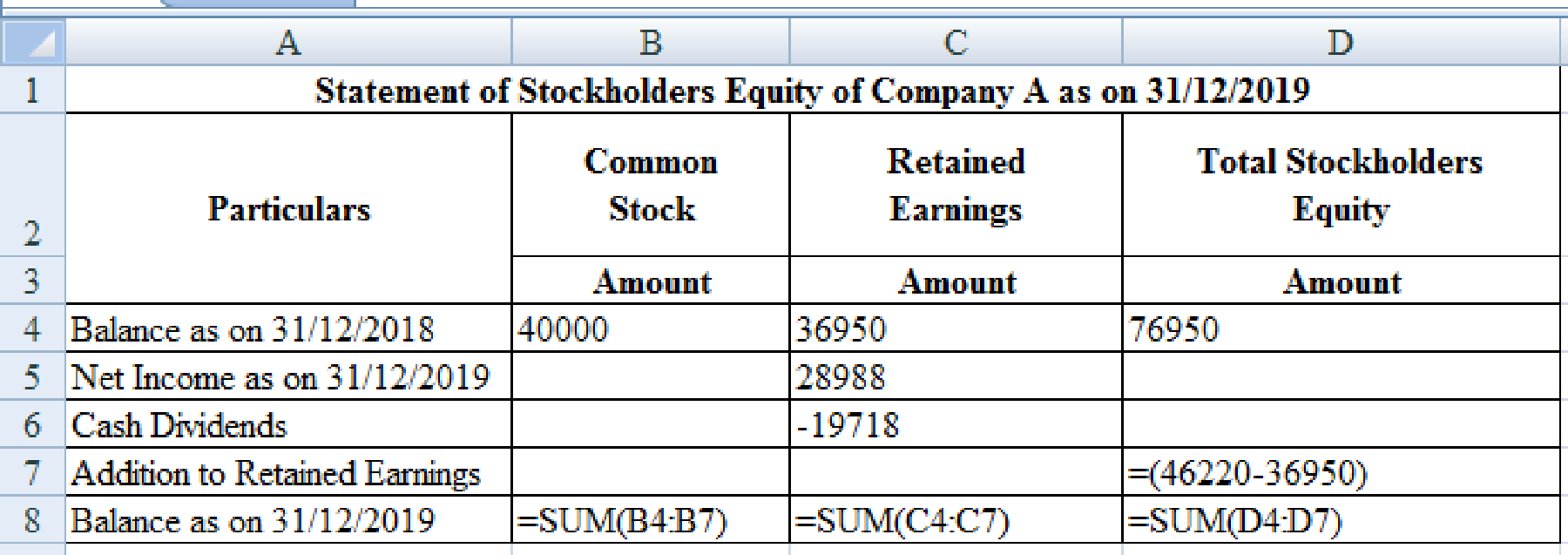

To determine: The statement of

c.

Explanation of Solution

The statement of stockholders equity for Company as on 2019 is as follows:

Excel Spreadsheet:

Excel Spreadsheet Workings:

d.

To determine: The EVA of Company A for 2019.

d.

Answer to Problem 14P

The EVA of Company A for 2019 is $21,678.

Explanation of Solution

Determine the EVA of Company A for 2019:

Therefore, the EVA of Company A for 2019 is $21,678.

e.

To determine: The MVA of Company A for 2019.

e.

Answer to Problem 14P

The MVA of Company A for 2019 is $13,780.

Explanation of Solution

Determine the MVA of Company A for 2019:

Therefore, the MVA of Company A for 2019 is $13,780.

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

- AFN EQUATION Refer to Problem 16-1 and assume that the company had 3 million in assets at the end of 2019. However, now assume that the company pays no dividends. Under these assumptions, what additional funds would be needed for the coming year? Why is this AFN different from the one you found in Problem 16-1?arrow_forwardInterest and Income Taxes Staggs Company has prepared its 2019 statement of cash flows. In conjunction with this statement, it plans to disclose the interest and income taxes it paid during 2019. The following information is available from its 2019 income statement and beginning and ending balance sheet: Required: 1. Compute the amounts of interest paid and income taxes paid by Staggs for 2019. 2. Next Level Under IFRS, how would interest paid and income taxes paid be reported?arrow_forwardDuring 2021, T Company engaged in the following activities: Distribution of cash dividends declared in 2020 Fair value of shares issued in a stock dividend Payment to retire bonds Proceeds from the sale of treasury stock (cost: $50) In T's statement of cash flows, what were net cash outflows from financing activities for 2021? Multiple Choice $374. $46 210 432 58 $420.arrow_forward

- Financial information for Powell Panther Corporation is shown here. a. What was net operating working capital for 2018 and 2019? Assume the firm has no excess cash.b. What was the 2019 free cash flow?c. How would you explain the large increase in 2019 dividends?arrow_forwardREQUIRED Study the statement of cash flows of Mantis Limited for the year ended 31 December 2021 and answer the following questions: Calculate the following for the year ended 31 December 2021: Depreciation Dividends paid Of what significance is this statement of cash flows to the shareholders of Mantis Limited? Comment on the following: Cash flows from operating activities (R181 800) 1.3.2. Increase in inventory (R808 000) Increase in receivables (R606 000) Interest paid (R80 800) Cash flows from investing activities (R2 343 200) INFORMATION MANTIS LIMITED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 2021 R Cash flows from operating activities (181 800) Operating profit 979 700 Depreciation ? Profit before working capital changes ? Working capital changes (808 000) Increase in inventory (808 000) Increase in receivables…arrow_forwardOn the basic of the cash flow statemnet attachd for Funtastic ltd for year 2019, 2018 and 2017, answer the below question. a) Was the firm able to generate enough cash from operations to pay for all of its capital expenditures?b) Did the cash flow from operations cover the dividend payment made by the firm (if any)?c) If the firm has generated excess cash from operations, how did the firm invest the excess cash? If not, what were the sources of cash the firm used to pay for the capital expenditures and/or dividends?arrow_forward

- Some selected financial statement items belonging to PXR Company are given in the table below. According to this information, which of the following is Return on Assets (ROA) in 2021? Receivables 18,500 Total Assets in 2021 130,000 Current Liabilities 42,000 Total Assets in 2020 110,000 Profit before Tax 18,000 Tax 3,000 Select one: a. 0.125 b. 0.150 c. 0.205 d. 0.137arrow_forwardSuppose you collected the following information of ABC corp. from the financial statements published in 2019. Entry Total Current Assets 14050001206000 Current Liabilities Notes Payable Earning before Interest and Taxes Depreciation Capital expenditures Tax rate Select one: @a. 1279990X b. 187578 0c Estimate the Free Cash Flow available for ABC corp. at the end of 2019. 60030 2019 d. 1092412 e 30 2018 602000 571500 476990 457912 97680 159000 -30000 40%arrow_forward10. Creditors' Cash Flows. On the statement of financial position on December 31, 2018, non-current liabilities were $1,350,000, and on the statement of financial position on December 31, 2019, non-current liabilities were $1,470,000. In the 2019 statement of comprehensive income, interest expense was $97,500. What is the creditor's cash flow in 2019? 11. Cash flow to shareholders. In the statement of financial position on December 31, 2018, common stock capital was $120,000 and capital surplus was $2,289,000. On the December 31, 2019 statement of financial position, the respective items were $137,000 and $2,568,000. If a cash dividend of $149,500 was paid in 2019, what was the shareholder's cash flow for that year?arrow_forward

- REQUIRED Study the statement of cash flows of Mantis Limited for the year ended 31 December 2021 and answer the following questions: Comment on the following: 1.3.1 Cash flows from operating activities (R181 800) 1.3.2. Increase in inventory (R808 000) 1.3.3 Increase in receivables (R606 000) 1.3.4 Interest paid (R80 800) 1.3.5 Cash flows from investing activities (R2 343 200) INFORMATION MANTIS LIMITED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 2021 R Cash flows from operating activities (181 800) Operating profit 979 700 Depreciation ? Profit before working capital changes ? Working capital changes (808 000) Increase in inventory (808 000) Increase in receivables (606 000) Increase in payables 606 000 Cash generated from operations 494 900 Interest paid (80 800) Dividends paid ? Income tax paid (272 700) Cash flows from investing activities (2…arrow_forwardwhat should have been the Cash Flow Provided By (Used In) FinancingActivities for 2021 if the gross profit of the company for the year 2021 equals $39,375? (Round to the nearest 2 decimal places)arrow_forwardPlease refer to the financial data for Link, Incorporation above. What is Link’s days’ sales in cash for 2021?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning