Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 5R

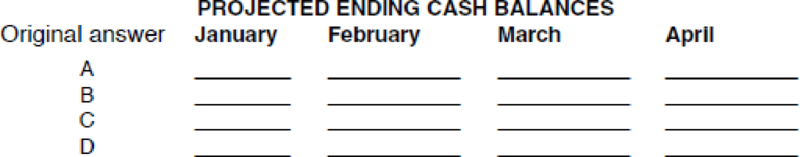

The following four suggestions have been made to improve the company’s cash position. Evaluate the effect on cash flow for each of the four suggestions. After evaluating each suggestion, enter the projected cash balances in the spaces provided. Consider each suggestion separately. Reset cells to their initial values after each new suggestion.

- a. Seek agreement with suppliers to extend the credit period to 30 days. This would mean that all current monthly purchases would be paid for in the following month.

- b. Raise the unit price from $28 to $30. A price increase will reduce unit sales by 10% each month. Unit purchases will also be reduced by 10%.

- c. Put the company’s two salespeople on straight commission. This would reduce fixed marketing and administrative costs to $1,500 per month and raise variable marketing and administrative costs to $7 per unit.

- d. Increase the cash discount from 5% to 10%. It is anticipated that this would increase the percentage of customers paying within the discount period to 85%, and those paying the month after the discount period would drop to 8%. Five percent would pay in the following month and 2% would still be uncollectible.

What are your recommendations for Sweet Pleasures, Inc.? Consider potential impact on profits as well as cash balances.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Below is a cash flow projection on a sequential-pay CMO, which has four tranches, A through D.

Assume the four tranches get paid in the order of A->B->C->D. In this month tranche A has an

outstanding balance of 63,000 and B has an outstanding balance of 45,000. What is the principal

payment towards tranche B in this month?

Enter your answer in thousands of dollars, with no decimals. For example, if your answer is $40,000,

then enter 40.

month

63

beginning.

balance

$585,000

scheduled principal

payment

$10,000

Prepayment

$17,000

Interest to MBS

investors

$57,000

Romano Inc. has the following data. What is the firm's cash conversion cycle?

Inventory Conversion Period =

59 days

Receivables Collection Period =

19 days

Payables Deferral Period =

41 days

Please explain process and show calculations.

note: can you help me answer the question for a, and b?

For Nibong Prawn Paste Enterprise (NPPE), the average age of accounts receivable (AAR) is 60 days, the average age of accounts payable (AAP) is 45 days, and the average age of inventory (AAI) is 72 days. Assume a 365-day year.

a. The length of the company’s cash conversion cycle (CCC) is? (days)

b. Based on the CCC calculated in (a) above, if the forecasted sales turnover is $5 million the working capital requirement (WCR) of NPPE is?

c. If NPPE is able to reduce its AAI to 65 days; maintain its AAR at 60 days, stretch its AAP to 60 days and maintain the same forecasted sales turnover of $5 million, the new CCC is _____ (days) and the new WCR is ______ (dollars)

d. Which of the following are TRUE about the impacts of the change in the CCC of NPPE? A) The WCR would be reduced to $310,000 B) NPPE’s trade creditors can be said to be financing part of its WCR by allowing the company an extension of credit C) NPPE can also…

Chapter 21 Solutions

Excel Applications for Accounting Principles

Ch. 21 - On January 1, Sweet Pleasures, Inc., begins...Ch. 21 - Open the file CASHBUD from the website for this...Ch. 21 - Can the 10,000 note be repaid on May 1? Explain.Ch. 21 - Prob. 4RCh. 21 - The following four suggestions have been made to...Ch. 21 - Reset cells to their initial values. Sweet...Ch. 21 - Prob. 7R

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a) Explain the significance of financing with accounts payable. b) Explain (including computations) the rationale of taking a cash discount, such as 2/15, n/40. c) Additionally, determine the approximate balance of accounts payable, if a company stretches its payables to 60 days and on average, they make purchases of $1,000,000 per day from their vendors. d) Explain what the stretching accomplishes if the vendors should be paid in 40 days.arrow_forwardCass & Company has the following data. What is the firm's cash conversion cycle? Inventory Conversion Period = 40 days Receivables Collection Period = 17 days Payables Deferral Period = 25 days Question options: 35 days 31 days 25 days 32 days 33 daysarrow_forwardML has the following data. What is the firm's cash conversion cycle? Inventory conversion period = 50 days Average collection period = 17 days Payables deferral period = 25 days 34 days 46 days 31 days 38 days O 42 daysarrow_forward

- a. Determine the optimal strategy for cash management for the person who earns $1600 per month, can earn 0.5 percent interest per month in a saving account, and has a transaction cost of $1. b. What is the individual’s average money holding? c. Suppose income rises to $1800. By what percentage does the person’s demand for money rise?arrow_forwardYou have to test cash and PP&E of your client. Both accounts have the same balance at the end of the year: $25 million. In a typical company, which account will you spend more time testing AND WHY?arrow_forwardSuppose that you borrow a loan of amount P from a bank at the end of month 3 and make the monthly deposits to the bank as in the cash flow diagram below. In the following cash flow diagram A7=A8=A9=1000, and starting with A10, deposits start decreasing in the amount of 40. However, due to a cash problem, you miss a payment at month 12 but continue with your original payment plan thereafter (that is, A10=960, A11=920, A12=0, A13=840 etc). With these payments, your dept to the bank will be 0 at the end of month 20. Assuming that the interest rate is 12% compounded monthly. 1-Find out the initial loan amount P. 2-Find the total interest paid to the bankarrow_forward

- Hussein Al Lawati SAOG has recognized that the organization is facing a liquidity crisis. Accordingly, the accountant of the organization has studied the payment records from the customer and has noticed that the company at present offers its customers 25 days credit. Half the customers by value, pay on time. The other half takes an average of 50 days to pay. In this background you are planning to offer a cash discount of 2.5 per cent to your customers for the payment made within 25 days. The credit controller anticipates that half of the customers who now take an average of 50 days to pay will pay in 25 days. The other half will still take an average of 50 days to pay. It is anticipated that the proposed scheme will reduce bad debts amount by RO. 450,000 a year. Annual sales revenue of RO 45,000,000 is made evenly throughout the year. At present the business has a large overdraft RO. 5,000,000 with its bank at an interest of 7 percent a year. Required: a. Calculate receivables…arrow_forwardHussein Al Lawati SAOG has recognized that the organization is facing a liquidity crisis. Accordingly, the accountant of the organization has studied the payment records from the customer and has noticed that the company at present offers its customers 25 days credit. Half the customers by value, pay on time. The other half takes an average of 50 days to pay. In this background you are planning to offer a cash discount of 2.5 per cent to your customers for the payment made within 25 days. The credit controller anticipates that half of the customers who now take an average of 50 days to pay will pay in 25 days. The other half will still take an average of 50 days to pay. It is anticipated that the proposed scheme will reduce bad debts amount by RO. 450,000 a year. Annual sales revenue of RO 45,000,000 is made evenly throughout the year. At present the business has a large overdraft RO. 5,000,000 with its bank at an interest of 7 percent a year. Required: Calculate receivables…arrow_forwardBSW & Company has the following data. What is the firm's cash conversion cycle? Inventory conversion period = 75 days Average collection period = 32 days Payables deferral period = 55 days 43 days 62 days 23 days 20 days 52 daysarrow_forward

- Price Mart is considering outsourcing its billing operations. A consultant estimates that outsourcing should result in cash savings of $9,500 the first year, $15.500 for the next two years, and $18,500 for the next two years. Interest is at 10%. Assume cash flows occur at the end of the year. Required: Calculate the total present value of the cash flows. Note: Use tables, Excel, or a financial calculator. Do not round intermediate calculations. Round your final answer to nearest whole dollar. (FV of $1. PV of $1. FVA of $1. PVA of $1, EVAD of $1 and PVAD of $1) Total present value of the cash flowsarrow_forwardFurles Inc. has hired you as a consultant to analyze their cash management policy and suggest the most efficient parameters. They have estimated their current daily variance of net cash flow to be $75,00O. Their bank requires them to maintain a minimum compensating balance in their account of $2,000. They have negotiated a fixed transaction cost with their broker of $15 per transaction and they are currently able to earn an annual return of 5% on their investment in marketable securities. Compute their optimal cash balance target (C*), optimal upper bound (U*) and lower bound (L), as well as the average cash balance (ACB) that they will have on hand so that you can also tell them their annual opportunity cost of maintaining the average cash balance. C* = U* = L = ACB = Annual Opportunity Cost ($) = %3Darrow_forwardIt typically takes Law Corporation 8 days to receive and deposit customer remissions. Law is considering a lockbox system and anticipates that the system will reduce the float time to 5 days. Average daily cash receipts are P220,000. The rate of return is 10 percent. Requirement: What is the reduction in cash balances associated with implementing the system? What is the rate of return associated with the earlier receipt of the funds? What should be the maximum monthly charge associated with the lockbox proposal?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY