Concept explainers

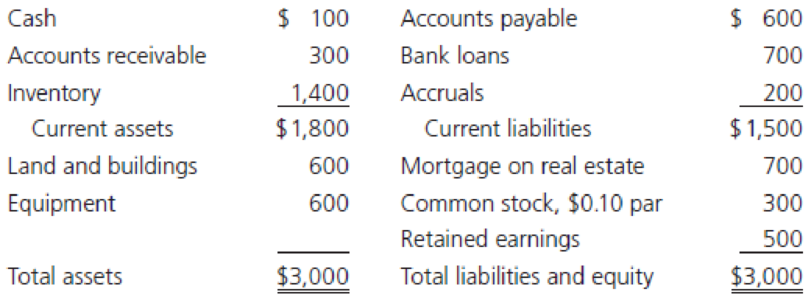

The Raattama Corporation had sales of $3.5 million last year, and it earned a 5% return (after taxes) on sales. Recently, the company has fallen behind in its accounts payable. Although its terms of purchase are net 30 days, its accounts payable represents 60 days’ purchases. The company’s treasurer is seeking to increase bank borrowing in order to become current in meeting its trade obligations (that is, to have 30 days’ payables outstanding). The company’s balance sheet is as follows (in thousands of dollars):

- a. How much bank financing is needed to eliminate the past-due accounts payable?

- b. Assume that the bank will lend the firm the amount calculated in part a. The terms of the loan offered are 8%, simple interest, and the bank uses a 360-day year for the interest calculation. What is the interest charge for 1 month? (Assume there are 30 days in a month.)

- c. Now ignore part b and assume that the bank will lend the firm the amount calculated in part a. The terms of the loan are 7.5%, add-on interest, to be repaid in 12 monthly installments.

- (1) What is the total loan amount?

- (2) What are the monthly installments?

- (3) What is the APR of the loan?

- (4) What is the effective rate of the loan?

- d. Would you, as a bank loan officer, make this loan? Why or why not?

a)

To determine: Size of bank loan.

Explanation of Solution

Calculation of size of bank loan:

Therefore, the size of bank loan is $300,000

Alternatively, one might simply recognize that accounts payable should be cut ½ of its existing result, because 30 days is ½ of 60 days.

b)

To determine: Interest charge per month.

Explanation of Solution

Calculation of simple interest per day:

Hence, simple interest per day is 0.000222222

Calculation of interest charge per month:

Hence, interest charge per month is $2,000

c)

1)

To determine: Total loan amount

Explanation of Solution

Calculation of total loan amount:

Hence, interest is $22,500

Therefore, total loan amount is $322,500

2)

To determine: Monthly instalments.

Explanation of Solution

Calculation of monthly instalments:

Hence, monthly instalments is $26,875

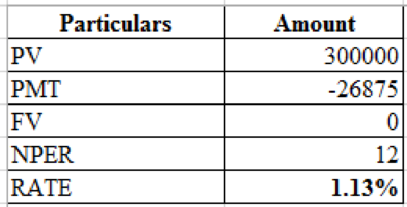

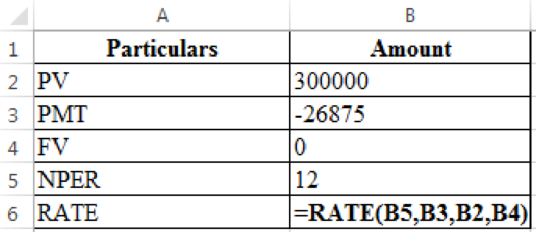

3)

To determine: APR (Annual percentage rate) of the loan.

Explanation of Solution

Calculation of APR on loan:

Working note:

Monthly rate is 1.13% so,

For 12 months,

Hence, APR on loan is 13.57%

4)

To determine: Effective rate on loan.

Explanation of Solution

Calculation of effective rate on loan:

Hence, Effective rate on loan is 14.44%

d)

To discuss: Whether person X as a bank officer to make this loan or not.

Explanation of Solution

The decision should be based on rule-of-thumb comparison,

Debt ratio: The debt ratio is 73% as compared to typical debt ratio of 50% so the company appears is to be undercapitalized.

Current ratio: The current ratio seems to be low, however current assets might cover current liabilities if all assets are collected and if inventory can be liquidated at its book value.

Quick ratio: Quick ratio indicates current assets, and excluding inventory, are solely adequate to cover 27% of current liabilities which is considered as worse.

Therefore, the company seems to be carrying additional inventory and financing extensively with debt. Bank borrowings are already high and therefore the liquidity situation is poor. Based on these observations the loan could be unused, and therefore, the treasurer should be suggested to seek permanent capital, particularly equity capital.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Financial Management (MindTap Course List)

- ALei Industries has credit sales of $146 million a year. ALei's management reviewed its credit policy and decided that it wants to maintain an average collection period of 35 days. a. What is the maximum level of accounts receivable that ALei can carry and have a 35-day average collection period? b. If ALei's current accounts receivable collection period is 55 days, how much would it have to reduce its level of accounts receivable in order to achieve its goal of 35 days?arrow_forwardIndiana Jones Adventure Tours has the following year-end data; $775,000 in credit sales, $250,000 in accounts receivable, and a $10,000 debit balance in its allowance for doubtful accounts account. It estimates 6% of its accounts receivable will be uncollectible. During the year, the company writes off a $3,000 uncollectible account. What is the company’s bad debt expense for the year? Group of answer choices $15,000 $28,000 $18,000 $25,000arrow_forwardGalambos Corporation had an average receivables collection period of 19 days in 2003.Galambos has stated that it wants to decrease its collection period in 2004 to match theindustry average of 15 days. Credit sales in 2003 were $300 million, and analysts expectcredit sales to increase to $400 million in 2004. To achieve the company’s goal of decreasing the collection period, the change in the average accounts receivable balance from 2003to 2004 that must occur is closest to:A . –$420,000.B . $420,000.C . $836,000.arrow_forward

- Brady and Sons uses accounts receivable as collateral to borrow money for operations and payroll when revenues are low. If the company borrows $1,950,000 now at a monthly interest rate of 1.5%, but the rate drops to 0.85 percent after 3 months, how much will the company owe after 1 year?arrow_forwardThe following information pertains to Striker Corporation, together with its DSO/ACP of the firms against which it benchmarks. The firm's new CFO believes that the company could reduce its receivables enough to reduce its DSO/ACP to the benchmarks' average. If this were done, by how much would receivables decline? Use a 365-day year. Sales=P110,000; Accounts receivable= P16,000; Days sales outstanding (DSO/ACP)= 53.09; Benchmark days sales outstanding (DSO/ACP)=20.00 * P 8,078 O P 8,975 P 9,973 P10,970 P12,067arrow_forwardDoD Ltd has an annual turnover of Tsh.30 million before taking into account bad debts of Tsh.0.2 million. All sales made by the business are on credit, and, at present, credit terms are negotiable by the customer. On average, the settlement period for trade receivables is 60 days. Trade receivables are financed by an overdraft bearing a 15% rate of interest per year. The business is currently reviewing its credit policies to see whether more efficient and profitable methods could be employed. Only one proposal has so far been put forward concerning the management of trade credit. The credit control department has proposed that customers should be given a 2% cash discount if they pay within 30 days. For those who do not pay within this period, a maximum of 45 days’ credit should be given. The credit department believes that 65% of customers will take advantage of the discount by paying at the end of the discount period, and the remainder will pay at the end of 45 days. The credit…arrow_forward

- A company plans to tighten its credit policy. The new policy will decrease the average number of days in collection from 75 to 50 days and will reduce the ratio of credit sales to total revenue from 70% - 60%. The company estimates that projected sales would be 5% less if the proposed new credit policy is implemented. If projected sales for the coming year are P50 million, calculate the estimated peso change in the firm's account receivable balance caused by this proposed change in credit policy. Assume a 365-day year. [Answer format: INCREASE 1234567]arrow_forwardBulldogs Inc. had credit sales last year amounted to P18,600,000. The firm also had an average accounts receivable balance of P1,380,000. Credit terms are 2/10, n/30. Bulldogs’ average collection period last year was (Use 360-day year) 26.71 days. 27.32 days. 26.22 days. 33.45 days. Which is correct with regards to the effects of restricting credit standards? An increase in recognition of doubtful accounts expense will probably happen Positive impact on the net profit can be noted from decline in the quantity of goods sold Investment in accounts receivable will likely increase Quantity of units sold will probably decrease and will result to a lower sales revenuearrow_forwardAtlantic Northern Inc. currently has $715,000 in accounts receivable and generated $4,650,000 in sales (all on credit) during the year that just ended. The firm’s days sales outstanding (DSO) is days. Use 365 days as the length of a year in all calculations. Atlantic Northern Inc.’s CFO is unhappy with its DSO and wants to improve collections next year. Sales are expected to grow by 13% next year, and the CFO wants to lower the DSO to the industry average of 30 days. How much accounts receivable is the firm expected to carry? $453,471 $431,877 $410,283 $388,689arrow_forward

- A firm's annual credit sales are $171 million, with 49.56% of its daily average paid out in purchases. It usually takes the company 34 days to meet its purchasing obligations. This payment pattern has not changed in recent years. However, the firm's commitment to accounts receivable has shifted based on its current annual net income of $28.6k which meets the 3.44% required return, anticipated by senior management a year earlier. Normally, the firm collects its accounts in 23 days, an average which remains unaffected. Required: In percentage terms, by how much are the firm's receivables greater (or less) than its payables? Note: The term "k" is used to represent thousands (x $1,000). % (ROUND YOUR ANSWER TO 2 DECIMAL PLACES. FOR EXAMPLE: 17.23)arrow_forwardMcKinney & Co. estimates its uncollectible accounts as a percentage of credit sales. McKinney made credit sales of $2,400,000 in 2019. McKinney estimates 2.5% of its sales will be uncollectible At the end of the first quarter of 2020, McKinney & Co. reevaluates its receivables. McKinney's management decides that $7,300 due from Mangold Corporation will not be collectible. This amount was previously included in the allowance account. On April 23, 2020, McKinney & Co. receives a check from Mangold Corporation for $7,300. Required: Prepare the journal entries for McKinney to record the collection of the account previously written offarrow_forwardCampbell Computing Inc. expects to have sales this year of $30 million under its current credit policy. The company offers a credit term of 2/8, net 20. Currently, 60 percent of paying customers take the discount and rest are paying on time. The bad debt loss is 2 percent. The company has a profit margin of 20%, and uses a 5% short-term bank loan to finance its accounts receivables. With 365-day a year assumption, please calculate the following items: a. The bad debt loss of the company this year b. The annual discount given to customers c. The accounts receivables level d. The financing cost of accounts receivablesarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT