Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 21, Problem 17P

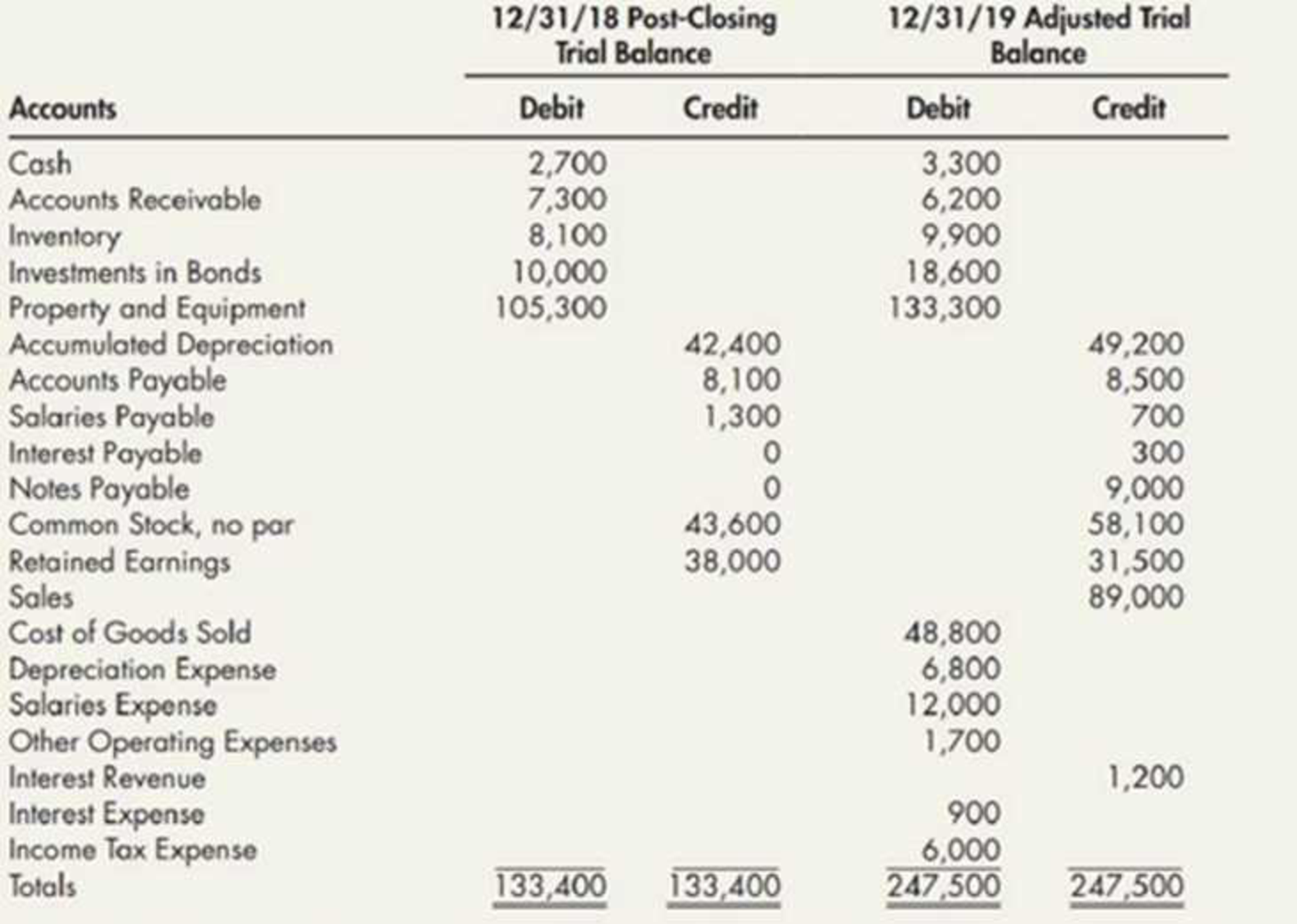

(Appendix 21.1) Comprehensive The following are Adair Company’s December 31, 2018, post-closing

A review of the accounting records reveals the following additional information for 2019:

- Investments in bonds to be held to maturity were purchased at year-end for $8,600.

- A building was purchased for $28,000.

- A note payable was issued for $9,000.

- Common stock was issued for $14,500.

- Dividends of $6,500 were declared and paid.

Required:

- 1. Using the direct method for operating

cash flows , prepare a spreadsheet to support the 2019 statement of cash flows for Adair. - 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Heinz Company’s post-closing trial balance as of December 31, 2018, and the adjusted trial balance as of December 31, 2019, are shown here:

A review of the accounting records reveals the following additional information: a. Bonds payable with a face value, book value, and market value of $14,000 were retired On June 30, 2019. b. Bonds payable with a face value of $8,000 were issued at 90.25 On August 1, 2019. They mature on August 1, 2024. The company uses the straight-line method to amortize the bond discount. c. The company sold a building that had an original cost of $8,000 and a book value of $4,800. The company received $2,200 in cash for the building and recorded a loss of $2,600. d. Equipment with a cost of $4,000 and a book value of $1,400 was exchanged for an acre of land valued at $2,700. No cash was exchanged. e.…

Below are selected transactions for Ink Corporation. Ink Corporation began operations on January 1, 2021 and

has a fiscal year end of December 31*. Prepare journal entries for each transaction.

MUST SHOW ALL YOUR WORK! IF NECESSARY, ROUND AMOUNTS TO NEAREST DOLLAR.

Date

Transaction Description

08/01/2021 Purchased for cash $95,000 of Zarpo, Inc. 12% bonds at 100 plus accrued interest. The bonds

pay interest on August 31* and February 28th.

8/31/2021

Received the semiannual interest payment.

11/30/2021 Sold $45,000 of the bonds at 98 plus accrued interest.

On January 1, 2018, the Apex Company exchanged some shares of common stock it had been holding as aninvestment for a note receivable. The note principal plus interest is due on January 1, 2019. The 2018 incomestatement reported $2,200 in interest revenue from this note and a $6,000 gain on sale of investment in stock. Thestock’s book value was $16,000. The company’s fiscal year ends on December 31.Required:1. What is the note’s effective interest rate?2. Reconstruct the journal entries to record the sale of the stock on January 1, 2018, and the adjusting entry torecord interest revenue at the end of 2018. The company records adjusting entries only at year-end

Chapter 21 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 21 - What information does the statement of cash flows...Ch. 21 - Briefly describe the three types of activities a...Ch. 21 - Thompson Company sold a piece of equipment that...Ch. 21 - Give two examples of a companys (a) cash inflows...Ch. 21 - Prob. 5GICh. 21 - Prob. 6GICh. 21 - Prob. 7GICh. 21 - Prob. 8GICh. 21 - Prob. 9GICh. 21 - List the three operating cash inflows that a...

Ch. 21 - Prob. 11GICh. 21 - Prob. 12GICh. 21 - Prob. 13GICh. 21 - Dunn Company recognized a 5,000 unrealized holding...Ch. 21 - Jordan Company recognized a 5,000 unrealized...Ch. 21 - Indicate how a company computes the amount of...Ch. 21 - Prob. 17GICh. 21 - Prob. 18GICh. 21 - Prob. 19GICh. 21 - Which of the following would be considered a cash...Ch. 21 - In a statement of cash flows (indirect method),...Ch. 21 - The net cash provided by operating activities in...Ch. 21 - The retirement of long-term debt by the issuance...Ch. 21 - Prob. 5MCCh. 21 - Selected information from Brook Corporations...Ch. 21 - Prob. 7MCCh. 21 - Prob. 8MCCh. 21 - Which of the following need not be disclosed in a...Ch. 21 - The following information was taken from Oregon...Ch. 21 - Prob. 1RECh. 21 - Prob. 2RECh. 21 - Given the following information, convert Cardinal...Ch. 21 - Given the following information, convert Robin...Ch. 21 - In the current year, Harrisburg Corporation had...Ch. 21 - Tifton Co. had the following cash transactions...Ch. 21 - Tifton Co. had the following cash transactions...Ch. 21 - Trenton Corporation has the following items....Ch. 21 - Prob. 9RECh. 21 - In the current year, Harrisburg Corporation...Ch. 21 - Providence Company sold equipment for 25,000 cash....Ch. 21 - Annapolis Corporation paid 270,000 to retire bonds...Ch. 21 - Given the following information, compute Lemon...Ch. 21 - Prob. 14RECh. 21 - Prob. 1ECh. 21 - Prob. 2ECh. 21 - Visual Inspection Noble Companys accounting...Ch. 21 - Prob. 4ECh. 21 - Prob. 5ECh. 21 - Prob. 6ECh. 21 - Prob. 7ECh. 21 - Prob. 8ECh. 21 - Partially Completed Spreadsheet Hanks Company has...Ch. 21 - Spreadsheet The following 2019 information is...Ch. 21 - Spreadsheet and Statement The following 2019...Ch. 21 - Fixed Asset Transactions The following is an...Ch. 21 - Retirement of Debt Moore Company is preparing its...Ch. 21 - Interest and Income Taxes Staggs Company has...Ch. 21 - Investments On October 4, 2019, Collins Company...Ch. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Investing Activities and Depreciable Assets...Ch. 21 - Spreadsheet and Statement The following 2019...Ch. 21 - (Appendix 21.1) Operating Cash Flows The following...Ch. 21 - (Appendix 21.1) Statement of Cash Flows The...Ch. 21 - (Appendix 21.1) Visual Inspection The following...Ch. 21 - Prob. 22ECh. 21 - Classification of Cash Flows A company's statement...Ch. 21 - Prob. 2PCh. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Statement of Cash Flows The following is a list of...Ch. 21 - Partially Completed Spreadsheet The following...Ch. 21 - Spreadsheet and Statement of Cash Flows The...Ch. 21 - Prob. 7PCh. 21 - Spreadsheet from Trial Balance Heinz Companys post...Ch. 21 - Prepare Ending Balance Sheet On December 31, 2019,...Ch. 21 - Infrequent Transactions The following transactions...Ch. 21 - Prob. 11PCh. 21 - Comprehensive Angel Company has prepared its...Ch. 21 - Comprehensive The following are Farrell...Ch. 21 - (Appendix 21.1) Operating Cash Flows Refer to the...Ch. 21 - (Appendix 21.1) Statement of Cash Flows The...Ch. 21 - Comprehensive The following are Farrell...Ch. 21 - (Appendix 21.1) Comprehensive The following are...Ch. 21 - Prob. 18PCh. 21 - Financial Statement Interrelationships Prepare an...Ch. 21 - Statement of Cash Flows A friend of yours is...Ch. 21 - Prob. 3CCh. 21 - Operating, Investing, and Financing Activities The...Ch. 21 - Prob. 5CCh. 21 - Spreadsheet Method The spreadsheet method is...Ch. 21 - Prob. 7CCh. 21 - Inflows and Outflows Alfred Engineering Company is...Ch. 21 - Ethics and Cash Flows You are the accountant for...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Refer to the information in RE13-5. Assume that on December 31, 2019, the investment in Smith Corporation bonds has a market value of 12,500. Prepare the year-end journal entry to record the unrealized gain or loss.arrow_forwardRekya Mart Inc. is a general merchandise retail company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Rekya Mart Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?arrow_forwardOn January 1, 2021, the Apex Company exchanged some shares of common stock it had been holding as an investment for a note receivable. The note principal plus interest is due on January 1, 2022. The 2021 income statement reported $2,200 in interest revenue from this note and a $6,000 gain on sale of investment in stock. The stock’s book value was $16,000. The company’s fiscal year ends on December 31.Required:1. What is the note’s effective interest rate?2. Reconstruct the journal entries to record the sale of the stock on January 1, 2021, and the adjusting entry to record interest revenue at the end of 2021. The company records adjusting entries only at year-end.arrow_forward

- Crane Corporation issued 2,100, 9%, 5-year, $1,000 bonds dated January 1, 2020, at 100. Interest is paid each January 1. prepare the adjusting journal entry on December 31, 2020, to record interest expense. what is the account title and explanation? what is debit or credited?arrow_forward) On October 1, 2018, North Co. invested excess cash of $80,000 by purchasing bonds of South Inc. At year-end, December 31, 2018, the market price of the bonds was $77,000. The investment is categorized as a trading debt investment. Journalize the adjusting entry needed at December 31, 2018. Omit explanationarrow_forwardBlackmon Corporation’s December 31, 2018, balance sheet disclosed the following information relating to its receiVables: 1. Prepare the journal entries to record the preceding receivable transactions during 2019 and the necessary adjusting entry on December 31, 2019. Assume a 360-day year for interest calculations and round calculations to the nearest dollar. 2. Prepare the receivables portion of Blackmon’s December 31, 2019, balance sheet. 3. Next Level Compute Blackmon’s accounts receivable turnover in days, assuming a 360-day business year. what is your evaluation of its collection policies? 4. If Blackmon uses IFRS, what might be the heading of the section for the receivables reported in Requirement 2?arrow_forward

- Grocery Corporation received $316,189 for 9.00 percent bonds issued on January 1, 2021, at a market interest rate of 6.00 percent. The bonds had a total face value of $259,000, stated that interest would be paid each December 31, and stated that they mature in 10 years. Required: Prepare the following table for each account by indicating (a) whether it is reported on the Balance Sheet (B/S) or Income Statement (I/S); (b) the dollar amount by which the account increases, decreases, or does not change when Grocery Corporation issues the bonds; and (c) the direction of change in the account [increase, decrease, or no change] when Grocery Corporation records the interest payment on December 31.arrow_forwardCone Corporation is in the process of preparing its December 31, 2021, balance sheet. There are some questions as to the proper classification of the following items: a. $66,000 in cash restricted in a savings account to pay bonds payable. The bonds mature in 2025. b. Prepaid rent of $40,000, covering the period January 1, 2022, through December 31, 2023. c. Notes payable of $232,0o00. The notes are payable in annual installments of $36,000 each, with the first installment payable on March 1, 2022. d. Accrued interest payable of $28,000 related to the notes payable. e. Investment in equity securities of other corporations, $112,000. Cone intends to sell one-half of the securities in 2022. Required: Prepare the asset and liability sections of a classified balance sheet to show how each of the above items should be reported. CONE CORPORATION Balance Sheet (Partial) At December 31, 2021 Assetsarrow_forwardGard Company completes the following transactions related to its short-term debt investments. May 8 Purchased FedEx notes as a short-term investment in available-for-sale securities for $12,975. Sep. 2 Sold part of its investment in FedEx notes for $4,475, which had cost $4,325. Oct. 2 Purchased Ajay bonds for $25,600 as a short-term investment in available-for-sale securities.arrow_forward

- The following information was provided by a company regarding its currently maturing obligations as of December 31, 2021: On December 31, 2021, the company had P1,000,000 short-term notes payable due February 14, 2022. On January 15, 2022, the company issued bonds with a face value of P900,000. The proceeds from the issuance of bond plus additional cash held by the company on December 31, 2021, were used to liquidate the P1,000,000 of short-term notes. A P500,000 notes payable is due on March 15, 2022. On December 31, 2021, the company signed an agreement to borrow up to P500,000 to refinance the notes payable on a long-term basis. The financing agreement called for borrowings not to exceed 80 percent of the value of collateral the company was providing. At the date of issue of the December 31, 2021 financial statements, the value of collateral was P500,000 and was not expected to fall below this amount during 2022. The financial statements of the company were authorized to be issued…arrow_forwardSandhill Corporation's adjusted trial balance contained the following liability accounts at December 31, 2020: Bonds Payable (due in 3 years) $101,750, Accounts Payable $77,800, Notes Payable (due in 90 days) $24,350, Salaries and Wages Payable $4,900, and Income Taxes Payable $8,730. Prepare the current liabilities section of the balance sheet.arrow_forwardThe following section is taken from Oriole Company's balance sheet at december 31, 2021. Current liabilities, Interest payable $87, 750 Long liabilities, Bonds payable, 5% due january 1, 2024 1,755,000. Bond interest ispayable annually on January 1. The bonds are callable on any interest date. Prepare the entry to record the accrual of interest on December 31, 2022arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY