Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 34P

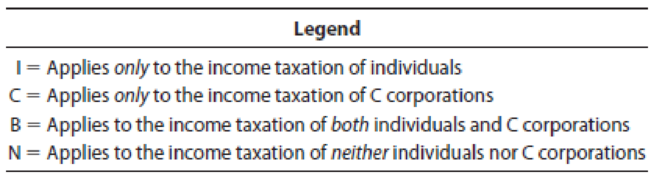

LO.3, 4, 5 Using the legend provided below, classify each statement under 2019 tax law.

- a. A foreign tax credit is available.

- b. The deduction of charitable contributions is subject to percentage limitation(s).

- c. Excess charitable contributions can be carried forward for five years.

- d. On the contribution of inventory to charity, the full amount of any appreciation can be claimed as a deduction.

- e. Excess capital losses can be carried forward indefinitely.

- f. Excess capital losses cannot be carried back.

- g. A net short-term

capital gain is subject to the same tax rate as ordinary income. - h. The deduction for qualified business income may be available.

- i. A dividends received deduction is available.

- j. The like-kind exchange provisions of § 1031 are available.

- k. A taxpayer with a fiscal year of May 1–April 30 has a due date for filing a Federal income tax return of July 15.

- l. Estimated Federal income tax payments may be required.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

27. Which of the following is a

type of regular income tax

a. Individual Income tax

b. Corporate Income Tax

c. Mixed Earner Income Tax

O d. Both A and B

28. A taxpayer using GAAP cash -

basis on a calendar year shall

compute the taxable income

using *

a. Tax cash basis on a calendar year

b. Tax cash basis on a fiscal year

c. Tax accrual basis on a calendar

year

d. Tax accrual basis on a fiscal year

Hw.67.

X corporation, an accrual basis taxpayer wishes to adopt the cash basis method for 2022. At the endof 2021, X has accounts receivable of 10,000 and accrued expenses of 8,000. Assume these amountssettle (are paid) in 2022. Assuming the IRS grants consent, what amounts are reflected on X’s taxreturns for 2021 and 2022 based on just these facts?

Answer whether each statement is True or False

1.Amounts withdrawn from deposit accounts of a decedent subjected to the 6% final withholding tax shall be included in the gross estate for estate tax purposes.

2. Transfer taxes provide income to the government.

3. It is possible that a transfer may be inter vivos in form but mortis causa in substance.

4. A power of appointment is the right to designate the person or persons who shall succeed to the property of a prior decedent.

5. A special power of appointment authorizes the donee of the power to appoint only from among a designated class or group of persons other than himself.

6. The donee-decedent of a special power of appointment only holds the property in trust; hence, the property shall form part of the donee-decedent's gross estate.

7. The designation of beneficiary in a life insurance is irrevocable unless expressly stated as revocable.

8. An insolvent person is one whose liabilities exceed his assets.

9. Only the property…

Chapter 20 Solutions

Individual Income Taxes

Ch. 20 - Prob. 1DQCh. 20 - LO.1 Sylvia and Trang want to enter into business...Ch. 20 - Prob. 3DQCh. 20 - Prob. 4DQCh. 20 - Prob. 5DQCh. 20 - LO.3, 4, 5 Contrast the income taxation of...Ch. 20 - LO.3, 8, 9 The taxpayer has generated excess...Ch. 20 - Prob. 8DQCh. 20 - Prob. 9DQCh. 20 - Prob. 10DQ

Ch. 20 - Prob. 11DQCh. 20 - Prob. 12DQCh. 20 - Prob. 13DQCh. 20 - Prob. 14DQCh. 20 - LO.5 Beige Corporation has a fiscal year ending...Ch. 20 - Prob. 16DQCh. 20 - Prob. 17DQCh. 20 - Prob. 18DQCh. 20 - Prob. 19DQCh. 20 - Prob. 20DQCh. 20 - Prob. 21DQCh. 20 - Blaine, Cassie, and Kirstin are equal partners in...Ch. 20 - LO.3 Green Corporation, a calendar year taxpayer,...Ch. 20 - Prob. 24CECh. 20 - Prob. 25CECh. 20 - LO.4 Gold and Silver are two unrelated calendar...Ch. 20 - Prob. 27CECh. 20 - Prob. 28CECh. 20 - Prob. 29CECh. 20 - Prob. 30CECh. 20 - Prob. 31CECh. 20 - Prob. 32CECh. 20 - Prob. 33CECh. 20 - LO.3, 4, 5 Using the legend provided below,...Ch. 20 - LO.3 Garnet incurs the following capital asset...Ch. 20 - Prob. 36PCh. 20 - LO.3 Taupe, a calendar year taxpayer, has a...Ch. 20 - LO.3, 8 Robin incurred the following capital...Ch. 20 - Prob. 39PCh. 20 - Prob. 40PCh. 20 - Prob. 41PCh. 20 - Prob. 42PCh. 20 - Prob. 43PCh. 20 - Prob. 44PCh. 20 - Prob. 45PCh. 20 - Prob. 46PCh. 20 - Prob. 47PCh. 20 - Prob. 48PCh. 20 - Prob. 49PCh. 20 - Prob. 50PCh. 20 - During the current year, Thrasher (a calendar...Ch. 20 - Prob. 52PCh. 20 - Prob. 53PCh. 20 - Prob. 54PCh. 20 - Prob. 55PCh. 20 - LO.9 The Pheasant Partnership reported the...Ch. 20 - Prob. 57PCh. 20 - Prob. 58PCh. 20 - Prob. 59PCh. 20 - Prob. 1RPCh. 20 - Prob. 2RPCh. 20 - Prob. 3RPCh. 20 - Prob. 5RPCh. 20 - On January 1, year 5, Olinto Corp., an accrual...Ch. 20 - Prob. 2CPACh. 20 - Prob. 3CPACh. 20 - Prob. 4CPACh. 20 - Prob. 5CPACh. 20 - Prob. 6CPACh. 20 - Prob. 7CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on its estimated state income tax for the year. During 2019, the company received a 4,000 refund upon filing its 2018 state income tax return. The company filed its 2019 state income tax return in August 2020 and paid the 7,000 state income tax due for 2019. In December 2019, the company received a notice from the state tax commission that an additional 6,000 of income tax was due for 2017 because of an error on the return. The company acknowledged the error in December 2019 and paid the additional 6,000 in tax in February 2020. What is Ospreys 2019 Federal income tax deduction for state income taxes?arrow_forwardConsider the following accounts and determine if the account is a current liability, a noncurrent liability, or neither. A. cash B. federal income tax payable this year C. long-term note payable D. current portion of a long-term note payable E. note payable due in four years F. interest expense G. state income taxarrow_forwardHow do the all events and economic performance requirements apply to the following transactions by an accrual basis taxpayer? a. The company guarantees its products for six months. At the end of 2019, customers had made valid claims for 600,000 that were not paid until 2020. Also, the company estimates that another 400,000 in claims from 2019 sales will be filed and paid in 2020. b. The accrual basis taxpayer reported 200,000 in corporate taxable income for 2019. The state income tax rate was 6%. The corporation paid 7,000 in estimated state income taxes in 2019 and paid 2,000 on 2018 state income taxes when it filed its 2018 state income tax return in March 2019. The company filed its 2019 state income tax return in March 2020 and paid the remaining 5,000 of its 2019 state income tax liability. c. An employee was involved in an accident while making a sales call. The company paid the injured victim 15,000 in 2019 and agreed to pay the victim 15,000 a year for the next nine years.arrow_forward

- In 2019, what is the top tax rate for individual long-term capital gains and the top tax rate for long-term capital gains of collectible items assuming that the Medicare tax does not apply. 10; 20 20; 28 15; 25 25; 28arrow_forwardLO.2 Oak Corporation has the following general business credit carryovers. If the general business credit generated by activities during 2019 equals 36,000 and the total credit allowed during the current year is 60,000 (based on tax liability), what amounts of the current general business credit and carryovers are utilized against the 2019 income tax liability? What is the amount of unused credit carried forward to 2020?arrow_forwardCalculate the amount of the child and dependent care credit allowed before any tax liability limitations or other credits for 2021 in each of the following cases, assuming the taxpayers had no income other than the stated amounts. TABLE 6.1 CHILD AND DEPENDENT CARE CREDIT PERCENTAGES Adjusted Gross Income Applicable Percentage Over But Not Over $0 – $15,000 35% 15,000 – 17,000 34% 17,000 – 19,000 33% 19,000 – 21,000 32% 21,000 – 23,000 31% 23,000 – 25,000 30% 25,000 – 27,000 29% 27,000 – 29,000 27% 29,000 – 31,000 27% 31,000 – 33,000 26% 33,000 – 35,000 25% 35,000 – 37,000 24% 37,000 – 39,000 23% 39,000 – 41,000 22% 41,000 – 43,000 31% 43,000 – No limit 20% Question Content Area a. William and Carla file a joint tax return. Carla earned $27,500 during the year, while William attended law school full-time for 9 months and earned no income. They paid $3,500 for the care of…arrow_forward

- 1. Firm B uses the calendar taxable year and the cash method of accounting. On December 31, 20x6, Firm B made certain cash payments. To what extent can it deduct the payment in 20x6? (Please note: payments for assets to be consumed in the following year are fully deductible in the 12 months or less and is consumed by the end of the following year.) year of payment if the expenditure results in a benefit with a duration of a) $3,000 compensation to a consultant who spent three weeks in January 20x7 analyzing B's internal control system. b) $500,000 to purchase a new piece of commercial real estate. The equipment was delivered on January 8, 20x7 and has a useful life of 40 years. c) $16,900 property tax to the local government for the first six months of 20x7. d) $50,000 for a two-year lease beginning on February 1, 20x7.arrow_forwardA resident citizen has the following data in 2022:Gross receipts from services, P800,000Cost of services, P200,000Long term capital gain, P15,000Short term capital loss, P5,000Dividend from a domestic corporation, P15,000Interest income from bank deposits, P10,000Operating expenses, P20,000Assuming the taxpayer chooses optional standard deduction, how much is the taxable income? Choices P486,000 P500,000 P364,500 P482,500arrow_forwardA resident citizen has the following data in 2022:Gross receipts from services, P800,000Cost of services, P200,000Long term capital gain, P15,000Short term capital loss, P5,000Dividend from a domestic corporation, P15,000Interest income from bank deposits, P10,000Operating expenses, P20,000Assuming the taxpayer chooses optional standard deduction, how much is the taxable income? a. P500,000 b. P482,500 c. P364,500 d. P486,000arrow_forward

- 3. Mr. So filed his 2022 income tax return on June 30, 2023. The BIR discovered a deficiency income tax on August 15, 2024. When should the deficiency tax assessment be served? a. On or before August 15, 2027 b. On April 15, 202 c. On or before June 30, 2026 d. On or before April 15, 2026arrow_forwardHow much is the deferred tax liability at December 31,2019 and the total income tax expense, respectively? A. P 33,000 and P 1,352,500 B. P 30,000 and P 372,690 C. P 30,000 and P 1,352,500 D. P 33,000 and P 372,690arrow_forwardSelf-Study Problem 2.13 A taxpayer (payor ex-spouse) is required to pay an ex-spouse (recipient ex-spouse) alimony of $12,000 per year. Determine how much alimony is deductible by the payor ex-spouse and how much alimony is recognized as income by the recipient ex-spouse based on the following information: If an answer is zero, enter "0". Details a. The payments are made in 2021 as part of a divorce decree executed in 2018. The divorce decree is modified in 2021 to explicitly apply the provisions of the TCJA. b. The payments are made in 2021 as part of a divorce decree executed in 2016. c. The payments are made in 2021 as part of a divorce decree executed in 2021. Deductible by payor Includable by recipient 00 00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License