Chapter 11 Reorganization

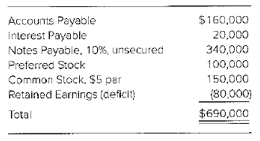

During the recent recession, Polydorous Inc. accumulated a deficit in

A plan of reorganization is filed with the court, which approves it after review and obtaining creditor and investor votes. The plan of reorganization includes the following actions:

1. The prepetition accounts payable will be restructured according to the following: (a) $40,000 will be paid in cash, (b) $20,000 will be eliminated, and (c) the remaining $100,000 will be exchanged for a five-year, secured note payable paying 12 percent interest.

2. The interest payable will be restructured as follows: elimination of $10,000 of the interest and payment of the remaining $10,000 in cash.

3. The 10 percent, unsecured notes payable will be restructured as follows: (a) $60,000 of them will be eliminated, (b) $10,000 of them will be paid in cash, (c) $240,000 of them will be exchanges for a five-year, 12 percent secured note, and (d) the remaining $30,000 will be exchanged for 3,000 shares of newly issued common stock having a par value of $10.

4. The preferred shareholder will exchange their stock for 5,000 shares of newly issued $10 par common stock.

5. The common shareholder will exchange their stock for 2,000 shares of newly issued $10 common stock.

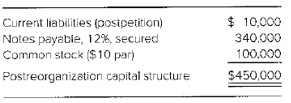

After extensive analysis, the company's reorganization value is determined to be $510,000 prior to any payments of cash required by the reorganization plan. An additional $10,000 in current liabilities have been incurred since the petition was filed. After the reorganization is completed, the capital structure of the company will be as follows:

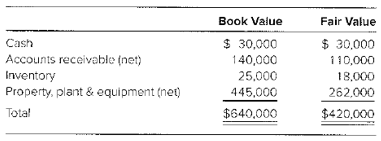

An evaluation of the assets' fair values was made after the company completed its reorganization, immediately prior to the point the company emerged from the proceedings. The following information is available:

Required

a. Prepare a plan of reorganization recovery analysis for the stockholders' equity accounts of Polydorous Inc. on the day plan of reorganization is approved. (Hint: The liabilities on the plan's approval are $530,000, which is $520,000 from prepetition payables plus $10,000 in additional accounts incurred postpetition.)

b. Prepare an analysis showing whether the company qualifies for fresh start accounting as it emerges from the reorganization.

c. Prepare

d. Prepare the

a

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs. It allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

A plan of reorganization recovery analysis for the liabilities and stockholders’ equity

Answer to Problem 20.6P

Pre-petition liabilities $520,000 and equity $700,000

Explanation of Solution

| Recovery | |||||||||

| Pre-confirmation ($) | Elimination of debt & equity ($) | Surviving debt ($) | Cash ($) | 12%Secured Notes ($) | Common% | Stock value ($) | Total($) | Recovery % | |

| Post − petition liabilities | (10,000) | (10,000) | (10,000) | 100 | |||||

| Claims/ Interest: | |||||||||

| Accounts payable | (160,000) | 20,000 | (40,000) | (100,000) | (140,000) | 88 | |||

| Interest payable | (20,000) | 10,000 | (10,000) | (10,000) | 50 | ||||

| Notes payable 10% | (340,000) | 60,000 | (10,000) | (240,000) | 30 | (30,000) | (280,000) | 82 | |

| Total | (520,000) | 90,000 | |||||||

| Preferred shareholders | (100,000) | 50,000 | 50 | (50,000) | (50,000) | ||||

| Common shareholders | (150,000) | 130,000 | 20 | (20,000) | (20,000) | ||||

| Retained earnings deficit | 80,000 | (80,000) | |||||||

| Total | (700,000) | 190,000 | (10,000) | (60,000) | (340,000) | 100% | (100,000) | (510,000) | |

b

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs. It allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

The analysis showing whether the company qualifies for fresh start accounting as it emerges from the reorganization.

Answer to Problem 20.6P

The analysis shows that company qualifies for the fresh start accounting as it emerges from reorganization.

Explanation of Solution

First condition for fresh start:

| Post-petition liabilities | $10,000 |

| Liabilities deferred pursuant to chapter 11 | 520,000 |

| Total post-petition liabilities and claims | $530,000 |

| Reorganization value | (520,000) |

| Excess of liabilities over reorganization value | $20,000 |

Second condition:

Holders of existing voting shares immediately before confirmation receive 20% of voting shares of emerging entity.

Therefore, both conditions for a fresh start occur, and fresh start accounting is used to account for the company.

c

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs, it allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

The entries for execution of the plan of reorganization with its general restructuring of debt and capital.

Explanation of Solution

| Particulars | Debit $ | Credit $ |

| Liabilities subjected to compromise | 520,000 | |

| Cash | 60,000 | |

| Notes payable | 340,000 | |

| Common stock | 30,000 | |

| Gain on debt discharge | 90,000 | |

| (Recognition of debt discharge) | ||

| Preferred stock | 100,000 | |

| Common stock old | 150,000 | |

| Common stock new | 70,000 | |

| Additional paid-in capital | 180,000 | |

| (Recording of exchange of stock) | ||

| Reorganization value in excess of amounts | ||

| Allocation to identifiable assets | 30,000 | |

| Gain on debt discharge | 90,000 | |

| Additional paid-in capital | 180,000 | |

| Accounts receivable | 30,000 | |

| Inventory | 7,000 | |

| Property, plant, and equipment | 183,000 | |

| Retained earnings deficit | 80,000 | |

| (Record fresh start accounting and elimination of deficit) |

Schedule to support allocation of reorganization value:

| Book value | Fair value | difference | |

| Cash | $30,000 | $30,000 | 0 |

| Accounts receivable | 140,000 | 110,000 | (30,000) |

| Inventory | 25,000 | 18,000 | (7,000) |

| Property, plant and equipment | 445,000 | 262,000 | (183,000) |

| Reorganization value in excess of amounts allocable to identifiable assets | 0 | 30,000 | 30,000 |

| Total | $640,000 | $450,000 | $(190,000) |

d

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs, it allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

The balance sheet for the company on completion of the plan of reorganization.

Answer to Problem 20.6P

Balance sheet total as per balance sheet $450,000

Explanation of Solution

Note showing effect of plan of reorganization balance sheet:

| Pre-confirmation $ | Adjustments | Re-organized balance sheet $ | |||

| DebtDischarge $ | Exchange of Stock $ | FreshStart $ | |||

| Assets: | |||||

| Cash | 90,000 | (60,000) | 30,000 | ||

| Accounts receivable | 140,000 | (30,000) | 110,000 | ||

| Inventory | 25,000 | (7,000) | 18,000 | ||

| 255,000 | (60,000) | 0 | (37,000) | 158,000 | |

| Property, plant & equipment | 445,000 | (183,000) | 262,000 | ||

| Reorganization value in Excess amount allocated to identifiable assets | 30,000 | 30,000 | |||

| Total assets | 700,000 | (60,000) | 0 | (190,000) | 450,000 |

| Liabilities: | |||||

| Not subjected to compromise: | |||||

| Current liabilities | (10,000) | (10,000) | |||

| Subjected to compromise | (520,000) | 520,000 | |||

| Notes payable | (340,000) | (340,000) | |||

| Total liabilities | (530,000) | 180,000 | 0 | 0 | (350,000) |

| Shareholders’ equity | |||||

| Preferred stock | (100,000) | 100,000 | |||

| Common stock old | (150,000) | 150,000 | |||

| Common stock new | (30,000) | (70,000) | (100,000) | ||

| Additional paid-in capital | (180,000) | 180,000 | |||

| Retained earnings | 80,000 | (90,000) | 90,000 | ||

| (80,000) | 0 | ||||

| Total Liabilities and Equity | (700,000) | 60,000 | 190,000 | (450,000) | |

P Company

Balance sheet

| $ | |

| Assets: | |

| Cash | 30,000 |

| Accounts receivable | 110,000 |

| Inventory | 18,000 |

| Total current assets | 158,000 |

| Property, plant and equipment | 262,000 |

| Reorganization value | 30,000 |

| Total assets | 450,000 |

| Liabilities: | |

| Accounts payable | 10,000 |

| Notes payable | 340,000 |

| Total liabilities | 350,000 |

| Shareholders’ equity: | |

| Common stock | 100,000 |

| Total liabilities and shareholders’ equity | 450,000 |

Want to see more full solutions like this?

Chapter 20 Solutions

Advanced Financial Accounting

Additional Business Textbook Solutions

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

INTERMEDIATE ACCOUNTING

Cost Accounting (15th Edition)

Managerial Accounting: Tools for Business Decision Making

Managerial Accounting (5th Edition)

Financial Accounting (12th Edition) (What's New in Accounting)

- Barber Technologies designs and develops software to be used for the management of inventory by both retailers and manufacturing firms. Over the past three years, the company has experienced significant competition and a declining market resulting in a significant deficit in retained earnings. In response to this condition, you have suggested that management consider the following: a. Recognize all asset impairments.b. Restructure the long-term debt by committing to make future payments that are less than the basis of the original debt.c. Adjust the par value of common stock to eliminate the deficit in retained earnings. Discuss how the above actions will likely affect: 1. The current ratio, debt-to-equity ratio, and return on equity. 2. The determination of net income in subsequent periods.arrow_forward1. A company is insolvent when Select one: a.it is in default on one-third or more of its outstanding debt obligations. b.it is unable to pay debts within 90 days following the close of the company's reporting year, whether such year is a calendar or fiscal year. c.it is unable to pay debts as the obligations come due. d.it is more likely than not that it will not be able to pay debts within a reasonable period of time following the date such obligations become due. e.it is unable to timely remit payments on more than two-thirds of its outstanding obligations measured on a rolling three-month basis. 2.The statement of financial affairs is prepared Select one: a.in order to bring clarity to the "liquidate or reorganize" decision. b.under the assumption that liquidation will occur. c.Under the going concern assumption. d.as the final statement produced in any liquidation or reorganization scenario. e.Both a) and b) are correct. 3. A Chapter 7 bankruptcy is a(n)…arrow_forwarde. Of the following, the most significant risk factor relating to the risk of misstatement arising from fraudulent financial reporting for SSC is that: Multiple Choice Company officers serve on the board of directors. The company must refinance a significant portion of its debt. The company operates in the Bisbee, Arizona, area. The company paid no dividend this year. Untitled docume...pdf Untitled docume....pdf docx Presentation se....pdf Untitled docume...pdf 身arrow_forward

- ABC Company filed a bankruptcy this month because of the impact of fraudulent act committed by its financial officer. The financial officer transfers the companies fund to his personal account. Which statement is related in this scenario? O a. Employee safety issues O b. Use of Corporate resources O c. Personal issues d. Conflicts of interestarrow_forwardAn example of a Type I subsequent event would be A. a sudden change in senior management after the financial statement date B. a filing with the Securities and Exchange Commission (SEC) of an amended form 10K after the financial statement date C. the bankruptcy of a client’s customer after year-end as a result of poor financial condition that existed as of the balance sheet date D. the bankruptcy of a client’s customer after year-end as a result of poor financial condition that existed after the balance sheet datearrow_forwardStatement of Affalrs and Deficiency Account Miner Company is being forced into bankruptcy. The company's creditors and stockholden have requested an estimate of the results of a liquidation of the cómpany. Miner's trial balgne follows: Debit P 6,000 63,000 Accounts Credit Cash.. Accounts receivable. Allowance for bad debts. Notes Receivable Accrued Interest on Notes Receivable, Inventory. Buildings.. ACcumulated Depreciation-Buildings. Equipment... ACcumulated Depreciation-Equipment. Prepaid insurance.. Goodwill Accrued Wages-with Priority. Taxes Payable-with Priority. Accounts Payable. P 2,000 Y 50,000 9011200 60,000 182,000 63.000 14,600 1,400 1,100 8,500 6,000 2,400arrow_forward

- Assume that Kingbird Company has recently fallen into financial difficulties. By reviewing all available evidence on December 31, 2025, one of Kingbird's creditors, the National American Bank, determined that Kingbird would pay back only 65% of the principal at maturity. As a result, the bank decided that the loan was impaired. If the loss is estimated to be $242,200. What entry should National American Bank make to record this loss? (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry.) Date Dec. 31, 2025 Account Titles and Explanation Debit Creditarrow_forwardAssume that Toni Braxton Company has recently fallen into financial difficulties. By reviewing all available evidence on December 31, 2017. one of Toni Braxton's creditors, the National American Bank, determined that Tonì Braxton would pay back only 65% of the principal at maturity. As a result, the bank decided that the loan was impaired. if the loan is estimated to be $225,000 what entry should National American Bank make to record this loss? Bad Debt Expense 225,000 Allowance for Doubtful Accounts 225,000 Bad Debt Expense 146,250 Allowance for Doubtful Accounts 146,250arrow_forward450 000 Bad Debts A company does not adjust its accounts receivable by estimating bad debts at the end of the fiscal period. It uses a method called direct write-off. With this method accounts receivable are written off when they are determined to be uncollectible For example, on January 31, 20-2, a debt of $1500 was determined to be uncol. lectible because the customer, P. Kully, had declared bankruptcy. The sale of $1500 had been made in the previous fiscal period. This entry was made on January 31, 20-2: Jan. 31 Bad Debts Expense 150000 Accounts Receivable/P. Kully To write off account of bankrupt customer. 150000 Questions 1. How does the fact that an adjustment for estimated bad debts was not made in 20-1 affect the financial statements for that year? 2. How does the write-off entry affect the financial statements of 20-2?arrow_forward

- Pleasearrow_forwardMiner Company is being forced into bankruptcy. The Company's creditors and stockholders have requested an estimate of the results of liquidation of the Company. Miner's trial balance follows: Accounts Cash Debit Credit P6,000 63,000 Accounts receivable Allowance for bad debts P2,000 Notes receivable 50,000 1,200 Accrued interest on notes receivable Inventory Buildings Accumulated depreciation-Buildings Equipment Accumulated depreciation-Equipment Prepaid insurance 60,000 182,000 63,000 14,600 1,400 1,100 Goodwill 8,500 Accrued wages 6,000 2,400 170,000 80,000 1,600 Taxes payable Accounts payable and other liabilities Notes payable Accrued interest payable Common stock 110,000 Retained earnings (deficit) 50,000 Total P436,400 P436,400 The assets are expected to bring cash on conversion in the following amounts Accounts receivable P50,000 40,800 Notes receivable including P1,000 accrued interest Building 75,000 Prepaid insurance 400arrow_forwardQuestion 4: Case Study The Enron scandal, revealed in October 2001, eventually led to the bankruptcy of the Enron Corporation, an American energy company based in Houston, Texas, and the de facto (complete) dissolution of Arthur Andersen, which was one of the five largest audit and accountancy partnerships in the world. In addition to being the largest bankruptcy reorganization in American history at that time, Enron was attributed as the biggest audit failure. Enron's auditor firm, Arthur Andersen, was accused of applying reckless standards in its audits because of a conflict of interest over the significant consulting fees generated by Enron. During 2000, Arthur Andersen earned $25 million in audit fees and $27 million in consulting fees from Enron. Enron hired numerous Certified Public Accountants as well as accountants who had worked on developing accounting rules with the Financial Accounting Standards Board. The accountants searched for new ways to save the company money,…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning