Steve and Linda Hom live in Bartlesville, Oklahoma. Two years ago, they visited Thailand. Linda, a professional chef, was impressed with the cooking methods and the spices used in Thai food. Bartlesville does not have a Thai restaurant, and the Homs are contemplating opening one. Linda would supervise the cooking, and Steve would leave his current job to be the maître d’. The restaurant would serve dinner Tuesday through Saturday.

Steve has noticed a restaurant for lease. The restaurant has seven tables, each of which can seat four. Tables can be moved together for a large party. Linda is planning on using each table twice each evening, and the restaurant will be open 50 weeks per year.

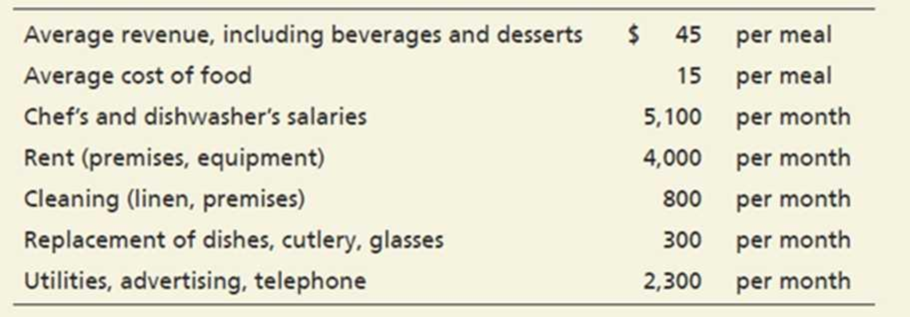

The Homs have drawn up the following estimates:

Requirements

- 1. Compute the annual breakeven number of meals and sales revenue for the restaurant.

- 2. Compute the number of meals and the amount of sales revenue needed to earn operating income of $75,600 for the year.

- 3. How many meals must the Homs serve each night to earn their target profit of $75,600?

- 4. What factors should the Homs consider before they make their decision as to whether to open the restaurant?

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Cost Accounting (15th Edition)

Managerial Accounting

Financial Accounting (12th Edition) (What's New in Accounting)

Construction Accounting And Financial Management (4th Edition)

Advanced Financial Accounting

Accounting for Governmental & Nonprofit Entities

- One of Natalie’s friends, Curtis Lesperance, runs a coffee shop where he sells specialty coffees and prepares and sells muffins and cookies. He is eager to buy one of Natalie’s fine European mixers, which would enable him to make larger batches of muffins and cookies. However, Curtis cannot afford to pay for the mixer for at least 30 days. He asks Natalie if she would be willing to sell him the mixer on credit. Natalie comes to you for advice. She asks the following questions. “Curtis has given me a set of his most recent financial statements. What calculations should I do with the data from these statements, and what questions should I ask him after I have analyzed the statements? How will this information help me decide if I should extend credit to Curtis?” “Is there an alternative other than extending credit to Curtis for 30 days?” “I am thinking seriously about being able to have my customers use credit cards. What are some of the advantages and disadvantages of letting my…arrow_forwardAngela Fox and Zooey Caulfield were food and nutrition majors at State University, as well as close friends and roommates. Upon graduation Angela and Zooey decided to open a French restaurant in Draperton, the small town where the university was located. There were no other French restaurants in Draperton, and the possibility of doing something new and somewhat risky intrigued the two friends. They purchased an old Victorian home just off Main Street for their new restaurant, which they named “The Possibility.” Angela and Zooey knew in advance that at least initially they could not offer a full, varied menu of dishes. They had no idea what their local customers’ tastes in French cuisine would be, so they decided to serve only two full-course meals each night, one with beef and the other with fish. Their chef, Pierre, was confident he could make each dish so exciting and unique that two meals would be sufficient, at least until they could assess which menu items…arrow_forwardAnn and Gilbert are recent graduates. One graduated with a Business degree and the other with a Culinary Arts degree. They have settled in their home town and are exploring opening a new restaurant. The town only has a few restaurants to compete with and they are eager to take a modern twist on old favorites. A new corporation has opened nearby and there is an influx of new people moving into town. Ann has noticed a restaurant for lease. The restaurant would serve dinner Tuesday through Saturday. The restaurant has 10 tables each of which can seat four. The tables can be moved together to seat larger groups. The Couple is planning two seatings per evening. They plan to be open 50 weeks per year. Anne and Gilbert would like to earn a net income of 75,000. WAL Below is an estimate of expenses Average Revenue per meal Averaget Cost of food Salaries of all staff Rent Cleaning utilities 20.00 per meal 9.25 per meal 4,150.00 per month 800.00 per month 300.00 per month 1,000.00 per month 1.…arrow_forward

- Mary Helu and Jason Haynes recently graduated from the same university. After graduation they decided not to seek jobs at established organizations but, rather, to start their own small business hoping they could have more flexibility in their personal lives for a few years. Mary's family has operated Mexican restaurants and taco-trucks for the past two generations, and Mary noticed there were no taco-truck services in the town where their university was located. To reduce the amount they would need for an initial investment, they decided to start a business operating a taco-cart rather than a taco-truck, from which they would cook and serve traditional Mexican-styled street food. They bought a used taco-cart for $18,000. This cost, along with the cost for supplies to get started, a business license, and street vendor license brought their initial expenditures to $22,000. They took $5,000 from personal savings they had accumulated by working part time during college, and they borrowed…arrow_forwardStaci Valek began dabbling in pottery several years ago as a hobby. Her work is quite creative, and it hasbeen so popular with friends and others that she has decided to quit her job with an aerospace company andmanufacture pottery full time. The salary from Staci’s aerospace job is $3,800 per month.Staci will rent a small building near her home to use as a place for manufacturing the pottery. Therent will be $500 per month. She estimates that the cost of clay and glaze will be $2 for each finishedpiece of pottery. She will hire workers to produce the pottery at a labor rate of $8 per pot. To sell herpots, Staci feels that she must advertise heavily in the local area. An advertising agency states that it willhandle all advertising for a fee of $600 per month. Staci’s brother will sell the pots; he will be paid acommission of $4 for each pot sold. Equipment needed to manufacture the pots will be rented at a costof $300 per month.Staci has already paid the legal and filing fees…arrow_forwardIn January 2006, Mary Jane Bowers was reviewing her plans for the April 1 opening of a garden center in Lynchburg, Virginia. She had selected Lynchburg as the town for a new home, after deciding to leave the large, northern city where she had both worked for the past 10 years. Bowers had a degree in horticulture and had worked for a large chemical company in its agricultural- herbicide division. Along with the decision to move, Bowers decided to change her work status as well. She wanted to devote her working days to something she enjoyed and was passionate about. Thus, she decided to go into business for herself, starting a retail garden store selling plants, trees, and shrubs. Bowers accumulated information on upscale retail garden stores from a number of sources, talked to suppliers, looked at potential locations, and established a banking relationship with the Campbell National Bank. She wanted to make sure that she had enough money to get the business off to a good start. Mary…arrow_forward

- In January 2006, Mary Jane Bowers was reviewing her plans for the April 1 opening of a garden center in Lynchburg, Virginia. She had selected Lynchburg as the town for a new home, after deciding to leave the large, northern city where she had both worked for the past 10 years. Bowers had a degree in horticulture and had worked for a large chemical company in its agricultural herbicide division. Along with the decision to move, Bowersdecided to change her work status as well. She wanted to devote her working days to something she enjoyed and was passionate about. Thus, she decided to go into business for herself, starting a retail garden store selling plants, trees, and shrubs. Bowers accumulated information on upscale retail garden stores from a number of sources, talkedto suppliers, looked at potential locations, and established a banking relationship with the Campbell National Bank. She wanted to make sure that she had enough money to get thebusiness off to a good start. Mary Jane…arrow_forwardHow Is He Doing? Ted Mohr had worked as a mid-level manager for a large retail chain with a regional headquarters in Fairfield County, Connecticut. For over fifteen years he had commuted on I95, and worried that too much of his family time was spent in traffic jams. Two years ago he acted on one of his dreams and relocated to New Hampshire to open a restaurant and novelty shop. The shop had been in its current location for over twelve years and had achieved a reputation for service and a wide range of tourist novelties. Ted ran the operations of the store, and his wife handled all the office and administrative functions. In the past year he had withdrawn $35,000 from the business for living expenses. During next year’s slow season he hoped that he and his wife would be able to take at least four weeks as a vacation. At a business luncheon a professor from the local university spoke about the university’s offer to help small businesses in the state with free consulting from its…arrow_forwardHeriot and Watt are planning to open a small shop selling lunch boxes, which they will prepare on the premises. After experimenting for some weeks Heriot and Watt have arrived at two possible lunch box sets, which they think will be popular: Lunch Box A and Lunch Box B. As they can only prepare one lunch box on the premises, they need to decide, which one to choose. The following information is available: You are tasked to help Heriot and Watt to make their decision and provide the information below: (a) What is the break-even point for both options? (b) What profit would the expected sales of each option achieve? (c) How many boxes of each option would Heriot and Watt have to sell if they wanted to achieve a profit of £800. (d) Heriot and Watt are considering a selling price increase of 10% for both lunch box options. How many boxes of each option would they have to sell to achieve a target profit of £900? (e) Based on the information calculated above (a – d) explain, which…arrow_forward

- Sally works as a manager in the gardening section of her local Bunnings Store. Recently, Sally was approached by a customer asking questions about the store's range of built-in kitchens. Although she knew nothing about the products, Sally recommended the deluxe kitchen package which came with free installation. After completing the sale, Sally handed the customer her Bunnings business card (which identified her as a manager), explained that the customer should get his new kitchen professionally installed and to forward her the 3 party's invoice- which Bunnings would pay. A few weeks later, the customer is shocked to learn that Bunnings is refusing to pay his carpenter's $10,000 invoice and that Sally failed to mention that the offer was capped at $500. Required: a) With reference to Pacific Cariers v Paribas, what is the test for deciding if an agent had apparent authority? b) Analyse whether Sally had apparent authority to bind Bunnings Pty Ltd to this $10,000 contract. C) How would…arrow_forwardMaria Gutierrez and Devin Cuncan recently graduated from the same university. After graduation they decided not to seek jobs at established organizations but, rather, to start their own small business hoping they could have more flexibility in their personal lives for a few years. Maria's family has operated Mexican restaurants and taco trucks for the past two generations, and Maria noticed there were no taco truck services in the town where their university was located. To reduce the amount they would need for an initial investment, they decided to start a business operating a taco cart rather than a taco truck, from which they would cook and serve traditional Mexican-style street food. They bought a used taco cart for $17,000. This cost, along with the cost for supplies to get started, a business license, and street vendor license brought their initial expenditures to $23,000. They withdrew $4,000 from personal savings they had accumulated by working part time during college, and…arrow_forwardHere is my situation. I currently own a heating and cooling business here in Indianapolis. I'm thinking about opening one in Sarasota, Florida. My plan is to work in both places. My wife and I currently rent a condominium here in Indy and we plan on renting one in Sarasota. I rent a small office for my Indianapolis location. However, I will initially run the Sarasota business from the condo. I'm not sure I would call it an "office" though. I have a good handle on the regular business expenses. I really just need help with travel expenses (hotel and meals) and duplicate personal expenses. I will incur (rent, utilities, renter's insurance) as a result of running the business in two locations. I have planning to appoint employees for my business in Sarasota. Of course, I would be in Florida when the weather is bad here. We will live in each location for 6 months. We will be in Sarasota from October through March and in Indianapolis from April through September. We will not sublet either…arrow_forward