Finding Unknowns

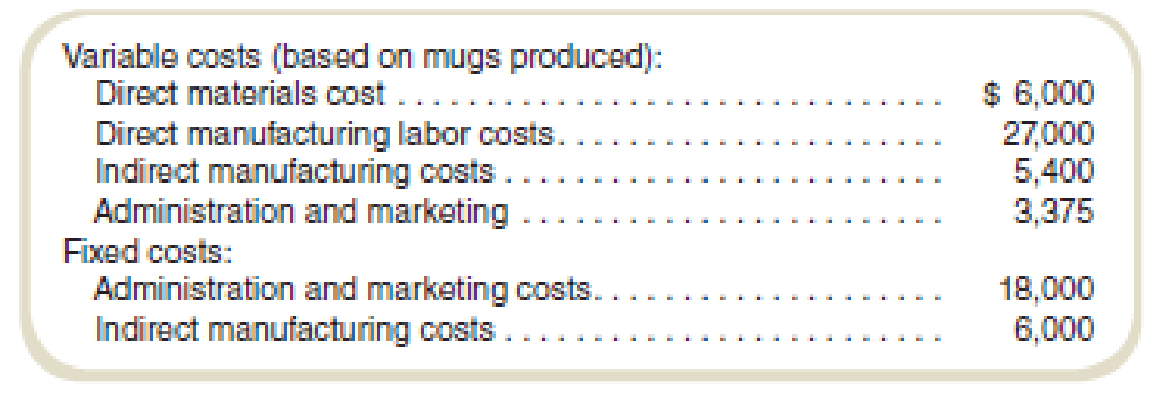

Mary’s Mugs produces and sells various types of ceramic mugs. The business began operations on January 1, year 1, and its costs incurred during the year include these:

On December 31, year 1, direct materials inventory consisted of 3,750 pounds of material. Production in that year was 20,000 mugs. All prices and unit variable costs remained constant during the year. Sales revenue for year 1 was $73,312. Finished goods inventory was $6,105 on December 31, year 1. Each finished mug requires 0.4 pounds of material.

Required

Compute the following:

- a. Direct materials inventory cost, December 31, year 1.

- b. Finished goods ending inventory in units on December 31, year 1.

- c. Selling price per unit.

- d. Operating profit for year 1.

a.

Calculate the value of closing direct material for Company M.

Answer to Problem 75P

The closing direct material is $2,812.

Explanation of Solution

Closing stock of direct material:

The material used in the production of the goods is known as direct material. Direct material cannot be separated from the finished product. It is also known as raw material. Business adds value in the raw material and sells it as the finished goods.

Calculate the closing direct material:

Thus, the closing stock of direct material is $2,812.

Working note 1:

Calculate the cost of direct material per pound:

Working note 2:

Calculate the cost of direct material per unit:

b.

Calculate the value of closing finished stock in units for Company M.

Answer to Problem 75P

The closing finished stock in units is $2,750.

Explanation of Solution

Closing stock of finished stock:

Finished stock is the cost of the goods that are ready to sell. Business put some value on the raw material by way of manufacturing overhead and direct labor and produces the finished goods. The stock left unsold at the end of the year is known as the closing stock of finished stock.

Calculate the closing finished stock in units:

Thus, the closing finished stock in units is 2,750.

Working note 3:

Calculate the manufacturing cost per unit:

Working note 4:

Calculate the total manufacturing cost:

| Particulars | Amount |

| Manufacturing cost: | |

| Direct material | $6,000 |

| Direct labor | $27,000 |

| Indirect manufacturing cost (variable cost) | $5,400 |

| Indirect manufacturing cost (fixed cost) | $6,000 |

| Total manufacturing cost | $44,400 |

Table: (1)

c.

Calculate the selling price per unit for Company M.

Answer to Problem 75P

The selling price per unit units is $4.25.

Explanation of Solution

Selling price:

Selling price is the amount that is charged per unit of finished goods sold to the customer. It is always set above the cost of the product to earn some margin over the cost of the product.

Calculate the selling price per unit:

Thus, the selling price per unit is $4.25.

Working note 5:

Calculate the units sold:

d.

Calculate the operating profit for Company M.

Answer to Problem 75P

The operating profit for Company M is $13,642.

Explanation of Solution

Operating profit:

Operating profit is calculated by deducting the full cost of the production from the sales of the business. Full cost of the production includes all the direct and indirect cost.

Calculate the operating profit:

| Particulars | Amount |

| Sales revenue | $73,312 |

| Less: cost of goods sold | $38,295 |

| Gross margin | $35,017 |

| Less: indirect manufacturing cost (variable cost) | $3,375 |

| Less: indirect manufacturing cost (fixed cost) | $18,000 |

| Operating profit | $13,642 |

Table: (2)

Thus, the operating profit is $13,642 for Company M.

Want to see more full solutions like this?

Chapter 2 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forwardCost of Goods Manufactured, Income Statement W. W. Phillips Company produced 4,000 leather recliners during the year. These recliners sell for 400 each. Phillips had 500 recliners in finished goods inventory at the beginning of the year. At the end of the year, there were 700 recliners in finished goods inventory. Phillips accounting records provide the following information: Required: 1. Prepare a statement of cost of goods manufactured. 2. Compute the average cost of producing one unit of product in the year. 3. Prepare an income statement for external users.arrow_forwardKildeer Company makes easels for artists. During the last calendar year, a total of 30,000 easels were made, and 31,000 were sold for 52 each. The actual unit cost is as follows: The selling expenses consisted of a commission of 1.30 per unit sold and advertising copayments totaling 95,000. Administrative expenses, all fixed, equaled 183,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 132,600 for 3,400 easels. Required: 1. Calculate the number and the dollar value of easels in ending finished goods inventory. 2. Prepare a cost of goods sold statement. 3. Prepare an absorption-costing income statement. Add a column for percentage of sales.arrow_forward

- Use the following information for Brief Exercise: Morning Smiles Coffee Company manufactures Stoneware French Press coffee makers and sold 8,000 coffee makers during the month of March at a total cost of 612,500. Each coffee maker sold at a price of 100. Morning Smiles also incurred two types of selling costs: commissions equal to 5% of the sales price and other selling expense of 45,000. Administrative expense totaled 47,500. 2-33 Income Statement Percentages Refer to the information for Morning Smiles Coffee Company on the previous page. Required: Prepare an income statement for Morning Smiles for the month of March and calculate the percentage of sales revenue represented by each line of the income statement. (Note: Round answers to one decimal place.)arrow_forwardUsing the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardFor each of the following independent situations, calculate the missing values: 1. The Belen plant purchased 78,300 of direct materials during June. Beginning direct materials inventory was 2,500, and direct materials used in production were 73,500. What is ending direct materials inventory? 2. Forster Company produced 14,000 units at an average cost of 5.90 each. The beginning inventory of finished goods was 3,422. (The average unit cost was 5.90.) Forster sold 14,120 units. How many units remain in ending finished goods inventory? 3. Beginning work in process (WIP) was 116,000, and ending WIP was 117,300. If total manufacturing costs were 349,000, what was the cost of goods manufactured? 4. If the conversion cost is 84 per unit, the prime cost is 55, and the manufacturing cost per unit is 105, what is the direct materials cost per unit? 5. Total manufacturing costs for August were 412,000. Prime cost was 64,000, and beginning WIP was 76,000. The cost of goods manufactured was 434,000. Calculate the cost of overhead for August and the cost of ending WIP.arrow_forward

- Brody Company makes industrial cleaning solvents. Various chemicals, detergent, and water are mixed together and then bottled in 10-gallon drums. Brody provided the following information for last year: Last year, Brody completed 100,000 units. Sales revenue equaled 1,200,000, and Brody paid a sales commission of 5 percent of sales. Required: 1. Calculate the direct materials used in production for last year. 2. Calculate total prime cost. 3. Calculate total conversion cost. 4. Prepare a cost of goods manufactured statement for last year. Calculate the unit product cost. 5. Prepare a cost of goods sold statement for last year. 6. Prepare an income statement for last year. Show the percentage of sales that each line item represents.arrow_forwardWyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forward

- Cost Classification Loring Company incurred the following costs last year: Required: 1. Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, 216,000. 2. What was the total product cost for last year? 3. What was the total period cost for last year? 4. If 30,000 units were produced last year, what was the unit product cost?arrow_forwardPattison Products, Inc., began operations in October and manufactured 40,000 units during the month with the following unit costs: Fixed overhead per unit = 280,000/40,000 units produced = 7. Total fixed factory overhead is 280,000 per month. During October, 38,400 units were sold at a price of 24, and fixed marketing and administrative expenses were 130,500. Required: 1. Calculate the cost of each unit using absorption costing. 2. How many units remain in ending inventory? What is the cost of ending inventory using absorption costing? 3. Prepare an absorption-costing income statement for Pattison Products, Inc., for the month of October. 4. What if November production was 40,000 units, costs were stable, and sales were 41,000 units? What is the cost of ending inventory? What is operating income for November?arrow_forwardZippy Inc. manufactures a fuel additive, Surge, which has a stable selling price of 44 per drum. The company has been producing and selling 80,000 drums per month. In connection with your examination of Zippys financial statements for the year ended September 30, management has asked you to review some computations made by Zippys cost accountant. Your working papers disclose the following about the companys operations: Standard costs per drum of product manufactured: Materials: Costs and expenses during September: Chemicals: 645,000 gallons purchased at a cost of 1,140,000; 600,000 gallons used. Empty drums: 94,000 purchased at a cost of 94,000; 80,000 drums used. Direct labor: 81,000 hours worked at a cost of 816,480. Factory overhead: 768,000. Required: Calculate the following for September, using the formulas on pages 421422 and 424 (Round unit costs to the nearest whole cent and compute the materials variances for both Surge and for the drums.): 1. Materials quantity variance. 2. Materials purchase price variance. 3. Labor efficiency variance. 4. Labor rate variance.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub