College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 4PB

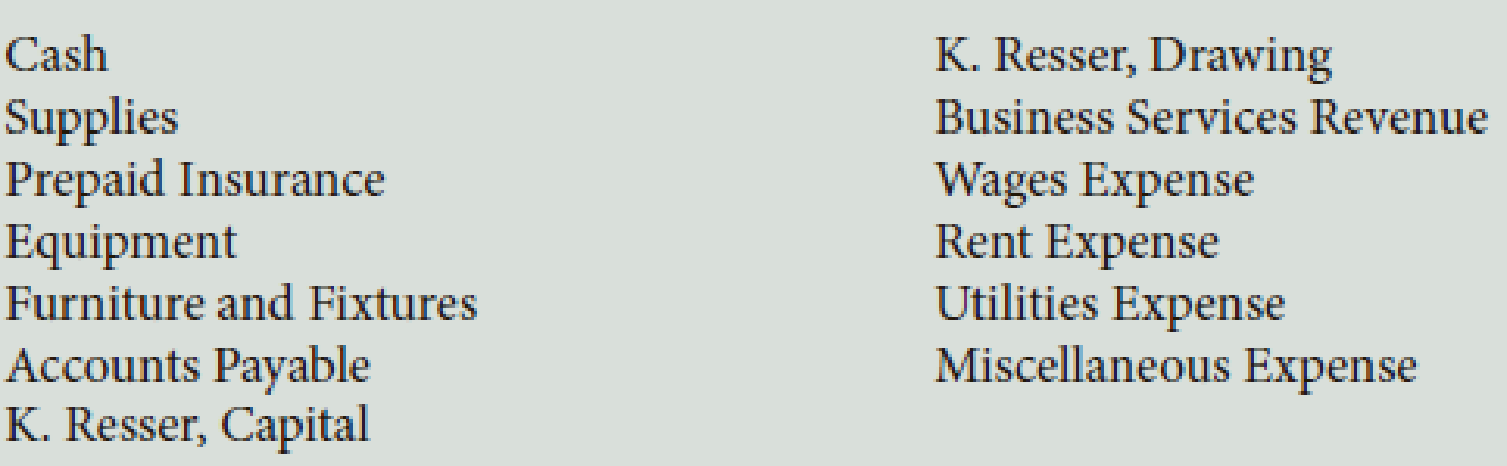

On July 1, K. Resser opened Resser’s Business Services. Resser’s accountant listed the following chart of accounts:

The following transactions were completed during July:

- a. Resser deposited $25,000 in a bank account in the name of the business.

- b. Bought tables and chairs for cash, $725, Ck. No. 1200.

- c. Paid the rent for the current month, $1,750, Ck. No. 1201.

- d. Bought computers and copy machines from Ferber Equipment, $15,700, paying $4,000 in cash and placing the balance on account, Ck. No. 1202.

- e. Bought supplies on account from Wiggins’s Distributors, $535.

- f. Sold services for cash, $1,742.

- g. Bought insurance for one year, $1,375, Ck. No. 1203.

- h. Paid on account to Ferber Equipment, $700, Ck. No. 1204.

- i. Received and paid the electric bill, $438, Ck. No. 1205.

- j. Paid on account to Wiggins’s Distributors, $315, Ck. No. 1206.

- k. Sold services to customers for cash for the second half of the month, $820.

- l. Received and paid the bill for the business license, $75, Ck. No. 1207.

- m. Paid wages to an employee, $1,200, Ck. No. 1208.

- n. Resser withdrew cash for personal use, $700, Ck. No. 1209.

Required

- 1. Record the owner’s name in the Capital and Drawing T accounts.

- 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts.

- 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction.

- 4. Foot the T accounts and show the balances.

- 5. Prepare a

trial balance as of July 31, 20--. - 6. Prepare an income statement for July 31, 20--.

- 7. Prepare a statement of owner’s equity for July 31, 20--.

- 8. Prepare a

balance sheet as of July 31, 20--. LO 1, 2, 3, 4, 5, 6

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

In the process of your examination of the financial statements of the Malu-oy Company for the year ended December 31, 20X6, you obtained the following data on its current account. The bank statement on November 30, 20X6 showed a balance of P76,500. Among the bank credits in November was a customer’s note for P25,000 collected for the account of the company which the company recognized in December among its receipts. Included on the bank debits were cost of checkbooks amounting to P300 and a P10,000 check which was charged by the bank in error against Malu-oy Company account. Also in November, you ascertained that there were deposits in transit amounting to P20,000 and outstanding checks totaling P42,500. The bank statement for the month of December showed total credit of P104,000 and total charges of P51,000. The company’s books for December showed total receipts of P183,900, disbursements of P101,800 and a balance of P121,400. Bank debit memos for December were: No. 14334 for service…

On Ontober 1, 20Y6, Jay Crowley estabished Afiordable Reakty, which oompleted the following transactions during the month:

1. Joumalize entries for transactions Oct. 1 through 9. Refer to the Chart of Accounts for exact wording of

Oet

1 Jay Crowley transferred cash from a personal bank account to

an account to be used for the business in exchange for

account titles.

common stock, $31,500.

2 Paid rent on office and equipment for the month, $2,450.

PAGE 1

JOURNAL

ACCOUNTING EQUATION

3 Purchased supplies on account, $2,200.

4

Paid creditor on account, $860.

DATE

DESCRIPTION

POST, REF.

DEBIT

CREDIT

ASSETS LIABILITIES

EQUITY

5

Earned sales commissions, receiving cash, $16,430.

6 Paid automobile expenses (including rental charge) for

2

month, $1,650, and miscellaneous expenses, $690.

7 Paid office salaries, $2,200.

4

* Determined that the cost of supplies used was $1,100.

* Paid dividends, $3,600.

1.

Joumalize entries for transactions Oct. 1 through 9. Refer to the Chart of Accounts for…

Weave Company received a bank statement for the month of August. The bank statement showed the following information: Balance 1 August $68,326 Deposits 45,300 Cheques processed (63,222) Service charges (50) Monthly deposit into saving account directly (26,120) Deducted by bank from account (780) Balance, 31st August $49,574 Weave Co’s general ledger account had a balance of $78,304 at the end of August. (i) Deposits shown in the general ledger account but not in the bank amounting to $8,200; (ii) all cheques written by the company were processed by the bank except for those totaling $8,420; (iii) A $2,000 cheque to a supplier correctly recorded by the bank but was incorrectly recorded by the company as $200 credit to cash. Required:

1. Prepare a bank reconciliation statement for the month of August.

2. Prepare the necessary journal entries at the end of August to adjust the general ledger cash account.

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - On a sheet of paper, draw the fundamental...Ch. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - A fellow accounting student has difficulty...Ch. 2 - What Would You Do? A new bookkeeper cant find the...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The amount that should be recorded by Company R for building under historical cost principle.

Financial Accounting (11th Edition)

Calculating certain information using the direct method (Learning Objective 4) 20-25 min. Trudeaus Marine, Inc....

Financial Accounting, Student Value Edition (5th Edition)

Dave Nelson recently retired at age 48, courtesy of the numerous stock options he had been granted while presid...

Managerial Accounting: Creating Value in a Dynamic Business Environment

Using the information from Problem 1-2B and the inventory information for the Best Bikes below, complete the re...

Managerial Accounting

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (4th Edition)

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

Principles Of Taxation For Business And Investment Planning 2020 Edition

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Infinity Emporium Company received the monthly statement for its bank account, showing a balance of $67,300 on August 31. The balance in the Cash account in the company's accounting system at that date was $72,628. The company's accountant reviewed the statement and the company's accounting records and noted the following. 1. 2. 3. After comparing the cheques written by the company with those deducted from the bank account in August, the accountant determined that all six cheques (totalling $6,180) that had been outstanding at the end of July were processed by the bank in August. However, five cheques written in August, totalling $4,500, were outstanding on August 31. A review of the deposits showed that a deposit made by the company on July 31 for $11,532 was recorded by the bank on August 1, and an August 31 deposit of $13,300 was recorded in the company's accounting system but had not yet been recorded by the bank. The August bank statement also showed: a service fee of $24 a…arrow_forwardCatherine’s Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger? Record the following transactions in the sales journal: Jan. 15 Invoice # 325, sold goods on credit for $2,400, to Maroon 4, account # 4501 Jan. 22 Invoice #326, sold goods on credit for $3,500 to BTS, account # 5032 Jan. 27 Invoice #327, sold goods on credit for $1,250 to Imagine Fireflies, account # 3896arrow_forwardAccompanying a bank statement for Santee Company is a credit memo for $21,600 representing the principal ($20,000) and interest ($1,600) on a note that had been collected by the bank. The company had been notified by the bank at the time of the collection but had made no entries.Required:On March 1, journalize the entry that should be made by the company to bring the accounting records up to date. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forward

- A company's Cash account shows a balance of $3,460 at the end of the month. Comparing the company's Cash account with the monthly bank statement reveals several additional cash transactions such as bank service fees ($50), an NSF check from a customer ($370), a customer's note receivable collected by the bank ($1,600), and interest earned ($130). Required: Record the necessary entry(ies) to adjust the company's balance for cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the items that increase cash. 2 Note: Enter debits before credits. Transaction Record entry General Journal Clear entry Debit Credit View general Journalarrow_forward2. Ranfurly has been operating a checking account for the past month. After his last transaction log reconciliation he calculated that his beginning balance was $3,465.22. He collected and deposited cash monies twice during the month in the amount of $354.44 and $900.00. He wrote check no 34 on august 3d in the amount of $56.78 to WSC, check no 35 pm august 18h in the amount of $667.00 to BPL, check no 36 on august 20h in the amount of $500.00 to Precious Tots preschool for his son, check no 37 on august 20h in the amount of $200.00 to Ycares fashion center, check no 38 on august 26th to Cable Bahamas in the amount of $90.00. His bank automatically withdraws $1500.00 for his monthly mortgage payment, and $500 for his monthly credit card payment. He also deposited his monthly paycheck on August 28 in the amount of $2900.00. Make all entries in the transaction log below: Transaction Date Description Debit Credit Balance Numberarrow_forwardAccompanying a bank statement for Santee Company is a credit memo for $15,120 representing the principal ($14,000) and interest ($1,120) on a note that had been collected by the bank. The company had been notified by the bank at the time of the collection but had made no entries. Required: On March 1, journalize the entry that should be made by the company to bring the accounting records up to date. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Chart of Accounts CHART OF ACCOUNTS Santee Company General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Receivable 131 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191…arrow_forward

- goumal Directions: Enter the transactions below, using the Chart of Accounts. TRANSACTIONS: (July) July 17 Paid $3,000 cash for computer equipment, check 164 18 Cash sales for 50 hats, $500.00, cash register summary tape 18. 22 Sarah Smith withdrew $10,000.00 from the business, check 165. 23 Received $2,000 cash on account from Kinston Rec. Dept., receipt 23. 24 Received $300 cash on account from Caps Inc., receipt 24 25 Paid $4,000 for rent, check 166. 27 Joe Smith deposited $5,000.00 of his own cash into his owner's equity account, receipt 27. 29 Paid $500 for an employee salary, check 167.arrow_forwardThe transactions completed by Revere Courier Company during December, the first month of the fiscal year, were as follows: Dec. 1. Issued Check No. 610 for December rent, $4,200. Dec. 2. Issued Invoice No. 940 to Clifford Co., $1,740 Dec. 3. Received check for $4,800 from Ryan Co. in payment of account. Dec. 5. Purchased a vehicle on account from Platinum Motors, $37,300. Dec. 6. Purchased office equipment on account from Austin Computer Co., $4,500. Dec. 6. Issued Invoice No. 941 to Ernesto Co., $3,870. Dec. 9. Issued Check No. 611 for fuel expense, $600. Dec. 10. Received check from Sing Co. in payment of $4,040 invoice. Dec. 10. Issued Check No. 612 for $330 to Office To Go Inc. in payment of invoice. Dec. 10. Issued Invoice No. 942 to Joy Co., $1,970. Dec. 11. Issued Check No. 613 for $3,090 to Essential Supply Co. in payment of account. Dec. 11. Issued Check No. 614 for $500 to Porter Co. in payment of account. Dec. 12. Received…arrow_forwardHarris, Inc. incurred the following transactions during the month of February. Record the appropriate ones in the cash payments journal. Include posting references. a. On February 3, the company purchased $650 worth of supplies on account. The supplies account number is 15. b. On February 5, Harris, Inc. made a payment on account to Sanders Industries in the amount of $1,215 (Check No. 2214). c. On February 14, Harris, Inc. bought a one-year insurance policy for $1,500. The prepaid insurance account number is 14 (Check No. 2215). d. On February 22, Harris, Inc. paid monthly rent of $2,000. The rent expense account number is 63 (Check No. 2216). e. On February 26, Harris, Inc. purchased equipment making a down payment of $3,000 (Check No. 2217) and agreeing to pay the $4,000 balance in 30 days. The equipment account number is 18. If an amount box does not require an entry, leave it blank. Page: OTHER ACCOUNT DEBITED CK. NO. POST. ACCOUNTS CASH REF. ACCOUNTS DR. PAYABLE DR. CR. DATE 1. 3arrow_forward

- The transactions completed by Fleetfoot Courier Company during December, the first month of the fiscal year, were as follows: Dec. 1. Issued Check No. 610 for December rent, $5,260. 2. Issued Invoice No. 940 to Clifford Co., $2,180. 3. Received check for $6,010 from Ryan Co. in payment of account. 5. Purchased a vehicle on account from Platinum Motors, $46,700. 6. Purchased office equipment on account from Austin Computer Co., $5,630. 6. Issued Invoice No. 941 to Ernesto Co., $4,850. 9. Issued Check No. 611 for fuel expense, $750. 10. Received check from Sing Co. in payment of $5,060 invoice. Issued Check No. 612 for $410 to Office To Go Inc. in payment of 10. Invoice. 10. Issued Invoice No. 942 to Joy Co., $2,470. Issued Check No. 613 for $3,870 to Essential Supply Co. in payment of 11. account. 11. Issued Check No. 614 for $630 to Porter Co. in payment of account. Received check from Clifford Co. in payment of $2,180 invoice of 12. December 2. Issued Check No. 615 to Platinum Motors…arrow_forwardYou obtained the following information on the current account of Par Company during your examination of its financial statements for the year ended December 31, 2021. The bank statement on November 30, 2021 showed a balance of P 306,000 . Among the bank credits in November was customer’s noted for P 100,000 collected for the account of the company which the company recognized in December among its receipts. Included in the bank debits were costs of checkbooks amounting to P 1,200 and a P 40,000 check which was charged by the bank in error against Par Company account. Also in November, you ascertained that there were deposits in transit amounting to P 80,000 and outstanding checks totaling P 170,000. The bank statement for the month of December showed total credits of P 416,000 and total charges of P 204,000. The company’s books for December showed total debits of P 735,600 , total credits of P 407,200 and a balance of P485,600. Bank debit memos for December were: No. 121 for service…arrow_forwardAndy's Autobody Shop has the following balances at the beginning of September: Cash, $9,800; Accounts Receivable, $1,300; Equipment, $44,900; Accounts Payable, $2,100; Common Stock, $20,000; and Retained Earnings, $33,900. a. Signed a long-term note and received a $123,800 loan from a local bank. b. Billed a customer $2,300 for repair services just completed. Payment is expected in 45 days. c. Wrote a check for $740 of rent for the current month. d. Received $360 cash on account from a customer for work done last month. e. The company incurred $350 in advertising costs for the current month and is planning to pay these costs next month. Required: 1. Prepare journal entries for the above transactions, which occurred during a recent month. 2. Prepare an income statement. 3. Prepare a statement of retained earnings. 4. Prepare a classified balance sheet.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY