Internal Service Fund Entries and Statements

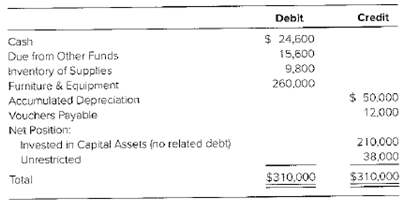

Bellevue City’s printing shop had the following

Additional Information for 20X2

- During 20X2, the printing shop acquired supplies for $96,000, furniture for $1,500, and a copier for $3,200.

- Printing jobs billed to other funds amounted to $292,000; cash received from other funds, $287,300; costs of printing jobs, $204,000, including $84,000 of supplies; operating expenses, $38,000, including $8,400 of supplies;

depreciation expense, $23,000; and vouchers paid, $243,000.

Required

- Prepare entries for the printing shop for 20X2, including closing entries.

- Prepare a statement of net position for the fund on December 31, 20X2. No debt is related to the year-end amount of the fund’s capital assets.

- Prepare a statement of revenues, expenses, and changes in fund net position for 20X2.

- Prepare a statement of

cash flows for 20X2.

a

Proprietary funds: These funds are established for governmental operations for income determination and capital maintenance. There are two major proprietary funds, the internal service fund, and the enterprise fund. As their funds are for revenue generation for government accrual method of accounting is used, these funds record their own long-term assets and record depreciation of these assets, and long-term debt as commercial operations. The entries for 20X2 including closing entries.

Explanation of Solution

Entries for 20X2

| Particulars | Debit $ | Credit $ |

| Inventory of supplies | 96,000 | |

| Furniture and equipment | 4,700 | |

| Vouchers payable | 100,700 | |

| (Acquisition of supplies furniture and office equipment recognized) | ||

| Due from other funds | 292,000 | |

| Billings to departments | 292,000 | |

| (Billings for completed jobs recognized) | ||

| Cash | 287,300 | |

| Due from other funds | 287,300 | |

| (Cash collection on billings recognized) | ||

| Costs of printing jobs | 204,000 | |

| Operating expenses | 38,000 | |

| Inventory of supplies | 92,400 | |

| Vouchers payable | 149,600 | |

| (Cost of printing jobs recognized) | ||

| Depreciation expense | 23,000 | |

| Accumulated depreciation | 23,000 | |

| (Depreciation for the period recorded) | ||

| Vouchers payable | 243,000 | |

| Cash | 243,000 | |

| (Paid approved vouchers) | ||

| Closing entries: | ||

| Billings to departments | 292,000 | |

| Costs of printing jobs | 204,000 | |

| Operating expenses | 38,000 | |

| Depreciation expense | 23,000 | |

| Profit and loss summary | 27,000 | |

| (All the nominal accounts closed and balance transferred to profit and loss summary) | ||

| Profit and loss summary | 27,000 | |

| Net Assets − Unrestricted | 27,000 | |

| (Profit and loss summary account closed) | ||

| Net Assets − Invested in capital assets, net related debt | 18,300 | |

| Net assets − unrestricted | 18,300 | |

| (Reclassification of net asset as of end of period) |

Reclassification of net assets as of end of period:

| Beginning balance in net assets | $210,000 |

| Less: Ending balance of net capital assets | $191,700 |

| $18,300 |

b

Proprietary funds: These funds are established for governmental operations for income determination and capital maintenance. There are two major proprietary funds, the internal service fund, and the enterprise fund. As their funds are for revenue generation for government accrual method of accounting is used, these funds record their own long-term assets and record depreciation of these assets, and long-term debt as commercial operations. The preparation of statement of net position for the fund on December 31, 20X2

Answer to Problem 18.10E

Net Assets as per statement of net position $275,000

Explanation of Solution

B Printing Shop Fund

Statement of Net Assets

December 31, 20X2

| $ | $ | |

| Assets: | ||

| Cash | 68,900 | |

| Due from other funds | 20,300 | |

| Inventory of supplies | 13,400 | |

| Furniture and equipment | $264,700 | |

| Less: Accumulated depreciation | (73,000) | 191,700 |

| Total assets | 294,300 | |

| Liabilities: | ||

| Vouchers payable | 19,300 | |

| Net assets: | ||

| Invested in capital assets net of related debt | 191,700 | |

| Unrestricted | 83,300 | |

| Total net assets | 275,000 |

c

Proprietary funds: These funds are established for governmental operations for income determination and capital maintenance. There are two major proprietary funds, the internal service fund, and the enterprise fund. As their funds are for revenue generation for government accrual method of accounting is used, these funds record their own long-term assets and record depreciation of these assets, and long-term debt as commercial operations. The preparation of Statement of revenues, expenses and changes in fund net position for 20X2

Answer to Problem 18.10E

Net Assets as per statement of net position $275,000

Explanation of Solution

B Printing shop fund

Statement of revenue, expenses and

Change in fund net assets

December 31, 20X2

| $ | $ | |

| Revenue: | ||

| Billing to departments | 292,000 | |

| Expenses: | ||

| Costs of printing jobs | 204,000 | |

| Operating | 38,000 | |

| Depreciation | 23,000 | (265,000) |

| Income | 27,000 | |

| Net assets January 1 | 248,000 | |

| Net assets December 31 | 275,000 |

d

Proprietary funds: These funds are established for governmental operations for income determination and capital maintenance. There are two major proprietary funds, the internal service fund, and the enterprise fund. As their funds are for revenue generation for government accrual method of accounting is used, these funds record their own long-term assets and record depreciation of these assets, and long-term debt as commercial operations. The preparation of statement of cash flow as of December 31, 20X2

Answer to Problem 18.10E

Net change in cash at the end $68,900

Explanation of Solution

B Printing shop fund

Internal service fund

Statement of cash flows

December 31, 20X2

| $ | $ | |

| Cash flows from operating activities: | ||

| Cash received from customers | 287,300 | |

| Cash payments for printing jobs | (283,300 | |

| Net cash provided by operating activities | 49,000 | |

| Cash flow from non-capital financing activity | 0 | |

| Cash flow from capital and related activity: | ||

| Acquisition of capital assets: | ||

| Furniture and copier | ($4,700) | |

| Cash flow from financing activity | (4,700) | |

| Cash flow from investing activities | 0 | |

| Net increase in cash | 44,300 | |

| Cash at beginning of year | 24,600 | |

| Cash at end of year | 68,900 |

Reconciliation of operating income to net cash

| $ | $ | |

| Operating income | 27,000 | |

| Adjustments to reconcile operating income to net cash used by operating activities: | ||

| Depreciation | 23,000 | |

| Change in assets and liabilities: | ||

| Increase in due from other funds from billings | (4,700) | |

| Increase in inventory of supplies | (3,600) | |

| Increase in vouchers payable | 7,300 | |

| Total adjustments | 22,000 | |

| Net cash provided by operating activities | 49,000 |

Want to see more full solutions like this?

Chapter 18 Solutions

Advanced Financial Accounting

Additional Business Textbook Solutions

Managerial Accounting (4th Edition)

Accounting For Governmental & Nonprofit Entities

Financial Accounting

Financial Accounting (12th Edition) (What's New in Accounting)

FINANCIAL ACCT.FUND.(LOOSELEAF)

Fundamentals of Cost Accounting

- A city orders a new computer for its police department that is recorded within its general fund. The computer has an anticipated cost of $89,600. Its actual cost when received is $91,880. Payment is subsequently made. a. Prepare all required journal entries for both fund and government-wide financial statements. (Select the appropriate fund for each situation when required. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardA city orders a new computer for its police department that is recorded within its general fund. The computer has an anticipated cost of $89,600. Its actual cost when received is $91,880. Payment is subsequently made. a. Prepare all required journal entries for both fund and government-wide financial statements. (Select the appropriate fund for each situation when required. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Transaction Fund/Activity General Journal Debit 1. Purchase and payment made for computers in the government wide financial statements. 1 Record the receipt of computers and the accompanying liability. Record payment made. 2. Purchase and payment made for computers in the general fund. 2 Record the order placed for purchase of computer. Credit Record entry to remove encumbrance for computers that has now been received. Record the receipt of computers and the accompanying liability. Record payment made.arrow_forwardThe Town of Weston has a Water Utility Fund with the following trial balance as of July 1, 2023, the first day of the fiscal year: Debits Credits Cash $220,000 Customer accounts receivable 200,000 Allowance for uncollectible accounts $27,000 Materials and supplies 120,000 Restricted assets (cash) 280,000 Utility plant in service 7,000,000 Accumulated depreciation-utility plant 2,600,000 Construction work in progress 180,000 Accounts payable 120,000 Accrued expenses payable 78,000 Revenue bonds payable 3,600,000 Net position Totals 1,575,000 $8,000,000 $8,000,000 During the year ended June 30, 2024, the following transactions and events occurred in the Town of Weston Water Utility. Fund: 1. Accrued expenses at July 1 were paid in cash. 2. Billings to nongovernmental customers for water usage for the year amounted to $1,372,000; billings to the General Fund amounted to $96,000. 3. Liabilities for the following were recorded during the year: Materials and supplies Costs of sales and…arrow_forward

- Prepare journal entries for the City of Pudding’s governmental funds to record the following transactions, first for fund financial statements and then for government-wide financial statements.a. A new truck for the sanitation department was ordered at a cost of $94,000.b. The city print shop did $1,200 worth of work for the school system (but has not yet been paid).c. An $11 million bond was issued to build a new road.d. Cash of $140,000 is transferred from the general fund to provide permanent financing for a municipal swimming pool that will be viewed as an enterprise fund.e. The truck ordered in (a) is received at an actual cost of $96,000. Payment is not made at this time.f. Cash of $32,000 is transferred from the general fund to the capital projects fund.g. A state grant of $30,000 is received that must be spent to promote recycling.h. The first $5,000 of the state grant received in (g) is appropriately expended.arrow_forwardA Government University has RO 15000 cash on hand in an appropriated fund. The University signs a purchase order for RO 7000 to purchase new projectors and systems deliverable in three months. The purpose of writing encumbrance in the ledger is:arrow_forwardPrepare journal entries for the City of Pudding’s governmental funds to record the following transactions, first for fund financial statements and then for government-wide financial statements. A new truck for the sanitation department was ordered at a cost of $94,000. The city print shop did $1,200 worth of work for the school system (but has not yet been paid). An $11 million bond was issued to build a new road. Cash of $140,000 is transferred from the general fund to provide permanent financing for a municipal swimming pool that will be viewed as an enterprise fund. The truck ordered in (a) is received at an actual cost of $96,000. Payment is not made at this time. Cash of $32,000 is transferred from the general fund to the capital projects fund. A state grant of $30,000 is received that must be spent to promote recycling. The first $5,000 of the state grant received in (g) is appropriately expended.arrow_forward

- The Village of Seaside Pines prepared the following enterprise fund Trial Balance as of December 31, 2020, the last day of its fiscal year. The enterprise fund was established this year through a transfer from the General Fund. Debits Credits Accounts payable $ 103,000 Accounts receivable $ 25,800 Accrued interest payable 28,900 Accumulated depreciation 46,500 Administrative and selling expenses 48,500 Allowance for uncollectible accounts 12,400 Capital assets 707,000 Cash 90,200 Charges for sales and services 553,000 Cost of sales and services 495,000 Depreciation expense 46,500 Due from General Fund 17,100 Interest expense 40,200 Interest revenue 4,300 Transfer in from General Fund 115,200 Bank note payable 625,300 Supplies inventory 18,300 Totals $ 1,488,600 $ 1,488,600…arrow_forwardThe year-end pre-closing trial balance for the Chance County Woodland Park Capital Projects Fund is provided below. Debits Credits Cash $ 921,000 Grant Receivables 690,000 Investments 1,300,000 Contract Payable $ 1,493,000 Contract Payable – Retained Percentage 71,000 Encumbrances Outstanding 1,850,000 Revenues 797,000 Encumbrances 1,850,000 Construction Expenditures 4,600,000 Other Financing Sources – Proceeds of Bonds 5,150,000 $ 9,361,000 $ 9,361,000 Required Prepare the year-end statement of revenues, expenditures, and changes in fund balances for the capital projects fund.arrow_forwardThe City of Bayamon maintains its books and records in a way that facilitates the preparation of the financial statements of the funds. Prepare all the journal entries necessary to record the city's revenue from the following transactions for the year ended December 31, 20X7. On January 15, the city received notification that it had been awarded a $300,000 federal grant to assist in the operation of its Meals on Wheels program. The federal government expects to send the cash in about three months. This is not a rebate-type grant and all eligibility requirements have been met. In February, the city spent $31,000 on Meals on Wheels. $1,800 parking tickets were issued in March. Payment must be made within 30 days, when the city has an enforceable legal claim to the amounts. In April, the city received the $300,000 grant from the federal government. In April, the city received $1,200 in cash for parking tickets issued in March. Additionally, $100 in fines were contested and court dates…arrow_forward

- Record the appropriate journal entries for Sturgis City for the following transactions. The city uses encumbrance accounting and maintains a provision for uncollectible accounts. Note: Each transaction may involve more than one fund. The appropriate fund must be identified to receive credit. The central motor pool billed the General Fund for $33,000 in services. The General Fund previously recorded an encumbrance for the same amount. The city owned landfill purchased two tractors for a total of $40,000. The related invoice was paid. The City entered into a contract with Maker’s Construction to build a civic center for $3 million. The General Fund paid the central motor pool invoice (item 1). The landfill issued $4 million in revenue bonds for renovations. The landfill recorded daily fee receipts of $14,000. Maker’s Construction issued a progress billing for $350,000. The contract provides for a 10% retained percentage. The landfill sold an old tractor for $5,000…arrow_forward7 Inglis City had a beginning cash and cash equivalents balance in its internal service fund of $895,685. During the current year, the following transactions occurred: 1. Interest received on investments totaled $42,450. 2. The city acquired additional equity investments totaling $75,050. 3. A grant was received from the state in the amount of $50,000 for summer interns. 4. Receipts from sales of goods or services totaled $2,915,570. 5. Payments for supplies were made in the amount of $1,642,150. 6. Payments to employees for salaries amounted to $479,360. 7. Equipment was sold for $57,500. It had a book value of $56,655. 8. A $25,000 transfer was made to the General Fund. 9. Other cash expenses for operations were $89,200. 10. Long-term debt payments for capital acquisitions totaled $525,040. Required Prepare a statement of cash flows for the Inglis City internal service fund. (Ignore the reconciliation of operating income to net cash provided by operating activities because…arrow_forward8 Inglis City had a beginning cash and cash equivalents balance in its internal service fund of $895,635. During the current year, the following transactions occurred: 1. Interest received on investments totaled $42,400. 2. The city acquired additional equity investments totaling $75,000. 3. A grant was received from the state in the amount of $50,000 for summer interns. 4. Receipts from sales of goods or services totaled $2,915,500. 5. Payments for supplies were made in the amount of $1,642,100. 6. Payments to employees for salaries amounted to $479,300. 7. Equipment was sold for $57,500. It had a book value of $56,625. 8. A $25,000 transfer was made to the General Fund. 9. Other cash expenses for operations were $89,200. 10. Long-term debt payments for capital acquisitions totaled $525,000. Required Prepare a statement of cash flows for the Inglis City internal service fund. (Ignore the reconciliation of operating income to net cash provided by operating activities because…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education