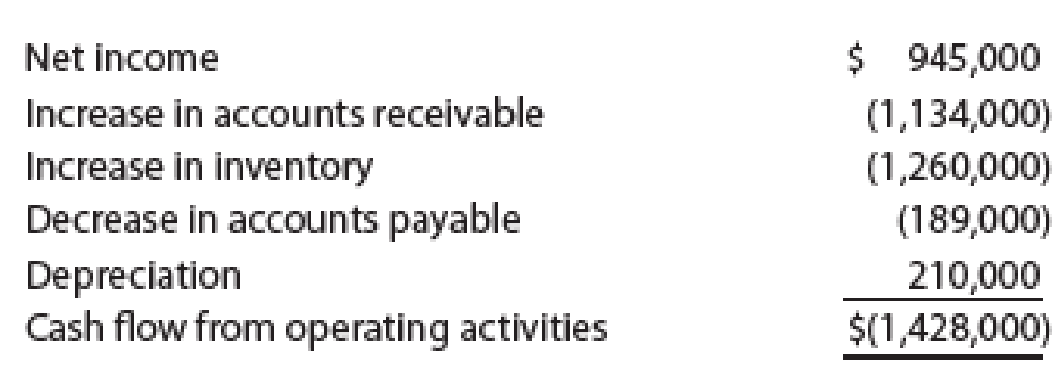

The Commercial Division of Tidewater Inc. provided the following information on its

The manager of the Commercial Division provided the accompanying memo with this report:

From: Senior Vice President, Commercial Division

I am pleased to report that we had earnings of $945,000 over the last period. This resulted in a

Comment on the senior vice president’s memo in light of the cash flow information.

Comment on the senior vice president’s memo in light of the cash flow information.

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Financial Accounting

- Owen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Cash Accounts receivable Inventory Current assets Fixed assets Total assets New funds Assets E 122 TOLCIE E S Balance Sheet (in $ millions) E $ 12 27 28 $ 67 45 N Owen's Electronics has an aftertax profit margin of percent and a dividend payout ratio of 40 percent. If sales grow by 30 percent next year, determine how many dollars of new funds are needed to finance the growth. Note: Do not round intermediate calculations. Enter your answer in dollars, not millions, (e.g., $1,234,567). $ 112 Liabilities and Stockholders' Equity Accounts payable Accrued wages Accrued taxes Current liabilities Notes payable Common stock…arrow_forwardOwen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Assets Cash Accounts receivable Inventory Current assets Fixed assets Total assets Balance Sheet (in $ millions) Liabilities and Stockholders' Equity $ 2 Accounts payable 22 24 $ 48 43 Accrued wages Accrued taxes Current liabilities Notes payable Common stock Retained earnings $91 Total liabilities and stockholders' equity $ 16 4 10 $30 Answer is complete but not entirely correct. New funds $ 8,075,000 > 12 17 32 $ 91 Owen's Electronics has an aftertax profit margin of 6 percent and a dividend payout ratio of 45 percent. If sales grow by 20 percent next year, determine how many dollars of new funds are needed to…arrow_forwardOwen's Electronics has nine operating plants in seven southwestern states, Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Cash Accounts receivable Inventory Current assets Fixed assets Assets Total #ssets New funds Balance Sheet (in 3 millions) 56 Accounts payable ****1 Liabilities and Stockholders Equity 24 Accrued wages 27 Accrued taxes $ 57 Notes payable Common stock Retained earnings $ 101 Total liabilities and stockholders' equity Owen's Electronics has an aftertax profit margin of 9 percent and a dividend payout ratio of 40 percent. If sales grow by 15 percent next year, determine how many dollars of new funds are needed to finance the growth. Note: Do not round intermediate calculations. Enter your answer in dollars, not…arrow_forward

- Use the following information for numbers 23 to 25: Corporate Valuators, Inc. is assessing the value of two companies, Capital Corp. and Earm, Inc. which projects the following net cash flows in the next five years, with its desired required rate of return. Net cash flows approximate to be its earnings also. The balance sheet of Capital Corp. and Eam, Inc. has recorded Property, Plant and Equipment of P100 million and P200 million, respectively. Operating assets are estimated at 80% and 70% respectively and the rest are considered idle. Capital Corp. 8,000,000 8,800,000 9,680,000 10,648,000 11,712,800 Required return 8% Net cash flows Net cash flows Earn, Inc. 9,600,000 10,560,000 11,616,000 12,777,000 14,055,3 6% Year 1 2 3 4 23. Using capitalization of earnings, compute for the equity value of Capital Corp. 24. Using capitalization of earnings, compute for the equity value of Eam, Inc. 25. Which company has higher equity value?arrow_forwardLucas Hunter, president of Simmons Industries Inc., believes that reporting operating cash flow per share on the income statement would be a useful addition to the company’s just completed financial statements. The following discussion took place between Lucas Hunter and Simmons’ controller, John Jameson, in January, after the close of the fiscal year:Lucas: I’ve been reviewing our financial statements for the last year. I am disappointed that our net income per share has dropped by 10% from last year. This won’t look good to our shareholders. Is there anything we can do about this?John: What do you mean? The past is the past, and the numbers are in. There isn’t much that can be done about it. Our financial statements were prepared according to generally accepted accounting principles, and I don’t see much leeway for significant change at this point.Lucas: No, no. I’m not suggesting that we “cook the books.” But look at the cash flow from operating activities on the statement of cash…arrow_forwardCarter Paint Company has plants in four provinces. Sales last year were $100 million, and the balance sheet at year-end is similar in percent of sales to that of previous years (and this will continue in the future). All assets and current liabilities will vary directly with sales. Assume the firm is already using capital assets at full capacity. Cash Accounts receivable Inventory Current assets Capital assets Total assets Assets Cash Accounts receivable Inventory Current assets Capital Assets Total assets Assets Current ratio Total debt assets ta $7 13 18 38 38 $76 $ Year 1 Balance Sheet (in $ millions) Accounts payable Accrued wages Accrued taxes X Liabilities and shareholders' Equity Current liabilities Long-term debt Common stock Retained earnings Total liabilities and shareholders' equity The firm has an aftertax profit margin of 6 percent and a dividend payout ratio of 30 percent. a. If sales grow by 10 percent next year, determine how many dollars of new funds are needed to…arrow_forward

- Carter Paint Company has plants in four provinces. Sales last year were $100 million, and the balance sheet year-end is similar in percent of sales to that of previous years (and this will continue in the future). All assets and current liabilities will vary directly with sales. Assume the firm is already using capital assets at full capacity. Assets Cash Accounts receivable Inventory Current assets Capital assets Total assets Assets (Click to select) (Click to select) (Click to select) Current assets (Click to select) Total assets The firm has an aftertax profit margin of 9 percent and a dividend payout ratio of 35 percent. a. If sales grow by 20 percent next year, determine how many dollars of new are needed to finance the expansion. (Do not round intermediate calculations. Enter the answer in millions. Round the final answer to 3 decimal places.) The firm needs $ Current ratio Total debt / assets b. Prepare a pro forma balance sheet with any financing adjustment made to long-term…arrow_forwardThe financial manager of Sarap Corporation wants to determine the amount of cash outlays to be spent for the next period. He asked the help of the accountant and the latter provided a cash budget for the next year. According to the computations, the company would be incurring cash expenses of P6,612,500 per month. The financial manager has estimated a cost of P40 per transaction in case non-cash asset is converted to cash. The firm's opportunity cost ratio is 12%. a. The optimum cash balance is?arrow_forwardThe financial manager of Sarap Corporation wants to determine the amount of cash atlays to be spent for the next period. He asked the help of the accountant and the lattes provided a cash budget for the next year According to the computation, the company would be incurring cash expenses of P6,612,500 per month. The financial manager has estimated a cost of P40 per transaction in case non-cash asset is converted to cash. The firm's opportunity cost ratio is 12% a) the optimum cash tufence is? b) The average cash balance is? c) the number of conversion made during the year? d) The total cash cost is? Please help me with these. Thank youuuu!arrow_forward

- Owen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Assets Cash Accounts receivable Inventory Current assets Fixed assets Total assets $ 10 32 33 $ 75 New funds $118 Balance Sheet (in $ millions) Liabilities and Stockholdera Equity Accounts payable Accrued wages Accrued taxes Current liabilities Notes payable Common stock Retained earnings Total liabilities and stockholders' equity $18 7 11 $ 36 14 17 51 $118 TOUS REPOR Owen's Electronics has an aftertax profit margin of 9 percent and a dividend payout ratio of 50 percent. STA U SLU KUTEN HOTEL If sales grow by 25 percent next year, determine how many dollars of new funds are needed to finance the growth. (Do not…arrow_forwardOwen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity. Assets Cash Accounts receivable Inventory Current assets Fixed assets Total assets New funds $7 25 28 $ 60 45 Balance Sheet (in $ millions) $ 105 Liabilities and Stockholders' Equity Accounts payable Accrued wages Accrued taxes Current liabilities Notes payable Common stock Retained earnings Total liabilities and stockholders' equity X Answer is complete but not entirely correct. $ 11,900,000 X $ 20 7 13 $ 40 Owen's Electronics has an aftertax profit margin of 10 percent and a dividend payout ratio of 45 percent. If sales grow by 20 percent next year, determine how many dollars of new funds are needed to finance the…arrow_forwardThe manager of a production system expects to spend $100,000 the first year with amounts decreasing by $10,000 each year. Income is expected to be $400,000 the first year, decreasing by $50,000 each year. a) Draw cash flow diagrams of expenditures and income separately over a 6 year period at an interest rate of 10% per year. b) Determine the present worth of the company's net cash flow (present worth = present income - present expenditure). Please write fomula and show your solution step by step. Use compound interest tables. How much money could a fim borow to finance a project if it is expected revenues of 5140,000 yeuly for the 9 years pesiod of time with the interest rate 9% per year? Please wnte fomuls and show your solutica step by step. Use compound iaterest tahles a) drawe the Cash fiow b) find the selution C) find the future value of the evenuesarrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning