Common-Size Statements and Financial Ratios for a Loan Application

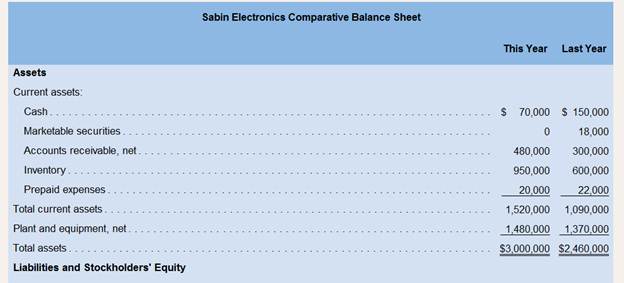

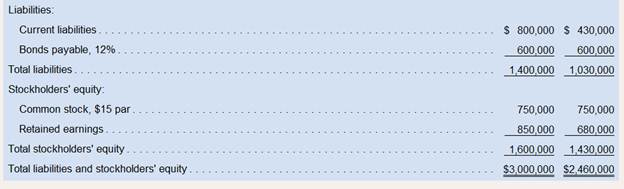

Paul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $500,000 long-term loan from Gulfport State Bank. $100,000 of which will be used to bolster the Cash account and $400,000 of which will be used to modernize equipment. The company's financial statements for the two most recent years follow:

During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lines in order to improve its profit margin. The company also hired a new sales manager, who has expanded sales into several new territories. Sales terms are 2/10, n/30. All sales are on account.

Required:

1. To assist in approaching the bank about the loan. Paul has asked you to compute the following ratios for both this year and last year:

a. The amount of

b. The

c. The acid-test ratio.

d. The average collection period. (The

e. The average sale period. (The inventory at the beginning of last year totaled $500,000.)

f The operating cycle.

g. The total asset turnover. (The total assets at the beginning of last year were $2,420,000.)

h. The debt-to-equity ratio.

i. The times interest earned ratio.

j. The equity multiplier. (The total

2. For both this year and last year:

a. Present the balance sheet in common-size format.

b. Present the income statement in common-size format down through net income.

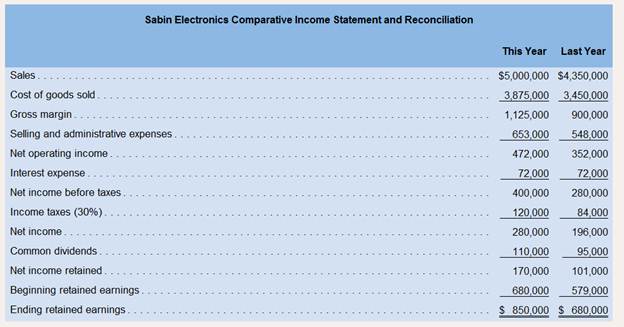

3. Paul Sabin has also gathered the following financial data and ratios that are typical of companies in the electronics industry:

Comment on the results of your analysis in (1) and (2) above and compare Sabin Electronics' performance to the benchmarks from the electronics industry. Do you think that the company is likely to get its loan application approved?

Financial Ratio Analysis:

The process of evaluating the financial ratios is known as financial ratio analysis

1.

Compute the following ratios for both this year and last year.

a. Working Capital

b. Current Ratio

c. Acid-Test Ratio

d. Average Collection Period

e. Average Sale Period

f. Operating Cycle

g. Total Asset Turnover

h. Debt-to-Equity Ratio

i. Times Interest Earned Ratio

j. Equity Multiplier

2.

Prepare balance sheet and income statement in common-size format for both this year and last year.

3.

Comment on the results of your analysis in (1) and (2) above and compare Sabin Electronics’ performance to the benchmarks from the electronics industry. Do you think that the company is likely to get its loan application approved?

Answer to Problem 18P

Solution:

1.

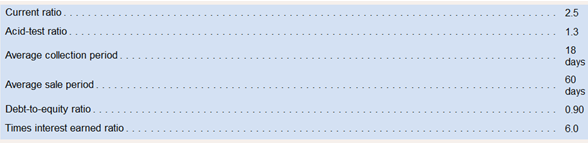

| Ratios | This Year | Last Year |

| Working Capital | $720,000 | $660,000 |

| Current Ratio | 1.90 | 2.53 |

| Acid-Test Ratio | 0.69 | 1.09 |

| Average Collection Period | 28 days | 23 days |

| Average Sale Period | 73 days | 58 days |

| Average Payable Period | 58 days | 45 days |

| Operating Cycle | 43 days | 36 days |

| Total Asset Turnover | 1.83 | 1.78 |

| Debt-to-Equity Ratio | 0.88 | 0.72 |

| Times Interest Earned Ratio | 6.56 | 4.89 |

| Equity Multiplier | 1.80 | 1.71 |

2.

| SABIN ELECTRONICS

Common Size Balance Sheet | ||||

| This Year | Percent | Last Year | Percent | |

| Assets | ||||

| Current assets: | ||||

| Cash | $70,000 | 2.3% | $150,000 | 6.1% |

| Marketable securities | 0 | 0.0% | 18,000 | 0.7% |

| Accounts receivable, net | 480,000 | 16.0% | 300,000 | 12.2% |

| Inventory | 950,000 | 31.7% | 600,000 | 24.4% |

| Prepaid expenses | 20,000 | 0.7% | 22,000 | 0.9% |

| Total current assets | 1,520,000 | 50.7% | 1,090,000 | 44.3% |

| Plant and equipment, net | 1,480,000 | 49.3% | 1,370,000 | 55.7% |

| Total Assets | $3,000,000 | 100% | $2,460,000 | 100% |

| Liabilities and Stockholders’ Equity | ||||

| Liabilities: | ||||

| Current liabilities | $800,000 | 26.7% | $430,000 | 17.5% |

| Bonds payable, 12% | 600,000 | 20% | 600,000 | 24.4% |

| Total Liabilities | 1,400,000 | 46.7% | 1,030,000 | 41.9% |

| Stockholders’ equity | ||||

| Common stock, $15 par | 750,000 | 25% | 750,000 | 30.5% |

| Retained Earnings | 850,000 | 28.3% | 680,000 | 27.6% |

| Total Stockholders’ Equity | 1,600,000 | 53.3% | 1,430,000 | 58.1% |

| Total liabilities and stockholders’ equity | $3,00,000 | 100% | $2,460,000 | 100% |

| SABIN ELECTRONICS

Common Size Income Statement | ||||

| This Year | Percent | Last Year | Percent | |

| Sales | $5,000,000 | 100% | $4,350,000 | 100% |

| Cost of goods sold | 3,875,000 | 77.5% | 3,450,000 | 79.3% |

| Gross margin | 1,125,000 | 22.5% | 900,000 | 20.7% |

| Selling and administrative expenses | 653,000 | 13.1% | 548,000 | 12.6% |

| Net operating income | 472,000 | 9.4% | 352,000 | 8.1% |

| Interest expense | 72,000 | 1.4% | 72,000 | 1.7% |

| Net income before taxes | 400,000 | 8% | 280,000 | 6.4% |

| Income taxes (30%) | 120,000 | 2.4% | 84,000 | 1.9% |

| Net Income | 280,000 | 5.6% | 196,000 | 4.5% |

3.

Considering the financial data and ratios of companies in the electronics industry, Sabin Electronics is likely to get its loan approved because the low debt equity ratio and improving times interest earned ratio which are good signs for the bank. In addition to that, the company is planning to invest 80% of the loan amount into modernizing the equipment which increase the productivity and ultimately resulting in higher profitability.

Explanation of Solution

1.

| a. Computation of Working Capital | ||||

| This Year | Last Year | |||

| Current Assets | $1,520,000 | $1,090,000 | ||

| Less: Current Liabilities | $800,000 | $430,000 | ||

| Working Capital | $720,000 | $660,000 | ||

With 80% of loan amount being invested in modernizing the equipment, the sales and net income of the company is likely to improve with productivity. The current ratio and acid-test ratio and other relevant ratios will probably improve with this investment. Considering all these factors, the bank is likely to approve the loan of the company.

Want to see more full solutions like this?

Chapter 14 Solutions

Introduction To Managerial Accounting

- Your supervisor has tasked you with evaluating several loans related to a new expansion project. Using the PVIFA table (table 9.4 in the textbook), determine the annual payment on a $365,900, 7% business loan from a commercial bank that is to be amortized over a five-year period. Show your work. Does this payment seem reasonable? Explain.arrow_forwardSnowflake Manufacturing [SM] has recently come to the bank you work for looking for a $280,000 long-term loan. The following data was submitted with SM's loan application: 2020 $475,200 155,400 175,200 408,600 103,500 13,200 34,200 56,100 64,200 2019 $316,500 120,000 2021 $820,800 Current assets.. Current liabilities. Non-current liabilities. Shareholders' equity.. Operating income... Interest expense... Income tax expense.. Net income... 414,600 60,800 303,700 168,900 7,200 65,400 96,300 106,300 300,000 490,200 208,500 28,500 72,000 108,000 115,000 Operating cash flow... The loan committee has asked you to analyze the data using at least three relevant financial ratios and complete a brief trend analysis. They would also like you to briefly discuss any limitations that might exist when completing this type of analysis and what data dashboards can do to help this. Finally, they have asked that your report also contain a recommendation about whether SM's loan request should be approved.…arrow_forward. No. 1. Abbott Private Limited wants to purchase an equipment worth $2650,000. However, the firm is in short of funds and thus would be looking to borrow the amount from a bank. The bank manager has offered two different types of loans i.e. 14.16% interest rate for 50 years with quarterly installments and 14% interest rate for 50 years with monthly installments. Being the finance manager of the company, you have been given a task to calculate the quarterly and monthly installment amounts as well as make a choice between both the loans i.e. which loan is to be opted and why?arrow_forward

- One year ago, JK Mfg. deposited $12,000 in an investment account for the purpose of buying new equipment four years from today. Today, it is adding another $15,000 to this account. The company plans on making a final deposit of $10,000 to the account one year from today. How much will be available when it is ready to buy the equipment, assuming the account pays 5.5 interest? solve using financial calculator pleasearrow_forwardA business purchases 3 new press machines for $150,000 each or a total of $450,000. It borrows $315,000 from its local bank. The interest rate on the loan is 6%, the loan term is 7 years. The loan is a closed end credit loan. Depreciation is $45,000 per year on the presses. What is the loan to value ratio for this loan? 60% 40% 50% 70%arrow_forwardThe employee credit union at State University is planning the allocation of funds for the coming year. The credit union makes four types of loans to its members. In addition, the credit union invests in risk-free securities to stabilize income. The various revenue-producing investments, together with annual rates of return, are as follows. Type of Loan/Investment Automobile loans Furniture loans Other secured loans Signature loans Risk-free securities $ ● Automobile loans The credit union will have $2,400,000 available for investment during the ng year. State laws and credit union policies impose the following restrictions on the composition of the loans and investments. Furniture loans Other secured loans • Risk-free securities may not exceed 30% of the total funds available for investment. Signature loans may not exceed 10% of the funds invested in all loans (automobile, furniture, other secured, and signature loans). Signature loans Risk-free securities • Furniture loans plus other…arrow_forward

- Company A is contemplating on borrowing $500,000 to start a business. Credit union 1 has offered to loan the company the money at an interest rate of 10% compounded monthly. Credit union 2 has offered the money with the stipulation that the company repays it by making monthly payments of $100,000 for 8 years. From which credit union should the company borrow the money? MANUAL CALCULATIONS AND CASH FLOW DIAGRAM!arrow_forwardPlease answer question 2 in its entirety. I have already used another question for number 1. Paul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $600,000 long-term loan from Gulfport State Bank, $150,000 of which will be used to bolster the Cash account and $450,000 of which will be used to modernize equipment. The company’s financial statements for the two most recent years follow: Sabin Electronics Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 110,000 $ 250,000 Marketable securities 0 28,000 Accounts receivable, net 607,000 400,000 Inventory 1,045,000 695,000 Prepaid expenses 30,000 32,000 Total current assets 1,792,000 1,405,000 Plant and equipment, net 1,946,400 1,470,000 Total assets $ 3,738,400 $…arrow_forwardPaul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $600,000 long-term loan from Gulfport State Bank, $150,000 of which will be used to bolster the Cash account and $450,000 of which will be used to modernize equipment. The company’s financial statements for the two most recent years follow: Sabin Electronics Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 110,000 $ 250,000 Marketable securities 0 28,000 Accounts receivable, net 607,000 400,000 Inventory 1,045,000 695,000 Prepaid expenses 30,000 32,000 Total current assets 1,792,000 1,405,000 Plant and equipment, net 1,946,400 1,470,000 Total assets $ 3,738,400 $ 2,875,000 Liabilities and Stockholders Equity…arrow_forward

- Paul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $600,000 long-term loan from Gulfport State Bank, $150,000 of which will be used to bolster the Cash account and $450,000 of which will be used to modernize equipment. The company’s financial statements for the two most recent years follow: Sabin Electronics Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 110,000 $ 250,000 Marketable securities 0 28,000 Accounts receivable, net 607,000 400,000 Inventory 1,045,000 695,000 Prepaid expenses 30,000 32,000 Total current assets 1,792,000 1,405,000 Plant and equipment, net 1,946,400 1,470,000 Total assets $ 3,738,400 $ 2,875,000 Liabilities and Stockholders Equity…arrow_forwardPaul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $600,000 long-term loan from Gulfport State Bank, $150,000 of which will be used to bolster the Cash account and $450,000 of which will be used to modernize equipment. The company’s financial statements for the two most recent years follow: Sabin Electronics Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 110,000 $ 250,000 Marketable securities 0 28,000 Accounts receivable, net 607,000 400,000 Inventory 1,045,000 695,000 Prepaid expenses 30,000 32,000 Total current assets 1,792,000 1,405,000 Plant and equipment, net 1,946,400 1,470,000 Total assets $ 3,738,400 $ 2,875,000 Liabilities and Stockholders Equity…arrow_forwardPaul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $600,000 long-term loan from Gulfport State Bank, $150,000 of which will be used to bolster the Cash account and $450,000 of which will be used to modernize equipment. The company’s financial statements for the two most recent years follow: Sabin Electronics Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 110,000 $ 250,000 Marketable securities 0 28,000 Accounts receivable, net 607,000 400,000 Inventory 1,045,000 695,000 Prepaid expenses 30,000 32,000 Total current assets 1,792,000 1,405,000 Plant and equipment, net 1,946,400 1,470,000 Total assets $ 3,738,400 $ 2,875,000 Liabilities and Stockholders Equity…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT