Concept explainers

Maccoa Soft, a division of Zayer Software Company, produces and distributes an automated payroll software system. A contribution margin format income statement for Maccoa Soft for the past year follows:

| Revenue (12,000 units × $1,200) | $14,400,000 |

| Unit-level variable costs | |

| Product materials cost (12,000 × $60) | (720,000) |

| Installation labor cost (12,000 × $200) | (2,400,000) |

| Manufacturing |

(24,000) |

| Shipping and handling (12,000 × $25) | (300,000) |

| Sales commissions (12,000 × $300) | (3,600,000) |

| Nonmanufacturing miscellaneous costs (12,000 × $5) | (60,000) |

| Contribution margin (12,000 × $608) | 7,296,000 |

| Fixed costs | |

| Research and development | (2,700,000) |

| Legal fees to ensure product protection | (780,000) |

| Advertising costs | (1,200,000) |

| Rental |

(600,000) |

| Depreciation on production equipment (zero market value) | (300,000) |

| Other manufacturing costs (salaries, utilities, etc.) | (744,000) |

| Division-level facility sustaining costs | (1,730,000) |

| Allocated companywide facility-level costs | (1,650,000) |

| Net loss | $ (2,408,000) |

- a. Divide the class into groups and then organize the groups into three sections. Assign Task 1 to the first section, Task 2 to the second section, and Task 3 to the third section. Each task should be considered independently of the others.

Group Tasks

- (1) Assume that Maccoa has excess capacity. The sales staff has identified a large franchise company with 200 outlets that is interested in Maccoa’s software system but is willing to pay only $800 for each system. Ignoring qualitative considerations, should Maccoa accept the special order?

- (2) Maccoa has the opportunity to purchase a comparable payroll system from a competing vendor for $600 per system. Ignoring qualitative considerations, should Maccoa outsource producing the software? Maccoa would continue to sell and install the software if the manufacturing activities were outsourced.

- (3) Given that Maccoa is generating a loss, should Zayer eliminate it? Would your answer change if Maccoa could increase sales by 1,000 units?

- b. Have a representative from each section explain its respective conclusions. Discuss the following:

- (1) Representatives from Section 1 should respond to the following: The analysis related to the special order (Task 1) suggests that all variable costs are always relevant. Is this conclusion valid? Explain your answer.

- (2) Representatives from Section 2 should respond to the following: With respect to the outsourcing decision, identify a relevant fixed cost and a nonrelevant fixed cost. Discuss the criteria for determining whether a cost is or is not relevant.

- (3) Representatives from Section 3 should respond to the following: Why did the segment elimination decision change when the volume of production and sales increased?

a1.

Whether Division MS should accept the special order by ignoring the qualitative considerations.

Explanation of Solution

Variable cost: It is also called as production costs that change in extent to the measure of goods that are manufactured. In other words, for each product that is manufactured, variable costs increment by a similar amount.

Opportunity cost: Opportunity cost is the forfeit of certain benefits such as cost savings, incomes, which is surrendered by not picking an option. Opportunity costs are applicable in decisions where the acknowledgment of one option disqualifies the likelihood of selecting different alternatives.

Determine the unit-level incremental costs

Therefore the unit-level incremental cost is $592.

From the result obtained above, the fixed costs are irrelevant since they will continue the similar irrespective of whether the special order is accepted. The total unit-level incremental costs that will be incurred if the special order is accepted will be $592. Because the incremental cost per unit of $592 is less than the incremental income of $800 per unit, hence the special order should be accepted.

Therefore the special order should be accepted.

a2.

Whether Division MS should outsource producing the software by ignoring the qualitative considerations.

Explanation of Solution

Determine the total avoidable costs

Therefore the total avoidable cost is $5,568,000.

Determine the total avoidable cost per unit

Therefore the avoidable cost per unit is $464.

From the result obtained above, the total avoidable expense per unit is $464. Since the avoidable cost is less than the value required to buy of $600, Division MS would be in an ideal situation to keep on producing the software.

Therefore Division MS should produce the software.

a3.

Whether Company Z should eliminate Division MS.

Explanation of Solution

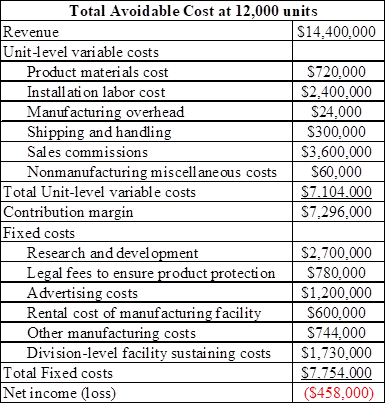

Determine the total avoidable costs at 12,000 units

If the division is eliminated, all expenses with the exception of the assigned companywide facility level expense and the depreciation on manufacturing the equipment or the sunk cost could be avoided.

Table (1)

(Refer excel for workings)

Therefore the total avoidable cost at 12,000 units is -$458,000.

From the result obtained above, the avoidable costs surpass the incremental revenue, the division must be eliminated.

Therefore Division MS should be eliminated.

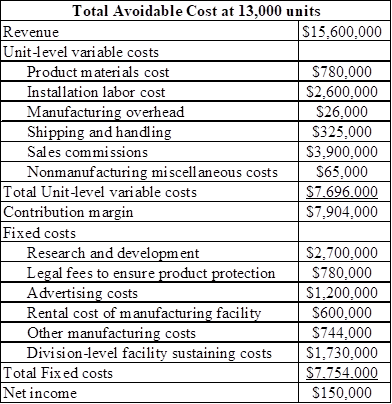

Whether the answer changes if the sales increase by 1,000 units.

Explanation of Solution

Determine the total avoidable costs at 13,000 units

The additional selling units of 1,000 units would build add up to the total sales of 13,000 units.

Table (2)

(Refer excel for workings)

Therefore the total avoidable cost at 13,000 units is $150,000.

From the result obtained above, At a sales volume level of 13,000 units, the division must not be eliminated.

Therefore Division MS should not be eliminated.

b1.

Whether the conclusion is valid.

Explanation of Solution

The reason on whether the conclusion is valid is as follows:

All the variable costs are not constantly relevant. For instance, assume that the special order customer move towards the organization openly, in this way eliminating the requirement to pay sales commissions. Under these conditions the sales commissions would not be relevant to a choice with respect to whether the special order should be accepted. The variable costs can be either relevant or irrelevant contingent upon the specific conditions related with the special decision.

b2.

The criteria for determining whether a cost is relevant or not relevant.

Explanation of Solution

The criteria for determining whether a cost is relevant or not relevant are as follows:

The research and development expenditures are applicable on the grounds that they are not incurred if the item is outsourced. The advertising costs are not relevant since they are important to advance the item irrespective of whether it is produced or outsourced. In other words, the costs must vary between the choices and be future arranged.

b3.

The reason on the segment elimination decision changes when the volume of production and sales increased.

Explanation of Solution

The reason on the segment elimination decision changes when the volume of production and sales increased are as follows:

Increases in volume influence the total contribution margin to increment. In like manner, additional margin is accessible to take care of fixed costs or to add to the productivity.

Want to see more full solutions like this?

Chapter 13 Solutions

Survey Of Accounting

- Table 1 Activity Cost Pool Total Cost Total Activity Assembly $ 942,480 66,000 machine-hours Processing orders $ 85,050 1,800 orders Inspection $ 126,854 1,820 inspection-hours Use Table 1 to answer this question. XYZ Corporation has provided the following data from its activity-based costing system (Table 1). The company makes 430 units of product ABA a year, requiring a total of 690 machine-hours, 40 orders, and 10 inspection-hours per year. The product's direct materials cost is $35.72 per unit and its direct labor cost is $29.46 per unit. According to the activity-based costing system, the average cost of product ABA is closest to: Select one: a. $94.11 per unit. b. $92.49 per unit. c. $65.18 per unit. d. none of the given answer. e. $89.72 per unit.arrow_forwardProblem 18 Service Cost Allocation Irish Corporation distributes its service department overhead cost directly tto producing departments. Information for January, 2030 is presented below. Maintenance Utilities FOH cost 93,500 45,000 Service Provided to Maintenance 10% Utilities 20% Mixing 40% 30% Assembly 40% 60% Required: Determined the amount of factory overhead cost of service departments allocated to producing departments using: Direct Method Step Method Reciprocal Methodarrow_forwardExercise 11-30 (Algo) Cost Allocation: Step Method (LO 11-3) Caro Manufacturing has two production departments, Machining and Assembly, and two service departments, Maintenance and Cafeteria. Direct costs for each department and the proportion of service costs used by the various departments for the month of August follow: Proportion of Services Used by Department Direct Costs Maintenance Cafeteria Machining Assembly Machining $ 115,000 Assembly 70,000 Maintenance 55,000 — 0.2 0.5 0.3 Cafeteria 35,000 0.6 — 0.2 0.2 Required: Use the step method to allocate the service costs, using the following: a. The order of allocation starts with Maintenance. b. The allocations are made in the reverse order (starting with Cafeteria).arrow_forward

- Hart Manufacturing makes three products. Each product requires manufacturing operations in three departments: A, B, and C. The labor-hour requirements, by department, are as follows: During the next production period the labor-hours available are 450 in department A, 350 in department B, and 50 in department C. The profit contributions per unit are 25 for product 1, 28 for product 2, and 30 for product 3. a. Formulate a linear programming model for maximizing total profit contribution. b. Solve the linear program formulated in part (a). How much of each product should be produced, and what is the projected total profit contribution? c. After evaluating the solution obtained in part (b), one of the production supervisors noted that production setup costs had not been taken into account. She noted that setup costs are 400 for product 1, 550 for product 2, and 600 for product 3. If the solution developed in part (b) is to be used, what is the total profit contribution after taking into account the setup costs? d. Management realized that the optimal product mix, taking setup costs into account, might be different from the one recommended in part (b). Formulate a mixed-integer linear program that takes setup costs provided in part (c) into account. Management also stated that we should not consider making more than 175 units of product 1, 150 units of product 2, or 140 units of product 3. e. Solve the mixed-integer linear program formulated in part (d). How much of each product should be produced and what is the projected total profit contribution? Compare this profit contribution to that obtained in part (c).arrow_forwardCommunication The controller of New Wave Sounds Inc. prepared the following product profitability report for management, using activity-based costing methods for allocating both the factory overhead and the marketing expenses. As such, the controller has confidence in the accuracy of this report. Home Theater Speakers Wireless Speakers Wireless Headphones Total Sales 1,500,000 1,200,000 900,000 3,600,000 Cost of goods sold 1,050,000 720,000 810,000 2,580,000 Gross profit 450,000 480,000 90,000 1,020,000 Marketing expenses 600,000 120,000 72,000 792,000 Income from operations (150,000) 360,000 18,000 228,000 In addition, the controller interviewed the vice president of marketing, who provided the following insight into the company's three products: The home theater speakers are an older product that is highly recognized in the marketplace. The wireless speakers are a new product that was just recently bunched. The wireless headphones are a new technology that has no competition in the marketplace, and it is hoped that they will become an important future addition to the companys product portfolio. Initial indications are that the product is well received by customers. The controller believes that the manufacturing costs for all three products are in line with expectations. Based on the information provided: 1. Calculate the ratio of gross profit to sales and the ratio of income from operations to sales for each product. 2. Write a brief (one page) memo using the product profitability report and the calculations in (1) to make recommendations to management with respect to strategies for the three products.arrow_forwardActivity-based and department rate product costing and product cost distortions Black and Blue Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows: Indirect labor 507,000 Cutting Department 156,000 Finishing Department 192,000 Total 855,000 The activity hase associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Activity Budgeted Activity Cost Activity Base Production control 237,000 Number of production runs Materials handling 270,000 Number of moves Total 507,000 The activity-base usage quantities and units produced for the two products follow: Number o Production Runs Number of Moves Direct Labor HoursCutting Direct Labor HoursFinishing Units Produced Snowboards 430 5,000 4,000 2,000 6,000 Skis _70 2,500 2,000 4,000 6,000 Total 500 7,500 6,000 6,000 12,000 Instructions 1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is 315,000 and 540,000 for the Cutting and finishing departments, respectively. 2. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (1). 3. Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. 4. Determine the total and per-unit cost assigned to each product under activity-based costing. 5. Explain the difference in the per-unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods.arrow_forward

- Production run size and activity improvement Littlejohn, Inc. manufactures machined parts for the automotive industry. The activity cost associated with Part XX-10 is as follows: Activity Activity-Base Usage Activity Rate = Activity Cost Fabrication 250 dlh 80per dlh 20,000 Setup 10 setups 80 per setup 800 Production control 10 prod, runs 30 per prod, run 300 Moving 10 moves 25 per move 250 Total activity cost per unit 21,350 Estimated units of production 500 Activity cost per unit 42.70 Each unit requires 30 minutes of fabrication direct labor. Moreover, part XX-10 is manufactured in production run sizes of 50 units. Each production run is set up, scheduled (production control), and moved as a batch of 50 units. Management is considering improvements in the setup, production control, and moving activities in order to cut the production run sizes by half. As a result, the number of setups, production runs, and mows will double from 10 to 20. Such improvements are expected to speed the companys ability to respond to customer orders. Setup is reengineered so that it takes 60% of the original cost per setup. Production control software will allow production control effort and cost per production run to decline by 60%. Moving distance was reduced by 40%, thus reducing the cost per mow by the same amount. A. Determine the revised activity cost per unit under the proposed changes. B. Did these improvements reduce the activity cost per unit? C. What cost per unit for setup would be required for the solution in (A) to equal the base solution?arrow_forwardBudget performance report for a cost center Sneed Industries Company sells vehicle parts to manufacturers of heavy construction equipment. The Crane Division is organized as a cost center. The budget for the Crane Division for the month ended August 31, 20Y6, is as follows (in thousands): During August, the costs incurred in the Crane Division were as follows: Instructions For which costs might the director be expected to request supplemental reports?arrow_forwardActivity-based department rate product costing and product cost distortions Big Sound Inc. manufactures two products: receivers and loud-speakers. The factory overhead incurred is as follows: Indirect labor 400,400 Cutting Department 198,800 Finishing Department 114,800 Total 714,000 The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Activity Budgeted Activity Cost Activity Base Setup 138,600 Number of setup Quality Control 261,800 Number of inspections Total 400,400 The activity-base usage quantities and units produced for the two products follow: Number o Setup Number of Inspections Direct Labor HoursSubassembly Direct Labor HoursFinal Assembly Units Produced Snowboards 430 5,000 4,000 2,000 6,000 Skis _70 2,500 2,000 4,000 6,000 Total 500 7,500 6,000 6,000 12,000 Instructions 1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is 5420,000 and 294,000 for the Subassembly and Final Assembly departments, respectively. 2. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (1). 3. Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. 4. Determine the total and per-unit cost assigned to each product under activity-based costing. 5. Explain the difference in the per-unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods.arrow_forward

- Appendix Absorption costing income statement On June 30, the end of the first month of operations, Tudor Manufacturing Co. prepared the following income statement, based on the variable existing concept: Sales (420,000 units) 7,450,000 Variable cost of goods sold: Variable cost of goods manufactured (500,000 units x 14 per unit) 7,000,000 Less ending inventory (80,000 units x 14 per unit) 1,120,000 Variable cost of goods sold 5,880,000 Manufacturing margin 1,570,000 Variable selling and administrative expenses 80,000 Contribution margin 1,490,000 Fixed costs: Fixed manufacturing costs 160,000 Fixed selling and administrative expenses 75,000 235,000 Income from operations 1,255,000 a. Prepare an absorption costing income statement. b. Reconcile the variable costing income from operations of 1,255,000 with the absorption costing income from operations determined in (a).arrow_forwardQuestion V – Allocate Costs with Reciprocal Method (8 Marks) Anchor Company manufactures a variety of tool boxes. They have two operating divisions – Corporate Sales and Consumer Sales – and two support divisions –Admin and IT. Each operating division operates independently. Anchor uses the number of employees to allocate Admin costs and computer processing time to allocate IT costs. The following data are available for the month: SUPPORT DEPT OPERATING DEPT Admin IT Corp Sales Cons. Sales Budgeted costs before interdivision allocations $170,000 $400,000 $2,000,000 $1,000,000 Admin budgeted # of employees 40 80 70 IT budgeted # of processing time (in minutes) 600 4,000 3,400 REQUIRED: Using the reciprocal method, allocate the support department costs.arrow_forwardExercise 11-35 (Algo) Cost Allocation: Direct Method (LO 11-2) Bens Corporation has three service departments (Repairs, HR, and IT) and two production departments (M1 and M2). The following usage data for each of the service departments for the previous period follow. Repairs HR IT M1 M2 Repairs — 0 % 0 % 40 % 60 % HR 10 % — 20 % 35 % 35 % IT 0 % 10 % — 20 % 70 % The direct costs of the service departments in the previous period were $84,000 for Repairs, $103,600 for HR, and $189,000 for IT. Required: Use the direct method to allocate the service department costs to the production departments. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.arrow_forward

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning