Concept explainers

Target service costs, value engineering, activity-based costing. Lagoon is an amusement park that offers family-friendly entertainment and attractions. The park boasts more than 25 acres of fun. The admission price to enter the park, which includes access to all attractions, is $35. To earn the required rate of

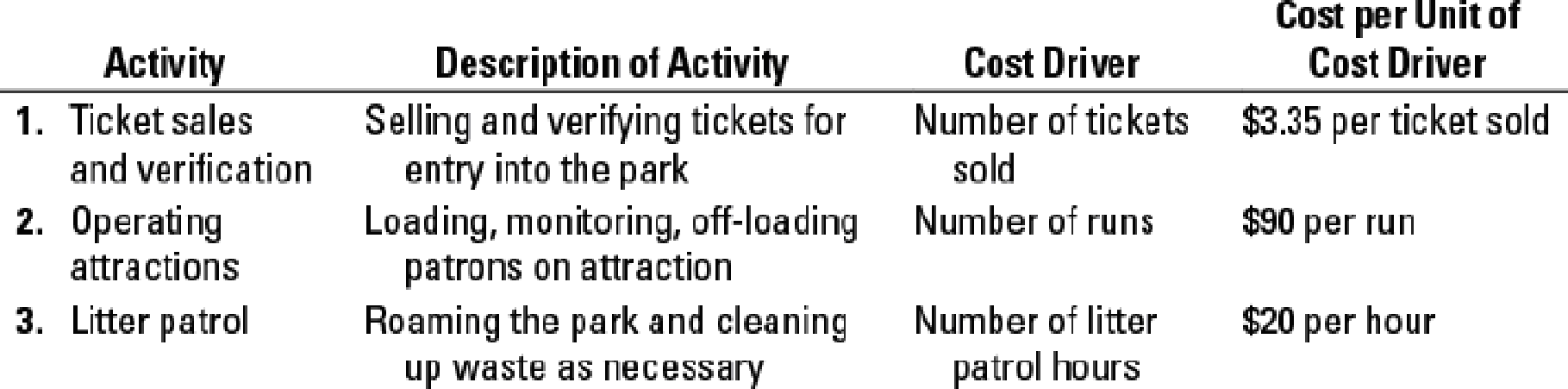

The following information describes the existing operations:

- a. The average number of patrons per week is 55,000.

- b. The total number of runs across all attractions is 11,340 runs each week.

- c. It requires 1,750 hours off litter patrol hours to keep the park clean.

In response to competitive pressures and to continue to attract 55,000 patrons per week, Lagoon has decided to lower ticket prices to $33 per patron. To maintain the same level of profits as before, Lagoon is looking to make the following changes to reduce operating costs:

- a. Reduce the cost of selling and verifying tickets by $0.35 per ticket sold.

- b. Reduce the total number of runs across all attractions by 1,000 runs by reducing the operating hours of some of the attractions that are not very popular.

- c. Increase the number of refuse containers in the park at an additional cost of $250 per week. This will decrease the litter patrol hours by 20%.

The cost per unit of cost driver for all other activities will remain the same.

- 1. Will Lagoon achieve its target operating income of 35% of revenues at ticket prices of $35 per ticket before any operating changes?

- 2. After Lagoon reduces ticket prices and makes the changes and improvements described above, will Lagoon achieve its target operating income in dollars calculated in requirement 1? Show your calculations.

- 3. What challenges might managers at Lagoon encounter in achieving the target cost? How might they overcome these challenges?

- 4. A new carbon tax of $3 per run is proposed to be levied on the energy consumed to operate the attractions. Will Lagoon achieve its target operating income calculated in requirement 1? If not, by how much will Lagoon have to reduce its costs through value engineering to achieve the target operating income calculated in requirement 1?

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Green Manufacturing is a traditional manufacturing company located in the midwestern United States. The company's operations manager is developing a strategy to become more CSR-oriented. In an effort to evaluate possible areas where CSR initiatives can be implemented, the manager has gathered the following data regarding three potential CSR activities: Initial Added Cost Variable Cost Variable Savings Recycle and reuse production materials $ 5,000 $0.10 per lb. of recycled material $0.15 per lb. of recycled material Add solar panels as a source of power 700,000 $ 1,000 per year $ 33,000 per year Replace assembly room light fixtures with natural light 120,000 $ 180 per month $ 220 per month The recycling activity would carry on indefinitely. The solar panels would have a useful life of 30 years. The replacement of assembly room light fixtures with natural light is assumed to have an 80-year effect. a. Identify which CSR activities Green Manufacturing should…arrow_forwardGreen Manufacturing is a traditional manufacturing company located in the midwestern United States. The company's operations manager is developing a strategy to become more CSR-oriented. In an effort to evaluate possible areas where CSR initiatives can be implemented, the manager has gathered the following data regarding three potential CSR activities: Initial Added Cost Variable Cost Variable Savings Recycle and reuse production materials $ 5,000 $0.10 per lb. of recycled material $0.15 per lb. of recycled material Add solar panels as a source of power 700,000 $ 1,000 per year $ 33,000 per year Replace assembly room light fixtures with natural light 120,000 $ 180 per month $ 220 per month The recycling activity would carry on indefinitely. The solar panels would have a useful life of 30 years. The replacement of assembly room light fixtures with natural light is assumed to have an 80-year effect. a. Identify which CSR activities Green Manufacturing should…arrow_forwardGreen Manufacturing is a traditional manufacturing company located in the midwestern United States. The company's operations manager is developing a strategy to become more CSR-oriented. In an effort to evaluate possible areas where CSR initiatives can be implemented, the manager has gathered the following data regarding three potential CSR activities: Initial Added Cost Variable Cost Variable Savings Recycle and reuse production materials $ 5,000 $0.10 per lb. of recycled material $0.15 per lb. of recycled material Add solar panels as a source of power 700,000 $ 1,000 per year $ 33,000 per year Replace assembly room light fixtures with natural light 120,000 $ 180 per month $ 220 per month The recycling activity would carry on indefinitely. The solar panels would have a useful life of 30 years. The replacement of assembly room light fixtures with natural light is assumed to have an 80-year effect. a. Identify which CSR activities Green Manufacturing should…arrow_forward

- The Conti Company is decentralized, and divisions are considered investment contors. Con has one division that manufactures oak dining room chairs with upholstered seat cushions. The Chair Division cuts, assembles, and finishes the cak chairs and then purchases and attaches the seat cushions (Click the icon to view additional information) Read the requirements Requirement 3. Assume the Chair Division purchases the 900 cushions needed from the Cushion Division at its current variable cost. What is the total contribution margin for each division and the company? (Enter "0" for any zero amounts) Number of units Contribution margin per unt Total contribution margin Cushion Division Total Requirement 4. Review your answers for Requirements 1, 2, and 3. What is the best option for Con Company? The best option for Cois in total contribution margin than if the duson purchanchons inveraly By having the Chair Division purchase the cushions from a in outside vendor, the company would get…arrow_forwardGreen Manufacturing is a traditional manufacturing company located in the midwestern United States. The company’s operations manager is developing a strategy to become more CSR-oriented. In an effort to evaluate possible areas where CSR initiatives can be implemented, the manager has gathered the following data regarding three potential CSR activities: Initialadded cost Variable cost Variable savings Recycle and reuse production material $5,000 $0.10 per lb. of recycled material $0.15 per lb. of recycled material Add solar panels as a source of power 700,000 $1,000 per year $33,000 per year Replace assembly room light fixtures with natural light 120,000 $180 per month $220 per month The recycling activity would carry on indefinitely. The solar panels would have a useful life of 30 years. The replacement of assembly room light fixtures with natural light is assumed to have an 80-year effect. a. Determine if it is viable to recycle and use…arrow_forwardWaterfun Technology produces engines for recreational boats. Because of competitive pressures, the company was making an effort to reduce costs. As part of this effort, management implemented an activity-based management system and began focusing its attention on processes and activities. Receiving was among the processes (activities) that were carefully studied. The study revealed that the number of receiving orders was a good driver for receiving costs. During the last year, the company incurred fixed receiving costs of $630,000 (salaries of 10 employees). These fixed costs provide a capacity of processing 72,000 receiving orders (7,200 per employee at practical capacity). Management decided that the efficient level for receiving should use 36,000 receiving orders. Required: 1. Explain why receiving would be viewed as a value-added activity. Which of these are possible reasons that explain why the demand for receiving is more than the efficient level of 36,000 orders. 2. Break…arrow_forward

- Waterfun Technology produces engines for recreational boats. Because of competitive pressures, the company was making an effort to reduce costs. As part of this effort, management implemented an activity-based management system and began focusing its attention on processes and activities. Receiving was among the processes (activities) that were carefully studied. The study revealed that the number of receiving orders was a good driver for receiving costs. During the last year, the company incurred fixed receiving costs of $630,000 (salaries of 10 employees). These fixed costs provide a capacity of processing 72,000 receiving orders (7,200 per employee at practical capacity). Management decided that the efficient level for receiving should use 36,000 receiving orders. Required: 1. Explain why receiving would be viewed as a value-added activity. List all possible reasons. Also, list some possible reasons that explain why the demand for receiving is more than the efficient level of…arrow_forwardThe manager of a regional warehouse must decide on the number of loading docks to request for a new facility in order to minimize the sum of dock costs and driver-truck costs. The manager has learned that each driver-truck combination represents a cost of $205 per day and that each dock plus loading crew represents a cost of $1,118 per day. Use Table 18.4. a. How many docks should be requested if trucks arrive at the rate of four per day, each dock can handle five trucks per day, and both rates are Poisson? Number of dock(s) b. An employee has proposed adding new equipment that would speed up the loading rate to 5.71 trucks per day. The equipment would cost an additional $100 per day for each dock. What is the lowest daily total cost that can be achieved with the new equipment? (Round your cost amount to 2 decimal places and all other calculations to 3 decimal places.) The daily total cost with the new equipment isarrow_forwardTheory of constraints, throughput margin, and relevant costs. Washington Industries manufactures electronic testing equipment. Washington also installs the equipment at customers’ sites and ensures that it functions smoothly. Additional information on the manufacturing and installation departments is as follows (capacities are expressed in terms of the number of units of electronic testing equipment): Washington manufactures only 250 units per year because the installation department has only enough capacity to install 250 units. The equipment sells for $55,000 per unit (installed) and has direct material costs of $30,000. All costs other than direct material costs are fixed. The following requirements refer only to the preceding data. There is no connection between the requirements.arrow_forward

- Nation's Capital Fitness, Incorporated, operates a chain of fitness centers in the Washington, D.C., area. The firm's controller is accumulating data to be used in preparing its annual profit plan for the coming year. The cost behavior pattern of the firm's equipment maintenance costs must be determined. The accounting staff has suggested the use of an equation, in the form of Y= a + bx, for maintenance costs. Data regarding the maintenance hours and costs for last year are as follows: Month January February March April May June July August September October November December Total Average Hours of Maintenance Service 560 480 280 470 350 460 320 430 490 380 350 340 4,910 409 Maintenance cost Maintenance Costs $ 5,110 4,240 2,730 4,300 3,030 4, 120 3,000 3,590 4,000 3,220 3,170 3,070 $ 43,580 $ 3,632 PR 6-38 (Algo) Part 3 Compute the predicted maintenance cost... 3. Compute the predicted maintenance cost at 670 hours of activity. Answer is complete but not entirely correct. $ 49,192 Xarrow_forwardNation's Capital Fitness, Incorporated, operates a chain of fitness centers in the Washington, D.C., area. The firm's controller is accumulating data to be used in preparing its annual profit plan for the coming year. The cost behavior pattern of the firm's equipment maintenance costs must be determined. The accounting staff has suggested the use of an equation, in the form of Y= a + bX, for maintenance costs. Data regarding the maintenance hours and costs for last year are as follows: Month January February March April May June July August September October November December Total Average Hours of Maintenance Service Variable maintenance cost 560 480 280 470 350 460 320 430 490 380 350 340 4,910 409 $ Maintenance Costs $ 5,110 4,240 2,730 4,300 3,030 4, 120 PR 6-38 (Algo) Part 2 What is the variable component of the maintenance cost? 2. Using your answer to requirement 1, what is the variable component of the maintenance cost? Note: Round your answer to 2 decimal places. 3,000 3,590…arrow_forwardKagle design engineers are in the process of developing a new “green” product, one that will significantly reduce impact on the environment and yet still provide the desired customer functionality. Currently, two designs are being considered. The manager of Kagle has told the engineers that the cost for the new product cannot exceed $550 per unit (target cost). In the past, the Cost Accounting Department has given estimated costs using a unit-based system. At the request of the Engineering Department, Cost Accounting is providing both unit- and activity-based accounting information (made possible by a recent pilot study producing the activity-based data). Unit-based system:Variable conversion activity rate: $100 per direct labor hourMaterial usage rate: $20 per partABC system:Labor usage: $15 per direct labor hourMaterial usage (direct materials): $20 per partMachining: $75 per machine hourPurchasing activity: $150 per purchase orderSetup activity: $3,000 per setup hourWarranty…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education