Concept explainers

(Supplement 12B) Preparing a Statement of

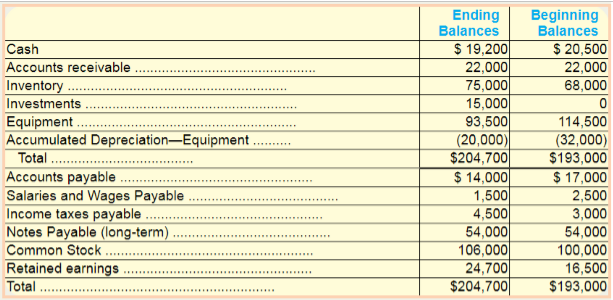

Golf Universe is a regional and online golf equipment retailer. The company reported the following for the current year:

• Purchased a long-term investment for cash, $15,000.

• Paid cash dividend, $12,000.

• Sold equipment for $6,000 cash (cost, $21.000;

• Issued shares of no-par stock, 500 shares at $12 cash per share.

• Net income was $20,200.

• Depreciation expense was $3,000.

Its comparative balance sheet is presented as follows.

Required:

1. Following Supplement 12B, complete a T-account worksheet to be used to prepare the statement of cash flows for the current year.

2. Based on the T-account worksheet, prepare the statement of cash flows for the current year in proper format.

(a)

Concept introduction:

Cash flow statements: It shows the inflow and outflow of cash along with the reasons, during a particular period of time. All the cash transactions are categorized in three types of activities i.e., operating, investing and financing activities.

To show:

The t-shape accounts for all the items.

Explanation of Solution

T-shape accounts for non-cash items:

| Accounts Receivable | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 22,000 | ||

| Increase | 0 | ||

| Ending Balance | 22,000 | ||

| Inventory | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 68,000 | ||

| Increase | 7,000 | ||

| Ending Balance | 75,000 | ||

| Investment | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 0 | ||

| Purchased | 15,000 | ||

| Ending Balance | 15,000 | ||

| Equipment | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 114,500 | ||

| Disposal | 21,000 | ||

| Ending Balance | 93,500 | ||

| Accumulated Depreciation | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 32,000 | ||

| Decrease | 12,000 | ||

| Ending Balance | 20,000 | ||

| Accounts Payable | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 17,000 | ||

| Decrease | 3,000 | ||

| Ending Balance | 14,000 | ||

| Salaries and Wages Payable | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 2,500 | ||

| Decrease | 1,500 | ||

| Ending Balance | 1,000 | ||

| Income Tax Payable | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 3,000 | ||

| Decrease | 1,500 | ||

| Ending Balance | 4,500 | ||

| Notes Payable (long-term) | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 54,000 | ||

| Increase | 0 | ||

| Ending Balance | 54,000 | ||

| Common Stock | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 100,000 | ||

| Decrease | 6,000 | ||

| Ending Balance | 106,000 | ||

| Retained Earnings | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 16,500 | ||

| Dividend | 12,000 | Net Income | 20,200 |

| Ending Balance | 24,700 | ||

T-shape accounts for cash account:

| Particulars | $ (debit) | Particulars | $ (credit) |

| Operating Activities | |||

| Net Income | 20,200 | Inventory | 7,000 |

| Depreciation Expense | 3,000 | Accounts Payable | 3,000 |

| Income tax payable | 1,500 | Salaries and Wages Payable | 1,000 |

| Net Cash flow from operating 13,700 | |||

| Investing Activities | |||

| Sold Equipment | 6,000 | Purchased Investments | 15,000 |

| Net cash used by Investing | 9,000 | ||

| Financing | |||

| Proceed from issue of stock | 6,000 | Paid Dividends | 12,000 |

| Net Cash used by Financing Activities | 6,000 | ||

| Net decrease in cash | 1,300 | ||

| Beginning Cash | 20,500 | ||

| Ending cash | 19,200 | ||

(b)

Concept introduction:

Cash flow statements: It shows the inflow and outflow of cash along with the reasons, during a particular period of time. All the cash transactions are categorized in three types of activities i.e., operating, investing and financing activities.

To prepare:

The cash flow statement.

Explanation of Solution

| Particulars | $ |

| Operating Activities: | |

| Net Income | 20,200 |

| Depreciation | 3,000 |

| Cashflow from operating activities before working capital changes | 23,200 |

| (-) Increase in inventory | (7,000) |

| (-) Decrease in Accounts Payable | (3,000) |

| (-) Decrease in Wages and Salaries Payable | (1,000) |

| (+) Increase in Income tax payable | 1,500 |

| Cashflow from operating activities | 13,700 |

| Investing Activities: | |

| (+) Cash proceeds from sale of equipment | 6,000 |

| (-) Purchase of investments | (15,000) |

| Cashflow used in investing activities | (9,000) |

| Financing Activities: | |

| Proceeds from issue of stock | 6,000 |

| (-) Paid dividends | (12,000) |

| Cashflow used in financing activities | (6,000) |

| Net decrease in cash | (1,300) |

| Beginning Cash | 20,500) |

| Ending Cash | 19,200 |

Want to see more full solutions like this?

Chapter 12 Solutions

Managerial Accounting

- Statement of Cash Flows A list of Fischer Companys cash flow activities is presented here: a. Patent amortization expense, 3,500 b. Machinery was purchased for 39,500 c. At year-end, bonds payable with a face value of 20,000 were issued for 17,000 d. Net income, 47,200 k. Inventories increased by 15,400 e. Dividends paid, 16,000 f. Depreciation expense, 12,900 g. Preferred stock was issued for 13,600 h. Investments were acquired for 21,000 i. Accounts receivable increased by 4,300 j. Land was sold at cost, 11,000 k. Inventories increased by 15,400 l. Accounts payable increased by 2,700 m. Beginning cash balance, 19,400 Required: Prepare Fischers statement of cash flows.arrow_forwardSeamus Industries Inc. buys and sells investments as part of its ongoing cash management. The following investment transactions were completed during the year: Journalize the entries for these transactions.arrow_forwardUse the following excerpts from Eagle Company's financial records to determine net cash flows from financing activities. acquired new plant assets $18,000 borrowed from bank, note payable 40,000 declared and paid dividends to shareholders 15,000arrow_forward

- Assume a company’s balance sheet showed beginning and ending balances in the Long-Term Investments account of $1,100,000 and $900,000, respectively. The company sold a long-term investment that cost $300,000 and recorded a gain on this sale of $35,000. Based solely on the information provided, the company’s net cash provided by (used in) investing activities would be: Multiple Choice $200,000. $300,000. $235,000. $335,000.arrow_forwardBased on the following information, compute cash flows from financing activities under GAAP. Purchase of investments $ 210 Dividends paid 1,160 Interest paid 360 Additional borrowing from bank 2,600arrow_forwardFollowing information of Beta Inc are as follows: Purchase of a machinery(Plant asset)=280,000 Proceeds from land sale=300,000 Proceeds from issuance of common shares=300,000 Proceeds from long term borrowings=400,000 Inventory purchases=850,000 Find the cash provided by investing activities for the year as per cash flow statement.arrow_forward

- E12-24 (Algo) (Supplement C) Preparing a Statement of Cash Flows, Indirect Method: T-Account Method GolfGear & More, Inc., Is a reglonal and online golf equipment retaller. The company reported the following for the current year: Purchased a long-term Investment for cash, $22,800. Pald cash dividend, $13,300. Sold equipment for $12,500 cash (cost, $34,000, accumulated depreciation, $21,500). Issued shares of no-par stock, 600 shares at $10 per share cash. Net income was $26,700. Depreciation expense was $4300. Its comparative balance sheet is presented below. Balances 12/31/Current 12/31/Prior Dalances Year Year 25,700 35,00 74,500 Cash 23,100 35,000 82,800 22,800 87,000 (16,100) 234,600 $ 15,300 2,800 7,100 67,000 Accounta receivable Merchandise inventory Investments Equipnent Accumulated depreciation 121,000 (33,300) 222,900 $23,500 5,100 4,300 67,000 Total Accounts payable Wagen payable Income taxes payable Notes payable Common atock and additional paid-in capital Retained earnings…arrow_forwardNet Cash Provided by Operating Activities Wiley Company’s income statement for Year 2 follows: The company’s selling and administrative expense for Year 2 includes $7,500 of depreciation expense. Selected balance sheet accounts for Wiley at the end of Years 1 and 2 are as follows: Required: 1. Using the direct method, convert the company’s income statement to a cash basis. 2. Assume that during Year 2 Wiley had a $9,000 gain on sale of investments and a $3,000 loss on the sale of equipment. Explain how these two transactions would affect your computations in (1) above.arrow_forwardIn the chapter of Statement of Cash Flows. There is a question asks for - "Identify how each transaction would be classified for purpose of creating a statement of cash flows." The Westside Deli has engaged in several transactions during the year as follows: 1. Purchased a delivery van for $15,000 and paid cash. 2. Sold 100 shares of capital stock with a $5 par value per share for $10 per share. 3. Borrowed $15,000 from the local savings and loan institution on a long-term basis. 4. Paid dividends of $10,000 during the year. 5. Sold investments, with book value of $8,000, for $6,000. 6. Purchased short-term investments (stock in a Fortune 500 company) for $4,500. 7. Repurchased fifty shares of its own capital stock for $300. Stock is to be held for pos-sible resale. 8. Paid $5,600 of long-term debt. 9. Exchanged 100 shares of capital stock for $1,000 of long-term debt owed to First Bank. 10. Purchased vacant land for $10,000 for potential expansion two years hence.arrow_forward

- Rainey enterprises loaned $50,000 to Small Co. on June 1, Year 1, for one year at 6% interest. Rainey Enterprises loaned $50,000 to Small Co. on June 1, Year 1, for one year at 6 percent interest. Required Show the effects of the following transactions in a horizontal statements. In the Cash Flow column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). For any element not affected by the event, leave the cell blank. (Not every cell will require entry. Do not round intermediate calculations. Enter any decreases to account balances and cash outflows with a minus sign. Round your answers to the nearest whole dollar.) (1) The loan to Small Co. (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. RAINEY ENTERPRISES Horizontal Statements Model Assets Equity Income Statenment Statement of Cash Flow Date Liabilinies Notes Receivable Interest Receivable Retained…arrow_forwardBad Brad's BBQ had cash flows for the year as follows ($ in millions): Cash received from: Customers Interest on investments Sale of land Sale of common stock Issuance of debt securities Cash paid for: $2,900 260 120 550 2,400 Interest on debt Income taxes Debt principal reduction Purchase of equipment Purchase of inventory Dividends on common stock Operating expenses Bad Brad's would report net cash inflows (outflows) from investing activities in the amount of: Multiple Choice $340 90 1,500 4,100 850 200 550arrow_forwardCash Flow Ratios Tracy Company reports the following amounts in its annual financial statements 31,000* Capital expenditures. (000 0 Average current assets. $90,000 Cash flow from operating activities. Cash flow from investing activities Cash flow from financing activities. 80,000 Average current liabilities Total assets P3000 (10,000) 000 0 Net income 000 000 * This amount is a cash outflow. Compute Tracy's free cash flow. a. Compute Tracy's operating-cash-flow-to-current-liabilities ratio. b. Compute Tracy's operating-cash-flow-to-capital-expenditures ratio. C.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning