Concept explainers

a)

The computation of magnitude of operating leverage utilising contribution margin approach of each firm.

a)

Answer to Problem 27P

the operating leverage of L Company and B Company are 1.5 times and 3 times.

Explanation of Solution

Given information:

The formula to calculate the magnitudes of operating leverage are as follows:

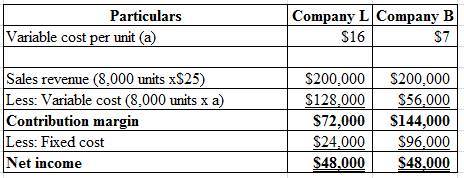

Calculate the magnitude of operating leverage of L Company and B Company:

Hence, the operating leverage of L Company and B Company are 1.5 times and 3 times.

b)

Determine the change in net income in amount and change in percentage of net income

b)

Explanation of Solution

Given information:

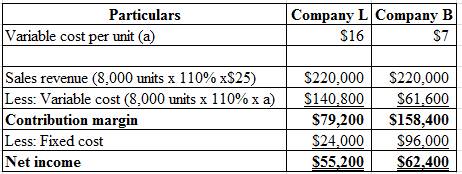

The sales increased by 10% for both Company L and Company B and selling price remain unchanged.

The formula to calculate the percentage change in net income:

Compute the change in net income in dollars:

Calculate the percentage change in net income of Company L and Company B:

Hence, the percentage change of net income of Company L and Company B is 15% and 30%

c)

Determine the change in net income in amount and change in percentage of net income.

c)

Explanation of Solution

Given information:

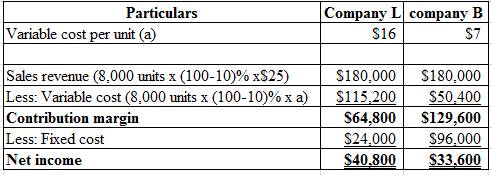

The sales decreased by 10% for both Company L and Company B and selling price remain unchanged.

The formula to compute the percentage change in net income:

Compute the change in net income in dollars:

Calculate the percentage change in net income of Company L and Company B:

Hence, the percentage change of net income of Company L and Company B is −15% and −30%

d)

Write a memo regarding the analyses and advice by Person JD.

d)

Explanation of Solution

To,

Person A

From,

Person JD

Subject:

Analysis and recommendation regarding the investment

Date: 11/29/2018

The rewards and risk of both the companies are different even though they have same amount of sales and net income. From the analysis of Person JD the operating leverage is 1.5 for Company L and 3 for Company B.

The analytical data indicates that income of Company B is more volatile than Company L.

Investment in Company B will be the better choice in a economy boom situation. Otherwise, Company L is considering better. An aggressive investor can choice Company B and a conservative investor can go for Company L.

Want to see more full solutions like this?

Chapter 11 Solutions

Survey Of Accounting

- QUESTION 27 Top management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 2 Sales $9,000,000 Operating income 300,000 Average operating assets 3,000,000 Required: Compute the Return on investment 8% 10% 12% 9%arrow_forwardQuestion 3 You have been presented with the following information : Customer Perspective Actual Performance $6.5 mil Targets a. Total Sales $ 10 mil b. No. of Stock Returns 10 20 Internal Business Perspective a. Maintenance Costs b. No of Workers (production) Targets $200k Actual Performance $50k 30 15 Financial Perspective Actual Performance Targets $4mil a. Net Profit $1mil b. Asset Turnover ratio 15 times 20 times Innovation & Growth Perspective Targets $100k Actual Performance $20k a. Training Costs b. No of Staff (Marketing) 20 12 Other information obtained are customers are frequently complaining and cancelling orders and machines breakdowns. Required : i) Comment on the performance. ii) Propose suggestion to improve.arrow_forwardQUESTION 31 Top management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 1 2 3 Sales $10,000,000 $9,000,000 $6,000,000 Operating income 200,000 300,000 300,000 Average operating assets 2,000,000 3,000,000 3,000,000 Minimum required rate of return = 8% Evaluate the three investment choices: Each investment choice has the same ROI, 10 percent. Choices 2 & 4 have a higher residual income then Choice 1, but that is to be expected given that they appear to be larger. Because residual income is an absolute measure, it should not be used to compare investment centers of different size. In general, larger investment centers should have larger residual incomes. Each investment choice has a different ROI. Choices 2 & 3 have a higher residual income then Choice 1, but that is to be expected given that…arrow_forward

- QUESTION 25 Top management is trying to determine which would be the best choice of the following: Data of investment choices: 1 Sales $10,000,000 Operating income 200,000 Average operating assets 2,000,000 Required: Compute the Return on Investment 9% 12% 8% 10%arrow_forwardQuestion 14 The cost function for Ciao Company is: TC = $800+ 0.375 × Revenue. If Ciao expects after-tax income of $600, and the tax rate is 40%, what is the firm's margin of safety in $?arrow_forwardProblem 1 Ziege Systems is considering the following independent projects for the next year. REQUIRED RATE OF INVESTMENT RETURN $4 million 14.0% $5 million 11.5 $3 million 9.5 9.0 12.5 12.5 7.0 11.5 PROJECT A B C D EFGH H $2 million $6 million $5 million $6 million $3 million RISK High High Low Average High Average Low Low The company estimates that its WACC is currently 10%. The company adjusts for risk by adding 2% for WACC for high-risk projects and subtracting 2 % from the WACC (discount rate) for low-risk projects. a. Which projects should Ziege accept if it faces no capital constraints ? b. If Ziege only has the ability to invest a total of $13 million, which projects should it accept?arrow_forward

- Problem 2 A company that manufactures many types of plastic products, used packaging and wrapping. If the company's cash flow (in thousand) for one of its product divisions is as shown below. Determine (a) the number of possible I values and (b) all rate of return values between 0% and 100%. Year 0 1 2 3 4 5 6 NCF, $ -30 -2 -6 9 +21 +30 +18 +40arrow_forward11:52 Investment Appraisal (Year 2 Column 2... Project 1 Project 2 Project 3 8. When calculating NPV will using a higher discount factor lead to ...? A higher NPV A lower NPV The same NPV 9. Which method of investment appraisal would be best for a business that has liquidity problems? NPV ARR ... Activity Chat Teams Assignments More 10arrow_forwardQUESTION 6 You have information about 4 different companies below in the table. The variable and fixed costs are expressed as the percentage of revenue based on the current sales. The companies are otherwise very similar. Which of these companies is probably have the highest degree of operating leverage? A B с D Variable cost (%) 35% 27% 50% 80% 50% 60% 30% 5% Fixed cost O Project A O Project D O Project C O Project Barrow_forward

- Question 8 of 17 A business has the capacity to manufacture 720 electronic components per annum that it sells for $500 each. The variable costs are $270 per component and the fixed costs are $102,000 per year. a. What quantity should it sell in a year to have a net income of $41,000 per year? Round up to the next whole number b. What is the net income per year at capacity? SAVE PROGRESS SUBMIT ASarrow_forwardExercise 10-10A (Algo) Using the internal rate of return to compare investment opportunities LO 10-3 Velma and Keota (V&K) is a partnership that owns a small company. It is considering two alternative investment opportunities. The first investment opportunity will have a three-year useful life, will cost $6,328.24, and will generate expected cash inflows of $2,500 per year. The second investment is expected to have a useful life of four years, will cost $11,072.11, and will generate expected cash inflows of $3,800 per year, Assume that V&K has the funds available to accept only one of the opportunities. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a. Calculate the internal rate of return of each investment opportunity. (Do not round intermediate calculations.) b. Based on the internal rates of return, which opportunity should V&K select? Internal Rate of Return a. First investment Second investment b. V&K should select thearrow_forwardProblem #9 Ratios to Evaluate the Use of Leverage You have been asked to evaluate Ballada Hardware and Del Mundo Building Supply to determine which one is doing the better job of using leverage to increase the return to ordinary shareholders. The data for the two firms are presented below. Ballada Hardware Del Mundo Building Supply Total Assets: Total Assets: Jan. 1 P1,340,000 Jan. 1 P250,000 Dec. 31 1,500,000 Dec. 31 280,000 Total Equity: Total Equity: Jan. 1 650,000 830,000 64,000 Jan. 1 150,000 Dec. 31 Dec. 31 175,000 Interest Expense Interest Expense 10,000 Profit 156,000 Profit 37,500 Required: 1. Calculate the return on total assets and the return on ordinary equity for both firms. 2. In your opinion, which firm is making the better use of leverage to increase the return to ordinary shareholders?arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning