Concept explainers

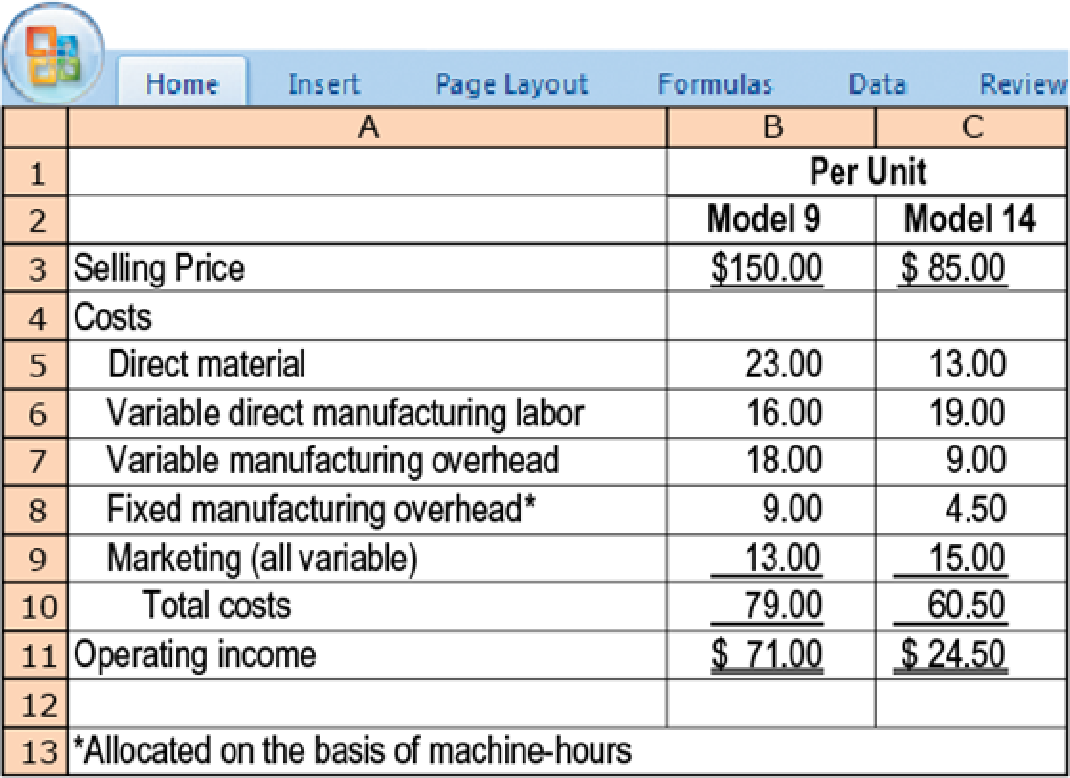

Selection of most profitable product. Body Image, Inc., produces two basic types of weight-lifting equipment, Model 9 and Model 14. Pertinent data are as follows:

The weight-lifting craze suggests that Body Image can sell enough of either Model 9 or Model 14 to keep the plant operating at full capacity. Both products are processed through the same production departments. Which product should the company produce? Briefly explain your answer.

Learn your wayIncludes step-by-step video

Chapter 11 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Intermediate Accounting

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Financial Accounting (12th Edition) (What's New in Accounting)

Financial Accounting (11th Edition)

Principles of Accounting Volume 1

- Hurney Corporation manufactures plastic water bottles. It plans to grow by producing high-quality water bottles at a low cost that are delivered in a timely manner. There are a number of other manufacturers who produce similar water bottles. Hurney believes that continuously improving its manufacturing processes and having satisfied employees are critical to implementing its strategy. Required: Is Hurney's strategy one of product differentiation or cost leadership? Explain briefly. Identify at least one key element that you would expect to see included in the balanced scorecard a. for the financial perspective. b. for the customer perspective. c. for the internal business process perspective. d. for the learning and growth perspective.arrow_forwardPlanet Fit, Inc., produces two basic types of weight-lifting equipment, Model 9 and Model 14. Pertinent data are as follows: LOADING... (Click the icon to view the data.) The weight-lifting craze suggests that Planet Fit can sell enough of either Model 9 or Model 14 to keep the plant operating at full capacity. Both products are processed through the same production departments. Read the requirements LOADING... . Before determining which products to produce, let's calculate the contribution margin per unit and the contribution margin per machine hour for each machine. (Reduce the fixed manufacturing overhead to the lowest possible ratio of machine hours in order to calculate the contribution margin per machine hour. Example: 8:4 would be 2:1. Enter the amounts to the nearest cent.) Model 9 Model 14 - = Contribution margin per unit ÷ = Contribution margin…arrow_forwardAndrews Ceramics produces specialty ceramic products for multiple uses. The company is evaluating a proposal from a start-up company that is manufacturing micro generators. The start-up wishes to purchase a quantity of your Type D48 ceramic spools. You believe that micro generators could be a growth market in the future. Being an early supporter of the start-up business could allow for substantial future business for your company. Using regression analysis, determine the cost-estimating equation to manufacture Type D48 ceramic spools. Month Spools Produced Manufacturing Costs January 7,920 $12,416 February 10,571 $11,400 March 7,560 $8,526 April 10,875 $12,420 May 13,695 $17,221 June 12,150 $15,552 July 6,448 $12,760 August 9,801 $15,077 September 13,365 $15,675 October 12,672 $18,018 November 5,360 $10,032 December 8,276 $12,974 What is the lowest price that your company could accept without making the company worse off?arrow_forward

- The jarvis corporation produces bucket loader assemblies for the tractor industry. The product has a long term life expectancy. Jarvis has a traditional manufacturing and inventory system. Jarvis is considering the installation of a just-in-time inventory system to improve its cost structure. In doing a full study using its manufacturing engineering team as well as consulting with industry JIT experts and the main vendors and suppliers of the components Jarvis uses to manufacture the bucket loader assemblies, the following incremental cost-benefit relevant information is available for analysis: The Jarvis cost of investment capital hurdle rate is 15%. One time cost to rearrange the shop floor to create the manufacturing cell workstations is $275,000. One time cost to retrain the existing workforce for the JIT required skills is $60,000. Anticipated defect reduction is 40%. Currently there is a cost of quality defect assessment listed as $150,000 per year. The setup time for…arrow_forwardRaider Corporation is planning to introduce a new product to its product line. 1. You are tasked with conducting a Cost - Volume - Profit (CVP) analysis for the new product. 2. Discuss the key components of CVP analysis, including the breakeven point, contribution margin, and margin of safety. 3. Additionally, explain how CVP analysis can assist Raider Corporation in making strategic decisions related to pricing, sales volume, and overall profitability for the new product. 4. Discuss any assumptions or limitations associated with CVP analysis that management should be aware of when using this tool for decision-making. 5. Finally, suggest potential strategies that Raider Corporation could employ to improve its CVP metrics and enhance the financial performance of the new product.arrow_forwarda) CVP analysis help managers to take better decision. Justify with real life scenario. (b)Paste Corporation has established new plant for the production of new product called “Diazinon”. There are two different manufacturing methods available to produce Diazinon. Either by using a process or an order base method. The assembling technique won't influence the quality or deals of the item. The evaluated manufacturing expenses of the two strategies are as per the following: Process base Order base Variable manufacturing cost per unit..................... Rs14.00 Rs.17.60 Fixed manufacturing cost per year ......................Rs. 2,440,000 Rs. 1,320,000 The organization's statistical surveying office has suggested an initial selling cost of Rs.35 per unit for Diazinon. The yearly fixed selling and admin costs…arrow_forward

- ExerLight produces two types of exercise treadmils: Regular and Deluxe. The exercise craze and relatod demand is such that ExerLight could use all of its available machine hours producing either model. The two models are processed through the sarne produclion department. E (Click the icon to view the data.) What product mix will maximize operating income? (Hint: Use the allocation of fixed manufacturing overhead to determine the proportion of machine hours used by each product.) Prepare the product mix analysis. Data table ExerLight Product Mix Analysis A B Doluxe Regular Per Unit Sale price per unit 1,050 600 2 Deluxe Regular 111 57 Variable cosls per unit 3 Sale price 1,050 $ 600 Contribution margin per unit 4 Less expenses: Units produced with equivalent number of machine hours 5 Direct materials 260 150 Contribution margin for equivalent number of machine hours Direct labor 80 6 178 Variable manufacturing overhead 282 94 Fixed manufacturing overhead* 144 48 Variable operating…arrow_forwardGreen manufactures agricultural equipment and is planning to develop and launch a new fuel efficient tractor. Required: Discuss how the strategic management accounting techniques below could offer Green opportunities for improving performance and ways to seek to achieve cost reduction. Just-in-time and the Theory of Constraintsarrow_forwardKelson Sporting Equipment, Inc., makes two types of baseball gloves: a regular model and a catchers model. The firm has 900 hours of production time available in its cutting and sewing department, 300 hours available in its finishing department, and 100 hours available in its packaging and shipping department. The production time requirements and the profit contribution per glove are given in the following table: Assuming that the company is interested in maximizing the total profit contribution, answer the following: a. What is the linear programming model for this problem? b. Develop a spreadsheet model and find the optimal solution using Excel Solver. How many of each model should Kelson manufacture? c. What is the total profit contribution Kelson can earn with the optimal production quantities? d. How many hours of production time will be scheduled in each department? e. What is the slack time in each department?arrow_forward

- Select a manufacturing organization (Toyota Motors) for justifying "Companies with labor incentive manufacturing processes are most likely to benefit from sending manufacturing operations overseas because the bulk of potential cost savings relate to labor costs". Identify relevant and irrelevant costs and benefits in a decision. Prepare an analysis showing whether a product line or other business segment should be added or dropped. Determine the value of obtaining the constrained resources. (Note-MANUFACTURING ORGANIZATION- Toyota motors)arrow_forwardThe Conti Company is decentralized, and divisions are considered investment contors. Con has one division that manufactures oak dining room chairs with upholstered seat cushions. The Chair Division cuts, assembles, and finishes the cak chairs and then purchases and attaches the seat cushions (Click the icon to view additional information) Read the requirements Requirement 3. Assume the Chair Division purchases the 900 cushions needed from the Cushion Division at its current variable cost. What is the total contribution margin for each division and the company? (Enter "0" for any zero amounts) Number of units Contribution margin per unt Total contribution margin Cushion Division Total Requirement 4. Review your answers for Requirements 1, 2, and 3. What is the best option for Con Company? The best option for Cois in total contribution margin than if the duson purchanchons inveraly By having the Chair Division purchase the cushions from a in outside vendor, the company would get…arrow_forwardWalton Bike Company makes the frames used to build its bicycles. During year 2, Walton made 21,000 frames; the costs incurred follow. Unit-level materials costs (21,000 units x $49) Unit-level labor costs (21,000 units × $56) Unit-level overhead costs (21,000 x $11) Depreciation on manufacturing equipment Bike frame production supervisor's salary Inventory holding costs Allocated portion of facility-level costs $1,029,000 1,176,000 231,000 90,000 93,400 280,000 590,000 Total costs $3,489,400 Walton has an opportunity to purchase frames for $120 each. Additional Information 1. The manufacturing equipment, which originally cost $550,000, has a book value of $410,000, a remaining useful life of 4 years, and a zero salvage value. If the equipment is not used to produce bicycle frames, it can be leased for $76,000 per year. 2. Walton has the opportunity to purchase for $990,000 new manufacturing equipment that will have an expected useful life of 4 years and a salvage value of $47,600. This…arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning