Concept explainers

a.

The

a.

Answer to Problem 26P

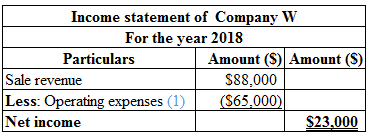

The calculation of income statement of Company W is as follows:

Table (1)

Hence, the net income of Company W is $23,000.

The calculation of balance sheet of Company W is as follows:

Table (2)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The entire $65,000 is treated as operating expenses.

(1)

The total cash is calculated as follows:

Hence, the total cash is $93,000.

(2)

b.

The balance sheet and income statement of Company W according to GAAP.

b.

Answer to Problem 26P

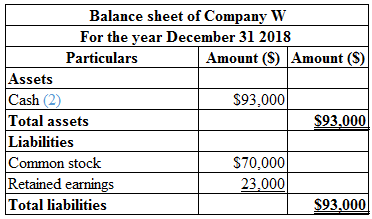

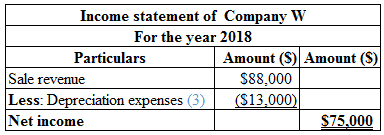

The calculation of income statement of Company W is as follows:

Table (3)

Hence, the net income of Company W is $75,000.

The calculation of balance sheet of Company W is as follows:

Table (4)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The

Hence, the depreciation is $13,000.

(3)

The depreciation amount $13,000 must be adjusted in the balance sheet as

(4)

c.

The balance sheet and income statement of Company W according to GAAP.

c.

Answer to Problem 26P

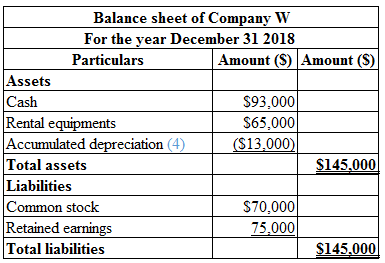

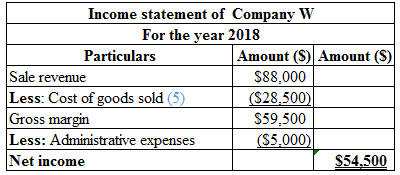

The calculation of income statement of Company W is as follows:

Table (5)

Hence, the net income of Company W is $54,500.

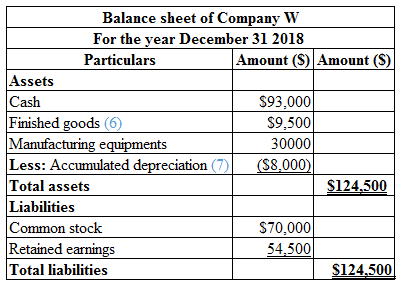

The calculation of balance sheet of Company W is as follows:

Table (6)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The depreciation on the manufacturing equipment is calculated as follows:

Hence, the depreciation cost is $8,000.

The cost per unit is calculated as follows:

Hence, the cost per unit is $19.

Calculate the cost of goods sold:

Hence, the cost of goods sold is $28,500.

(5)

The total finished goods are calculated as follows:

Hence, the finished goods are $9,500.

(6)

The depreciation on the manufacturing equipment is calculated as follows:

Hence, the accumulated depreciation cost is $8,000.

(7)

d.

Explain the reason why management might be more interested in average cost than the actual cost.

d.

Explanation of Solution

The exact cost of the product cannot be determined because the labor and material usage will differ among the same products. Cost average is an element that smoothens these differences.

Want to see more full solutions like this?

Chapter 10 Solutions

Survey Of Accounting

- PROBLEM 14: MMM Company started operations in 2019. The following data are abstractedfrom the company’s production and sales records: 2019 2020 2021 Number of units produced 120,000 116,250 101,250 Number of units sold 75,000 108,750 97,500 Unit production cost P 4.50 P 5.20 P 5.80 Sales revenue 600,000 900,000 975,000 Using the FIFO cost flow assumption, the gross profit for the year ended December 31, 2021 is:arrow_forwardQuestion 5 Zombie Berhad has the following trial balance at 31 December 2021: Revenue Purchases Returns inwards Plant at cost Machinery at cost Office equipment at cost Accumulated depreciation-- Plant Accounts payable Long-term borrowing Accounts receivable Inventory -- Machinery - Office equipment Cash and bank Administration expenses Long term borrowing interests Salaries and wages Marketing expenses Discount allowed Share capital Retained profits as at 1 Jan 2021 General Reserve Total RM 730,600 208,000 10,712,000 4,940,000 4,680,000 2,191,072 218,400 358,904 520,000 26,000 252,720 208,000 72,800 25,118,496 RM 7,602,504 936,000 988,000 520,000 629,200 1,040,000 • Ordinary share dividend proposed to be 6%. Long term borrowing interest where half year interest still owing. 8,320,000 4,602,208 480,584 25,118,496 ..5/- Additional information: • Inventory as at 31 December 2021 was RM447,200. • Provision for company tax was RM429,520. • Depreciation 20% on cost per annum based on…arrow_forwardQuestion 1: Following amounts have been Extracted from the records of Monday Limited. Description 2019 2018 - Rs. In 000- Sales 32,875 31,390 Gross profit 16,880 14,310 Profit for the year 3,300 2,700 Account receivable 3,860 2,510 Account payable 4,660 2,890 Inventory 430 445 Cash at bank 12 37 Bank overdraft 280 40 Monday Limited secured a large new contract to supply goods to a large departmental store across a two year period from 1st July 2019. Monday Limited normally offers wholesale customers 30 days’ credit, but department store would only agree to the contract with 90 days credit terms. The directors of Monday Limited agreed to this as they believed it was worth it to have their products placed with this department store. Monday Limited has an average 45 day credit from its suppliers. The bank overdraft is used to fund working capital and currently has a limit of Rs.300,000.…arrow_forward

- Question 3 ABC Company Ltd. has annual revenues of $750 million and annual cost of goods sold of $450 million. Annual cash flows from operations are $51 million, while daily credit sales were $163,548. It published its annual report for the financial year 2021- 22 ending, with the following balance sheet items as at 31 march 2022: Ending inventory: $82 million Ending accounts receivable: $56 million Ending accounts payable: $43 million ● ABC Co. Ltd. treasurers forecast the following balance pattern for monthly collections: ● ● ● Month 0: 5% Month 1: 40% Month 2: 35% Month 3: 15% Month 4: 5% Required: a) Calculate the Cash Conversion Cycle (CCC) for the company and discuss measures the company could adopt to shorten its CCC. b) What percentage of outstanding sales proceeds are yet to be collected as receivables 3 months after the sales were invoiced?arrow_forwardPLEASE ANSWER ASAP Problem No. 1 AACA Corporation was incorporated on Dec. 1, 2021, and began operations one week later. Before closing the books for the fiscal year ended Nov. 30, 2022, the controller prepared the following financial statements: AACA Corporation Statement of Financial Position November 30, 2022 Assets Current assets Cash P150,000 Marketable securities, at cost 60,000 Accounts receivable 450,000 Allowance for doubtful accounts ( 59,000) Inventories 430,000 Prepaid insurance 15,000 Total current assets 1,046,000 Property, plant and equipment 426,000 Less accumulated depreciation ( 40,000) Property, plant and equipment, net 386,000 Research and development costs 120,000 Total assets P1,552,000 Liabilities and Shareholders' Equity Current liabilities Accounts payable and accrued expenses P 592,000…arrow_forwardProblem 24-02 Windsor Corporation is a diversified company that operates in five different industries: A, B, C, D, and E. The following information relating to each segment is available for 2021. A B C D E Sales revenue $40,200 $75,000 $582,000 $35,000 $55,000 Cost of goods sold 19,300 49,500 270,600 19,400 30,500 Operating expenses 9,800 40,800 231,000 12,300 17,600 Total expenses 29,100 90,300 501,600 31,700 48,100 Operating profit (loss) $11,100 $(15,300) $80,400 $3,300 $6,900 Identifiable assets $34,600 $81,500 $504,000 $66,000 $50,600 Sales of segments B and C included intersegment sales of $19,900 and $99,200, respectively. Determine which of the segments are reportable based on the: Reportable Segment (1) Revenue test. (2) Operating profit (loss) test. (3) Identifiable assets…arrow_forward

- 14 Victory ML Bus company has the following data for the first quarter of 2021: Gross receipt from passengers P 8,000,000 Gross revenue from cargo operations 5,000,000 Expenses – Passengers operation 4,750,000 Expenses – Cargo operations 2,500,000 Gross receipt from rental of facilities 2,000,000 Additional info: 25% of its gross revenue from cargo operations were still outstanding as of the end of the quarter Required: determine the total business tax due for the first quarterarrow_forwardPROBLEM 14: MMM Company started operations in 2019. The following data are abstracted from the company's production and sales records: 2019 2020 2021 of units Number produced Number of units sold Unit production cost 116,250 108,750 P 4.50 P 5.20 P 5.80 900,000 120,000 75,000 101,250 97,500 Sales revenue 600,000 975,000 19. Using the FIFO cost flow assumption, the gross profit for the year ended December 31, 2021 is: PROBLEM 15: The following quarterly cost data have been accumulated for New DDD Manufacturing, Inc.: Raw materials, 1/1/2022 Purchases of raw materials 10,000 units at P6.00 8,500 units at P7.00 11,000 units at P7.50 Raw materials transferred to work in process Work in process, 1/1/2022 Direct labor Manufacturing overhead Work in process, 3/31/2022 21,500 units 5,600 units at P13.50 P 250,000 325,000 4,200 units at P13.75 20. If New Dehi uses the FIFO method for valuing raw materials inventories, compute for the cost of goods manufactured for the quarter ended March 31,…arrow_forwardProblem 13-02A (Video) The comparative statements of Cullumber Company are presented here: Cullumber CompanyIncome StatementsFor the Years Ended December 31 2020 2019 Net sales $1,891,640 $1,751,600 Cost of goods sold 1,059,640 1,007,100 Gross profit 832,000 744,500 Selling and administrative expenses 501,100 480,100 Income from operations 330,900 264,400 Other expenses and losses Interest expense 23,700 21,700 Income before income taxes 307,200 242,700 Income tax expense 93,700 74,700 Net income $213,500 $168,000 Cullumber CompanyBalance SheetsDecember 31 Assets 2020 2019 Current assets Cash $60,100 $64,200 Debt investments (short-term) 74,000 50,000 Accounts receivable 118,900 103,900 Inventory 127,700 117,200 Total current assets 380,700 335,300 Plant assets (net)…arrow_forward

- Members of the board of directors of Security One have received the following operating income data for the year ended May 31, 2018: E (Click the icon to view the operating income data.) Members of the board are surprised that the industrial systems product line is not profitable. They commission a study to determine whether the company should drop the line. Company accountants estimate that dropping industrial systems will decrease fixed cost of goods sold by $82,000 and decrease fixed selling and administrative expenses by $10,000. Read the requirements. Requirement 1. Prepare a differential analysis to show whether Security One should drop the industrial systems product line. (Use parentheses or a minus sign to enter decreases to profits.) in operating income Requirements 1. Prepare a differential analysis to show whether Security One should drop the industrial systems product line. 2. Prepare contribution margin income statements to show Security One's total operating income under…arrow_forwardCase 13. Master Roshi Company provided the following information pertaining to operating segments for the year ended December 31, 2015: Total revenue P 80,000,000 Sales to external customers included in total revenue 30,000,000 13. External revenue reported by reportable operating segments must be at least what amount?a. 60,000,000b. 37,500,000c. 30,000,000d. 22,500,000arrow_forwardProblem B Peter Senen Corporation provided the following account balances as of September 30, 2020: Cash P112,000 Accumulated depreciation P 36,000 Accounts Receivable 64,000 Accounts payable 40,000 Finished Goods 48,000 Income tax payable 9,000 Work in process 36,000 Share Capital 500,000 Raw materials 52,000 Retained Earnings 207,000 Property and Equipment 480,000 The following transactions occurred during October: Materials purchased on account, P150,000 Materials issued to production: direct materials- P90,000, Indirect materials- P10,000. Payroll for the month of October 2020 consisted of the following (also paid during the month): Direct labor P62,000…arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning