Computing missing information using accounting knowledge

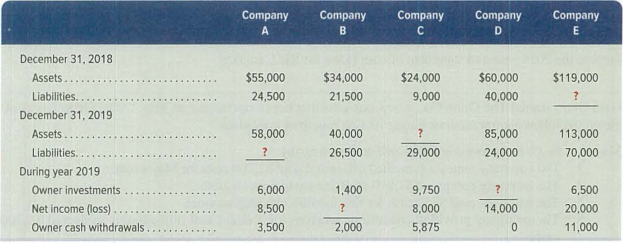

The following financial statement information is from five separate companies.

Required

1. Answer the following questions about Company A.

a. What is the amount of equity on December 31, 2018?

b. What is the amount of equity on December 31, 2019?

c. What is the amount of liabilities on December 3 I, 2019?

2. Answer the following questions about Company B.

a. What is the amount of equity on December 31, 2018?

b. What is the amount of equity on December 31, 2019?

c. What is net income for year 2019?

3. Compute the amount of assets for Company Con December 31,2019.

4. Compute the amount of owner investments for Company D during year 2019.

5. Compute the amount of liabilities for Company Eon December 31, 20 I 8.

1)

Calculate (a) the value of equity on December 31, 2018 (b) value of equity on December 31, 2019 (c) value of liabilities on December 31, 2019 for Company A.

Explanation of Solution

Liabilities:

Liabilities are an obligation of the business to pay to the creditors in future for the goods and services purchased on account or any for other financial benefit received. It can be current liabilities or a non-current liabilities depending upon the time period in which it is paid.

(a)

Calculate the value of equity on December 31, 2018.

Therefore, the value of equity as on December 31, 2018 is $30,500.

(b)

Calculate the value of equity on December 31, 2019.

Therefore, the value of equity as on December 31, 2019 is $41,500.

(c)

Calculate the value of liabilities on December 31, 2019.

Therefore, the value of liabilities as on December 31, 2019 is $16,500.

2)

Calculate (a) the value of equity on December 31, 2018 (b) value of equity on December 31, 2019 (c) value of net income for the year 2019 for Company B.

Explanation of Solution

(a)

Calculate the value of equity on December 31, 2018.

Therefore, the value of equity as on December 31, 2018 is $12,500.

(b)

Calculate the value of equity on December 31, 2019.

Therefore, the value of equity as on December 31, 2019 is $13,500.

(c)

Calculate the value of net income for the year 2019 for Company B.

Therefore, net income of Company B reported an amount of $1,600 during the year 2019.

3)

Calculate (a) the value of assets on December 31, 2019 for Company C.

Explanation of Solution

Calculate the value of assets on December 31, 2019 for Company C.

Therefore, the value of assets as on December 31, 2019 is $55,875.

Working notes:

Calculate the value of equity on December 31, 2018 of Company C.

Calculate the ending balance of equity of Company C.

4)

Calculate the Value of stock issuance during the year 2019 for Company D.

Explanation of Solution

Calculate the value of stock issuance of Company D for the year 2019.

Therefore, stock issuance of Company D reported an amount of $27,000 during the year 2018.

Working notes:

Calculate the value of equity on December 31, 2018 of Company D.

Calculate the ending balance of equity of Company D.

5)

Calculate the value of liabilities for December 31, 2018 for Company E.

Explanation of Solution

Calculate the value of liabilities of Company E for December 31, 2016.

Therefore, the value of liabilities as on December 31, 2018 is $91,500.

Working notes:

Calculate the value of equity on December 31, 2019.

Calculate the ending balance of equity.

Want to see more full solutions like this?

Chapter 1 Solutions

Principles of Financial Accounting.

- The following financial statement information is from five separate companies.Answer the following questions about Company A. a. What is the amount of equity on December 31, 2018? b. What is the amount of equity on December 31, 2019? c. What is the amount of liabilities on December 31, 2019?arrow_forwardQuestions about the Income Statement. a. List 2 expense accounts AND their amounts for 2020. b. What was the net profit/(loss) for 2020? What about 2019?c. Compared with 2019, has the net profit/(loss) increased or decreased? . Questions about the Statement of Financial Positiona. What was the Total Assets for the company at December 31, 2020? What about December 31, 2019? b. Mention the biggest liability with its amount for the company at December 31, 2020.c. What was the Total Equity for the company at December 31, 2020? What about December 31, 2019? . please help me answering both sectionsarrow_forwardPreparing financial statements Presented here are the accounts of Pembroke Bookkeeping Company for the year ended December 31, 2018: Requirements Prepare Pembroke Bookkeeping Company’s income statement. Prepare the statement of retained earnings. Prepare the balance sheet.arrow_forward

- The following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 2019: 1. Prepare a multiple-step income statement.2. Prepare a statement of owner’s equity.3. Prepare a balance sheet, assuming that the current portion of the note payable is$7,000.4. Briefly explain how multiple-step and single-step income statements differ.arrow_forwardRequirement Referring to the qualitative characteristics of accounting information, indicate the fundamental characteristic (relevance or representationally faithful) and its related attribute (confirmatory value, completeness, materiality, neutrality, or predictive value) for each of the following uses of accounting information. Use of Accounting Information This year's reported earnings per share is a. $.50 below analysts' forecasts Potential creditors review a company's long- term liabilities footnote to determine that b. entity's ability to assume additional debt. A corporation discloses both favorable and unfavorable tax settlements. C. A company discloses the write-off of an accounts receivable. The receivable due from a major customer accounts for 35% of the d. company's current assets. A financial analyst computes a company's five-year average cost of goods sold in order e. to forecast next year's profit margin. ***** Fundamental Characteristic Attributearrow_forwardOn January 1, 2019, Northern Manufacturing Company bought a piece of equipment by signing a non-interest-bearing $80,000, 1-year note. The face value of the note includes the price of the equipment and the interest. The effective interest rate is an annual rate of 16%, and the note is to be paid in four $20,000 quarterly installments on March 31, June 30, September 30, and December 31. The price of the equipment is the present value of the four payments discounted at the effective interest rate.arrow_forward

- Use the following information from XYZ Company's balance sheet to answer the next six questions: Assets a. b. c. d. a. b. 30. C. d. Cash........ Marketable Securities Accounts Receivable Inventory........ Property and Equipment. Accumulated Depreciation. Total Assets a. b. c. d. Liabilities and Stockholders' Equity Accounts Payable. Notes Payable (current). Mortgage Payable (long-term). Bonds Payable (long-term). Common Stock, $50 Par.. The average number of common stock shares outstanding during the year was 840 shares. Net earnings for the year were $6,300. 25. XYZ's current ratio is 6.0 to 1. 5.5 to 1. 26. XYZ's quick (acid-test) ratio is 4.0 to 1. 4.5 to 1. 3.5 to 1. 3.0 to 1. Paid-in Capital in Excess of Par......... Retained Earnings............ Total Liabilities, and Stockholders' Equity 4.0 to 1. 4.5 to 1. ***** 27. XYZ's earnings per share is $7.50 per share. $7.00 per share. $0.13 per share. $6,300 per share. 28. XYZ's return on assets is a. 6.9% b. 7.9% C. 14.6% d. 23.4% 29.…arrow_forwardThe December 31, 2021, adjusted trial balance for the Blueboy Cheese Corporation is presented below. Debits 14,600 345,000 14,500 54,000 640,000 Account Title Credits Cash Accounts receivable Prepaid rent Inventory Office equipment Accumulated depreciation Accounts payable Notes payable (due in six months) Salaries payable Interest payable Common stock Retained earnings Sales revenue 266,000 78,000 72,000 7,800 2,400 400, 000 165,000 780,000 Cost of goods sold Salaries expense Rent expense Depreciation expense Interest expense Advertising expense 468,000 117,000 43, 500 64,000 4,800 5,800 1,771, 200 1,771, 200 Totals Required: 1-a. Prepare an income statement for the year ended December 31, 2021. 1-b. Prepare a classified balance sheet as of December 31, 2021. Re LA Reg 1a Re 2 Prepare an incoe statement for the year anded December 31, 2021. BLUEBOY CHEESE CORPORATION Income Satement For the Year Ended December 31, 221arrow_forwardREQUIRED Study the Statement of Financial Position as at 31 December 2021 and 2020 before answering the following questions: Is the company in good financial health? Motivate your answer by referring to at least SIX(6) items on the statement. Ratios are not required. Calculate the ratios (expressed to two decimal places) that would reflect the following: A measure of the company’s ability to settle its short-term obligations within twelve A measure of the amount of total assets that are financed by creditors instead of investors INFORMATION Lomax Ltd commenced operations at the start of 2020 manufacturing only standard-sized bricks for the building industry. It’s financial position at the end of 2020 and 2021 is evident in the statements provided below: INFORMATION Lomax Ltd commenced operations at the start of 2020 manufacturing only standard-sized bricks for the building industry. It’s financial position at the end…arrow_forward

- Listed below are the current Accounting Assumptions and Principles Economic Entity Assumption Monetary Unit Assumption Historical Cost Principle Going Concern Assumption Revenue Recognition Principle Full Disclosure Principle Time Period Assumption Matching Principle Required: For the following situations, identify whether the situation represents a violation or a correct application of GAAP, and which assumption/principle is applicable. a. In May 2021, Regent Corporation recorded as revenue $5,000 received in advance from a customer for a job that would be completed in June 2021. Violation: (Yes/No) Applicable Assumption/Principle: b. Sally Maze made sure to keep her personal expenditures separate from her marketing company books.…arrow_forwardRequired: For each of the following accounts, what amount will Voltac report on its 2024 financial statements? a. Inventory b. Cost of goods sold c. Sales d. Accounts receivable e. Accounts payable f. Casharrow_forwardRequired: Based on the preceding information, prepare a correct December 31, 2022 statement of financial position for E Company with accounts properly classified.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub