Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1.6E

Changes in Owners’ Equity

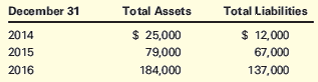

The following amounts are available from the records of Coaches and Carriages Inc. at the end of the years indicated:

Required

- Compute the changes in Coaches and Carriages owners’ equity during 2015 and 2016.

- Compute the amount of Coaches and Carriages’ net income (or loss) for 2015 assuming that no dividends were paid and the owners made no additional contributions during the year.

- Compute the amount of Coaches and Carriages’ net income (or loss) for 2016 assuming that dividends paid during the year amounted to $10,000 and no additional contributions were made by the owners.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

REQUIRED

Use the information provided below to prepare the Statement of Changes in Equity of Ashton Traders for the

year ended 29 February 2020. Use the following format:

STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 29 FEBRUARY 2020

Total (R)

Capital Accounts

Balance at 28 February 2019

Changes in capital

Balance at 29 February 2020

Ashwin (R)

Tony (R)

Ashwin (R)

Total (R)

Current Accounts

Balance at 28 February 2019

Net profit for the year

Tony (R)

Interest on capital

Salaries

Bonus

Profit Share

Drawings

Balance at 29 February 2020

INFORMATION

Ashwin and Tony are partners in a business trading as Ashton Traders. The following information is available

for the financial year ended 29 February 2020:

Extract from the ledger of Ashton Traders as at 29 February 2020

Debit

Credit

R

R

Capital: Ashwin

|Capital: Tony

600 000

400 000

Current a/c: Ashwin (01 March 2019)

Current a/c: Tony (01 March 2019)

Drawings: Ashwin

Drawings: Tony

40 000

30 000

400 000

500 000

Accounting

The following information is available for Sage Hill Inc. for the year ended

December 31, 2017:

Loss on discontinued

operations

Rent revenue

Income tax applicable

to continuing

operations

Administrative

expenses

Loss on write-down of

inventory

Gain on sale of

equipment

Unrealized gain on

available-for-sale

securities

$68,000

95,000

314,000

509,000

38,000

39,000

33,000

Retained earnings

January 1, 2017

Selling expenses

Income tax applicable to

loss on discontinued

operations

Cost of goods sold

Sales revenue

Cash dividends declared

Interest expense

200,000 shares were outstanding during all of 2017.

$1,420,000

867,000

24,000

1,672,000

3,760,000

211,000

57,000

Below are the restated amounts of net income and retained earnings for Volunteers Inc. and Raiders Inc. for the period 2012–2021. Volunteers began operations in 2013, while Raiders began several years earlier.Required: Calculate the balance of retained earnings each year for each company. Neither company paid dividends during this time.

Chapter 1 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 1 - Prob. 1.1KTQCh. 1 - Prob. 1.1ECh. 1 - Prob. 1.2ECh. 1 - The Accounting Equation For each of the following...Ch. 1 - The Accounting Equation Ginger Enterprises began...Ch. 1 - The Accounting Equation Using the accounting...Ch. 1 - Changes in Owners Equity The following amounts are...Ch. 1 - The Accounting Equation For each of the following...Ch. 1 - Classification of Financial Statement Items...Ch. 1 - Classification of Financial Statement Items Regal...

Ch. 1 - Net Income (or Loss) and Retained Earnings The...Ch. 1 - Statement of Retained Earnings Ace Corporation has...Ch. 1 - Accounting Principles and Assumptions The...Ch. 1 - Prob. 1.13ECh. 1 - Prob. 1.14ECh. 1 - Prob. 1.15MCECh. 1 - Prob. 1.16MCECh. 1 - Prob. 1.1PCh. 1 - Users of Accounting Information and Their Needs...Ch. 1 - Prob. 1.3PCh. 1 - Prob. 1.4PCh. 1 - Income Statement, Statement of Retained Earnings,...Ch. 1 - Income Statement and Balance Sheet Green Bay...Ch. 1 - Prob. 1.7PCh. 1 - Statement of Retained Earnings for The Coca-Cola...Ch. 1 - Prob. 1.9PCh. 1 - Prob. 1.10MCPCh. 1 - Prob. 1.1APCh. 1 - Users of Accounting Information and Their Needs...Ch. 1 - Prob. 1.3APCh. 1 - Prob. 1.4APCh. 1 - Income Statement, Statement of Retained Earnings,...Ch. 1 - Income Statement and Balance Sheet Fort Worth...Ch. 1 - Corrected Financial Statements Heidis Bakery Inc....Ch. 1 - Statement of Retained Earnings for Brunswick...Ch. 1 - Prob. 1.9APCh. 1 - Prob. 1.10AMCPCh. 1 - Prob. 1.1DCCh. 1 - Reading and Interpreting Chipotles Financial...Ch. 1 - Comparing Two Companies in the Same Industry:...Ch. 1 - Prob. 1.5DCCh. 1 - Prob. 1.6DCCh. 1 - Prob. 1.7DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bodie Corporation reported the following amounts in its financial statements: Retained earnings, Jan. 1, 2018 $79842 Retained earnings, Dec. 31, 2018 $60120 Net income, 2018 $53440 What were the dividends declared and paid in 2018? $___________arrow_forwardNeed asap please and thank you. Cullumber Company provides you with the following balance sheet information as of December 31, 2017. Current assets $14,720 Current liabilities $15,360 Long-term assets 32,860 Long-term liabilities 16,860 Total assets $47,580 Stockholders’ equity 15,360 Total liabilities and stockholders’ equity $47,580 In addition, Cullumber reported net income for 2017 of $20,480, income tax expense of $3,904, and interest expense of $1,664. Compute the current ratio and working capital for Cullumber for 2017. (Round current ratio to 2 decimal places, e.g. 2.75. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Current ratio enter current ratio rounded to 2 decimal places :1 Working capital $enter a dollar amountarrow_forwardThe following information is related to Nash Company for 2025. Retained earnings balance, January 1, 2025 Sales revenue Cost of goods sold Interest revenue Selling and administrative expenses Write-off of goodwill Income taxes for 2025 Gain on the sale of investments Loss due to flood damage. Loss on the disposition of the wholesale division (net of tax) Loss on operations of the wholesale division (net of tax) Dividends declared on common stock Dividends declared on preferred stock (a1) $901,600 23,000,000 14,720,000 Nash Company decided to discontinue its entire wholesale operations (considered a discontinued operation) and to retain its manufacturing operations. On September 15, Nash sold the wholesale operations to Rogers. Company. During 2025, there were 500,000 shares of common stock outstanding all year. + 64,400 4,324,000 754,400 1,144,480 101,200 358,800 404,800 82,800 230,000 73,600 Prepare a multiple-step income statement. (Round earnings per share to 2 decimal places, e.g.…arrow_forward

- Presented below is information related to Swifty Corporation at December 31, 2017, the end of its first year of operations. Sales revenue Cost of goods sold Interest expense Selling and administrative expenses Dividends declared and paid Loss on sale of investments Allocation to non-controlling interest Unrealized gain on available-for-sale financial assets Gain on discontinued operations Compute the following: Ignore tax effects. Income from operations Net income Comprehensive income $534,000 361,000 Retained earnings balance at December 31, 2017 29,300 111,100 9,500 5,500 23,500 16,600 Net income attributable to Swifty Corporation controlling shareholders 18,900 $ LA $ LA $arrow_forwardFollowing balances are extracted from the books of City Light Supply Corporation $ as on 31st March, 2016 : $ Equity Shares Debentures Sundry Creditors on Open Accounts Depreciation Fund Capital Expenditure on 31-3-2015 Capital Expenditure during 2015-16 Sundry Debtors for Current Supplied Other Debtors Stores in Hand Cash in Hand Cost of Generation of Electricity Cost of Distribution of Electricity Rent, Rates and Taxes Management Expenses Depreciation Interest on Debentures Interim Dividend Sale of Current Meter Rent Balance of Net Revenue Account as on 1st April, 2015 1,64,700 60,000 300 75,000 2,85,000 18,300 12,000 150 1,500 1,500 9,000 1,500 1,500 3,600 6,000 3,000 6,000 39,000 1,500 8,550 3,49,050 3,49,050 Prepare:- (a) Capital Account (b) Revenue Account (c) Net Revenue Account and (d) General Balance sheet from the above Trail Balance.arrow_forwardThe accounting income (loss) figures for Pronghorn Corporation are as follows: 2015 $162,000 2016 242,000 I 2017 82,000 2018 (162,000) 2019 (382,000) 2020 2021 140,000 154,000 Accounting income (loss) and taxable income (loss) were the same for all years involved. Assume a 30% tax rate for 2015 and 2016, and a 25% tax rate for the remaining years. Prepare the journal entries for each of the years 2017 to 2021 to record income tax expense and the effects of the tax loss carrybacks and carryforwards, assuming Pronghorn Corporation uses the carryback provision first. All income and losses relate to normal operations and it is more likely than not that the company will generate substantial taxable income in the future.arrow_forward

- The current sections of Bridgeport Corp.'s balance sheets at December 31, 2016 and 2017, are presented here. Bridgeport Corp.'s net income for 2017 was $153,459. Depreciation expense was $27,081. 2017 2016 Current assets Cash $105,315 $ 99,297 Accounts receivable 80,240 89,267 Inventory 168,504 172,516 Prepaid expenses 27,081 22,066 Total current assets $381,140 $383,146 Current liabilities Accrued expenses payable $ 15,045 $ 5,015 Accounts payable 85,255 92,276 Total current liabilities $100,300 $ 97,291 ember 31, 2017, using Prepare the net cash provided (used) by operating activities section of the company's statement (15,000).) cash flows or the year ende indirect ethod. (Show am that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. Bridgeport Corp. Partial Statement of Cash Flows $ Adjustments to reconcile net income to $ $1arrow_forwardUse the information provided to answer the questions that follows below: Extract of Statement of Changes in Equity for the year ended 31 December 2020 Retained earnings R Balance on 01 January 2020 1500 000 Profit after tax 480 000 Dividends paid and proposed in 2020 (180 000) Balance on 31 December 2020 1 800 000 INFORMATION The information provided below was extracted from the accounting records of Harmony Limited on 31 December 2020: Harmony Limited Extract of Statement of Comprehensive Income for the year ended 31 December 2020 Sales 6 600 000 Cost of sales (3 900 000) Gross profit 2 700 000 Operating expenses (1710 000) Selling and administrative expenses 1 260 000 Depreciation 450 000 Operating profit 990 000 Interest expense (270 000) Profit before tax 720 000 Company tax (240 000) Profit after tax 480 000arrow_forwardApplying Financial Statement Relations to Compute Dividends a. Fill in the amounts for the Norfolk Southern statement of changes in retained earnings. Note: Use negative signs with your answers, when appropriate. Norfolk Southern Inc. Consolidated Statements of Changes in Retained Income Beginning Balance at Dec. 31, 2015 $10,191 Net income Dividends on Common Stock Share repurchases Other Ending Balance at Dec. 31, 2016 Net income Dividends on Common Stock Share repurchases Other Ending Balance at Dec. 31, 2017 Net Dividends on Common Stock Share repurchases Other Ending Balance at Dec. 31, 2018 0 (695) (731) (8) 10,425 5,404 0 (945) (5) 14,176 2,666 (844) 0 81 $13,440 b. Is it true (or false) that Norfolk Southern purchased its own shares back during each year from 2016 to 2018? ◆arrow_forward

- The following information is related to Tamarisk Company for 2025. Retained earnings balance, January 1, 2025 Sales revenue Cost of goods sold Interest revenue Selling and administrative expenses Write-off of goodwill Income taxes for 2025 Gain on the sale of investments Loss due to flood damage Loss on the disposition of the wholesale division (net of tax) Loss on operations of the wholesale division (net of tax) Dividends declared on common stock Dividends declared on preferred stock $1,176,000 30,000,000 19,200,000 84,000 5,640,000 984,000 1,492,800 (a1) 132,000 468,000 528,000 108,000 300,000 96,000 Tamarisk Company decided to discontinue its entire wholesale operations (considered a discontinued operation) and to retain its manufacturing operations. On September 15, Tamarisk sold the wholesale operations to Rogers Company. During 2025, there were 500,000 shares of common stock outstanding all year. Prepare a multiple-step income statement. (Round earnings per share to 2 decimal…arrow_forwardAddtional Infomation: Commonsharsa wars lasusd for cash. Cash Paid during the year for income tax = ?arrow_forwardThe following account balances are for the Agee Company as of January 1, 2017, and December 31, 2017. All amounts are denominated in kroner (Kr).Additional Information• Agee issued additional shares of common stock during the year on April 1, 2017. Common stock at January 1, 2017, was sold at the start of operations in 2010.• Agee purchased buildings in 2011 and sold one building with a book value of Kr 1,500 on July 1 of the current year.• Equipment was acquired on April 1, 2017.Relevant exchange rates for 1 Kr were as follows:a. Assuming the U.S. dollar is the functional currency, what is the remeasurement gain or loss for 2017? The December 31, 2016, U.S. dollar–translated balance sheet reported retained earnings of $145,200, which included a remeasurement loss of $28,300.b. Assuming the foreign currency is the functional currency, what is the translation adjustment for 2017? The December 31, 2016, U.S. dollar–translated balance sheet reported retained earnings of $162,250 and a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License