Advanced Accounting

12th Edition

ISBN: 9781305084858

Author: Paul M. Fischer, William J. Tayler, Rita H. Cheng

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1.1AC

(Note: The use 01 a financial calculator or Excel is suggested for this case.)

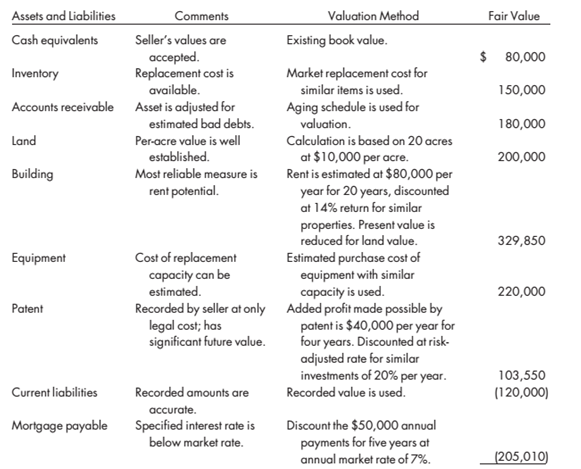

Modern Company acquires the net assets of Frontier Company for $1,300,000 on January 11, 2015. A business valuation consultant arrives at the price and deems it to be a good value.

Part A. The following list of fair values is provided to you by the consultant:

Using the information in the preceding table, contra the accuracy of the present value cal Required collations mode for the building, patent, and mortgage payable.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Prior to finishing the final offer, Simpson's M&A team has a discussion with NPV Advisory. You were asked to provide a combined valuation for the new company based on the information below.

?

Table 1. Simpsons

2017A

2018A

2019F

stores local

Sales (2 locations)

6.00

10.00

17.00

Operating Costs

Operating Income

-4.20

-6.60

-11.50

1.80

3.40

5.50

Depreciation and

Amortization

1.00

1.20

1.50

EBITDA

?

Net debt of the

20.00

company

?

Table 2. RaTrade

2017A

2018A

2019F

Sales (20 locations)

120.00

134.00

145.00

Operating Costs

-90.00

-104.50

-111.70

Operating Income

30.00

29.50

33.30

Depreciation and

5.00

4.50

6.00

amortization

EBITDA

?

Net debt of the

56.00

company

1) What is the expected valuation of the Combined Company based on EBITDA ignoring all the discounts and premiums?

2) If the offer price by the Simpsons was $165M for 100% of equity, what is the upside for the buyer in dollars and as a percentage, if the new company will be valued at an international EV/EBITDA ratio of 6?

PROBLEM 4:

You are the senior auditor in charge for the annual audit of Samal Corp. for the year ended December

31, 2020. You checked mostly the information in the financial records for this small/medium entity and

was highly satisfied.

You noticed however, that the property account consisted of land which was acquired on January 1,

2018 together with eight identical buildings equally built on it. The initial purchase price was

P48,000,000, thirty percent of which is attributable to the land. The eight buildings were estimated to

have a 50 years as economic lives of which two of them were used for general and administrative

offices while the rest were leased out to independent parties under operating lease arrangements.

The following costs were also incurred during acquisition:

Non-refundable transfer taxes paid to government

3,000,000

Title insurance and legal fees attributable to the acquisition

1,000,000

Actual borrowing costs

220,000

Marketing and advertisements

100,000

Office…

Can you please help me understand how to solve problems like this one by giving a detailed solution? Would appreciate your help so much. Thank you!

PROBLEM:

The following data were taken from the statement of affairs of ROBINSONS Corp.:

Assets pledged for fully secured liabilities (current fairvalue, $75,000)

$90,000

Assets pledged for partially secured liabilities (currentfair value $52,000)

$74,000

Free assets (current fair value, $40,000)

$70,000

Unsecured liabilities with priority

$7,000

Fully secured liabilities

$30,000

Partially secured liabilities

$60,000

Unsecured liabilities without priority

$112,000

*The amount that will be paid to creditors with priority is:a. 7,000 b. 6,000 c. 7,500 d. 6,200*The amount to be paid fully secured creditors is:a. 30,000 b. 32,000 c. 20,000 d. 35,000*The amount to be paid to partially secured creditors is:a. 52,700 b. 57,200 c. 56,200 d. 57,000*The amount to be paid to unsecured creditors:a. 78,200 b. 70,800 c. 72,000 d.…

Chapter 1 Solutions

Advanced Accounting

Ch. 1 - Prob. 1UTICh. 1 - Prob. 3UTICh. 1 - Prob. 4UTICh. 1 - Prob. 5UTICh. 1 - Prob. 6UTICh. 1 - Prob. 7UTICh. 1 - Prob. 8UTICh. 1 - Prob. 9UTICh. 1 - Prob. 10UTICh. 1 - Prob. 1.1E

Ch. 1 - Prob. 1.2ECh. 1 - Prob. 1.3ECh. 1 - Prob. 2ECh. 1 - Prob. 5.1ECh. 1 - Prob. 5.2ECh. 1 - Prob. 6ECh. 1 - Lake craft Company has the following balance...Ch. 1 - Prob. 8.2ECh. 1 - Prob. 8.3ECh. 1 - Prob. 9.1ECh. 1 - Prob. 9.2ECh. 1 - Prob. 1A.1.1AECh. 1 - Prob. 1A.1.2AECh. 1 - Prob. 1.2PCh. 1 - Prob. 1.3.1PCh. 1 - Prob. 1.4PCh. 1 - Jack Company is a Corporation that was organized...Ch. 1 - Prob. 1.6PCh. 1 - Prob. 1.7.1PCh. 1 - Prob. 1.7.2PCh. 1 - Prob. 1.8PCh. 1 - Prob. 1.10.A1PCh. 1 - Prob. 1.11PCh. 1 - Prob. 1.12PCh. 1 - Prob. 1.13.2PCh. 1 - Prob. 1A.1.1APCh. 1 - Prob. 1A.1.2APCh. 1 - (Note: The use 01 a financial calculator or Excel...Ch. 1 - Frontier does not have publicly traded stock. You...Ch. 1 - Frontier does not have publicly traded stock. You...Ch. 1 - Prob. 1.1B.3CCh. 1 - Prob. 1.1CCCh. 1 - Prob. 1.2.1CCh. 1 - Prob. 1.2.2CCh. 1 - Case 1-2 Disney Acquires Marvel Entertainment On...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- the number of the question or statement being answered. MULTIPLE CHOICE PROBLEM. Write the letter of the best answer before VALUATION CONCEPTS AND METHODOLOGIES , Green Tea Corp. reported the following information: Revenue of Php 32,500, Operating Expenses of Php16,250. Included in the operating expense are salaries and wages of Php1,450, depreciation of Php500, and rentals of Php275. The interest expense incurred is Php200. How much is the EBITDA for the period? а. Php16,750 b. Php16,250 c. Php16,550 d. Php14,025 2. Cornerstone Inc. reported revenue for the period amounting to Php75,200 and EBITDA Margin of 60%. How much is the operating expenses excluding depreciation? a. Php75,200 b. Php45,120 с. Php30,080 d. Zero 3. Singapore Ltd. has reported Php125,000 revenue where their EBITDA Margin is 45%. If the taxes are 30% of the EBITDA, how much is the Net Cash Flows if the capital expenditure was purchased at Php1,500? а. Php37,875 b. Php39,375 с. Php56,250 d. Php46,625 4. Malaysia Inc.…arrow_forwardThe following data were included in a recent Mango, Incorporated annual report ($ in millions): Net sales In millions Net property, plant, and equipment Required: 2017 $ 189,234 34,783 2018 2019 $ 225,595 $ 220,174 47,304 34,378 2020 $ 284,515 35,766 Compute Mango's fixed asset turnover ratio for 2018, 2019, and 2020. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. 2018 2019 Fixed asset turnover ratio 2020arrow_forwardBusiness Combination Versus Asset Acquisition As part of a project, Webflow Inc. acquires these assets from Digital Sea Company (in millions): Fair Value $4 Cash Trading debt investments Equipment in process R&D 6 240 60 The in-process R&D has no alternative future use. Webflow pays $335 million in cash for the acquired assets, and also pays $5 million in cash for legal and advisory costs Note: Provide all answers in millions and round answers to the nearest whole number. For example. 16.355.000 would be 16. a Prepare the journal entry to record the acquisition if it qualifies as a business combination. Debit Credit Cash to record the business combination 0 0 0 0 0 D O 0 10 0 0 0 340 it is an ecat acnuutine Ama the cash and die thindacatearrow_forward

- PART TWO OF THE QUESTION: USING JOYFUL'S 2018 SALES REVENUE OF $4,530 (MILLION) AND ITS AVERGAE NET FIXED ASSESTS OF $266 (MILLION), CALCULATE THE FIXED ASSET TURN OVER RATIO FOR 2018. (ROUND TO THE NEAREST 2 DECIMAL PLACE).arrow_forwardAnswer Required, Correct Ans Q: During the financial year 2019-20 OGDCL has earned huge profits and they have surplus funds available for making new investments. The top management after detailed discussion and analysis has decided to purchase the share of Hascol Company Ltd in a recent IPO. This decision of the management is called as ____________. a. Asset Management Decisionb. Investment Decisionc. Financing Decisionarrow_forwardAssets Liabilities and Owners' Equity Accounts and notes payable Income taxes payable Current portion of long-term debt Unearned revenue Cash and cash equivalents $325,000.00 $125,000.00 Marketable securities $180,000.00 $150,000.00 Accounts & notes receivable $420,000.00 $250,000.00 $125,000.00 Inventories $325,000.00 Prepaid expenses $150,000.00 Miscellaneous other payables $200,000.00 $925,000.00 Deferred taxes $75,000.00 Total current liabilities Miscellaneous current assets $75,000.00 $1,475,000.00 Total current assets Long-term debt Capital lease obligations Deferred taxes $3,100,000.00 $450,000.00 Plant, property & equipment $3,225,000.00 $150,000.00 Investment in affiliates $1,800,000.00 Total other liabilities $3,700,000.00 Other fixed assets $500,000.00 Total other assets $5,525,000.00 Owners' equity Preferred stock $1,450,000.00 Common stock $325,000.00 $375,000.00 Retained earnings Other equity items Total owners' equity $225,000.00 $2,325,000.00 Total assets $7,000,000.00…arrow_forward

- I need to know how to calculate the gain on the equipment sold in part C The balance sheets of HiROE Inc. showed the following at December 31, 2020 and 2019: December 31, 2020 December 31, 2019 Equipment, less accumulated depreciation of $212,625 at December 31, 2020, and $151,875 at December 31, 2019. $ 273,375 $ 334,125 Required: If there have not been any purchases, sales, or other transactions affecting this equipment account since the equipment was first acquired, what is the amount of the depreciation expense for 2020? Assume the same facts as in part a, and assume that the estimated useful life of the equipment to HiROE Inc., is eight years and that there is no estimated salvage value. Determine: What the original cost of the equipment was. What depreciation method is apparently being used. When the equipment was acquired. Assume that this equipment account represents the cost of 5 identical machines. Prepare the horizontal model and record the journal…arrow_forwardAssume Walmart acquires a tract of land on January 1, 2016, for $100,000 cash. On December 31, 2016, the current market value of the land is $150,000. On December 31, 2017, the current market value of the land is $120,000. The firm sells the land on December 31, 2018, for $180,000 cash. Ignore income taxes. Indicate the effect on the balance sheet and income a. Valuation of the land at acquisition cost until sale of the land (Approach 1) b. Valuation of the land at current market value and including market value changes each year in net income (Approach 2) c. Valuation of the land at current market value but including unrealized gains d. Why is retained earnings on December 31, 2018, equal to $80,000 in all three cases despite the reporting of different amounts of net income each year?arrow_forwardWrite a report to management by carefully analyzing the following comments made by the Finance Manager of Combo Company Limited, a listed company with a total net worth of GH¢ 25,000,000.00. Your position should be supported by the relevant accounting standard, convention, and concept.i. “The depreciation of a motor vehicle is charged on a straight-line basis but after some years of the asset usage, I notice that the efficiency of the asset has reduced, but the same amount of depreciation amount is charged and that reduces profit level. So, let us change from straight line to reducing balance method which to him is fair”ii. The company bought two needles at the cost of GH¢1.00 each. The Finance Manager said “this is an acquisition of non-current asset (equipment) which should be recorded in the asset register and depreciated in line with equipment depreciation policy”iii. “Our customers have proved to be trustworthy for the years the company has dealt with them, so to me, making…arrow_forward

- You were engaged to audit the financial statements of the Philippine Refining Company for the year ended December 31, 2021 with comparative figures for the year ended December 31, 2020. One of your concern regarding material risk is on their long-term liabilities related to the acquisition of machinery. Your examination of their books revealed that on December 31, 2019, Philippine Refining Company purchased machinery having a cash selling price of P85,933.75. The company paid P10,000 down and agreed to finance the remainder by making four equal payments each December 31 at the implicit interest rate of 12%. The accountant prepared a table of payment below for their long-term financing for you to test for the accuracy of their presentation and payment. Date Total Payment Interest Payment Principal Payment Carrying Valu 12/31/1910,000.00 75.933.75 12/31/20 28.095.49 9.112.05 18,983.44 $6.950.31 12/31/21 25.817.48 6.834,04 18,983.44 137.966.87 12/31/22/23.519.46 4,556,02 18.983.44…arrow_forwardSam wants to purchase Smith, Inc. The following information is available for Smith from the balance sheet Accounts Receivable Inventory Building Accumulated Depreciation View transaction list 250,000 400,000 625,000 (180,000) The Company estimates that the Accounts Receivable are worth $230,000, the inventory is worth $425,000, and the building is worth $800,000. Everything else is worth its book value. Sam will pay $1,400,000 for Smith, Record the journal entry for this purchase. Journal entry worksheet Note: Enter debits before credits. What is the journal entry to record the purchase? Transaction number Accounts Payable Note Payable Common Stock Retained Earnings Account Name 135,000 275,000 400,000 285,000 Debit Creditarrow_forwardYou were engaged to audit the financial statements of the Philippines Refining Company for the year ended December 31, 2021 with comparative figures for the year ended December 31, 2020. One of your concern regarding material risk is on their long-term liabilities related to the acquisition of machinery. Your examination of their books revealed that on December 31, 2019, Philippines Refining Companypurchased machinery having a cash selling price of P85,933.75. The company paid P10,000 down and agreed to finance the remainder by making four equal payments each December 31 at the implicit interest rate of 12%. The accountant prepared a table of payment below for their long-term financing for you to test for the accuracy of their presentation and payment. Date Total Payment Interest Payment Principal Payment Carrying Value 12/31/19 10,000.00 75,933.75 12/31/20 28,095.49 9,112.05 18,983.44 56,950.31 12/31/21 25,817.48…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Property, Plant and Equipment (PP&E) - Introduction to PPE; Author: Gleim Accounting;https://www.youtube.com/watch?v=e_Hx-e-h9M4;License: Standard Youtube License