EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

am. 108.

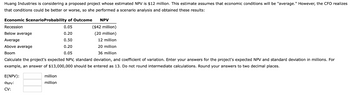

Transcribed Image Text:Huang Industries is considering a proposed project whose estimated NPV is $12 million. This estimate assumes that economic conditions will be "average." However, the CFO realizes

that conditions could be better or worse, so she performed a scenario analysis and obtained these results:

Economic ScenarioProbability of Outcome

NPV

Recession

Below average

Average

Above average

Boom

0.05

($42 million)

0.20

0.50

(20 million)

12 million

20 million

36 million

0.20

0.05

Calculate the project's expected NPV, standard deviation, and coefficient of variation. Enter your answers for the project's expected NPV and standard deviation in millions. For

example, an answer of $13,000,000 should be entered as 13. Do not round intermediate calculations. Round your answers to two decimal places.

E(NPV):

ONPV

CV:

million

million

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Huang Industries is considering a proposed project whose estimated NPV is $12 million. This estimate assumes that economic conditions will be "average." However, the CFO realizes that conditions could be better or worse, so she performed a scenario analysis and obtained these results: Economic Scenario Probability of Outcome NPV Recession 0.05 ($64 million) Below average 0.20 (10 million) Average 0.50 12 million Above average 0.20 16 million Boom 0.05 30 million Calculate the project's expected NPV, standaarrow_forwardHuang Industries is considering a proposed project whose estimated NPV is $12 million. This estimate assumes that economic conditions will be "average." However, the CFO realizes that conditions could be better or worse, so she performed a scenario analysis and obtained these results: Economic Scenario Probability of Outcome NPV Recession 0.05 ($34 million) Below average 0.20 (16 million) Average 0.50 12 million Above average 0.20 16 million Boom 0.05 28 million Calculate the project's expected NPV, standard deviation, and coefficient of variation. Enter your answers for the project's expected NPV and standard deviation in millions. For example, an answer of $13,000,000 should be entered as 13. Do not round intermediate calculations. Round your answers to two decimal places. E(NPV): million σNPV: million CV:arrow_forwardHuang Industries is considering a proposed project whose estimated NPV is $12 million. This estimate assumes that economic conditions will be "average." However, the CFO realizes that conditions could be better or worse, so she performed a scenario analysis and obtained these results: Economic Scenario Probability of Outcome Recession Below average Average Above average E(NPV): ONPV: CV: X million 0.05 million 0.20 Boom 40 million Calculate the project's expected NPV, standard deviation, and coefficient of variation. Enter your answers for the project's expected NPV and standard deviation in millions. For example, an answer of $13,000,000 should be entered as 13. Do not round intermediate calculations. Round your answers to two decimal places. 0.50 0.20 NPV 0.05 ($38 million) (16 million) 12 million 20 millionarrow_forward

- Huang Industries is considering a proposed project whose estimated NPV is $12 million. This estimate assumes that economic conditions will be "average." However, the CFO realizes that conditions could be better or worse, so she performed a scenario analysis and obtained these results: Economic Scenario Probability of Outcome Recession ($40 million) (24 million) 12 million 18 million Boom 0.05 34 million Calculate the project's expected NPV, standard deviation, and coefficient of variation. Enter your answers for the project's expected NPV and standard deviation in millions. For example, an answer of $13,000,000 should be entered as 13. Do not round intermediate calculations. Round your answers to two decimal places. Below average Average Above average E(NPV): ONPV: CV: million million 0.05 0.20 0.50 NPV 0.20arrow_forwardA company is considering a project that has the following cash flows: C0 = -5,000, C1 = +900, C2 = +2,500, C3 = +1,100, and C4 = +2,900 with a risk-adjusted discount rate of 12%. Calculate the Net Present Value (NPV), Internal Rate of Return (IRR), Profitability Index, and the Payback of this project. If you were the manager of the firm, will you accept or reject the project based on the calculation results above?arrow_forwardHuang Industries is considering a proposed project whose estimated NPV is $12 million. This est However, the CFO realizes that conditions could be better or worse, so she performed a scenaric Economic ScenarioProbability of Outcome NPV Recession 0.05 ($86 million) Below average 0.20 (14 million) Average 0.50 12 million Above average 0.20 24 million Вoom 0.05 40 million Calculate the project's expected NPV, standard deviation, and coefficient of variation. Enter your deviation in millions. For example, an answer of $13,000,000 should be entered as 13. Do not re decimal places. E(NPV): million ONPV: millionarrow_forward

- Huang Industries is considering a proposed project whose estimatedNPV is $12 million. This estimate assumes that economic conditions will be “average.”However, the CFO realizes that conditions could be better or worse, so she performed ascenario analysis and obtained these results: Calculate the project’s expected NPV, standard deviation, and coefficient of variation.arrow_forwardA firm has two potential investment projects. The project information is summarised in the table below. Project A $670 Project B $700 Expected value of profit Standard deviation of profit Coefficient of variation of profit 175 370 0.26 0.53 Which project has a lower absolute risk level? Which project has a lower relative risk level? Which project would you advise the firm to choose? Explain your answers. ---- --- ---- ..- ---arrow_forwardLEI has the following investment opportunities that are average-risk projects for the firm: Project A B C D E Cost at t = 0 $10,000 20,000 10,000 20,000 10,000 Rate of Return 16.4% 15.0% 13.2% 12.0% 11.5% Which projects should LEI accept? Why?arrow_forward

- The Webex Corporation is trying to choose between the following two mutually exclusive designprojects: Year Net Cash Flow Project - I($) Net Cash Flow Project - II($) 0 (53,000) (16,000) 1 27000 9100 2 27000 9100 3 27000 9100 (a) If the required return is 10% and the company applies the Profitability Index decision rule,which project should the firm accept?(b) If the company applies the Net Present Value decision rule, which project should it take?(c) Explain why your answers in (a) and (b) are different(d) Calculate the Internal Rate of Return of both projects.arrow_forwardConsider the case of another company. Kim Printing is evaluating two mutually exclusive projects. They both require a $1 million investment today and have expected NPVS of $200,000. Management conducted a full risk analysis of these two projects, and the results are shown below. Risk Measure Project A Project B Standard deviation of project's expected NPVS $80,000 $120,000 Project beta 0.9 1.1 Correlation coefficient of project cash flows (relative to the firm's existing projects) 0.7 0.9 Which of the following statements about these projects' risk is correct? Check all that apply. O Project A has more corporate risk than Project B. O Project B has more corporate risk than Project A. O Project B has more market risk than Project A. O Project B has more stand-alone risk than Project A.arrow_forward6. Within-firm risk and beta risk Understanding risks that affect projects and the impact of risk consideration Yatta Net International has manufacturing, distribution, retail, and consulting divisions. Projects undertaken by the manufacturing and distribution divisions tend to be low-risk projects, because these divisions are well established and have predictable demand. The company started its retail and consulting divisions within the last year, and it is unknown if these divisions will be profitable. The company knew that opening these new divisions would be risky, but its management believes the divisions have the potential to be extremely profitable under favorable market conditions. The company is currently using its WACC to evaluate new projects for all divisions. If Yatta Net International does not risk-adjust its discount rate for specific projects properly, which of the following is likely to occur over time? Check all that apply. The firm will accept too many relatively…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning