Date January 1 (beginning inventory) January 24 February 8 March 16 June 11 Purchases Sales Number of Units Unit Cost Number of Units Sales Price 590 $4.30 390 $5.80 690 $4.40 390 $5.80 690 $4.40

Date January 1 (beginning inventory) January 24 February 8 March 16 June 11 Purchases Sales Number of Units Unit Cost Number of Units Sales Price 590 $4.30 390 $5.80 690 $4.40 390 $5.80 690 $4.40

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 4PB: The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are...

Related questions

Topic Video

Question

Please solve the three parts

Transcribed Image Text:Neverstop Corporation sells item A as part of its product line. Information about the beginning inventory, purchases, and sales of item

A are given in the following table for the first six months of the current year. The company uses a perpetual inventory system:

Date

January 1 (beginning inventory)

January 24

February 8

March 16

June 11

Required:

Purchases

Sales

Number of Units Unit Cost

Number of Units

Sales Price

590

$4.30

390

$5.80

690

$4.40

390

$5.80

690

$4.40

1. Compute the cost of ending inventory by using the weighted-average costing method. (Do not round intermediate calculations and

round the final answer to 2 decimal places.)

Ending inventory

Transcribed Image Text:Help

Save

2. Compute the gross profit for the first six months of the current year by using the FIFO costing method. (Do not round intermediate

calculations and round the final answer to 2 decimal places.)

Gross profit

3. Would the gross profit be higher, lower, or the same if Neverstop used the weighted-average costing method rather than the FIFO

method?

Remain the same

○ Lower

O Higher

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:26

EhaLbrowser=0&launch Url=https:253A%252F%252Fnewcorrected education on 1726

Saved

Help

Save & E

first account field.)

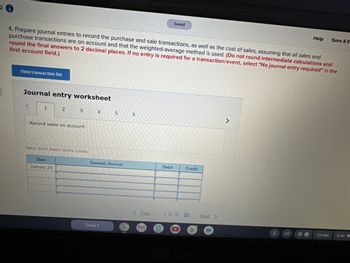

4. Prepare journal entries to record the purchase and sale transactions, as well as the cost of sales, assuming that all sales and

purchase transactions are on account and that the weighted-average method is used. (Do not round intermediate calculations and

round the final answers to 2 decimal places. If no entry is required for a transaction/event, select "No journal entry required" in the

View transaction list

Journal entry worksheet

1

2

3

4

5

6

Record sales on account.

Note: Enter debits before credits.

Date

January 24

General Journal

Debit

Credit

Desk 1

< Prev

3 of 15

Next >

7

e

US

23 Mar

6:44

Transcribed Image Text:26

EhaLbrowser=0&launch Url=https:253A%252F%252Fnewcorrected education on 1726

Saved

Help

Save & E

first account field.)

4. Prepare journal entries to record the purchase and sale transactions, as well as the cost of sales, assuming that all sales and

purchase transactions are on account and that the weighted-average method is used. (Do not round intermediate calculations and

round the final answers to 2 decimal places. If no entry is required for a transaction/event, select "No journal entry required" in the

View transaction list

Journal entry worksheet

1

2

3

4

5

6

Record sales on account.

Note: Enter debits before credits.

Date

January 24

General Journal

Debit

Credit

Desk 1

< Prev

3 of 15

Next >

7

e

US

23 Mar

6:44

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College