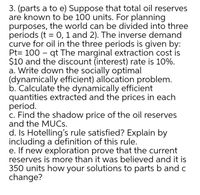

3. (parts a to e) Suppose that total oil reserves are known to be 100 units. For planning purposes, the world can be divided into three periods (t = 0, 1 and 2). The inverse demand curve for oil in the three periods is given by: Pt= 100 – qt The marginal extraction cost is $10 and the discount (interest) rate is 10%. a. Write down the socially optimal (dynamically efficient) allocation problem. b. Calculate the dynamically efficient quantities extracted and the prices in each period. c. Find the shadow price of the oil reserves and the MUCS. d. Is Hotelling's rule satisfied? Explain by including a definition of this rule. e. If new exploration prove that the current reserves is more than it was believed and it is 350 units how your solutions to parts b and c change?

3. (parts a to e) Suppose that total oil reserves are known to be 100 units. For planning purposes, the world can be divided into three periods (t = 0, 1 and 2). The inverse demand curve for oil in the three periods is given by: Pt= 100 – qt The marginal extraction cost is $10 and the discount (interest) rate is 10%. a. Write down the socially optimal (dynamically efficient) allocation problem. b. Calculate the dynamically efficient quantities extracted and the prices in each period. c. Find the shadow price of the oil reserves and the MUCS. d. Is Hotelling's rule satisfied? Explain by including a definition of this rule. e. If new exploration prove that the current reserves is more than it was believed and it is 350 units how your solutions to parts b and c change?

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Hi and thanks for your question! Unfortunately we cannot answer this particular question due to its complexity.

We've credited a question back to your account. Apologies for the inconvenience.

Your Question:

Transcribed Image Text:3. (parts a to e) Suppose that total oil reserves

are known to be 100 units. For planning

purposes, the world can be divided into three

periods (t = 0, 1 and 2). The inverse demand

curve for oil in the three periods is given by:

Pt= 100 – qt The marginal extraction cost is

$10 and the discount (interest) rate is 10%.

a. Write down the socially optimal

(dynamically efficient) allocation problem.

b. Calculate the dynamically efficient

quantities extracted and the prices in each

period.

c. Find the shadow price of the oil reserves

and the MUCS.

d. Is Hotelling's rule satisfied? Explain by

including a definition of this rule.

e. If new exploration prove that the current

reserves is more than it was believed and it is

350 units how your solutions to parts b and c

change?

Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education