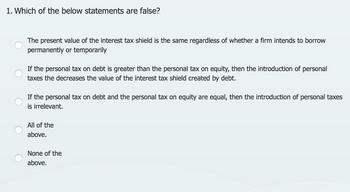

1. Which of the below statements are false? The present value of the interest tax shield is the same regardless of whether a firm intends to borrow permanently or temporarily If the personal tax on debt is greater than the personal tax on equity, then the introduction of personal taxes the decreases the value of the interest tax shield created by debt. If the personal tax on debt and the personal tax on equity are equal, then the introduction of personal taxes is irrelevant. All of the above. None of the above.

1. Which of the below statements are false? The present value of the interest tax shield is the same regardless of whether a firm intends to borrow permanently or temporarily If the personal tax on debt is greater than the personal tax on equity, then the introduction of personal taxes the decreases the value of the interest tax shield created by debt. If the personal tax on debt and the personal tax on equity are equal, then the introduction of personal taxes is irrelevant. All of the above. None of the above.

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts are unable to provide you with a solution at this time. Try rewording your question, and make sure to submit one question at a time. We've credited a question to your account.

Your Question:

Transcribed Image Text:1. Which of the below statements are false?

The present value of the interest tax shield is the same regardless of whether a firm intends to borrow

permanently or temporarily

If the personal tax on debt is greater than the personal tax on equity, then the introduction of personal

taxes the decreases the value of the interest tax shield created by debt.

If the personal tax on debt and the personal tax on equity are equal, then the introduction of personal taxes

is irrelevant.

All of the

above.

None of the

above.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning